- Cardano’s symmetrical triangle pattern could lead to a major price surge or downside risk

- Whale activity and broader market trends will shape the altcoin’s next price action

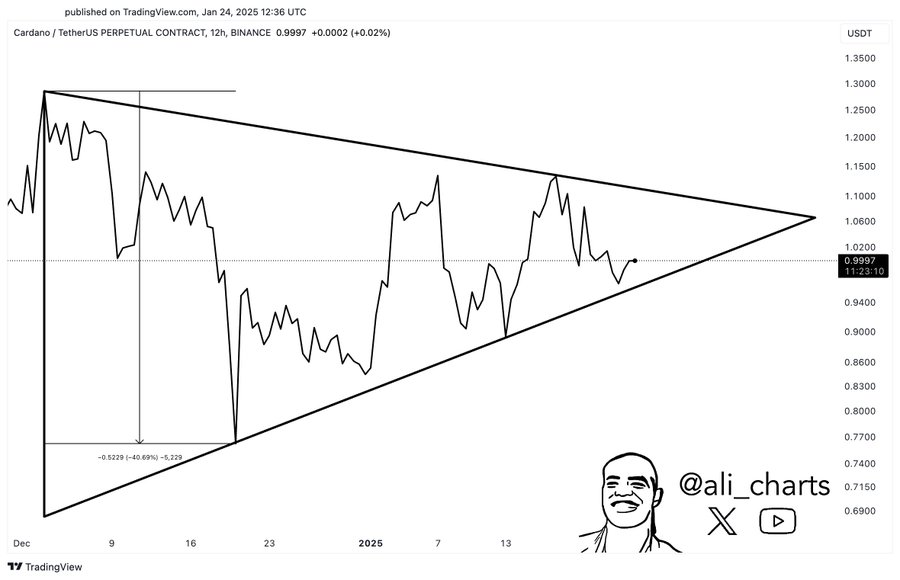

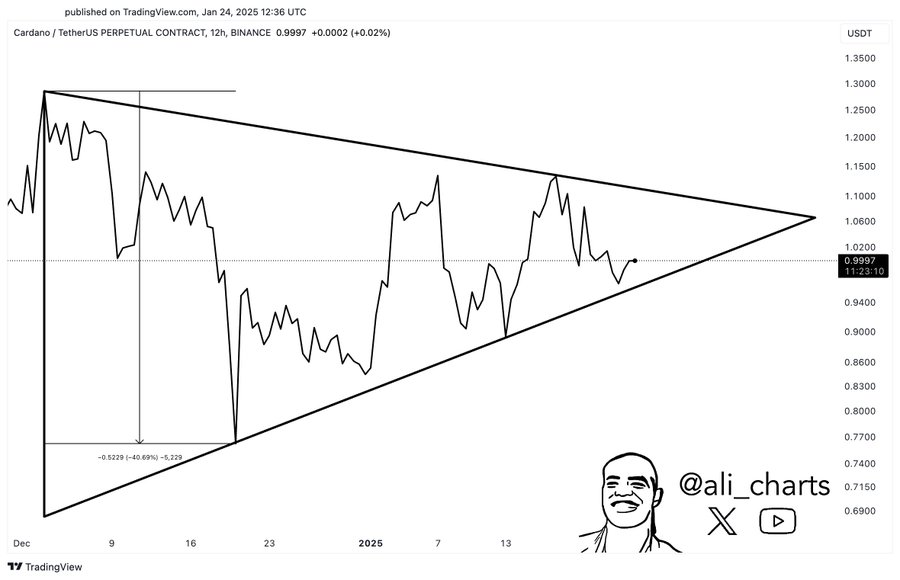

Cardano [ADA] finds itself at a pivotal juncture, with its price movement narrowing into a symmetrical triangle pattern – One that often precedes a significant breakout. This period of consolidation has caught the attention of market watchers, who forecast a potential 40% price surge if momentum shifts to the upside.

While the pattern leaves room for both bullish and bearish scenarios, the tightening range seemed to indicate that heightened volatility may be imminent. With ADA’s next move likely to set the tone for its short to mid-term trajectory, the market is closely watching for signs of a decisive breakout.

Why symmetrical triangles often precede price breakouts

Symmetrical triangles form when an asset’s price consolidates on the charts, creating lower highs and higher lows. This pattern reflects a balance between buyers and sellers, progressively narrowing the range until a breakout occurs.

Symmetrical triangles do not inherently signal direction, but often precede sharp price movements due to the buildup of market pressure.

