- Bitcoin whales shift from selling to buying, signaling potential bullish momentum ahead

- Whale accumulation resumes after a month of selling, possibly setting the stage for a rally

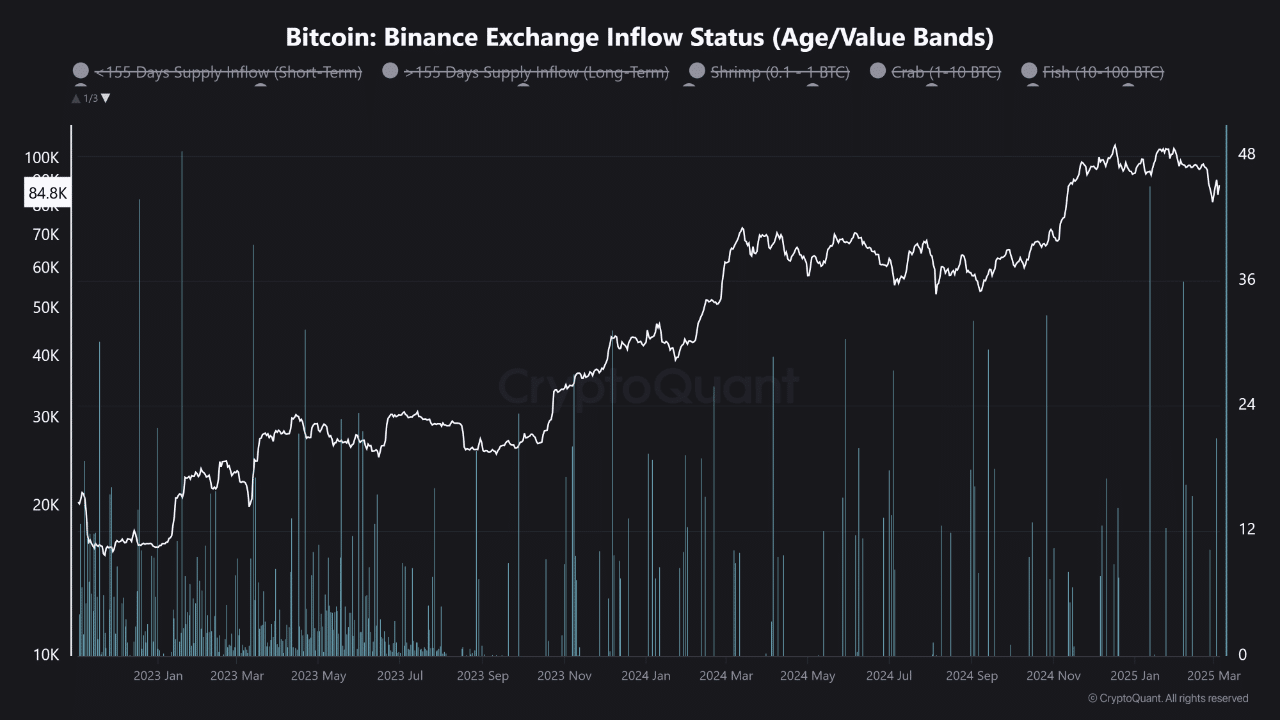

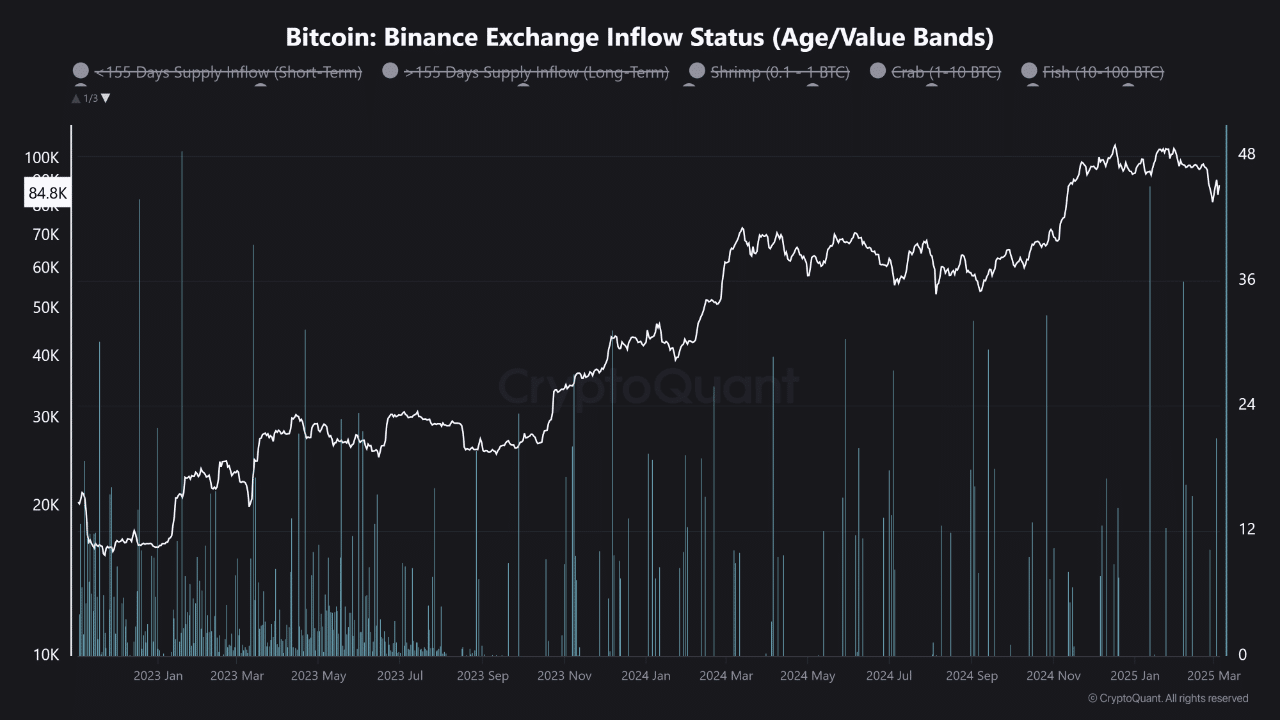

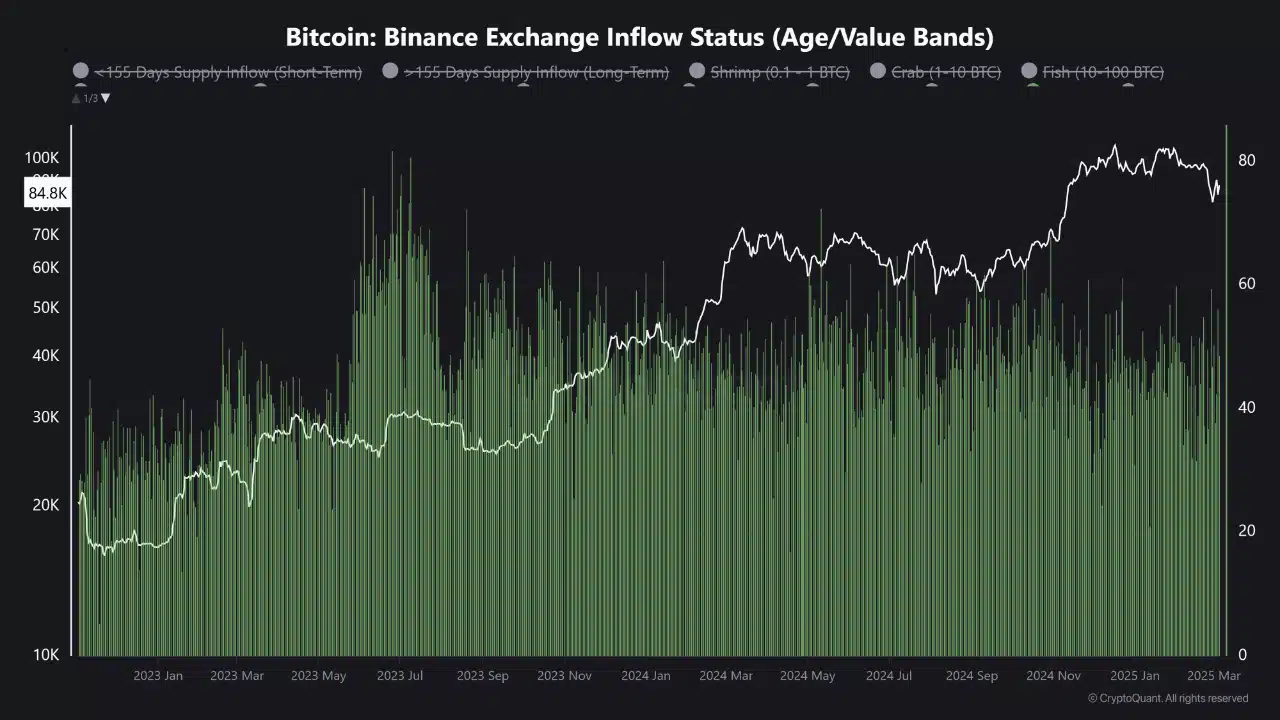

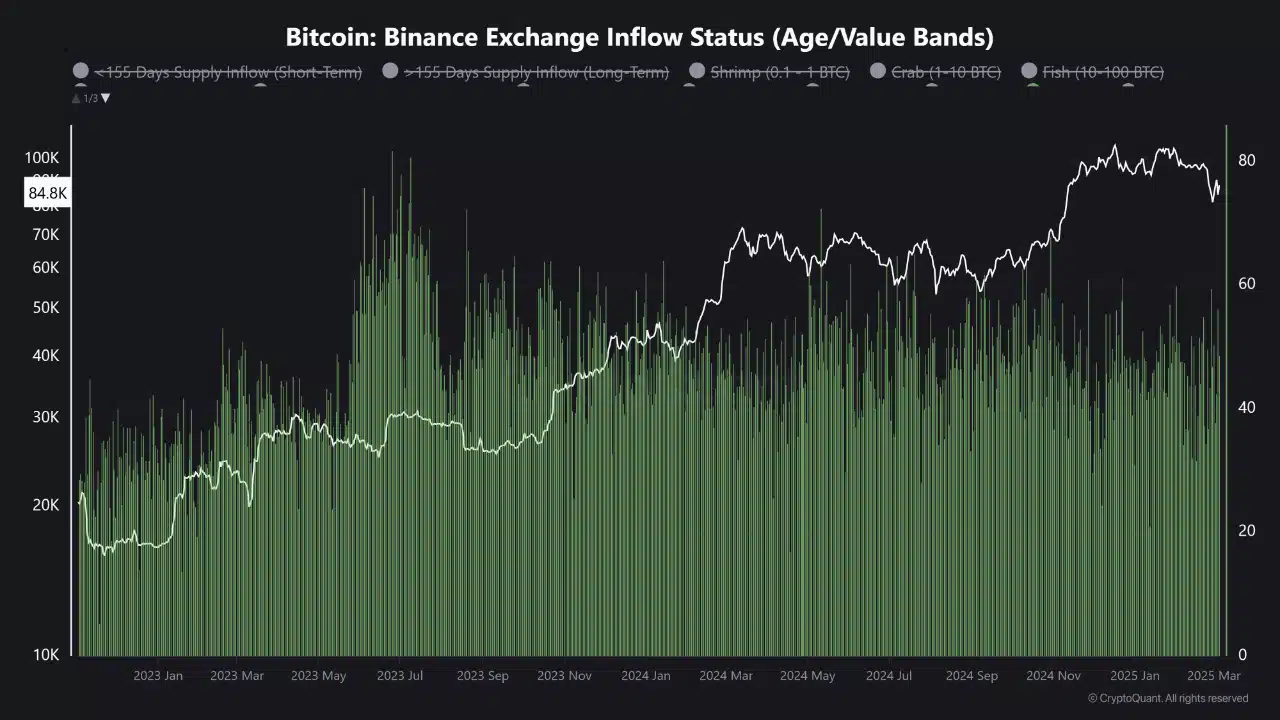

For the past month, Bitcoin’s [BTC] has faced consistent selling pressure from whales. Binance, one of the world’s largest crypto exchanges, plays a critical role in shaping market liquidity and price discovery.

