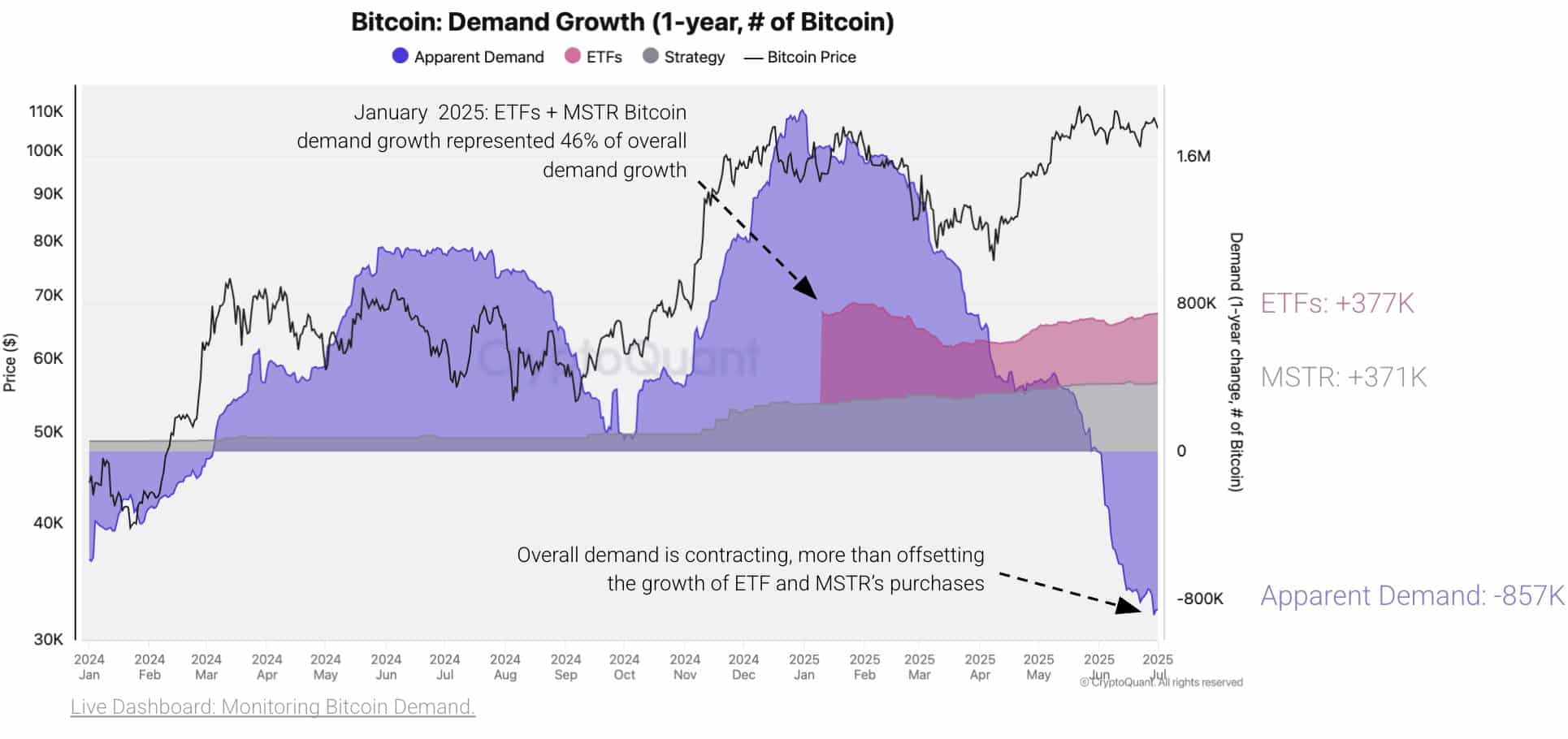

- Net demand dropped 857K BTC despite institutional buying, weakening Bitcoin’s growth foundation.

- Whale outflows, rising CDD, and falling transactions signal fading market conviction.

Bitcoin [BTC]’s net demand has dropped by 857K BTC despite ETFs and MicroStrategy accumulating 748K BTC combined—highlighting weakening organic interest from broader market participants.

At press time, Bitcoin traded at $109,011, yet this rally appears hollow as it lacks the transaction volume and retail engagement seen during past bull runs.

The failure of institutional accumulation to offset falling demand creates fragility beneath the surface, raising concerns about the sustainability of further upside.

Are whales losing faith as netflows plunge into the red?

Large holders have sharply reduced their exposure, with netflows showing a 7-day drop of over 1300%. This mass withdrawal reflects significant bearish sentiment among whales, which undermines the bullish narrative.

Notably, even brief price spikes failed to reverse the outflow trend, implying structural hesitation across this investor class.

Therefore, despite a relatively steady price floor near $96K–$97K, the sustained negative flows from large addresses point to deeper doubts about BTC’s short-term upside potential.

Why are long-term holders starting to move their coins?

At the time of writing, Coin Days Destroyed (CDD) increased by 7.06%, indicating that older BTC were moved more frequently.

CDD tracks the lifespan of coins being spent and helps gauge long-term holder sentiment. Rising CDD often signals that seasoned holders are preparing to exit positions, which introduces overhead supply pressure.

Since long-term holders typically sell during uncertain or overheated conditions, this shift may reflect growing caution. If sustained, it could put further strain on any attempt to reclaim all-time highs.

Will falling transactions cripple BTC’s momentum?

BTC on-chain transaction activity has plummeted, falling to just 97.1K, its lowest reading in months. This signals fading retail and network engagement.

While institutional involvement has increased, the broader network shows signs of stagnation. A decline in active usage reduces organic demand and hinders fundamental strength.

Hence, without renewed transaction volume and participation, Bitcoin’s bullish case weakens structurally, even if prices temporarily remain supported by large buyers.

Source: Santiment

Can positive funding rates hold up in a weak demand climate?

Notably, Funding Rates remained marginally positive at +0.008%, indicating mildly bullish positioning among derivatives traders.

However, the shallow value suggests a lack of conviction, with little evidence of aggressive long exposure. This subdued funding pattern aligns with low net demand and fading engagement.

Consequently, the derivative market is not providing meaningful momentum, reflecting uncertainty across both retail and leveraged participants in the current cycle.

Are leveraged traders at risk around the $110K zone?

Binance’s liquidation heatmap shows densely packed liquidation clusters just above $110K. These zones indicate where many traders have open long positions with high leverage.

If price tests these areas, a liquidation cascade could occur, adding volatility instead of sustained breakout energy. Therefore, this cluster creates both psychological and technical resistance.

Breaking through this level without stronger demand and volume could result in exaggerated downside risk for overleveraged positions.

Can BTC rally without real demand behind it?

Despite steady institutional inflows, BTC faces mounting pressure from falling transaction counts, declining large-holder support, and weak derivative conviction.

Long-term holders are beginning to reposition, and liquidation risk remains high around key price zones. Unless these demand-side metrics reverse meaningfully, BTC’s chances of breaking all-time highs remain slim in the near term.