- The Blockchain Group confirmed a 580 BTC buy, boosting its stock by 226% amid growing institutional Bitcoin interest.

- Whale accumulation trends aligned with the firm’s move, suggesting broader market confidence in Bitcoin’s next leg up.

The Blockchain Group has confirmed the acquisition of 580 Bitcoin [BTC], valued at approximately $40 million, in a strategic move that has sent its stock soaring by 226% over the past week.

The announcement, made on the 26th of March via Euronext, marks a pivotal turn in the company’s Bitcoin strategy and comes just as whale activity across the BTC network accelerates.

With retail investors hesitating, whales are making decisive plays, and The Blockchain Group appears to be following suit.

Strategic accumulation meets market timing

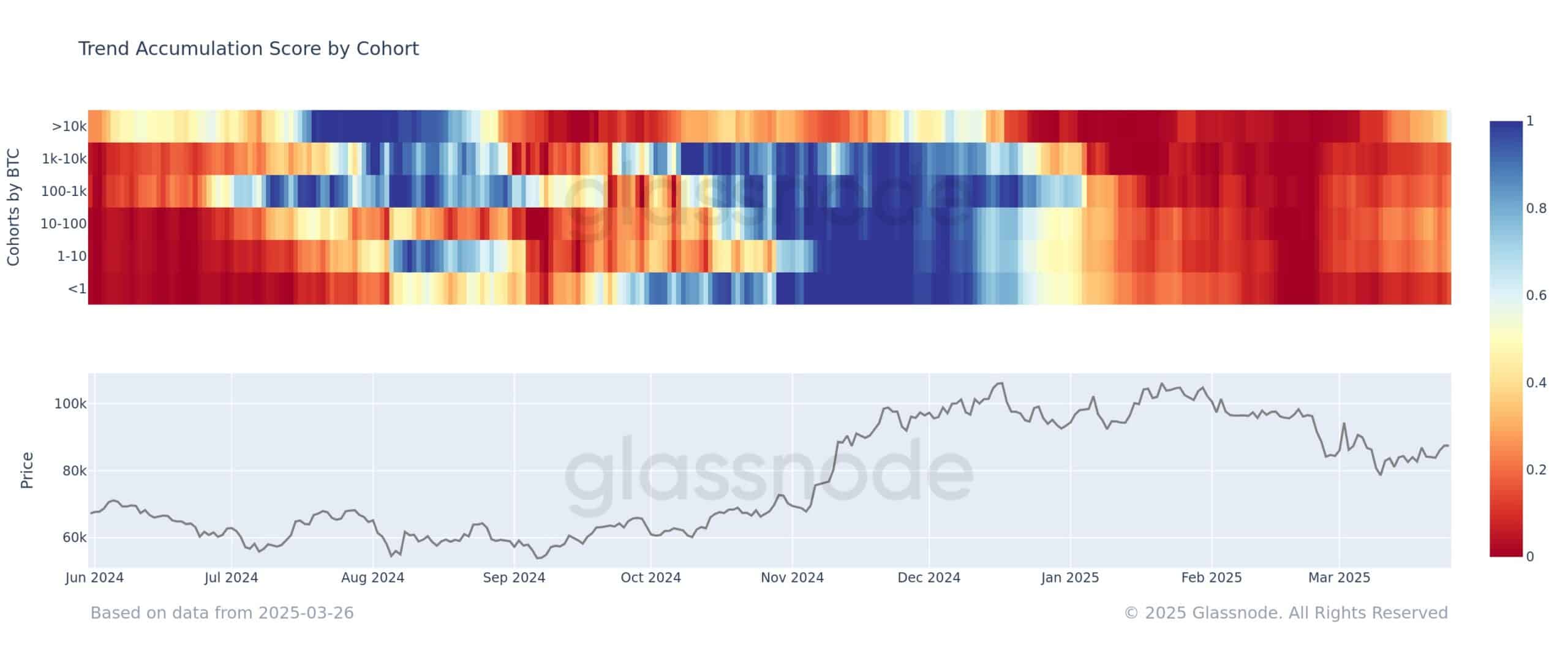

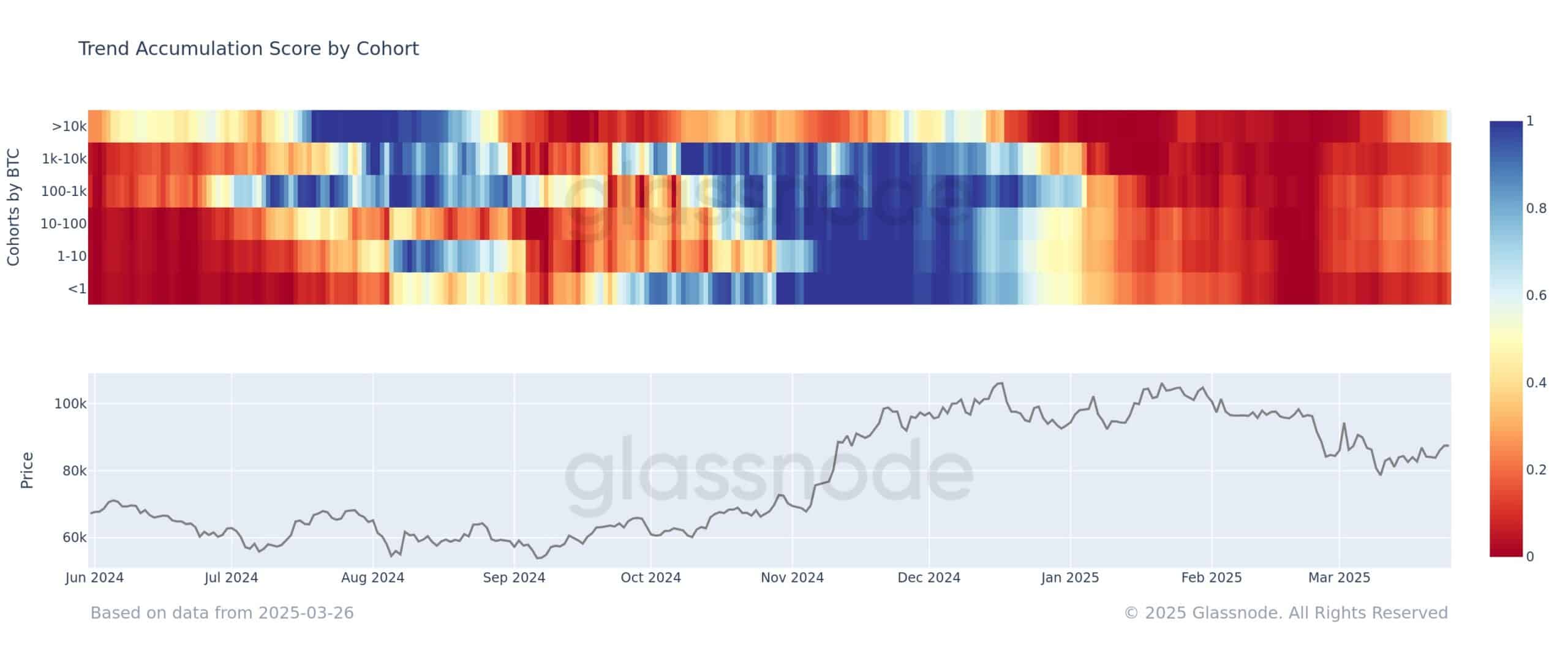

