- Solana’s $120-level was supposed to be a make-or-break zone for the altcoin

- SOL liquidated most of the bulls with signals still short, suggesting altcoin could go below $100

The pivotal $120-price level has been Solana’s [SOL] main focus point over the past few months. In fact, this has been a crucial region, one where historical price trends have typically changed.

If the past is any suggestion, SOL’s price drops fast anytime it fails to maintain the $120-support. At the time of writing, that seemed to be the case though, with the altcoin trading close to $102 on the price charts.

Source: TradingView

Could the altcoin fall further though?

Maybe, yes. The altcoin’s decline could possibly continue below this level, just as previous breakdowns produced swift bouts of price depreciation. How SOL does over the next few days will determine whether the altcoin heads for market recovery or additional price declines.

What do market signals say about the potential drop?

According to analyst Joao Wedson on X, a further drop in Solana’s price may be incoming. Especially since multiple different indicators exhibited bearish trends and hinted at the possibility of the price falling below $100.

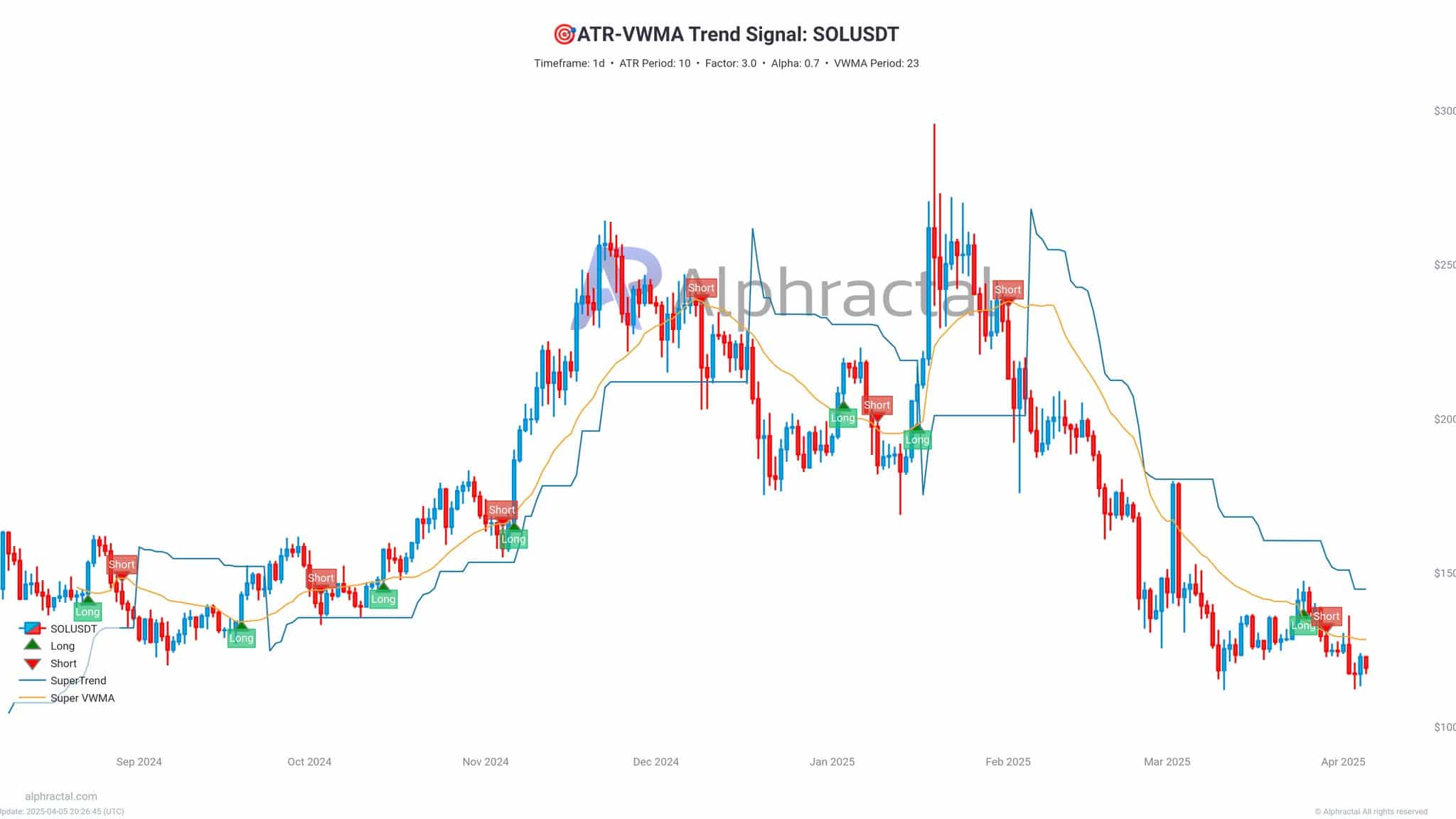

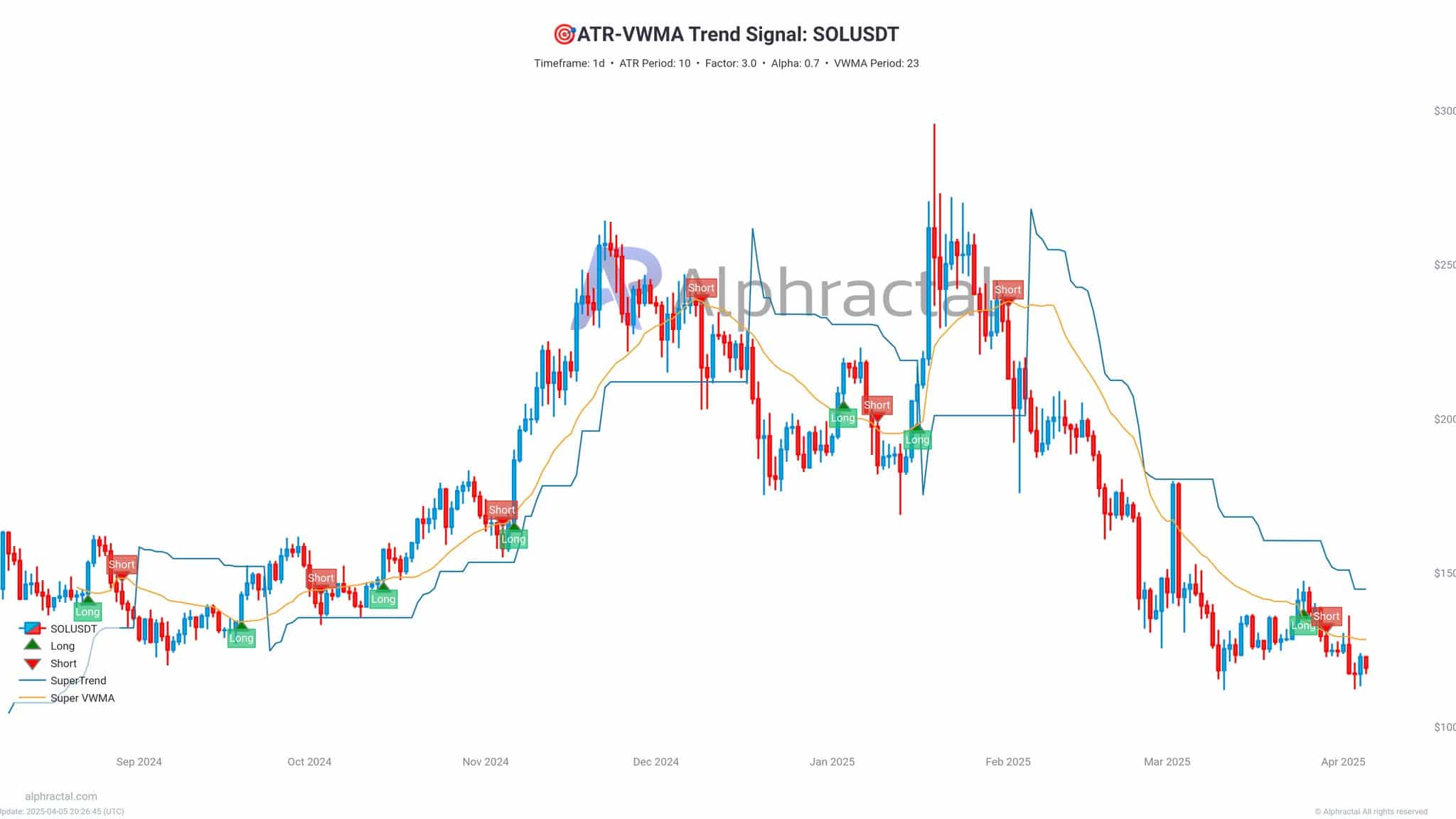

First of all, Solana’s price traded below various resistance levels at around $155 and $160, according to both the Super VWMA and SuperTrend indicators from its recent market action.

Also, the Alpha Quant Signal generated multiple successive short signals under $155 while its oscillator remained underwater. This, compared to the RSI smoothing and below the 50 neutral point to confirm significant downtrends.

Source: Alphractal

