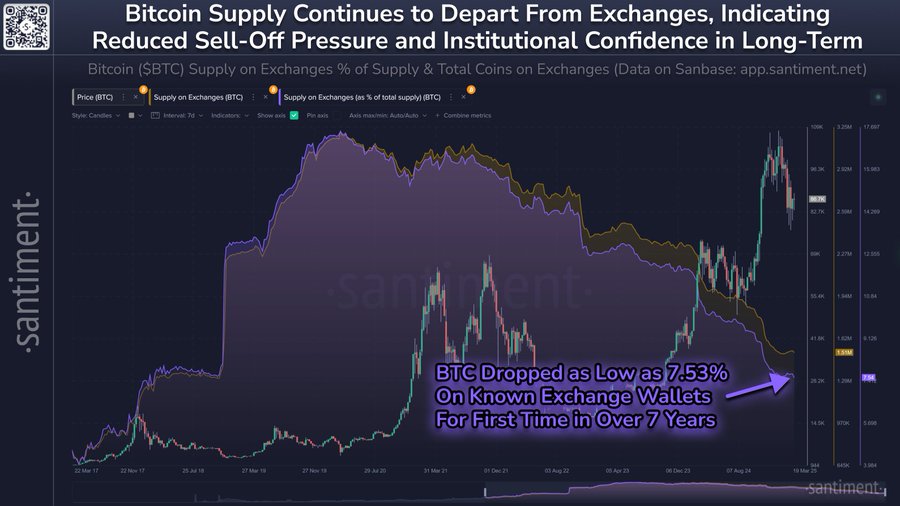

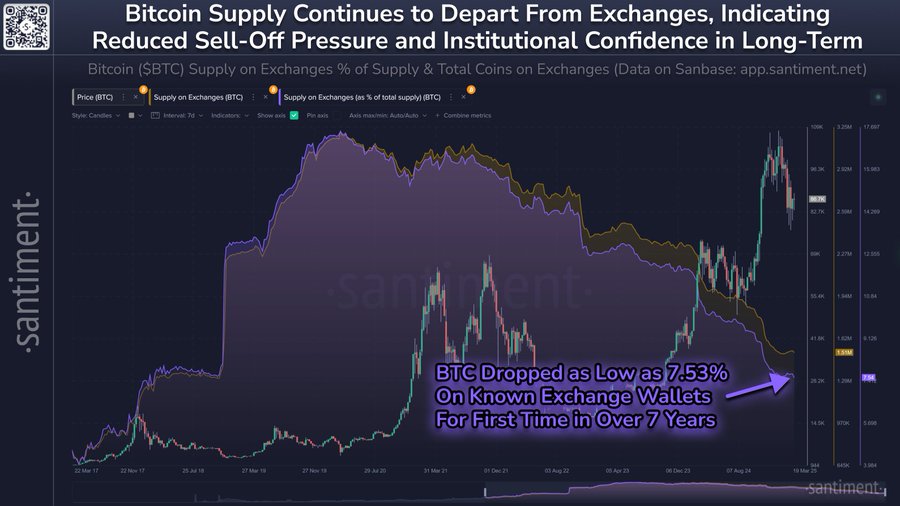

- Bitcoin’s supply on exchanges dropped by 7.53%, indicating increased investor confidence and reduced liquidity.

- Rising network activity and technical indicators suggested that Bitcoin could be entering a bullish phase.

Bitcoin’s [BTC] supply on exchanges has dropped to just 7.53%, marking its lowest level since February 2018. At press time, Bitcoin traded at $87,075.28, down 0.95% over the past 24 hours.

As more investors choose to ‘hodl’ their BTC, this shrinking supply reflects increasing institutional confidence in Bitcoin’s long-term value. With fewer people willing to sell, BTC could see heightened volatility due to the decreasing liquidity in the market.

Why is Bitcoin’s exchange supply shrinking?

The sharp decline in Bitcoin’s exchange supply reflects a shift in investor sentiment toward holding rather than selling. This indicates growing confidence in Bitcoin’s future potential.

With reduced availability, price fluctuations may occur as demand surpasses supply. Increased market confidence means fewer holders are willing to sell, further limiting Bitcoin’s exchange supply.

Source: Santiment

How active is the Bitcoin network?

