- AAVE’s Open Interest surge suggests increased engagement and potential breakout.

- Rising active addresses signal growing network activity and support for upward movement.

Aave [AAVE] is currently showing strong signs of a potential reversal after bouncing from its accumulation zone. At press time, the price was $267.39, up by 5.07% over the past 24 hours.

With the asset continuing to build momentum, traders are closely monitoring the situation to see whether AAVE can break free from its consolidation phase and continue upward.

AAVE Open Interest surge: What does it imply?

Open interest is a crucial metric for gauging market sentiment, and AAVE has seen a rise of 23.76%, reaching a total of $290.79M according to Coinglass data.

This increase indicates that more traders are entering the market, which often precedes a larger price movement.

A rise in Open Interest signals that traders are expecting volatility, as more positions are being taken on both sides.

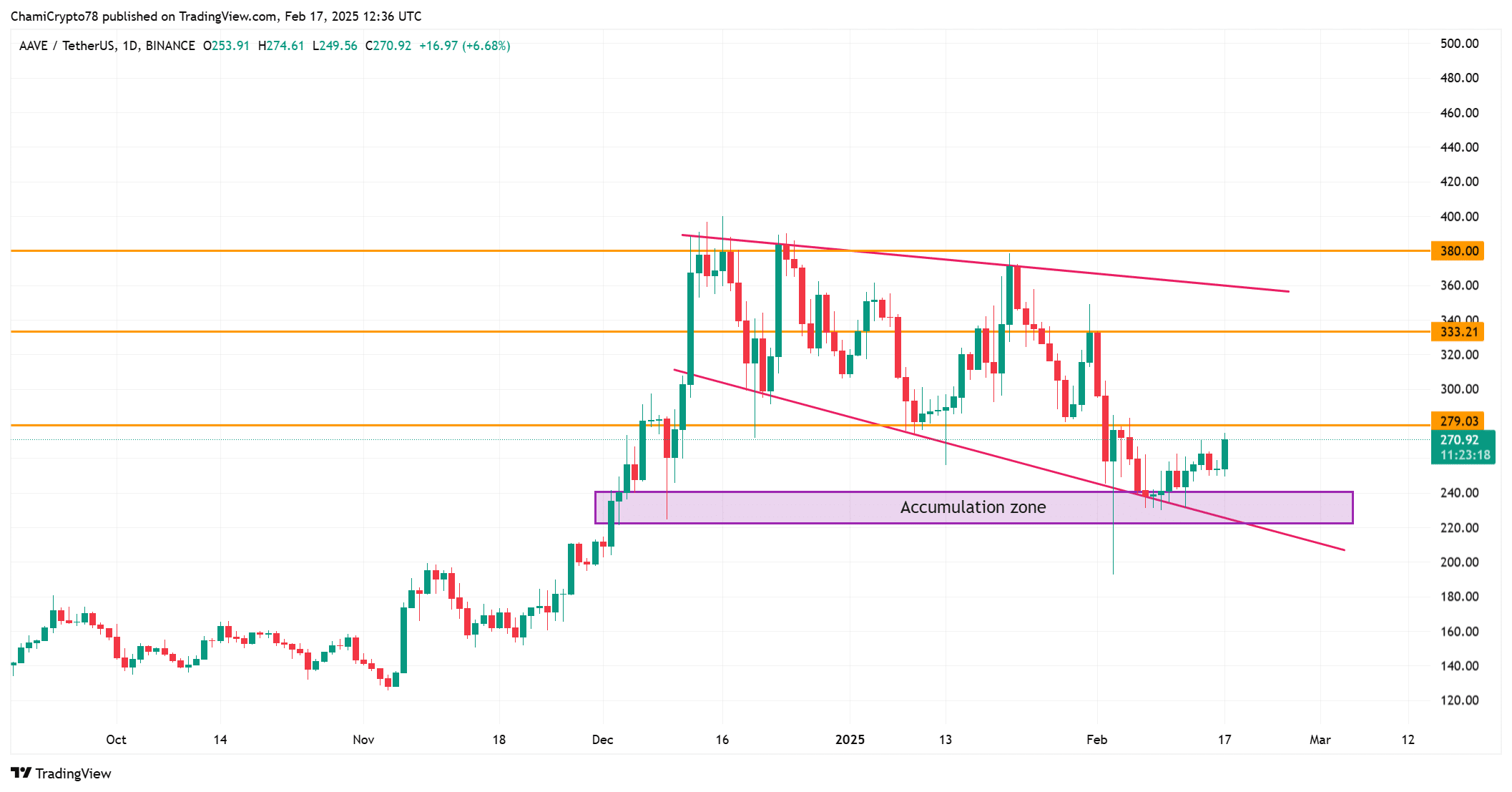

Analyzing key resistance levels

Price action analysis shows that AAVE is testing crucial resistance levels after its recent bounce. The price has moved toward the $270 level, which is the first significant resistance point.

If AAVE manages to break this level, the next target lies at $279.03. However, $333.21 is the key resistance level to watch, as it could dictate whether the price can continue its rally.

If AAVE fails to break above these resistance points, it may consolidate or face a slight pullback before attempting another breakout.

