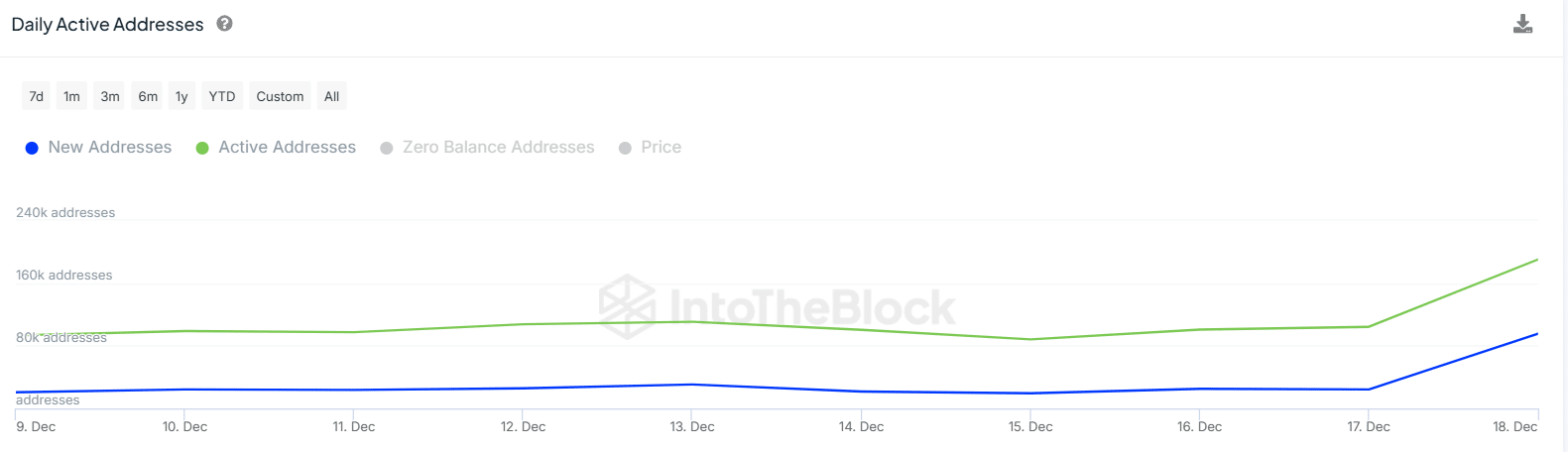

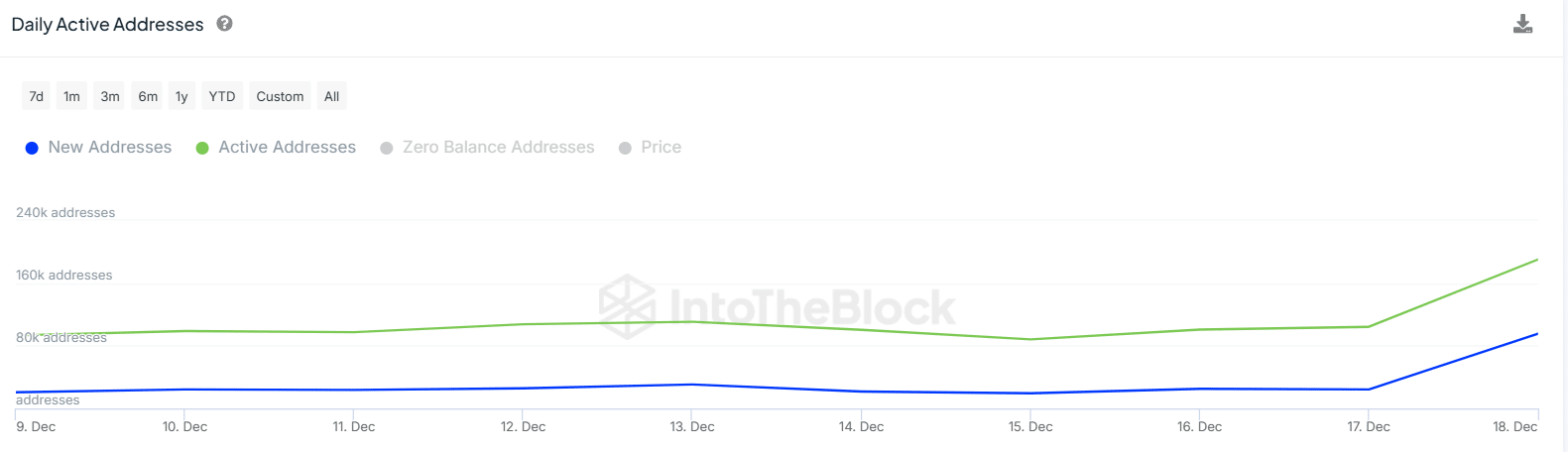

- ALGO’s active addresses have risen from 104,000 to 190,000 in just 24 hours

- These addresses could be selling, following a 20% decline in the altcoin’s price

Algorand’s (ALGO) price dropped by more than 20% in the last seven days to trade at $0.371, at press time. The prevailing bearish trend seems to be a reversal from the rally seen earlier this month, one that saw ALGO clinch a multi-year high of $0.613.

Amid this dip, however, the number of active addresses has risen, according to IntoTheBlock. These addresses surged from 104,000 to 190,000 addresses in just 24 hours. At the same time, the new addresses rose from 24,000 to 95,000.

Source: IntoTheBlock

The spike in active addresses could be a result of traders selling ALGO to minimize their losses during the dip. Consequently, the spike in new addresses could be new traders engaging in speculative activity.

If ALGO fails to recover from the ongoing bearish trends as addresses continue to hike, it will indicate that selling activity has surged. This will, in turn, fuel a volatile downtrend.

