- TON hit a low-risk zone on Sharpe Ratio & NMR! Despite weak performance.

- TON’s one-hour Binance chart displayed a head and shoulders inverse pattern, a historically bullish reversal signal.

Despite weak recent performance, Toncoin [TON] remains one of the few altcoins near its all-time high, showing resilience.

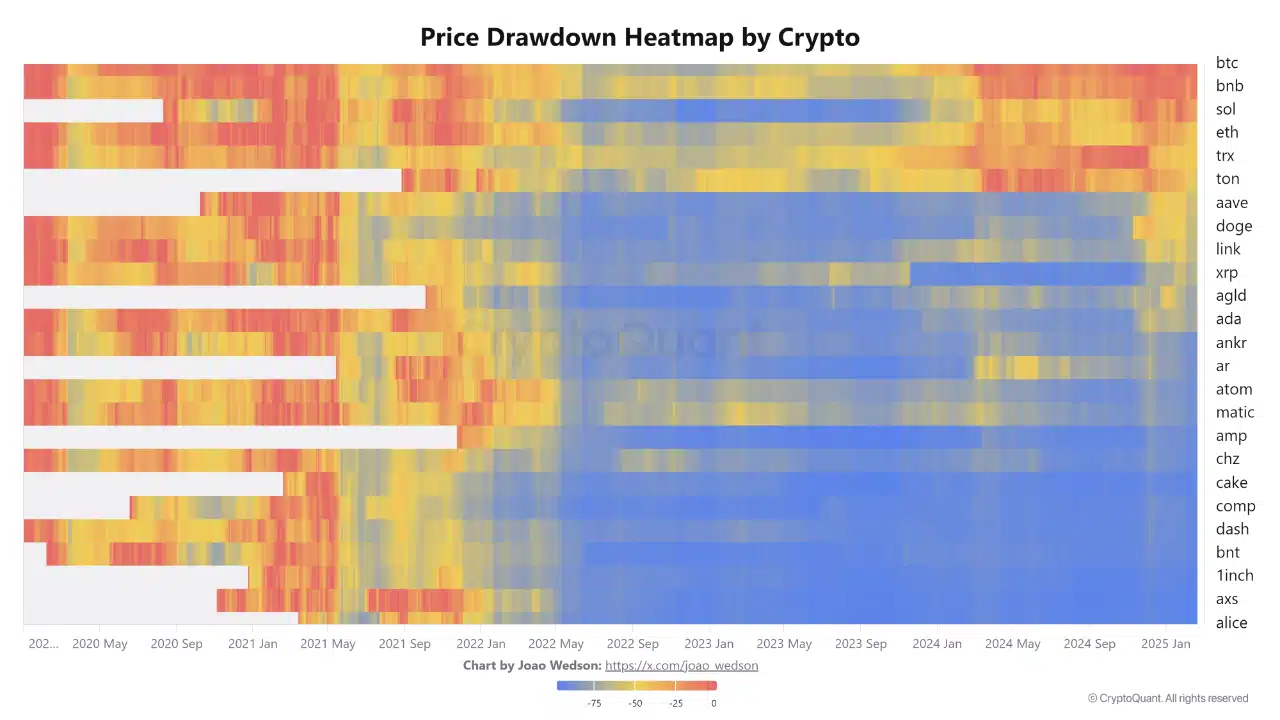

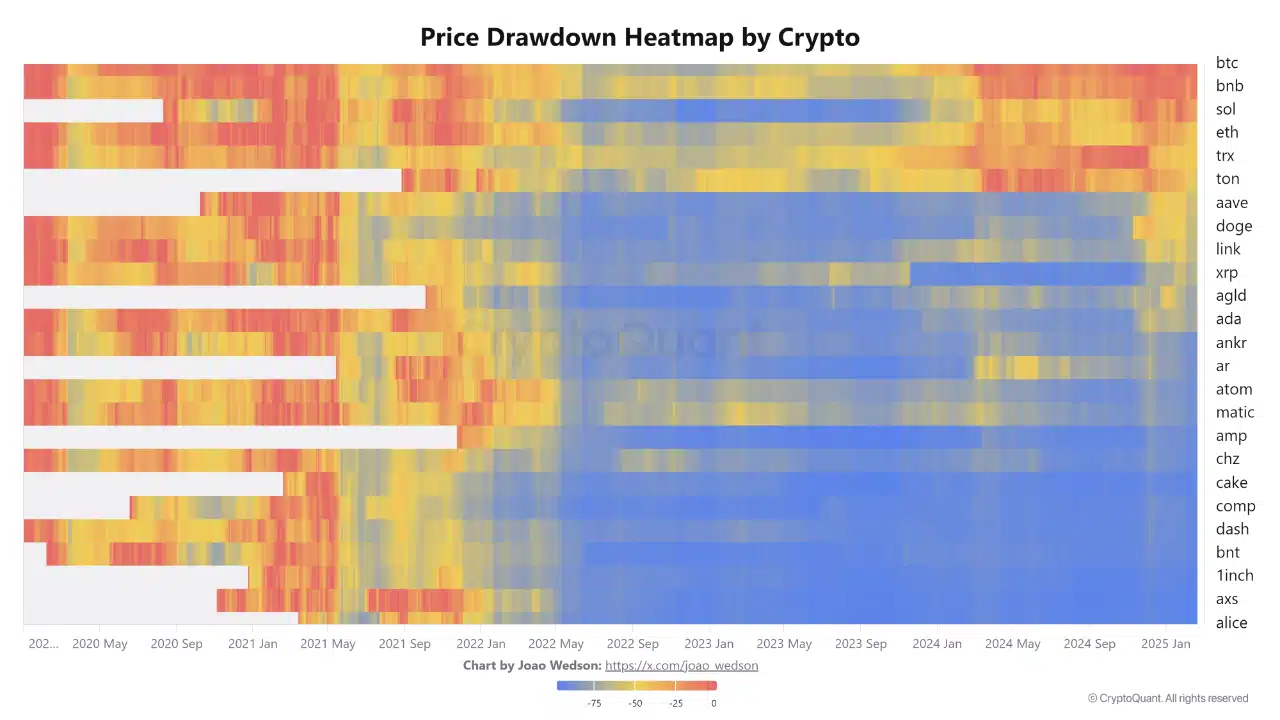

Unlike many altcoins that have significantly declined, TON, alongside BTC, TRX, and SOL, maintains a stronger market structure.

A historical buy signal for TON?