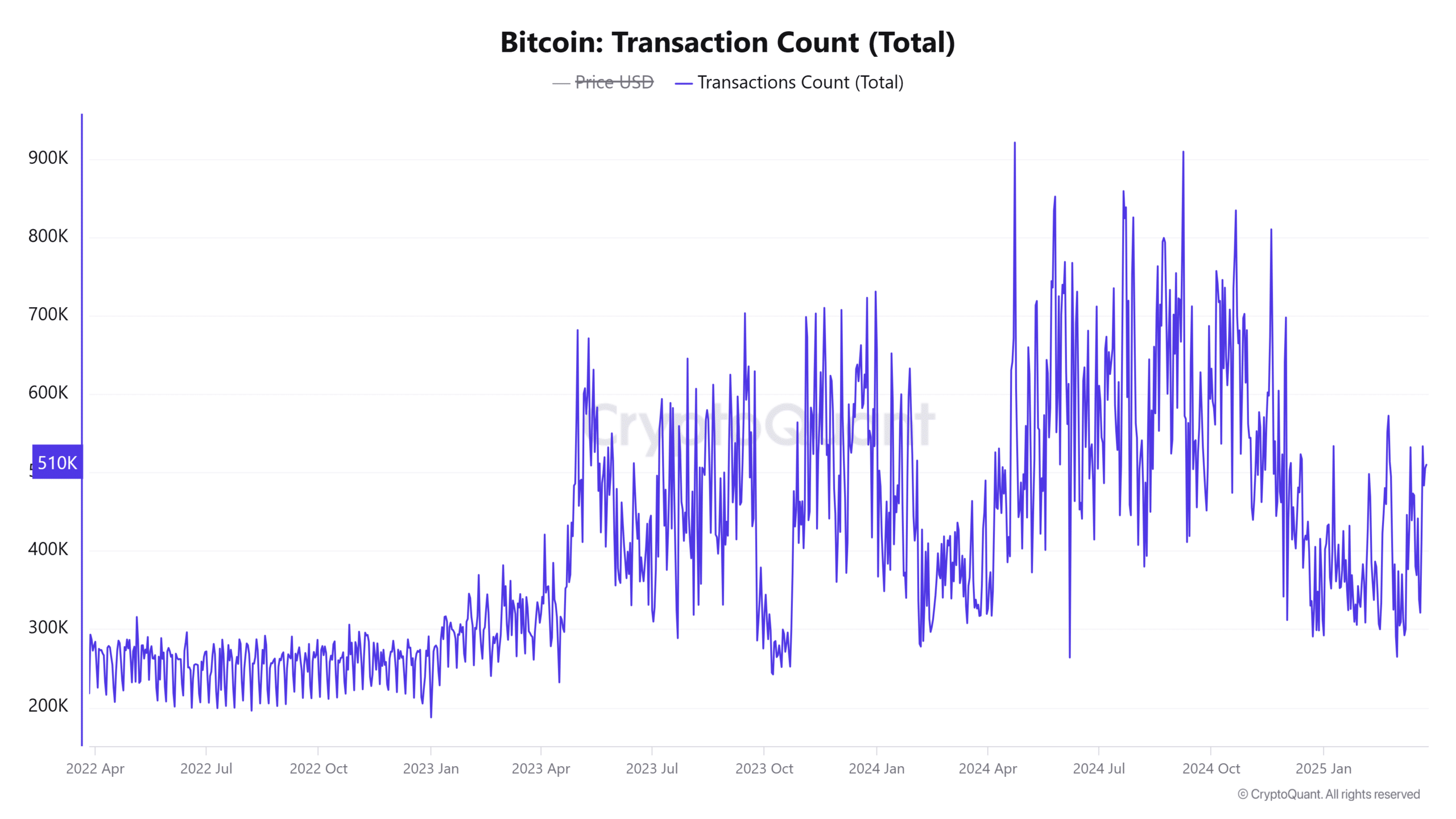

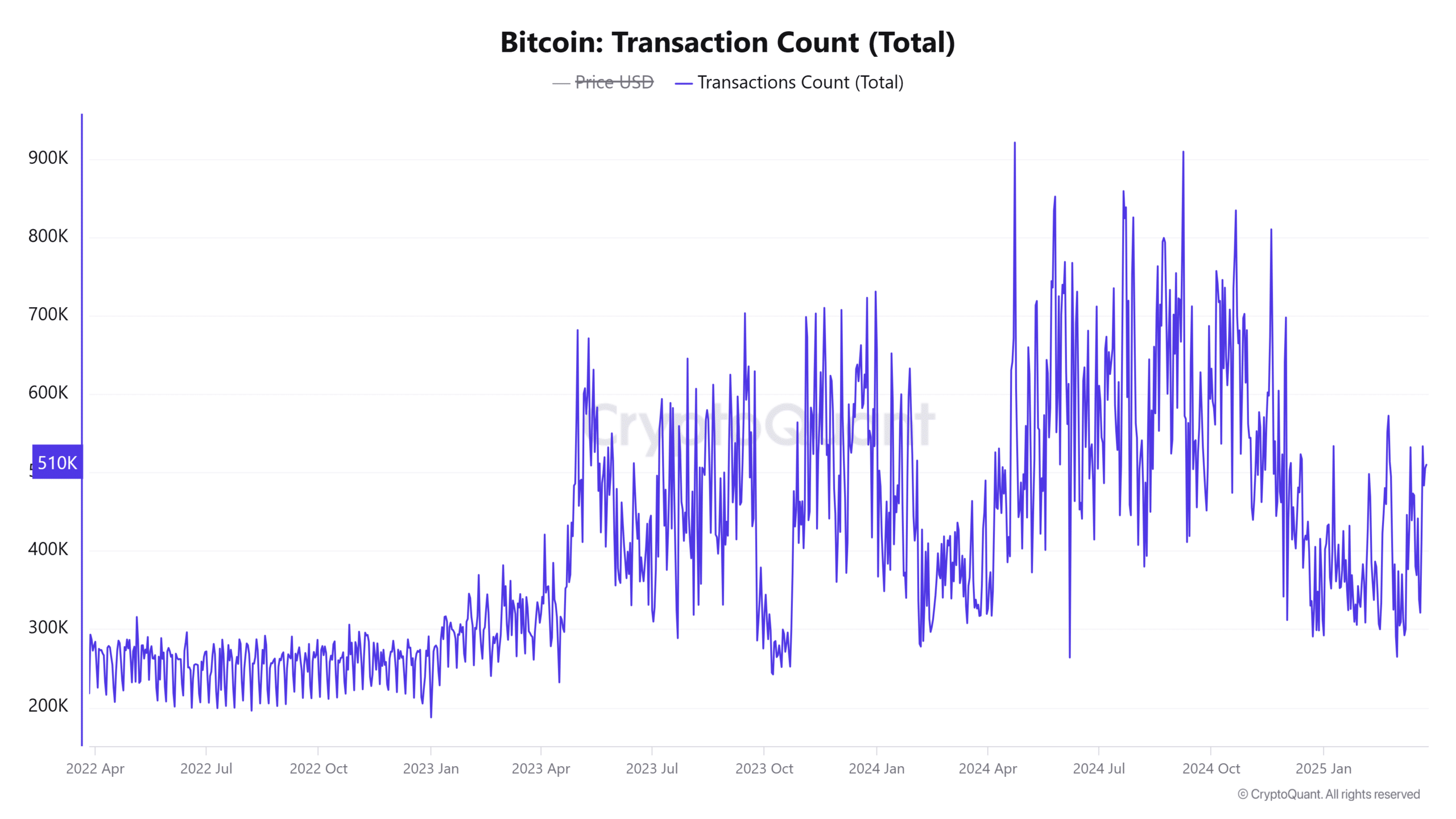

Bitcoin’s network activity also reflects growing investor interest. Active addresses have increased by 1.16%, reaching 10.17 million. This rise shows more users interacting with the BTC network, whether by sending or receiving funds.

Additionally, the transaction count has risen by 0.74%, totaling over 418,000 transactions. This increase in network activity indicates that more people are becoming involved in BTC, which could lead to higher demand and, potentially, upward price pressure.