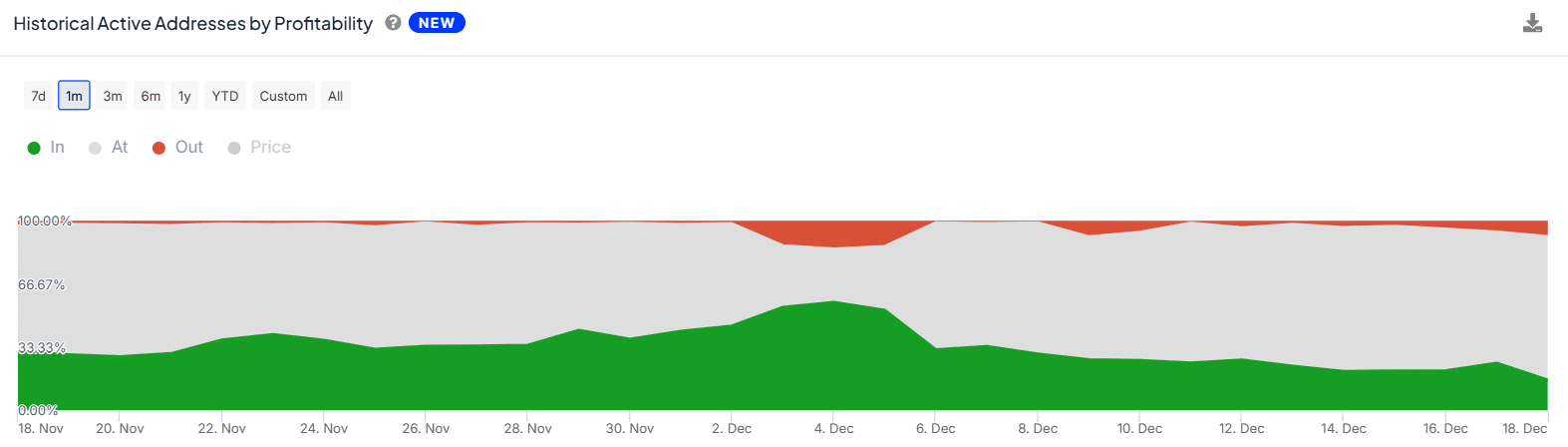

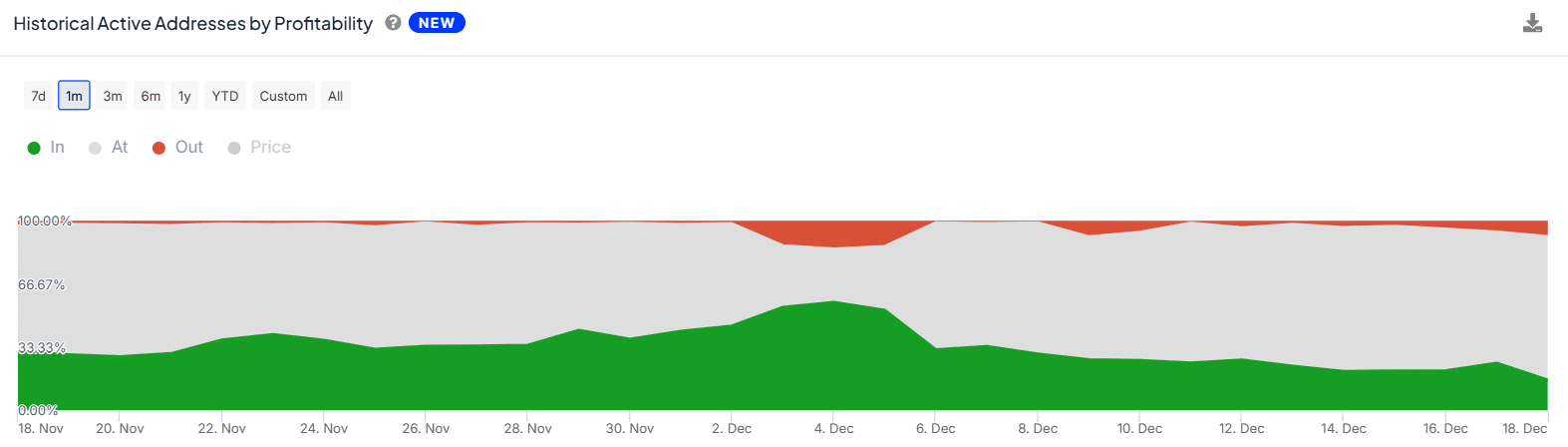

Active address profitability plummets

The profitability of active ALGO addresses dropped significantly too, hitting a one-month low after hitting a peak earlier this month. At the time of writing, the profitability of these addresses stood at 16% – A notable decline from 57% just two weeks ago.

Source: IntoTheBlock

If these addresses are becoming less profitable, it could increase the selling pressure as traders seek to minimize losses. It could also suggest that the traders who bought during the rally are booking profits.

If the profitability keeps dropping, it could lead to negative and bearish sentiment that could push the price lower.

