- Spot traders of AAVE have bought out large holders selling across the market

- AAVE became the most valuable protocol, overtaking Lido over the past 24 hours

Over the past 24 hours, AAVE, despite all the positive market sentiment, has failed to assume a bullish position on the charts. Instead, it registered a slight decline of 4.74% – A move that can be associated with large holders selling across the market.

However, according to AMBCrypto, this sell-off may only temporary. Especially since several bullish indicators seemed to hint at a short-term hike for the altcoin.

Spot traders engulf large holders in the market

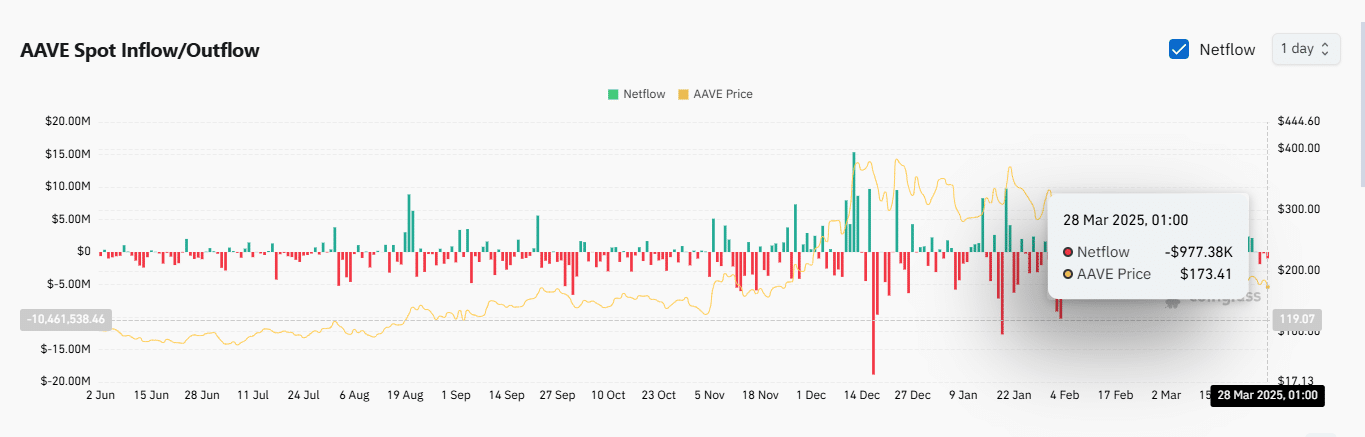

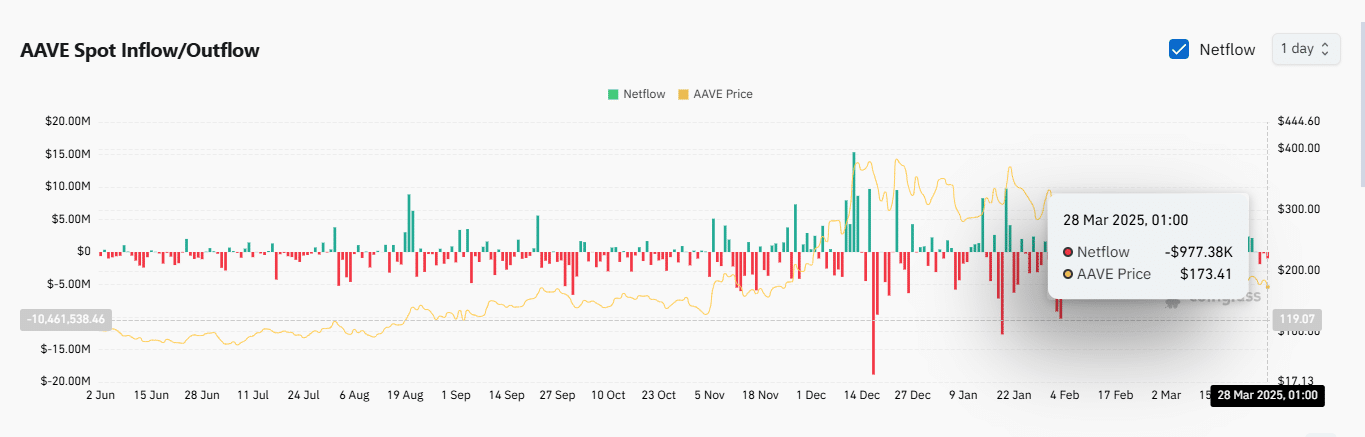

In the last 24 hours, large investors have continued to sell AAVE – A move that can be associated with potential profit-taking.

A total of approximately 4,500 AAVE, worth $830,000, was sold by these investors to the market. Such a sale, by default, tends to lead to a price decline on the charts.

Source: Coinglass

And yet, despite these sell-offs, there has been massive buying activity in the spot market. At the time of writing, these spot traders had acquired nearly four times the selling pressure, purchasing $2.39 million worth of AAVE over the last four days.