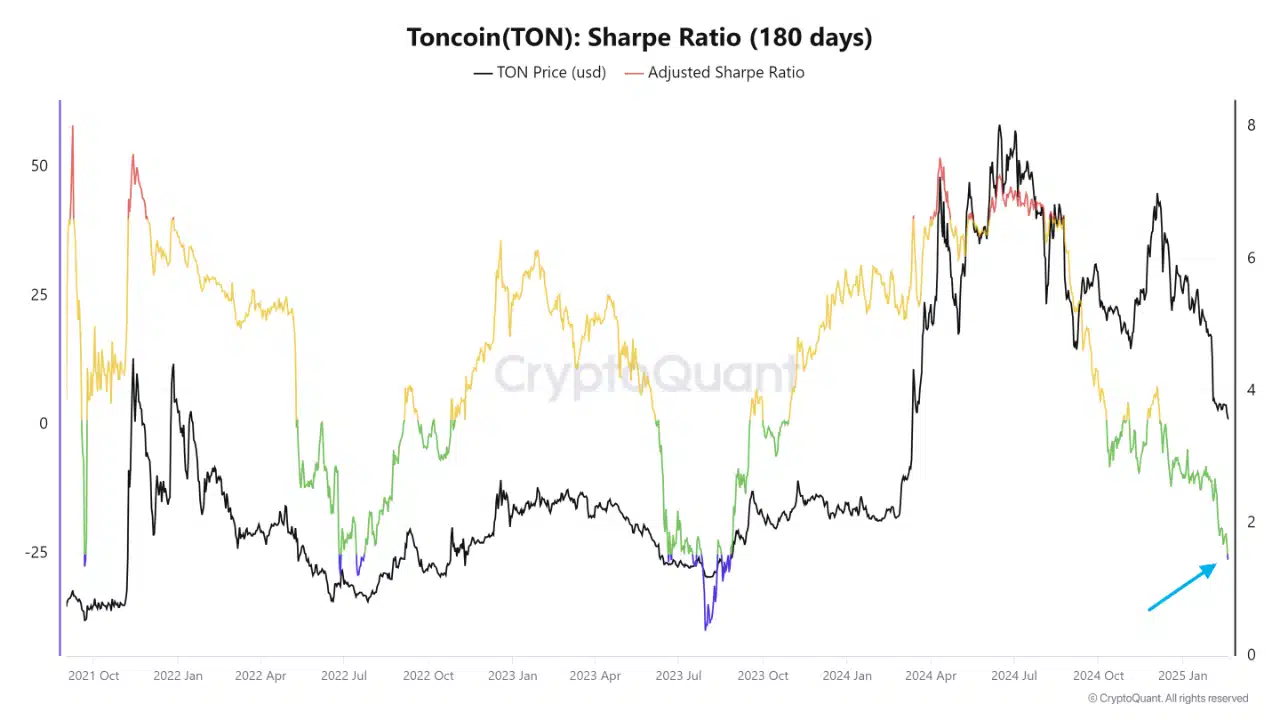

The Sharpe Ratio (180-day) has fallen to historically low levels, indicating reduced risk-adjusted returns.

This trend has previously aligned with TON’s price bottoms and accumulation phases.

Source: CryptoQuant

Similar past Sharpe Ratio declines signaled market rebounds, suggesting that TON might be entering another accumulation phase.

If history repeats, this could mark an optimal long-term entry point for traders seeking favorable risk-reward setups.