Therefore, traders need to carefully watch these levels for signs of further movement, especially the $279.03 resistance level.

Source: TradingView

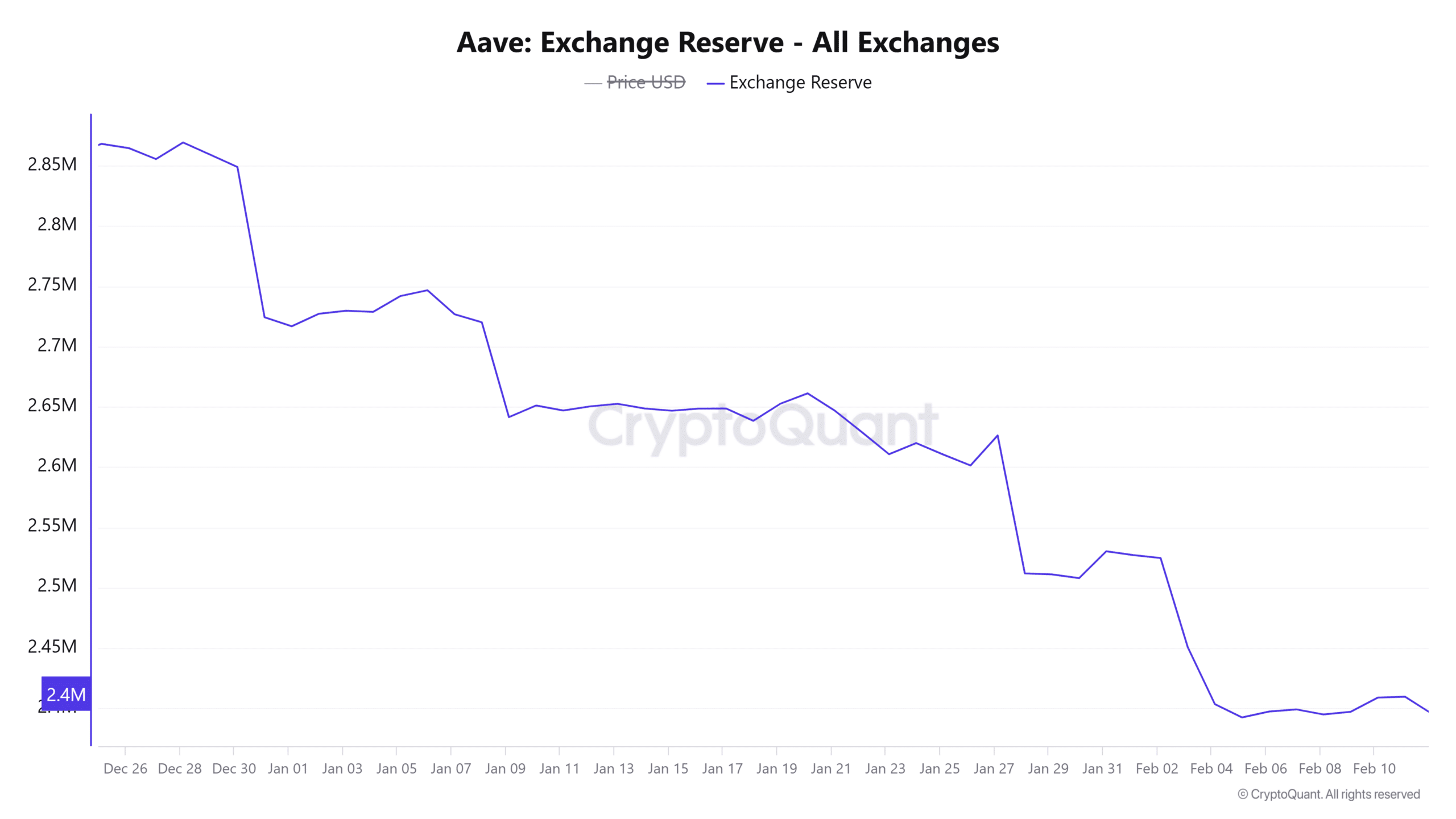

Monitoring selling pressure

Looking at AAVE’s exchange reserve data, the total number of coins held in exchanges stands at 2.39M, showing a slight decrease of 0.06%.

While this decrease is minor, it suggests that the selling pressure may not be as intense as some might expect.

However, higher exchange reserves typically indicate a buildup of selling pressure, so it’s essential to keep an eye on this metric.

Source: CryptoQuant

Growing network activity

The network activity continues to show growth, with active addresses increasing by 1.54%, reaching a total of 113. This uptick reflects growing engagement with the AAVE platform.

Additionally, the transaction count has risen by 2.06%, totaling 5.43K transactions, further indicating that more users are interacting with AAVE.

As more addresses and transactions contribute to the overall activity, this growth can help fuel further positive price movement, as it reflects a healthy, engaged network.

Source: CryptoQuant

Can AAVE break out of its accumulation zone?

AAVE is indeed showing strong signs of a potential breakout, thanks to a combination of increased open interest, positive price action, and growing network activity.

With key resistance levels ahead, AAVE has a clear path toward a sustained uptrend if it can maintain momentum.

However, the market must also keep an eye on exchange reserves, as rising levels could bring selling pressure.