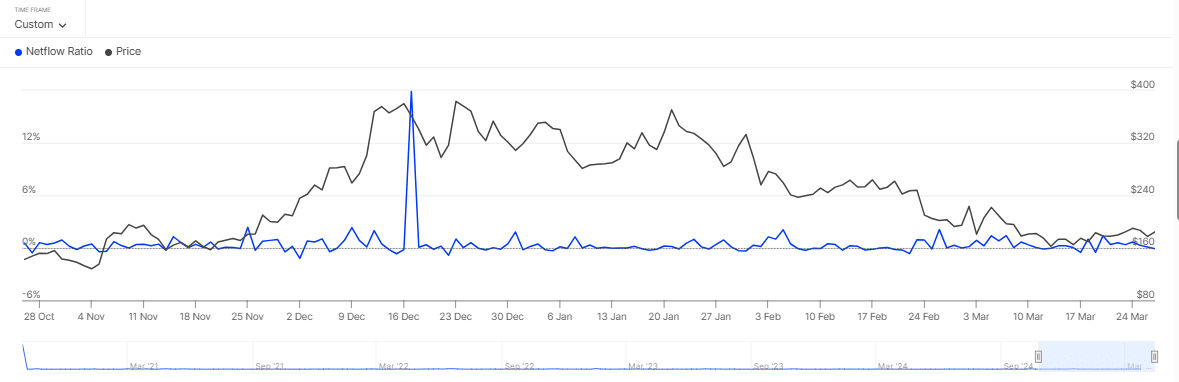

This was confirmed as the exchange netflows turned negative during this period. A negative reading means traders aren’t just buying, but are likely to hold for the long term as they move AAVE. In this case, to private wallets.

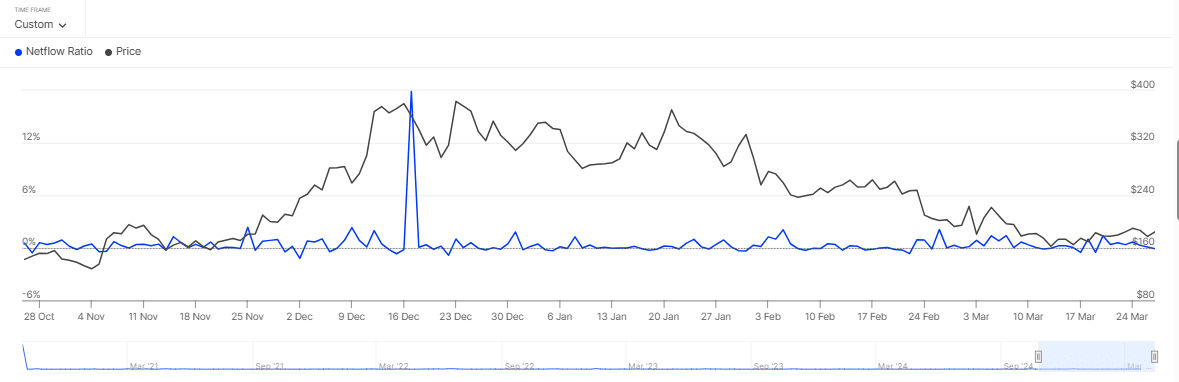

Source: IntoTheBlock

The bullish sentiment was further confirmed as the large holders’ netflows to exchange turned negative, with a reading of -0.08%. When this happens, it implies that retailers are more dominant in the market.

Combined with the earlier buying activity, it can be seen as a sign that these retailers are dominating through their buying activity.

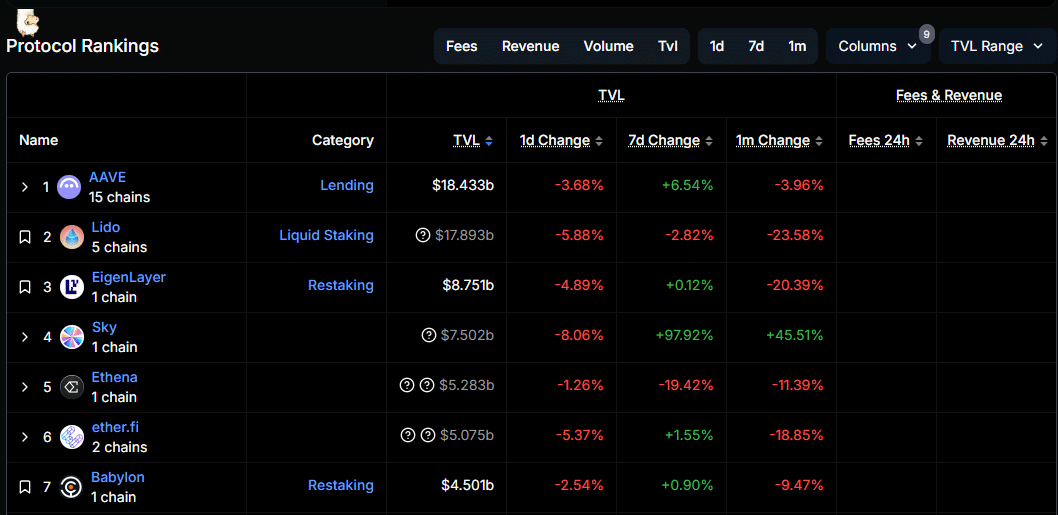

At press time, AAVE had become the most valuable protocol in the market, with a TVL value of $18.433 billion. Thanks to its latest uptick, it now holds a $450 million lead over Lido.

Source: DeFiLlama

AAVE’s growth confirmed the massive flow of liquidity into the asset and the potential for a major market rally. Especially since AAVE buying is expected to soar in the coming days.

Negative sentiment among derivatives traders

Unlike the spot market which highlighted clear accumulation by traders, derivative market traders have been flashing completely bearish signals.

For example – Open Interest climbed over the last few days, with the same valued at $239.12 million at press time. This underlined a hike in the number of unsettled contracts across the market.

Source: Coinglass

As a standalone metric, it doesn’t provide clear insights into what to expect from derivative traders. However, it can be combined with the rising selling volume and the long-to-short ratio dropping to 0.909. Here, a reading below 1 implies that sellers are dominating – Indicative of a bearish trend.

Concurrently, the funding rate also turned negative, implying that short traders have been paying a premium fee occasionally to maintain their positions. This has contributed to downward pressure on the price charts.