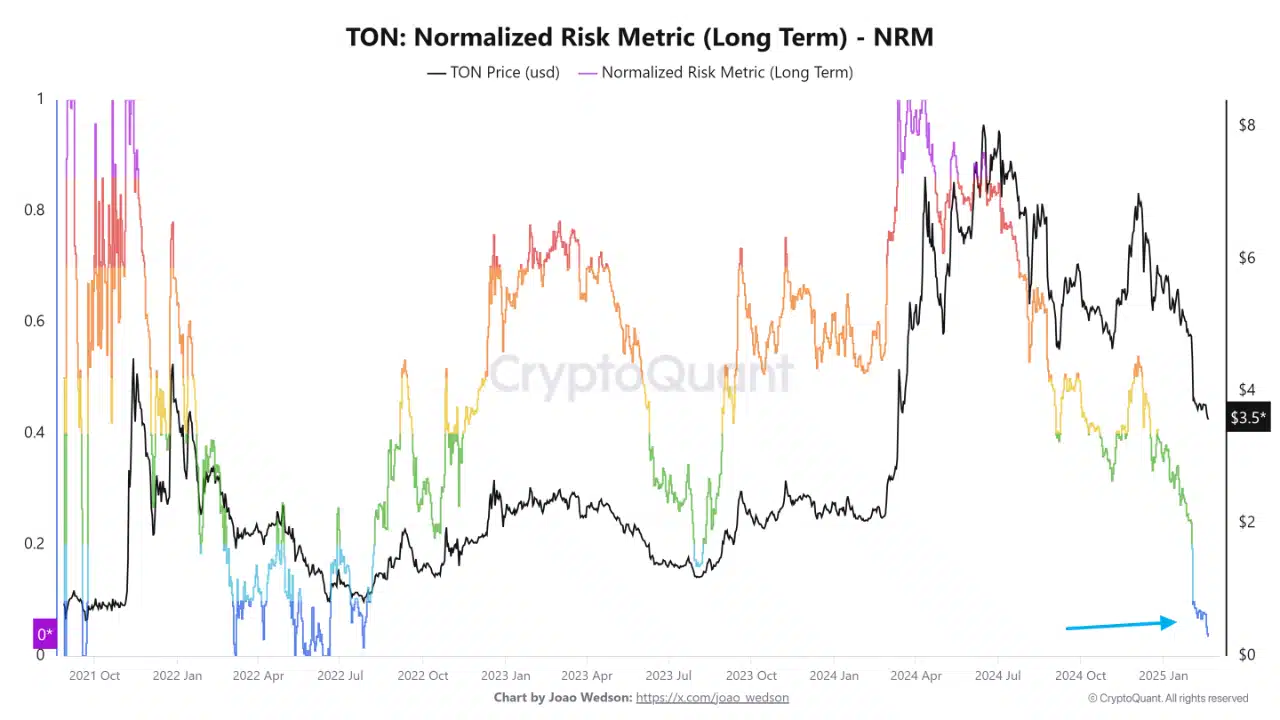

The Normalized Risk Metric (NRM) mirrors this trend, reaching low-risk levels comparable to past accumulation zones.

Source: CryptoQuant

The Price Drawdown Heatmap shows that while many altcoins are deeply underwater, TON remains structurally stronger.

Source: CryptoQuant

These indicators together reinforce the argument that TON is nearing an optimal accumulation phase, as traders reduce exposure to weaker assets in favor of high-performing, resilient cryptos.

