- $3B in crypto options expired on the 16th of May, but next week positioning was somewhat bullish.

- For June, Option traders expected BTC to rally to $110K-$125K with a $95K as floor price.

On the 16th of May, at 8:00 UTC, $3 billion worth of crypto options expired. Bitcoin [BTC] accounted for $2.6B of the notional value, while Ethereum [ETH] had $252 million.

According to Deribit data, BTC had a max pain of $100K, and the ETH level was at $2,200. Max pain is a level that most options will expire worthless, and sometimes act as a price magnet.

On the positioning front, Deribit stated,

“BTC skew is neutral, ETH puts slightly outweigh calls. Price action could get interesting.”

Source: Deribit

The positioning was reflected by the Put/Call ratio. A value above 1 indicates more puts (bearish bets) than calls (bullish bets) while values below 1 lean towards the bulls’ side.

Put simply, ETH had more bearish bets ahead of the Friday expiry, while BTC was at 1 — neutral.

Post-Friday expiry market reaction

At the time of writing, about 2 hours after the 15 May expiry, BTC was valued at $103.8K, jumped 2% from Thursday’s low of $101K.

For ETH, it traded at $2.6K, up 6% from Thursday’s low of $2.4K.

This showed ETH was relatively volatile than BTC, and the $3B expiry didn’t stir much retracement as earlier feared.

Looking forward, Amberdata’s 25RR (25-delta risk reversal) were positive for next Friday’s (23 May) and end of May (30th) expiries.

The metric’s positive reading meant that calls outpaced puts (more bullish than bearish bets), reflecting positive market sentiment for the last part of May.

However, there was no strong macro or crypto-centric catalyst to push BTC higher after the U.S.-China trade deal lifted it to over $100K the previous week.

Whether Fed rate expectations will drive BTC going forward remains to be seen. However, the most popular call buying in the past 24 hours was targeting $ 110K-$120K for end June expiries.

For the 23rd of May expiry, the $107K call option was popular, too. However, the $95K put for June expiry appeared as the likely floor price in early summer.

Overall, the positioning showed that option traders expected a potential BTC all-time-high (ATH) in late May or June with a downside risk target of $95K.