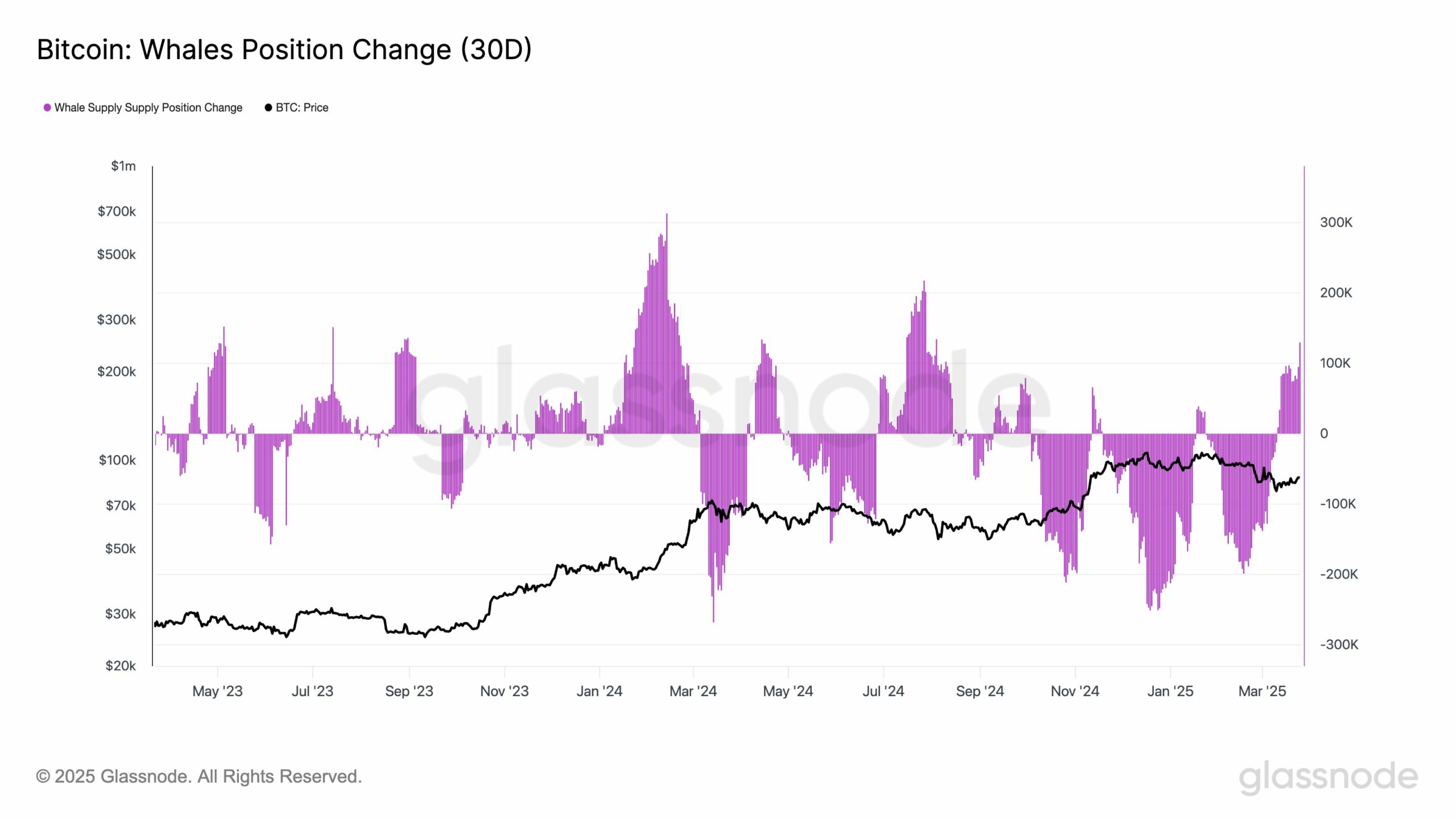

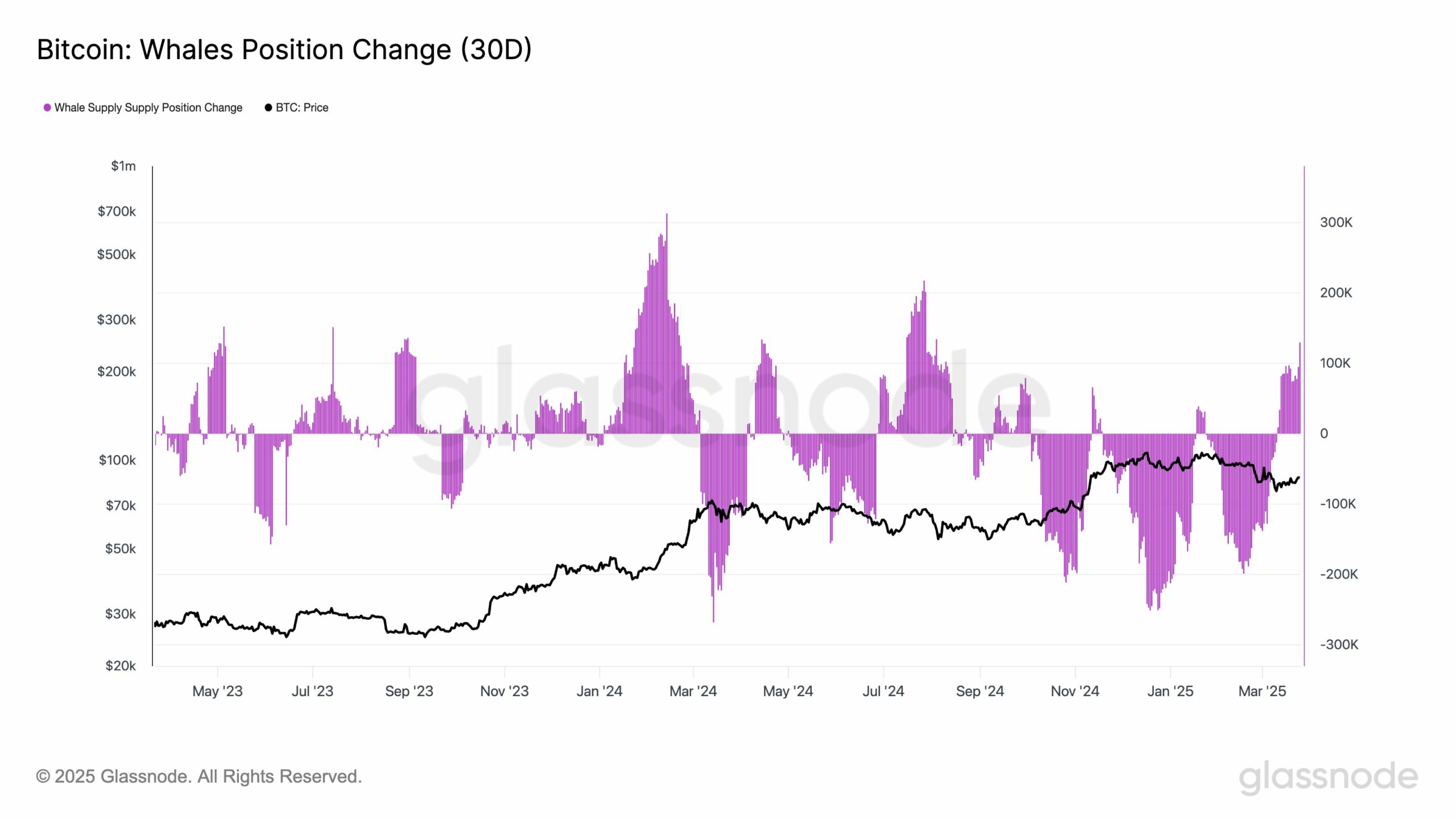

The firm’s acquisition, which began in early March, aligns with a surge in accumulation by the largest whale wallets.

Wallets holding over 10,000 BTC have increased their Accumulation Trend Score to above 0.5, reflecting renewed confidence in the asset.

The Blockchain Group appears to be capitalizing on this sentiment shift, following the momentum created by smart money investors.

Source: Glassnode

The company also stated its intention to expand its Bitcoin treasury position, reinforcing long-term bullishness. This mirrors broader macro trends, where firms like MicroStrategy have normalized BTC as a balance sheet asset.

The Blockchain Group’s pivot may thus attract institutional attention, particularly as traditional markets continue to grapple with inflation and macro uncertainty.