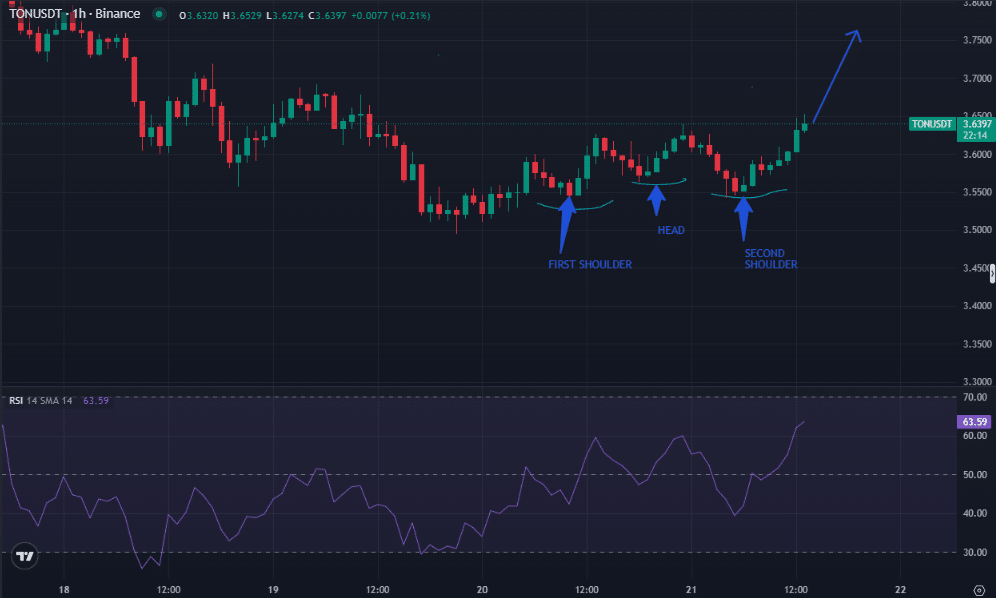

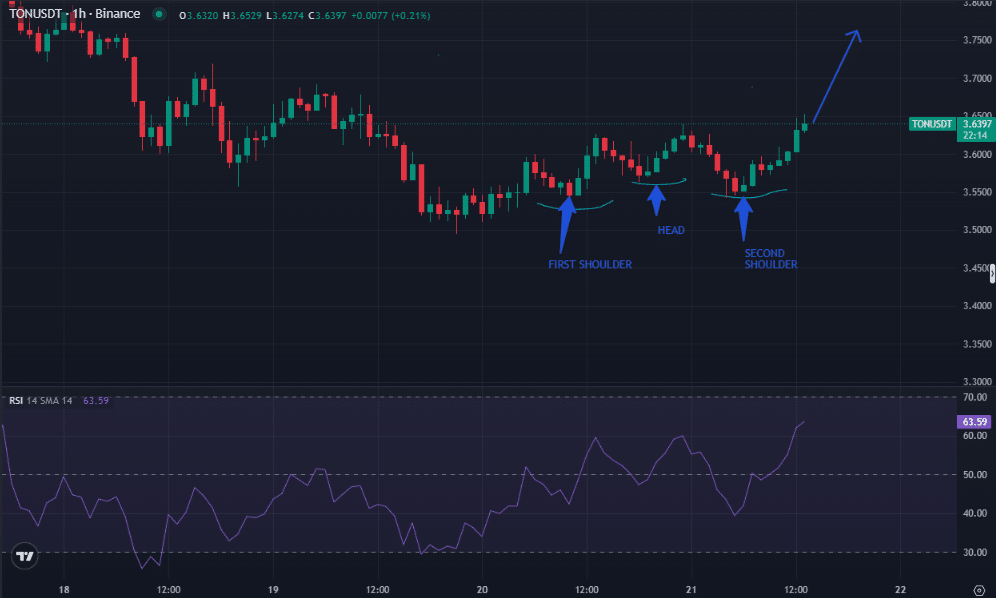

Pattern hints at potential breakout

TON’s 1-hour Binance chart displays a head and shoulders inverse pattern, a historically bullish reversal signal.

This formation suggests a potential breakout above the neckline, which could lead to sustained upward momentum.

Source: Coinglass

At the time of writing, the Relative Strength Index (RSI) was at 63.59. This indicates increased buying pressure, but the RSI remains below overbought territory, allowing room for further gains.

If TON surpasses key resistance levels, it may confirm a bullish reversal. This would align with historical price rebounds observed when the Sharpe Ratio and NRM reached similar lows.

The confluence of these indicators strengthens the argument for an upcoming trend shift in TON’s favor.

