- FET breaks out of a multi-month downtrend to hit a 3-month high, signaling renewed bullish momentum.

- Strong accumulation from whales, retailers, and rising network activity is fueling FET’s sharp upside.

Artificial Superintelligence Alliance [FET] has snapped a multi-month downtrend, climbing to a 3-month high of $0.85.

At press time, the AI-focused token changed hands at $0.8476, marking a 9.10% jump in 24 hours.

Since reaching $2.2 in December 2024, FET has traded within a descending channel dipping below $1.

However, with the crypto market recovering to recent highs, the AI coin has made significant gains on its price charts.

Over the same period, the AI token’s Volume surged by 47.06%, hitting $295 million. With such a massive price upswing, the question is what’s driving the surge?

What’s driving FET’s surge?

According to AMBCrypto’s analysis, two main factors are driving the altcoin’s price rise. First, the altcoin’s network adoption and growth have soared.

Daily Active Addresses surged to 1.3K, hitting a 2-month high. On top of that, Network Growth spiked to 398, back to March levels.

Source: Santiment

The second factor is the growing demand from whales and retailers. Both whales and retailers are back in the market. The demand from whales and retailers is mostly driving prices up.

Source: Coinalyze

Looking at FET Spot Buy vs. Sell volume, investors have bought 4.4 million with a positive delta of 989k, which suggests that retail traders are highly active, with buyers dominating the market.

This buying activity is even more prevalent among FET whales.

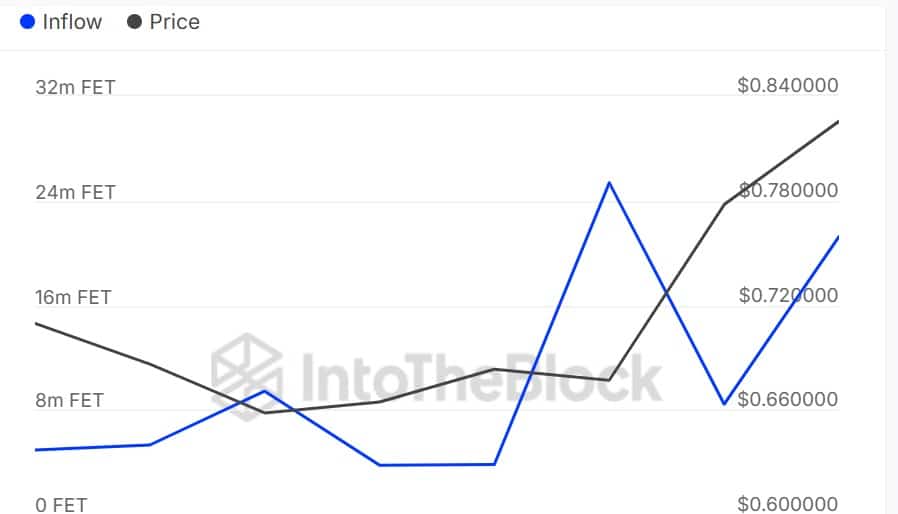

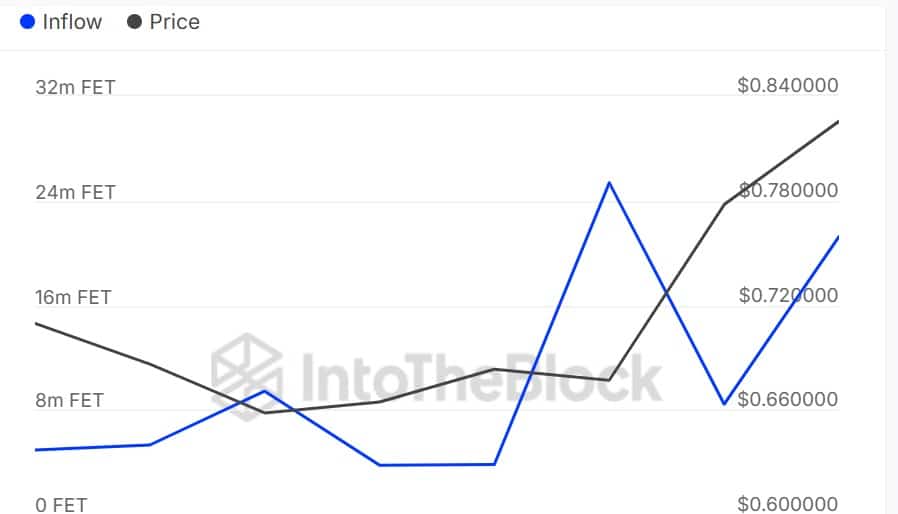

According to IntoTheBlock, whales scooped up 21.2 million tokens over the past day. The surge in Inflow has left large holders with a positive capital inflow of 8.11 million tokens.

Source: IntoTheBlock

This suggests that whales are buying more than they are selling, reflecting strong accumulation behavior. When whales turn to accumulation, it signals growing confidence in the market as they expect prices to rise further.

Therefore, network growth accompanied by actual demand has pushed FET to break out of a strong downtrend.

What’s next? $1 or rejection?

As observed above, the Artificial Superintelligence Alliance token was experiencing strong demand across all market participants.

With adoption soaring, FET’s scarcity is climbing too. Its Stock-to-Flow Ratio has risen, reflecting fewer tokens available for sale as accumulation addresses spike.

Source: Santiment

Historically, growing scarcity as investors accumulate has preceded a price rally. If sentiment holds, FET could attempt a clean break above $1 and test $1.20 soon after.

However, having said that, there’s still a caveat. Holders trapped during the past three months may choose to take profits. If that happens, FET could retrace to $0.73 before finding support.