According to the 3-day Liquidation Heatmap, the market has operated with mainly strong selling pressure from $210. And yet, it showed weak demand below $190 – A sign that sellers have been in control.

The 1-month heatmap revealed that market was clearly bearish from its massive liquidation clusters between $150-$160, together with rising long-side liquidations. Liquidations of long positions accumulated to $6 billion while short positions stood at less than $4 billion before reaching their peak.

Considerable evidence pointed to an upcoming decline in SOL’s price, especially given the uncertainty of the crypto market. In fact, the altcoin could drop to the $100-zone or below.

M2 Global Money supply and sentiment

Meanwhile, Solana against the M2 Global Liquidity (M2 Global Money Supply) chart, highlighted decoupling. This was the same case as for many cryptos, including Bitcoin, where liquidity has been increasing, but the assets’ valuation did not correspond.

The market opinions between institutions versus other participants likely indicated fundamental worries about sustained price stability.

Solana’s sentiment indicated a broad bearish activity as crowd sentiment was -1.15 and smart money sentiment was -5.00. The institutions based on their extreme smart money reading adopted an extremely defensive role, most likely due to their bearish expectations.

Source: X

The moderate level of bearishness within the crowd indicated that retail investors are also doubtful. And yet, they remain hesitant to fully give up on SOL.

The absence of an absolute price target at $100 might allow SOL to drop further. Especially if sentiment remains low, unless general market conditions show improvements.