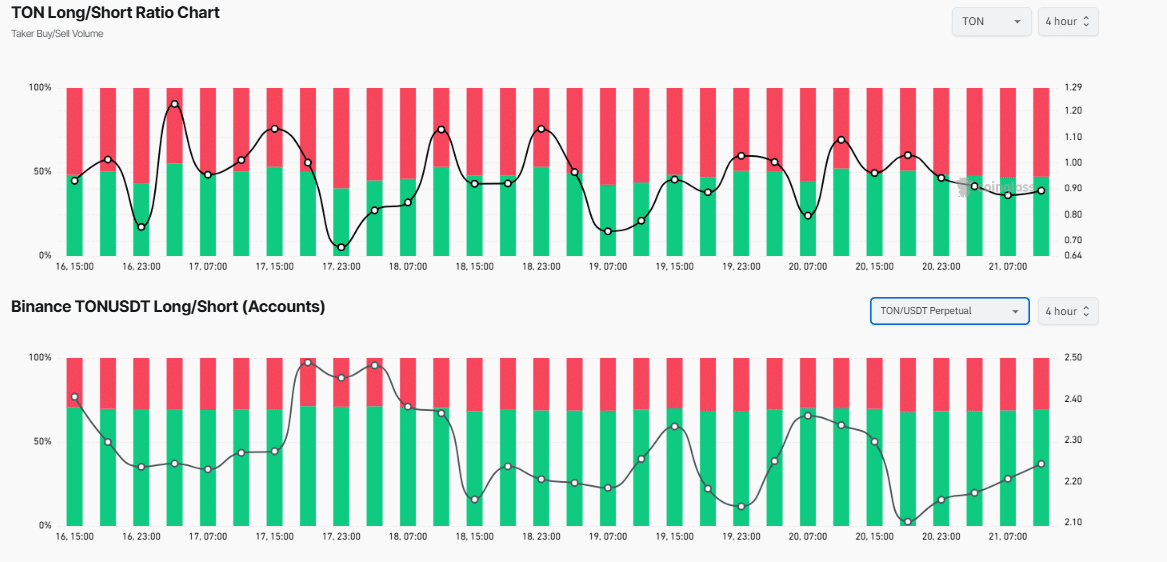

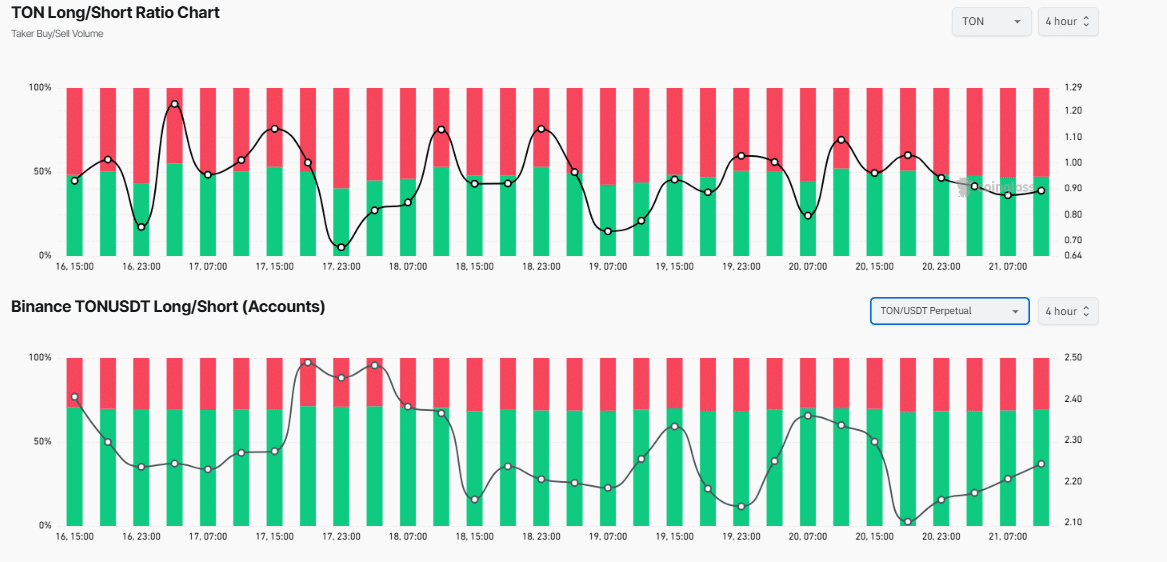

Rising long positions could trigger a short squeeze

A closer look at the Long/Short Ratio on Binance indicates that long positions have gradually gained dominance, signaling growing optimism among traders.

The fluctuations in short positioning suggest persistent skepticism, but the recent trend shift toward a higher long ratio indicates traders may be positioning for a breakout move.

Source: Coinglass

Historically, similar shifts in Long/Short positioning have preceded strong upward movements, especially with bullish indicators like a low Sharpe Ratio and inverse head and shoulders patterns.

If long positioning continues to rise while shorts remain trapped, a liquidation cascade could fuel further price gains, reinforcing the bullish outlook for TON.

Normally, when the Sharpe Ratio and NRM reach low levels, they indicate potential bottoms or accumulation zones.

Therefore, TON’s low Sharpe Ratio, declining NRM, and price drawdown resilience suggest an optimal long-term accumulation opportunity.

The inverse head and shoulders pattern supports potential upside, while Long/Short positioning hints at rising bullish sentiment.