- Circle crypto aims to list on the New York Stock Exchange under the ticker symbol “CRCL.”

- Analysts speculate that Ripple or Coinbase could acquire Circle after the IPO.

Circle, the issuer of the USDC stablecoin, is making a bold move toward public trading with its recently filed initial public offering (IPO).

The company has submitted its prospectus to the SEC, aiming to list on the New York Stock Exchange under the ticker symbol “CRCL.”

This marks Circle’s second attempt at going public after a failed special purpose acquisition company (SPAC) merger in 2022 due to regulatory hurdles.

Circle’s revenue spikes

Circle, supported by financial giants JPMorgan Chase and Citigroup, is aiming for a valuation of up to $5 billion.

Despite its rising revenue, concerns about Circle’s financial stability have surfaced as the company prepares for its IPO.

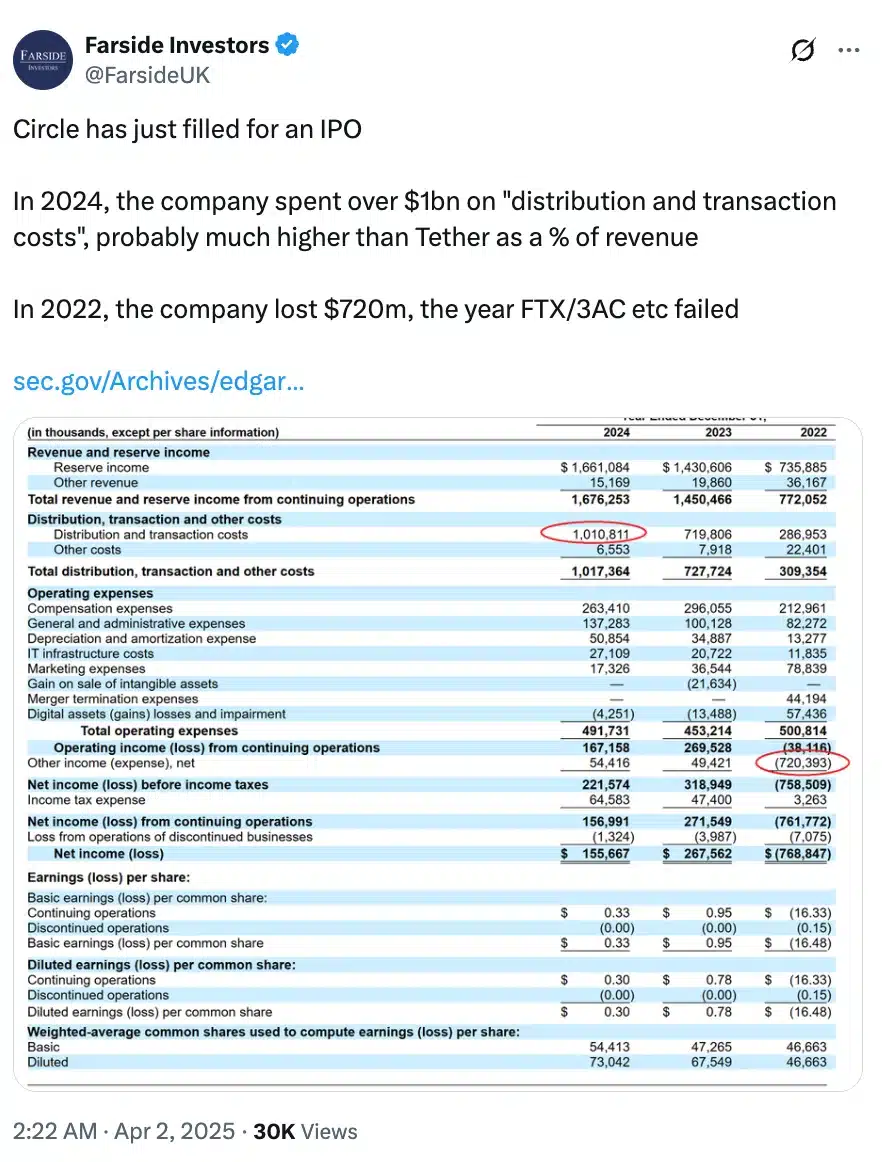

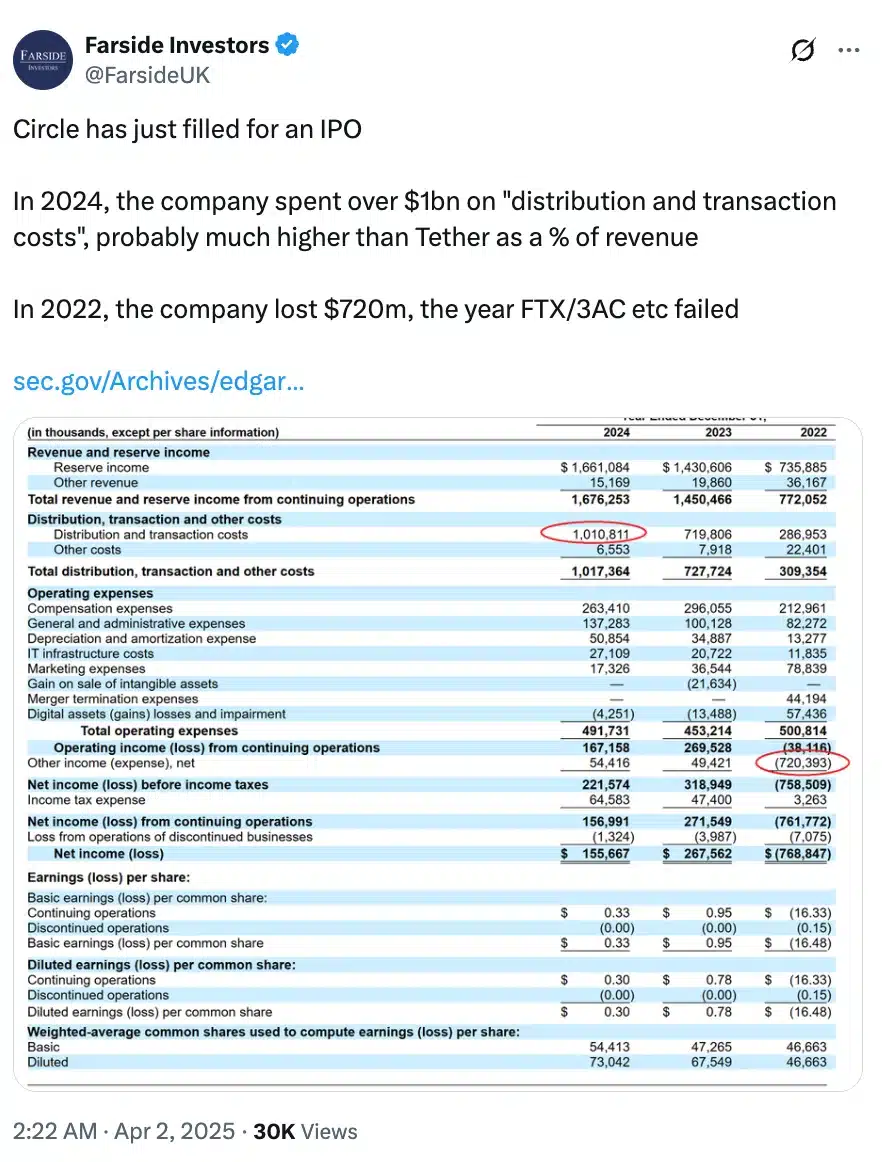

In 2024, Circle reported $1.68 billion in revenue and reserve income, demonstrating consistent growth from $1.45 billion in 2023 and $772 million in 2022.

However, its net income dropped significantly to $156 million—a 42% decrease from the previous year’s $268 million—highlighting a decline in overall profitability.

Critics question Circle’s growth — Why?

That being said, Matthew Sigel, Head of Digital Assets Research at VanEck, further highlighted a 29% drop in EBITDA, attributing it to rapid expansion, costly service integrations, and the discontinuation of revenue streams like Circle Yield.

These financial challenges have raised questions about the company’s valuation and long-term sustainability, making its IPO a crucial test for investor confidence.