Source: CryptoQuant

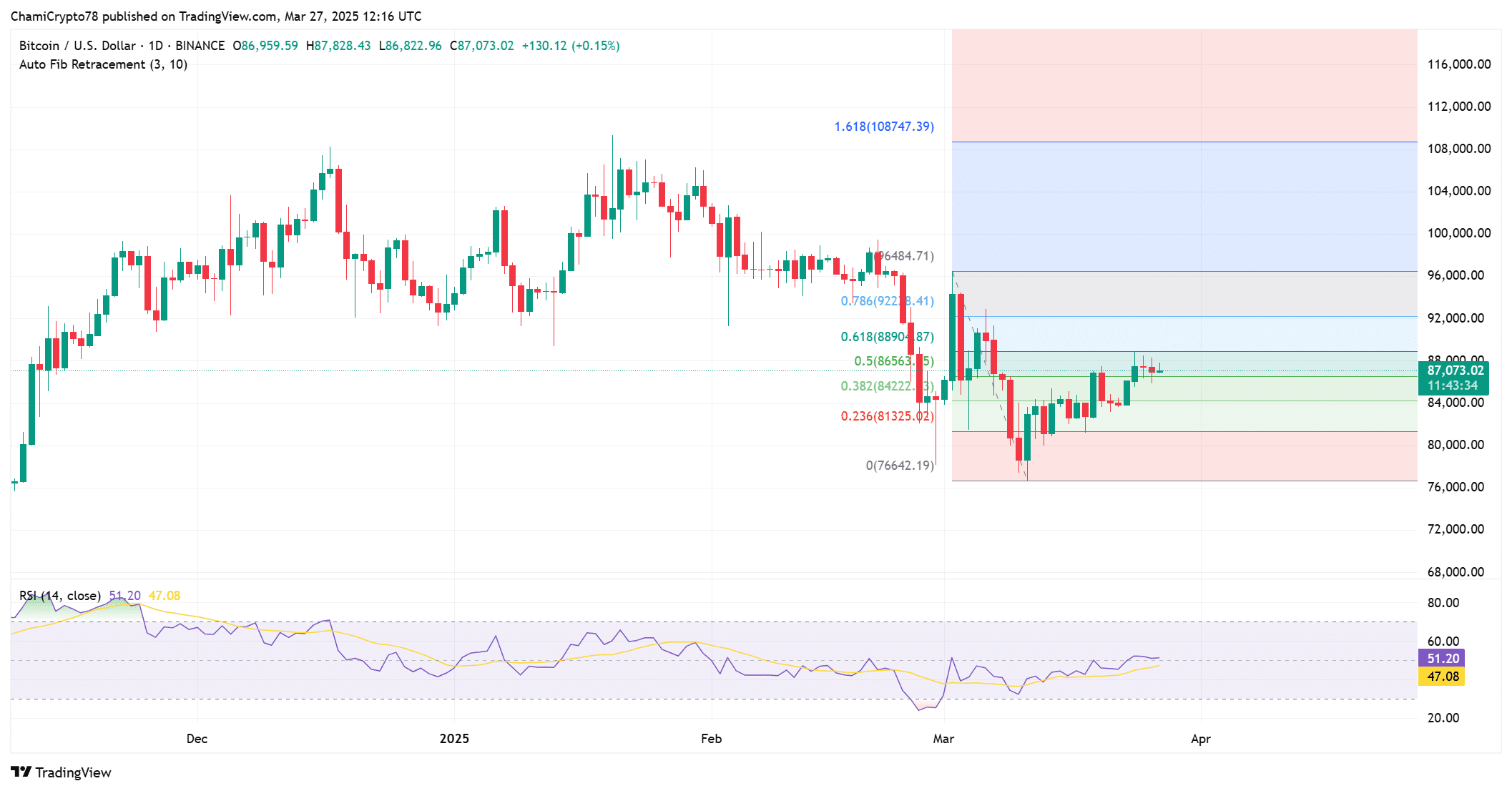

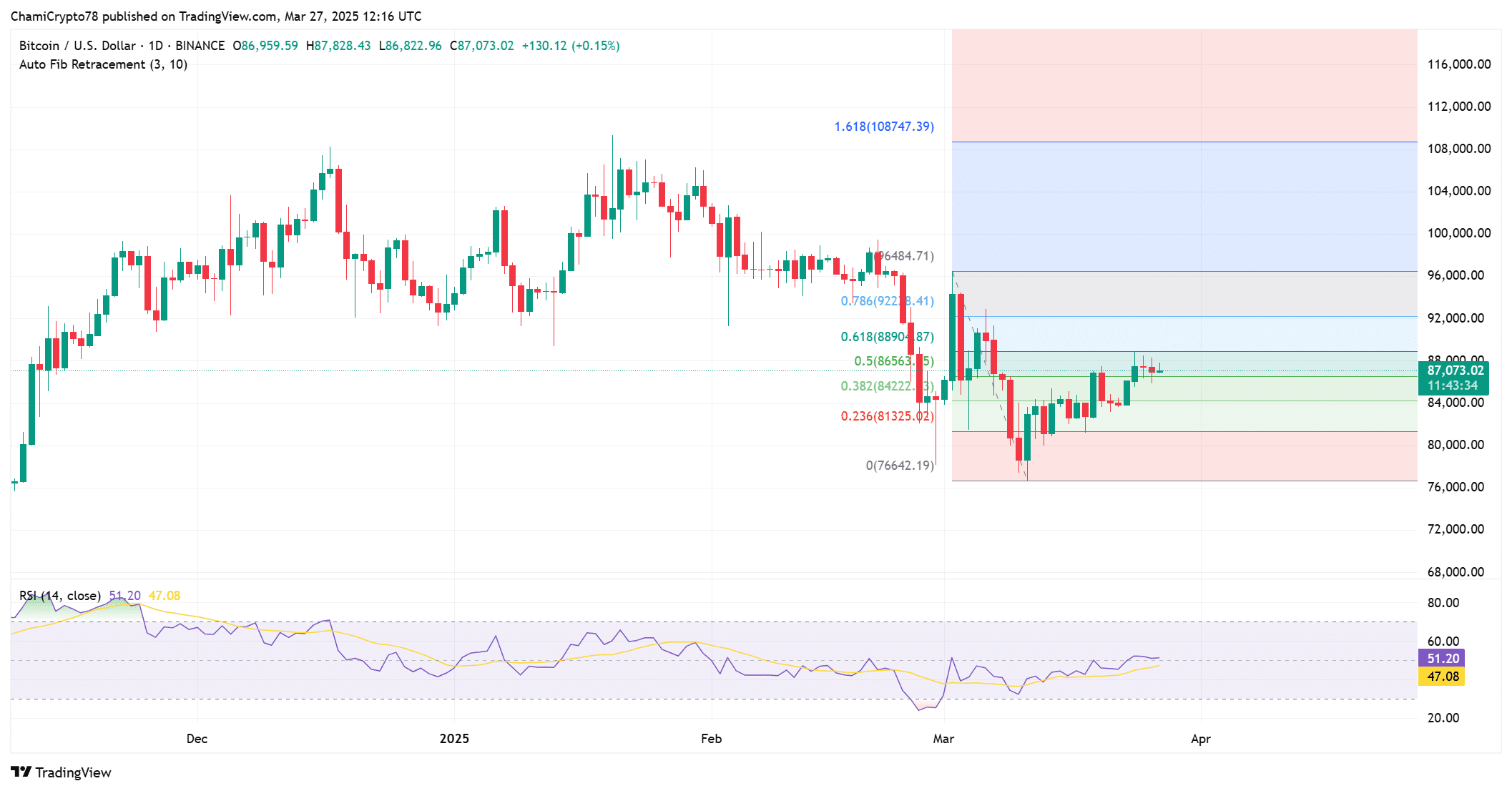

Technical indicators: Is BTC ready for a breakout?

Looking at technical indicators, BTC’s price chart shows encouraging signs. At press time, the Fibonacci retracement levels suggested that Bitcoin has found support at the 0.236 level, around $81,325.

Furthermore, the RSI was at 51, which indicates that BTC is neither overbought nor oversold. This suggests that BTC still has room to move in either direction, with a potential breakout on the horizon if it continues to hold above key support levels.