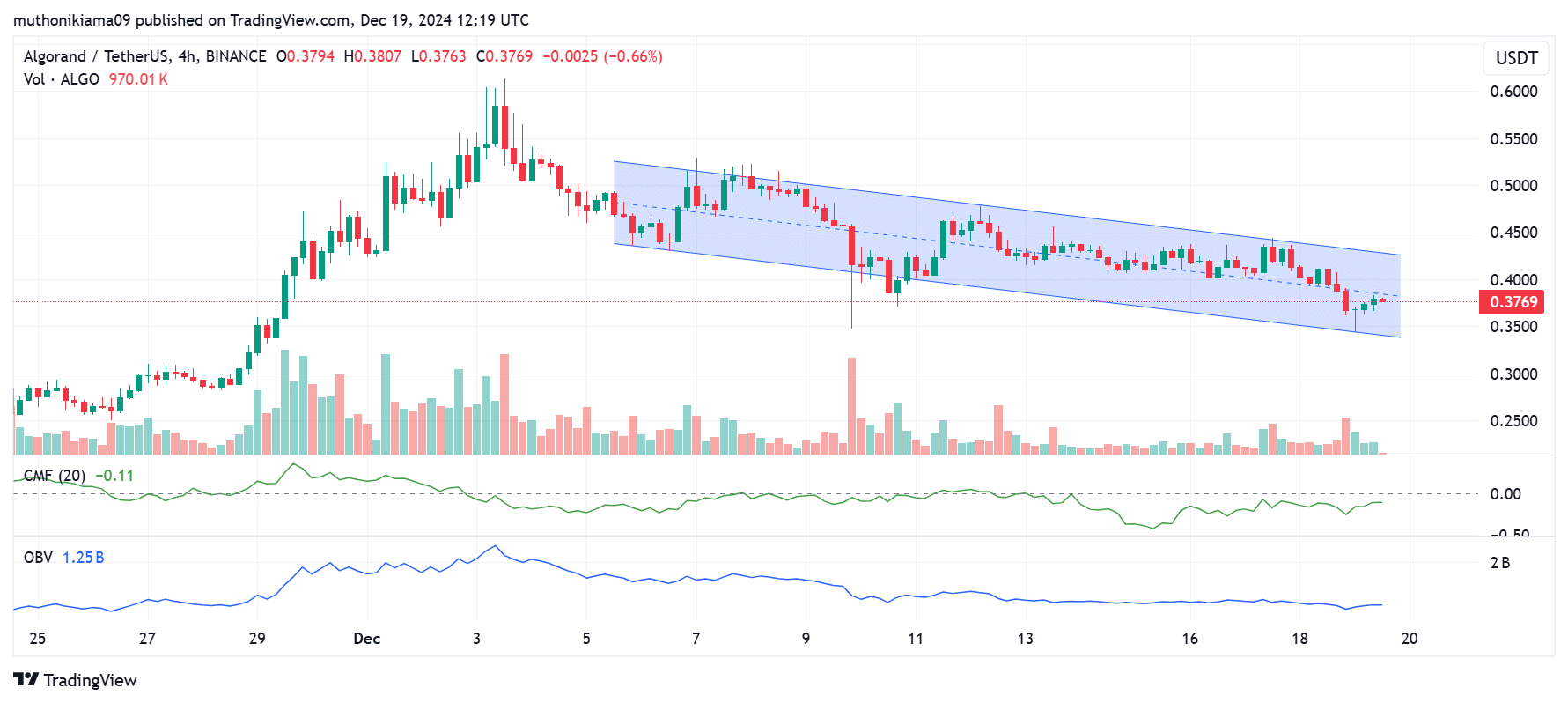

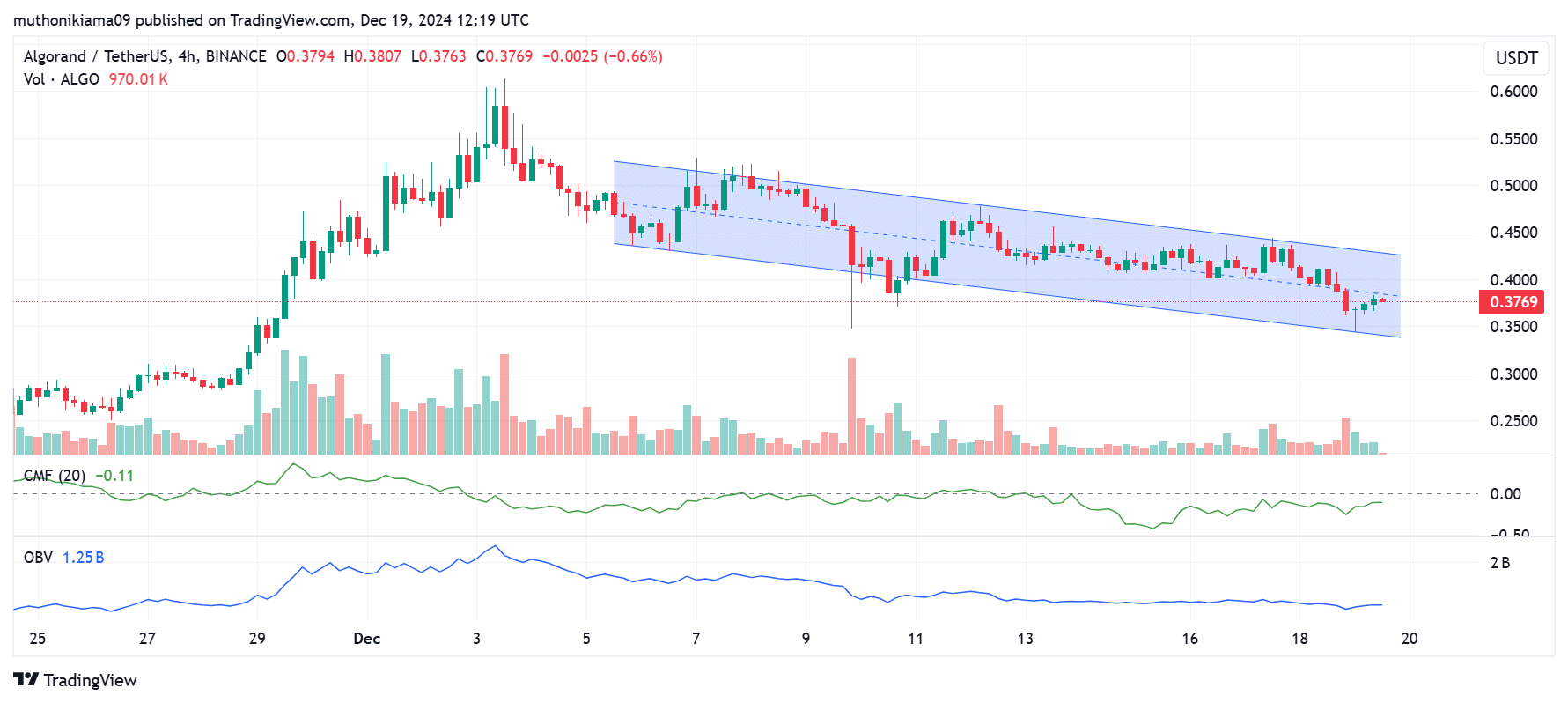

Technical indicators show THIS

Technical indicators on Algorand’s four-hour chart revealed that selling activity has been on the rise. The Chaikin Money Flow (CMF) seemed to be oscillating in the negative region, suggesting that selling pressure has been higher than the buying pressure.

On the other hand, the on-balance volume (OBV) indicator was also oscillating at range lows, indicating that trading volumes have declined.

(Source: Tradingview)

On the charts, ALGO seemed to be trading within a descending parallel channel, one which showed that bearish trends were prevailing. A drop below the lower trendline of this channel could ignite further dips, while a gain above the resistance could fuel gains.