Source: X

Popular analyst Ali Martinez highlighted ADA’s price action within such a triangle, with the support near $0.83 and resistance around $1.06.

The prolonged consolidation seemed to align with historical precedents, one where the breakout direction typically matches the prevailing trend. Given ADA’s setup, the market is now awaiting a breach of either boundary. This could trigger a 40% move in the breakout’s direction.

Price analysis and whale activity’s impact

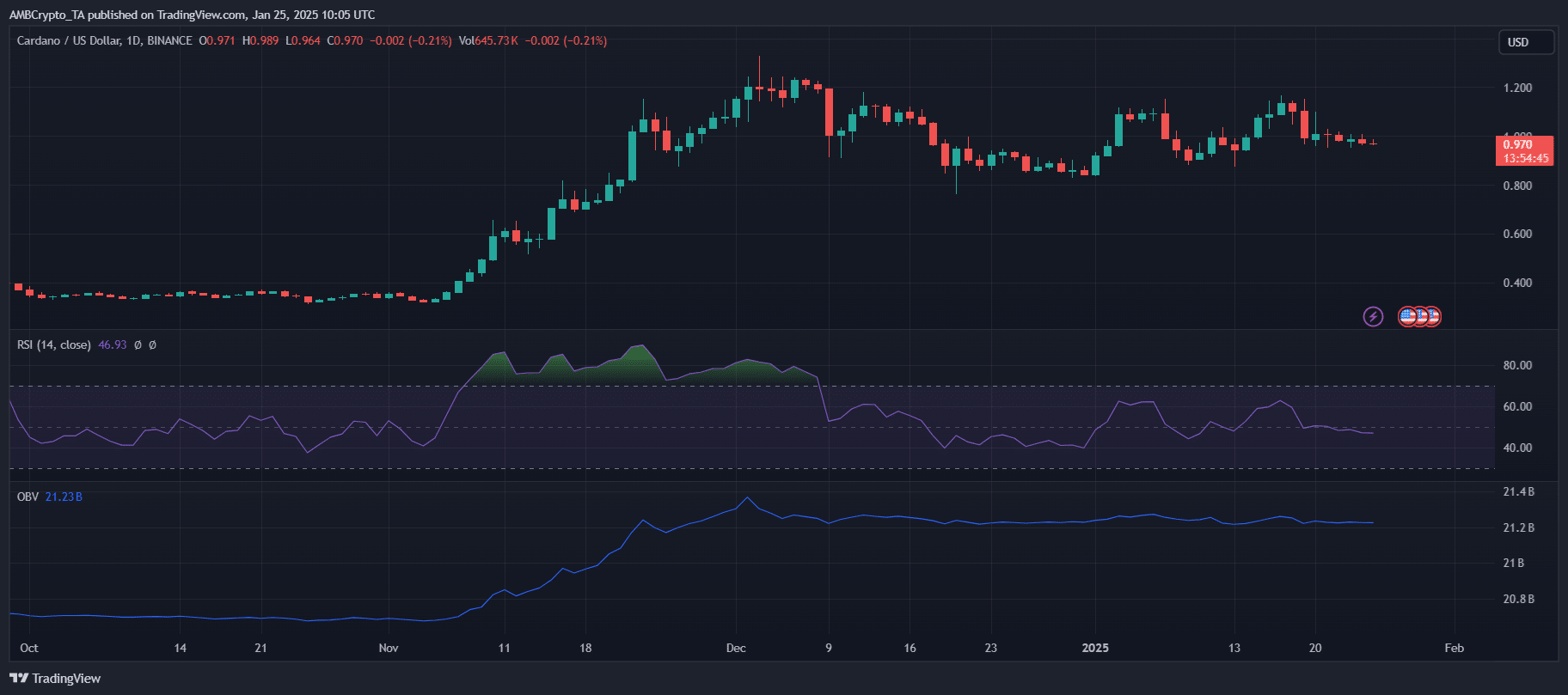

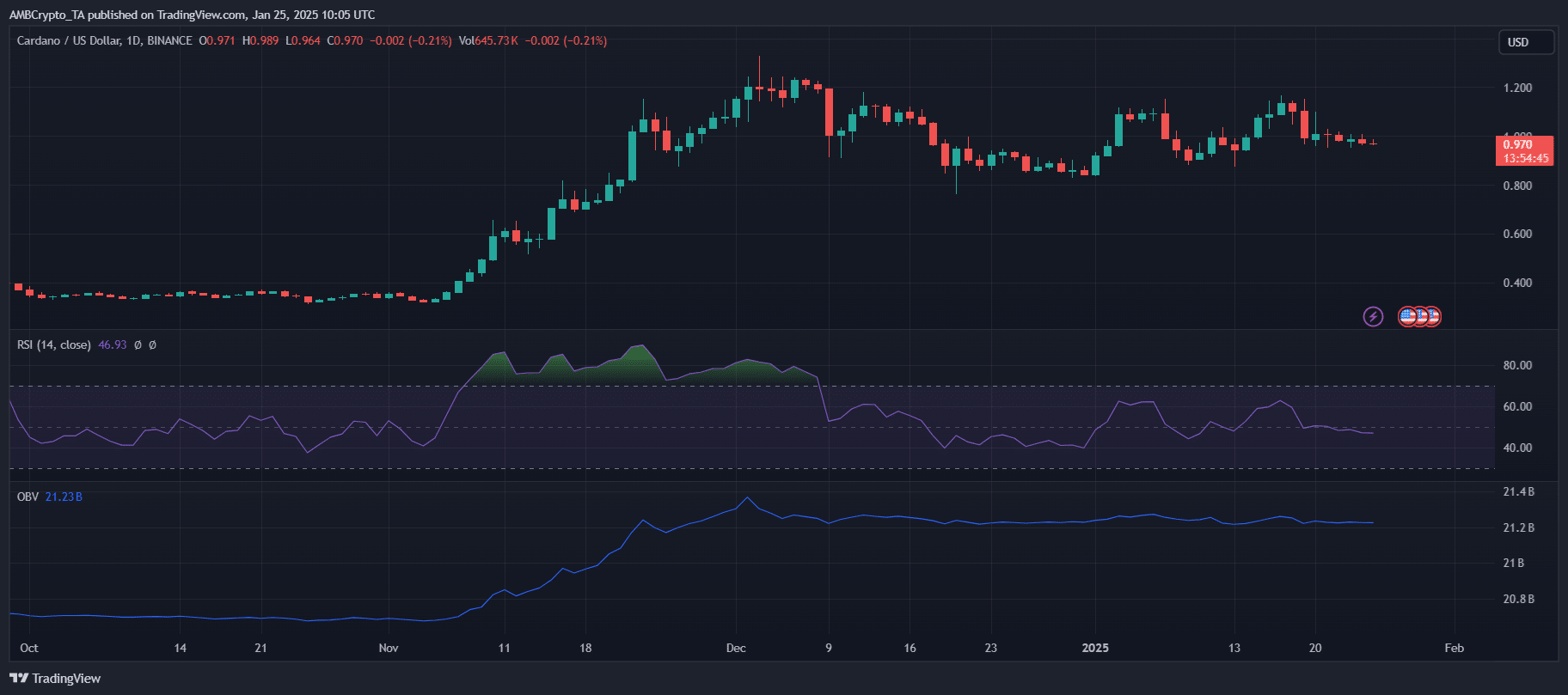

Source: TradingView

ADA’s press time price action seemed to be hovering around $0.97 – Maintaining a delicate balance between its $0.83 support and $1.06 resistance levels. The symmetrical triangle pattern underlined indecision, with the volatility likely to surge upon breakout.

Source: Santiment

Whale activity has been pivotal, with on-chain data showing that over 180 million ADA was sold by major holders over the past week. This sell-off may have exerted downward pressure on ADA, stalling its upward momentum near $1.06. Consistent outflows from wallets holding over $1 million hinted at waning confidence among large investors too.

If this trend persists, it could trigger a bearish breakdown below the $0.83 support. Conversely, a halt in sell-offs could restore bullish sentiment and strengthen a push above $1.06.

Read Cardano’s [ADA] Price Prediction 2025–2026

What could affect ADA’s price in the following weeks?

Cardano’s price trajectory hinges on the resolution of its symmetrical triangle pattern. A bullish breakout above $1.06 could pave the way for a 40% hike, potentially drawing renewed interest from retail and institutional investors.

Key drivers for this scenario include reduced whale sell-offs, greater on-chain activity, and broader market optimism.

On the flip side, a breach below $0.83 support may lead to significant downside risks. Persistent whale outflows and weak market sentiment could amplify selling pressure, pushing ADA towards lower levels. Additionally, external factors like a general macroeconomic uncertainty and Bitcoin’s price movement will likely play a pivotal role in determining ADA’s path.