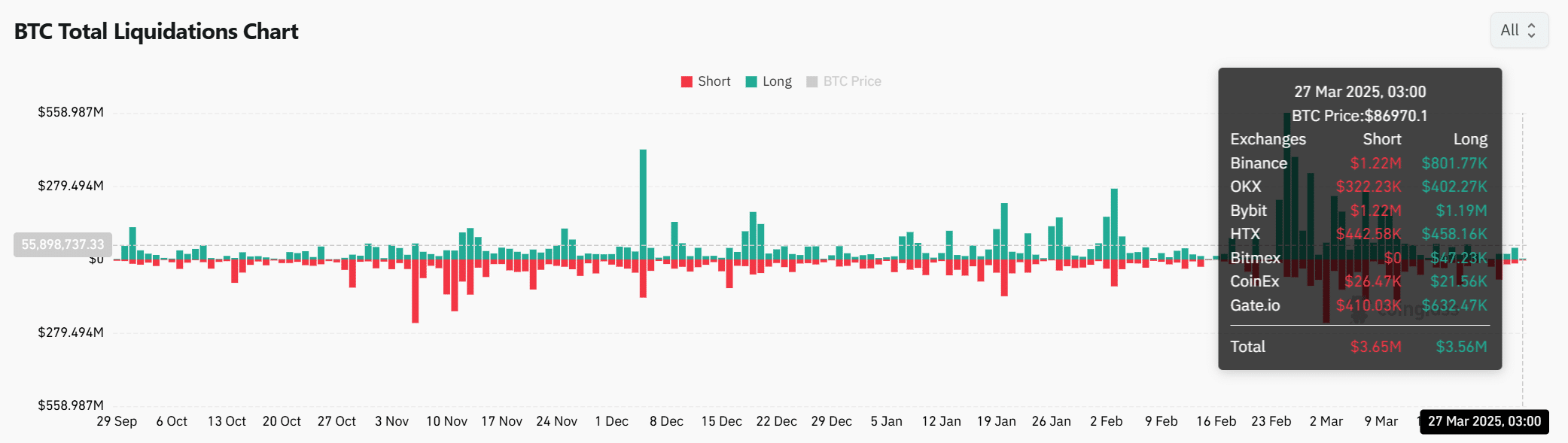

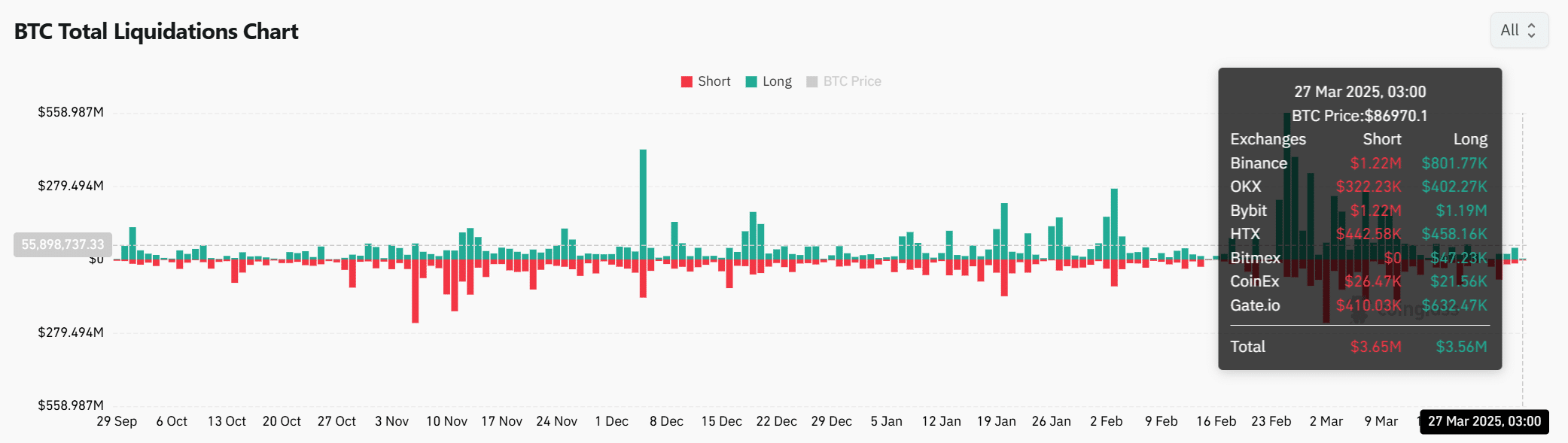

Long vs. short liquidations

BTC’s liquidation data shows that long and short liquidations are nearly equal, with $3.65 million in long liquidations and $3.56 million in short liquidations.

This suggests that the market is balanced, with both optimistic and cautious traders adjusting their positions. The balanced liquidations point to an equilibrium in the market, awaiting the next major price movement.

Source: Coinglass

Conclusively, BTC’s low supply on exchanges, rising network activity, and promising technical indicators suggest that BTC could be entering a new bullish phase.

The growing number of holders, combined with key support levels, points to upward momentum.

Therefore, it is likely that BTC will continue to see positive price action, although short-term volatility could still impact the market.