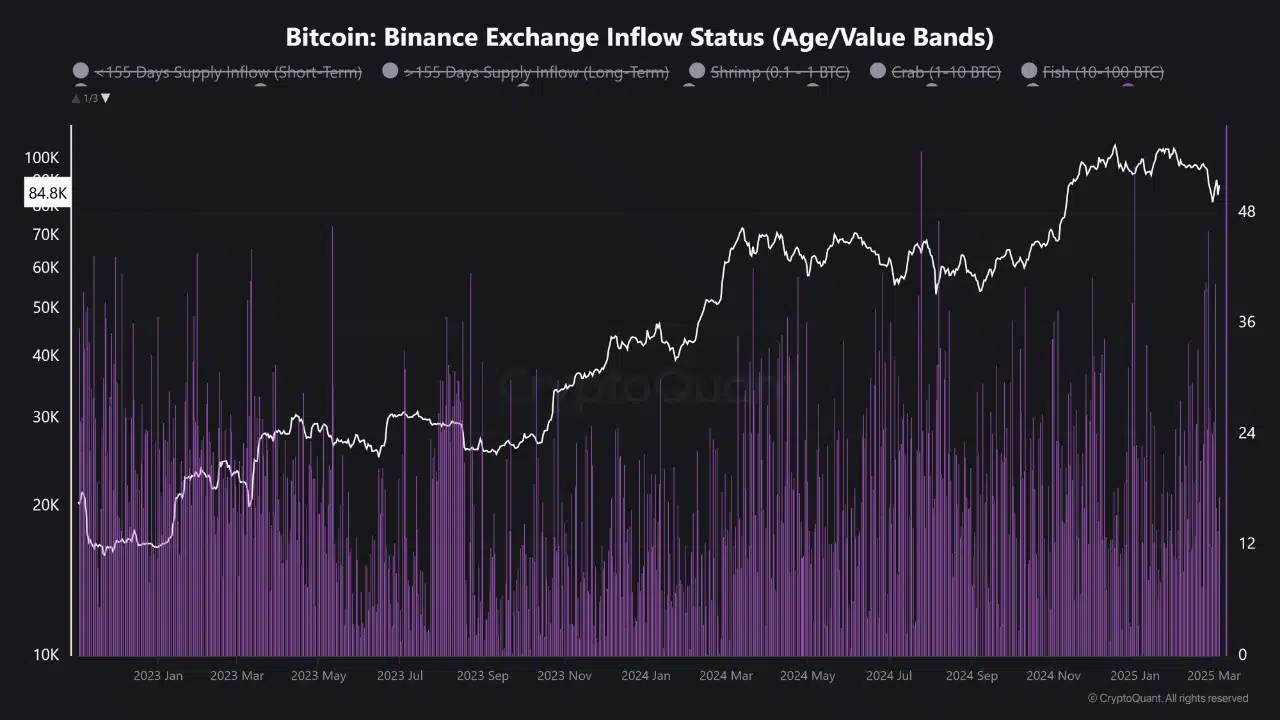

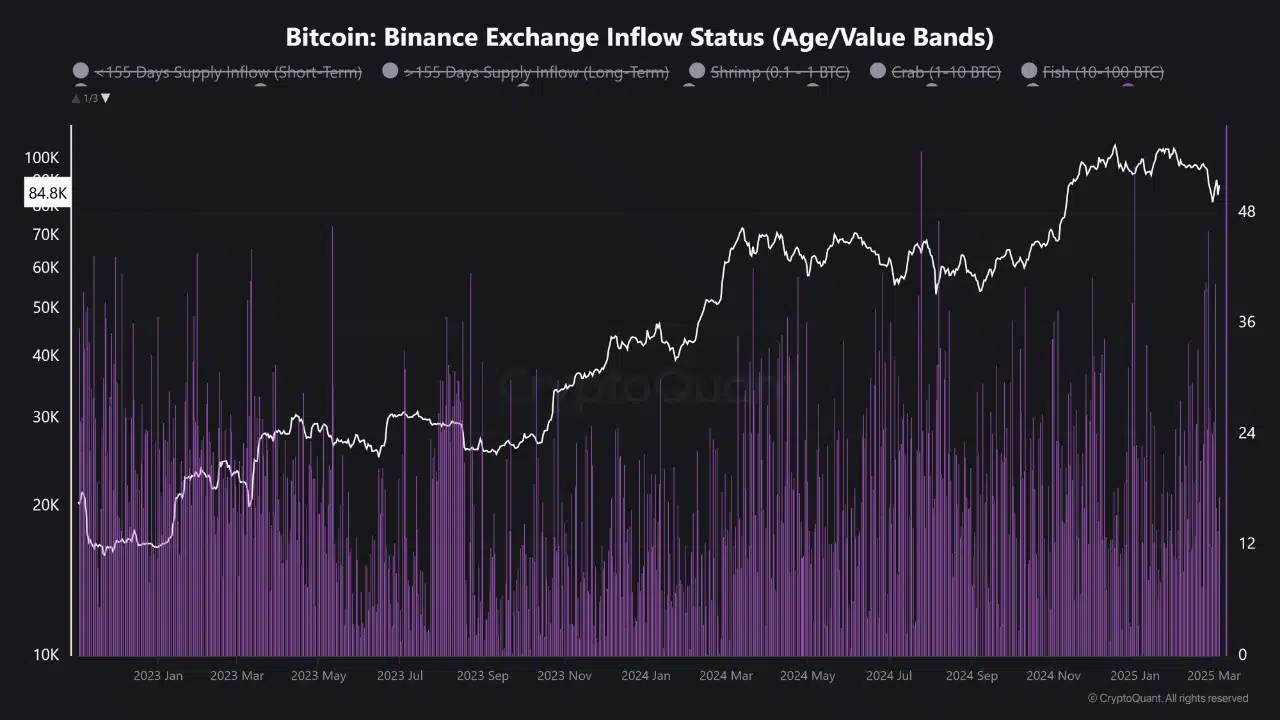

On-chain data reveals a significant shift as large holders move from net selling to accumulating once again. The monthly percentage change in whale holdings has turned positive, indicating a possible inflection point.

If this accumulation trend continues, it could pave the way for renewed bullish momentum in the market.

Bitcoin whale activity: Selling pressure to accumulation

Source: CryptoQuant

For over a month, Binance’s data reflected sustained Bitcoin inflows, predominantly from large holders. Historically, such inflows indicate selling pressure, as whales move BTC to exchanges for potential distribution.

However, fluctuations in these inflows suggest that selling may be giving way to strategic accumulation.

The latest figures confirm this shift. Binance inflows are now showing signs of fresh accumulation among larger holders.

Source: CryptoQuant

Additionally, the rise in inflows from younger coins suggests renewed confidence, while increased whale deposits indicate a transition away from distribution.

With the monthly percentage change in whale holdings now in positive territory, this could mark a turning point in market sentiment.

Source: CryptoQuant

Whales are back!

Source: X

After the longest phase of whale net reduction in a year, accumulation has resumed. Large holders are increasing their positions, reversing the previous downtrend.

This indicates whales might be preparing for the next market cycle phase. And, continued buying pressure could trigger widespread bullish sentiment.

However, it is uncertain if this trend is sustained or simply a short-term repositioning.