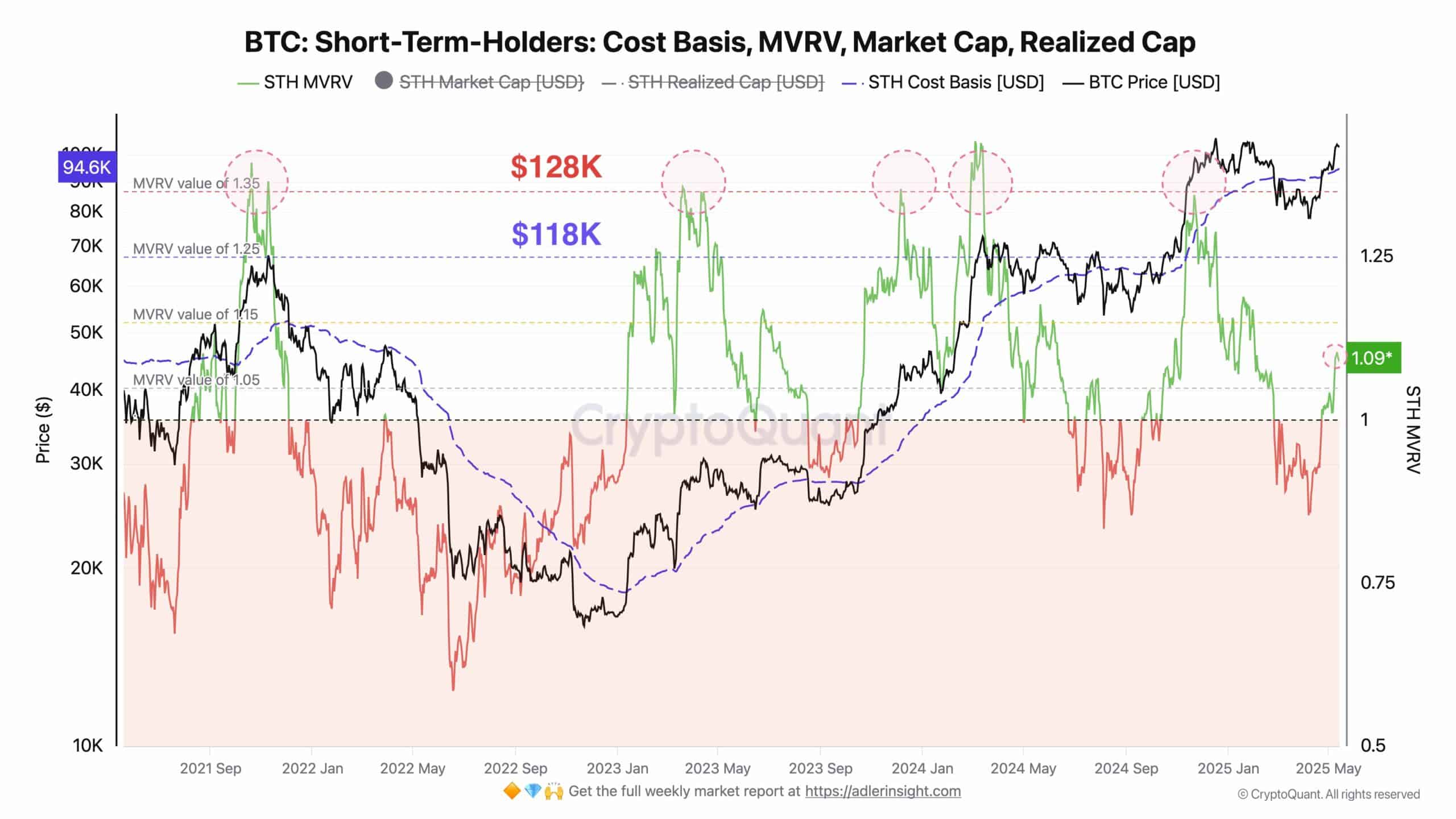

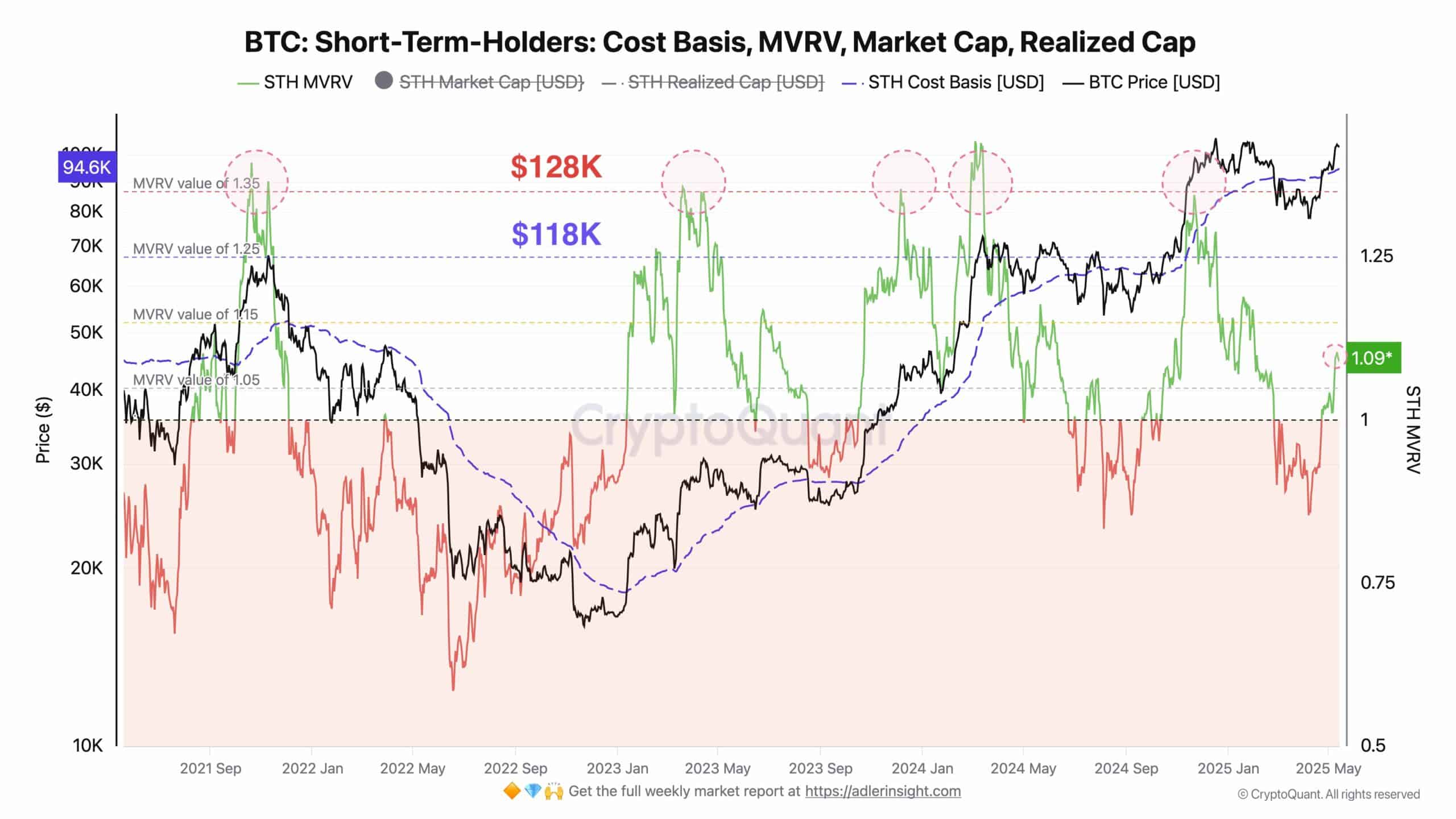

CryptoQuant analyst Axel Adler reiterated a similar projection, stating that BTC was currently undervalued from the STH (Short-term holder) MVRV metric.

He highlighted that, if there is no negative market catalyst, BTC pressure could heighten at $118K in June.

“The current STH MVRV is 1.09. The first significant wave of selling pressure is expected around 1.25 (price target ≈ $118K), with a stronger one likely at 1.35 (≈ $128K)”

Source: Axel Adler/X