Remarking on the same, Sigel added,

“Costs related to restructuring, legal settlements, and acquisition-related expenses also played a role in the decline in EBITDA and net income, despite overall revenue growth.”

Echoing similar sentiments, Farside Investors noted,

Source: Farside Investors/X

Not everyone shared the same line of thought

However, Wyatt Lonergan, General Partner at VanEck, outlined multiple possibilities for Circle’s IPO trajectory.

In an optimistic scenario, he projected that Circle could leverage the growing stablecoin market and strategic partnerships to fuel expansion.

However, in a more pessimistic outlook, unfavorable market conditions might force the company into a potential acquisition by Coinbase.

Lonergan hinted,

“Circle IPOs, the market continues to tank, Circle stock goes with it. Poor business fundamentals cited. Coinbase swoops in to buy at a discount to the IPO price. USDC is all theirs at long last. Coinbase acquires Circle for something close to the IPO price, and they never go public.”

USDC vs. USDT

While Circle pushes forward with its IPO plans, the stablecoin landscape remains fiercely competitive.

On-chain data from Visa on-chain analytics reveals that USDT continues to dominate, with a staggering $422.24 billion in transaction volume in March, significantly outpacing USDC’s $248.45 billion.

However, recent trends suggest a shift in momentum. Over the past three months, USDC has expanded its supply by $16.60 billion, far surpassing USDT’s $4.70 billion increase, according to Artemis Analytics.

This accelerated growth signals strengthening investor confidence in USDC, raising questions about whether Circle’s IPO could further tilt the balance in its favor.