Bitcoin: Will accumulation drive a rally?

Source: TradingView

Bitcoin’s price action remains uncertain despite renewed whale accumulation. At press time, BTC is trading at $88,227, down 1.92%, as the market adjusts to this shift.

At the time of writing, the RSI stood at 43.43, indicating weak momentum without clear signs of oversold conditions. Although selling pressure appears to be easing, buyers have yet to take charge.

OBV remained negative, reflecting low demand. Continued accumulation could alleviate liquidity constraints and support a stronger price recovery.

A breakout above $90,000 would signal a bullish reversal while failing to hold current levels could lead to further declines.

Bitcoin’s price trajectory depends on whether whales continue accumulating or revert to profit-taking.

Whales take the lead as retail stays cautious

The market is witnessing a clear divergence: retail investors remain sidelined, while whales and institutional players drive the narrative.

On-chain data suggests that smaller holders have not significantly increased their positions, highlighting persistent caution. In contrast, whales are accumulating, shifting market dynamics in their favor.

Will fresh accumulation be enough to offset past distribution? If institutional players continue buying, Bitcoin could establish strong support, fueling a sustained rally.

Also, remember that macroeconomic conditions, regulatory changes, and overall sentiment will play a crucial role in determining Bitcoin’s trend.

If retail demand returns alongside growing institutional interest, BTC may regain upward momentum. However, renewed whale offloading could trigger another wave of selling, potentially hindering the recovery.