Stock price and volume surge

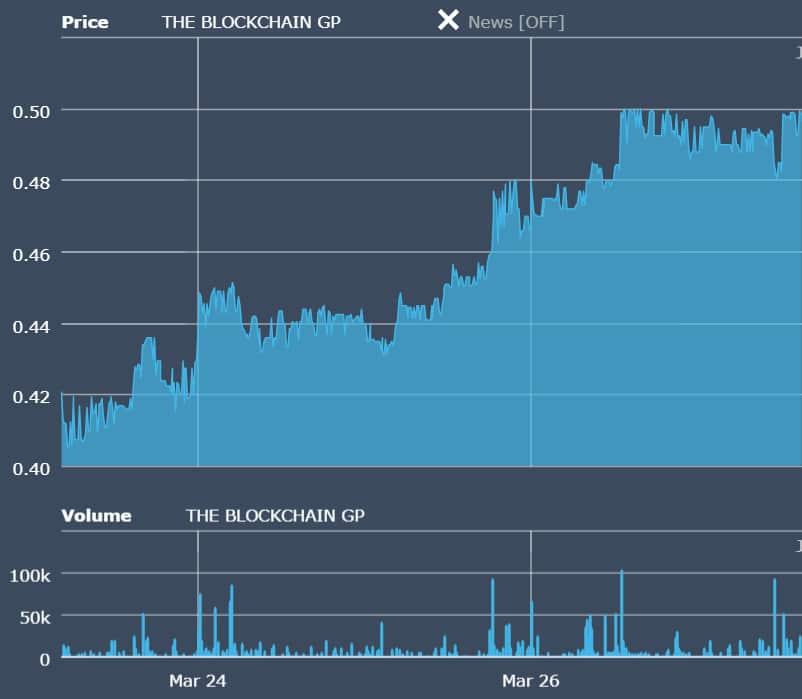

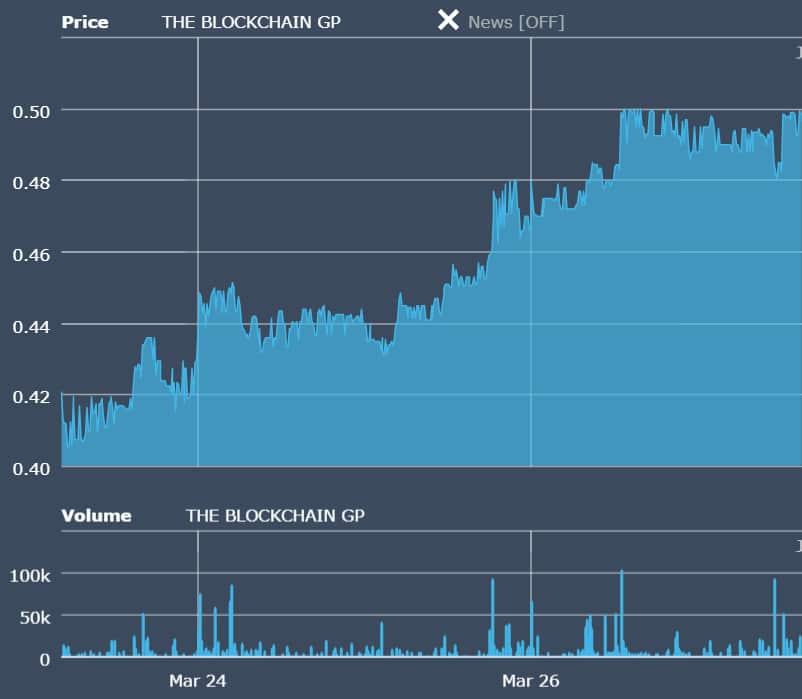

Following the acquisition news, The Blockchain Group’s stock has experienced a remarkable price surge, rising from below €0.42 to over €0.51 within a matter of days.

Trading volume also spiked sharply, with multiple days clearing the 100k mark.

Source: Euronext

This price action, reflected in the attached chart, suggests strong market conviction in the company’s Bitcoin-focused strategy.

Bitcoin whales: The broader context

Beyond The Blockchain Group, whale behavior is turning heads. The Whale Position Change (30D) metric shows a net inflow approaching 100K BTC, a sharp reversal from the persistent outflows that began in January.

The Supply per Whale metric is also climbing again, reinforcing that large holders are not only buying back in but are also increasing their exposure.

Source: Glassnode

With BTC trading near $87,000 at press time, bulls are testing resistance just below $88K. The 200-day MA sat higher at $94,443, while the RSI remained neutral.

As whales accumulate and institutional players like The Blockchain Group signal confidence, the possibility of BTC retesting its previous highs becomes more credible.

Conclusion

The Blockchain Group’s bold acquisition of 580 BTC has not only sent its stock soaring but also aligns with a broader accumulation trend led by whales.

This synergy between corporate treasuries and whale wallets may set the stage for the next leg of Bitcoin’s rally.

As the market digests these developments, The Blockchain Group’s actions stand out as both timely and potentially transformative.