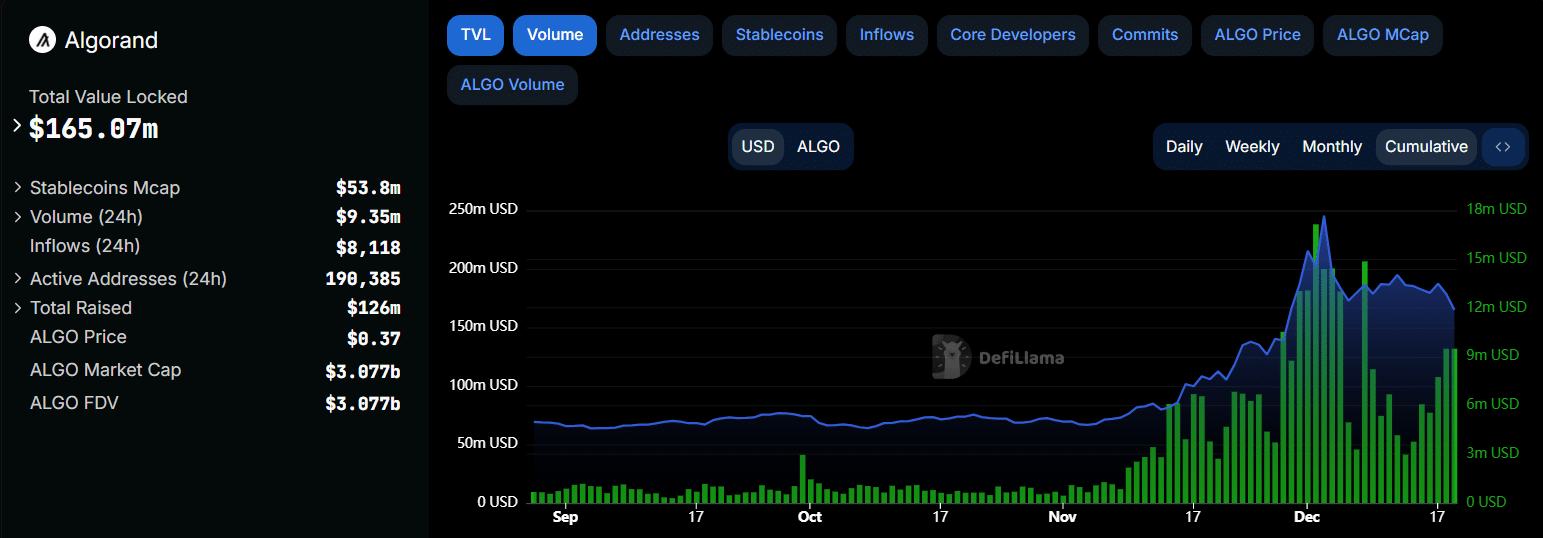

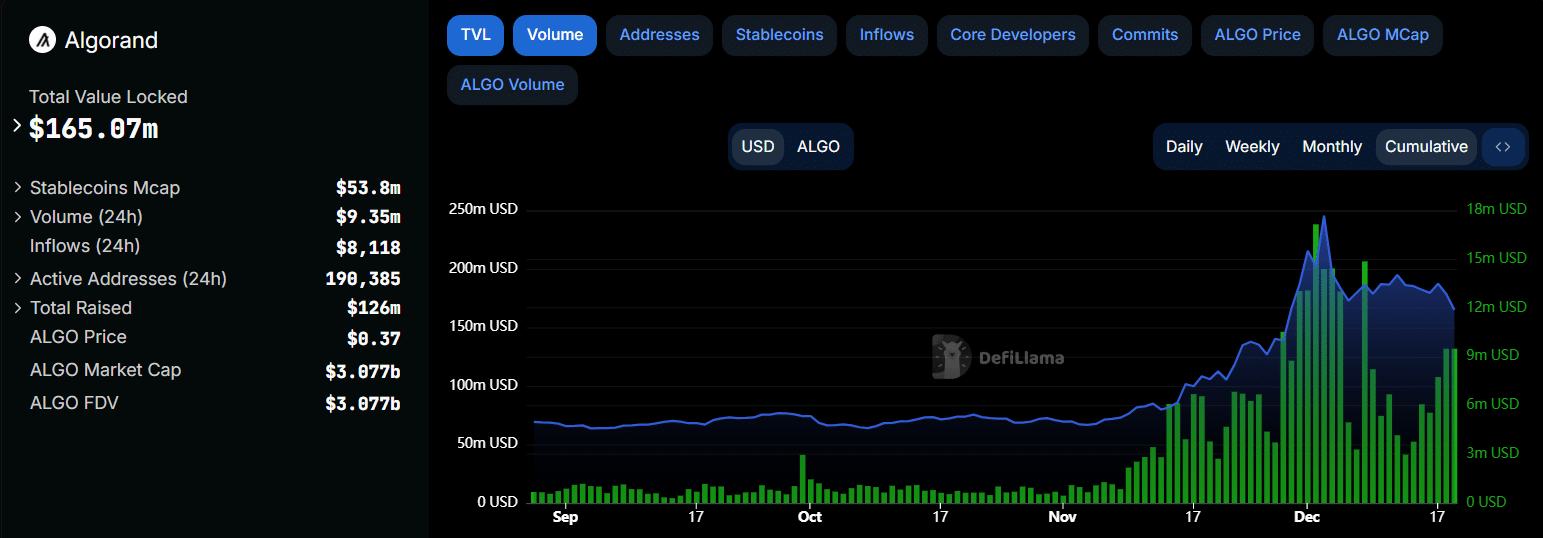

Declining DeFi activity could fuel the downtrend

According to DeFiLlama, Algorand’s Total Value Locked (TVL) declined from $245M to $165M in three weeks. This decline coincided with rising selling activity that pushed the price lower on the charts.

(Source: DeFiLlama)

Traders should watch out for a recovery in the DeFi TVL as that could precede a trend reversal. Conversely, if DeFi volumes and activity continue to plummet, it could extend the downtrend.