- AAVE depreciated by 20.69% over the last 24 hours

- Cumulative interest paid by AAVE borrowers on Ethereum surpassed $1 billion

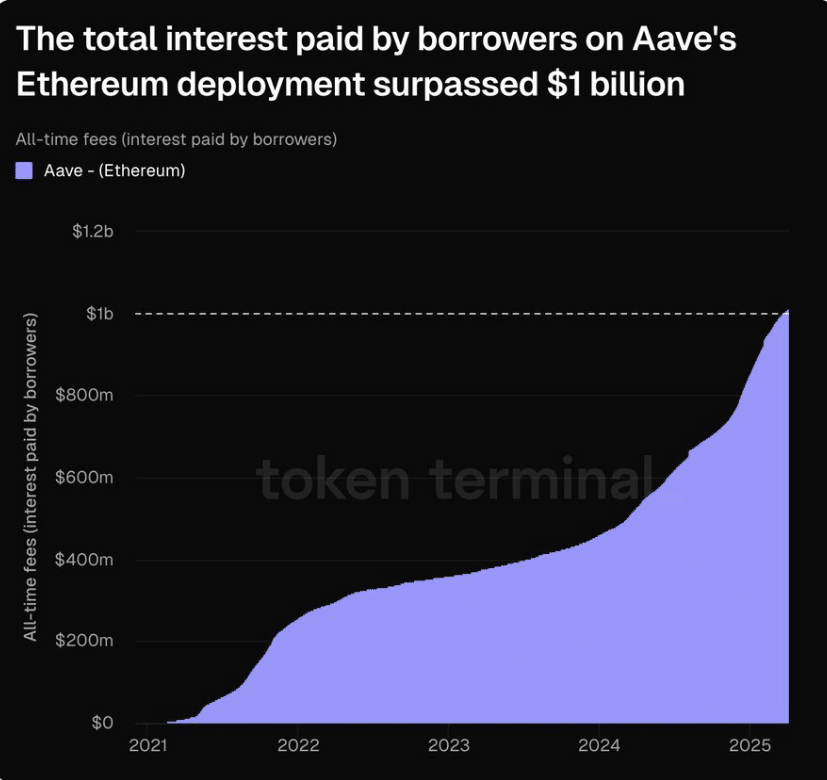

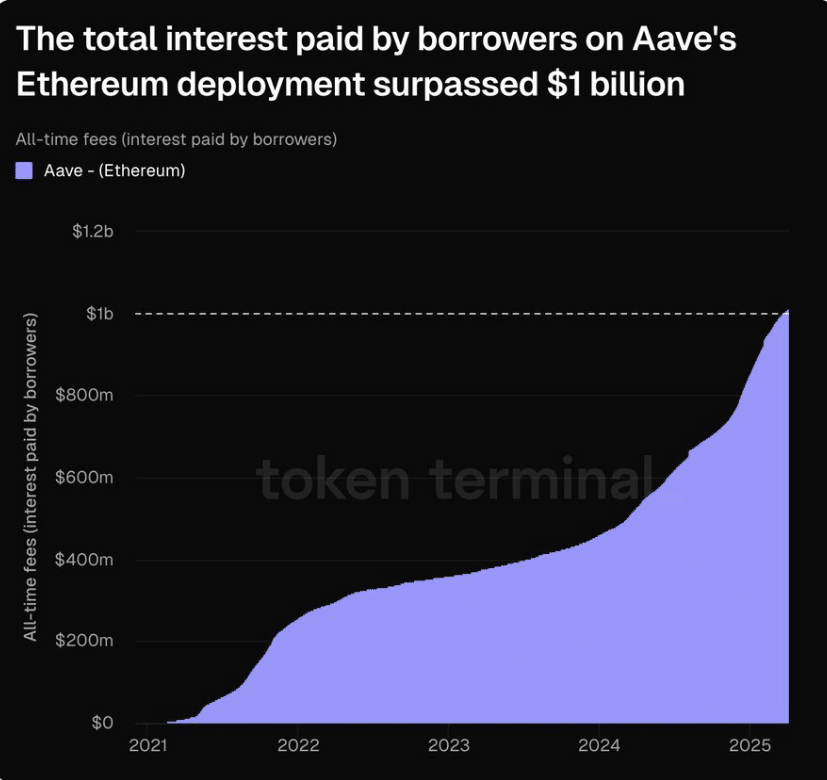

In a major milestone for the AAVE network, the cumulative interest paid by borrowers hit a new record recently.

According to data from Token Terminal, AAVE borrowers have paid over $1 billion in interest on Ethereum. Such a spike in interest paid is a sign of increasing volume, user demand, protocol usage, and most importantly, a hike in DeFi’s maturity.

Source: Token Terminal

What does this mean for the network?

Notably, the surge in interest rates by AAVE borrowers implies various things for the network. First of all, the rise here means that there is significant confidence in AAVE, especially in the network’s smart contracts and liquidity. When interest hikes as it has, it implies that AAVE is seeing very high activity in its pools. This also means that AAVE’s liquidity providers are earning significant yields and encouraging more deposits.

Secondly, the rise in fees paid is significant for AAVE’s revenue and sustainability. Notably, AAVE earns a significant share of revenue of the interest which means that the network is also generating considerable revenue. This not only supports the protocol’s sustained development, but also adds value to the token.

Growing confidence among users and liquidity providers offers them more room for growth. This, in turn, makes the protocol more attractive to investors.

Could this boost AAVE’s price performance?

While the AAVE protocol has been seeing a surge in demand and usage, this is yet to reflect on its price charts. In fact, for its part, the altcoin has seen a major downtrend take hold of its price action.

Source: Messari

That’s not all either.

In fact, the altcoin is recording strong underperformance on Futures and Spot market fronts. The Futures trade count, for instance, declined over the previous day to hit 917.23k. When the Futures trade count drops, it means that fewer traders are opening Futures positions.

Such a drop signals a strong lack of confidence as uncertainty rises. This often leads to investors taking a step back, fearing more losses.

Source: Messari

This market behavior of investors sitting on the sidelines can be further evidenced by the decline in AAVE’s Futures buy volume. This metric dropped to 116.65 million after a previous spike. Therefore, fewer traders are willing to buy the asset, leaving the market to sellers.

To put it simply, sellers have overpowered buyers, resulting in a strong downtrend on the price charts. At the time of writing, the altcoin was trading at $117 following a 20% decline in the last 24 hours.