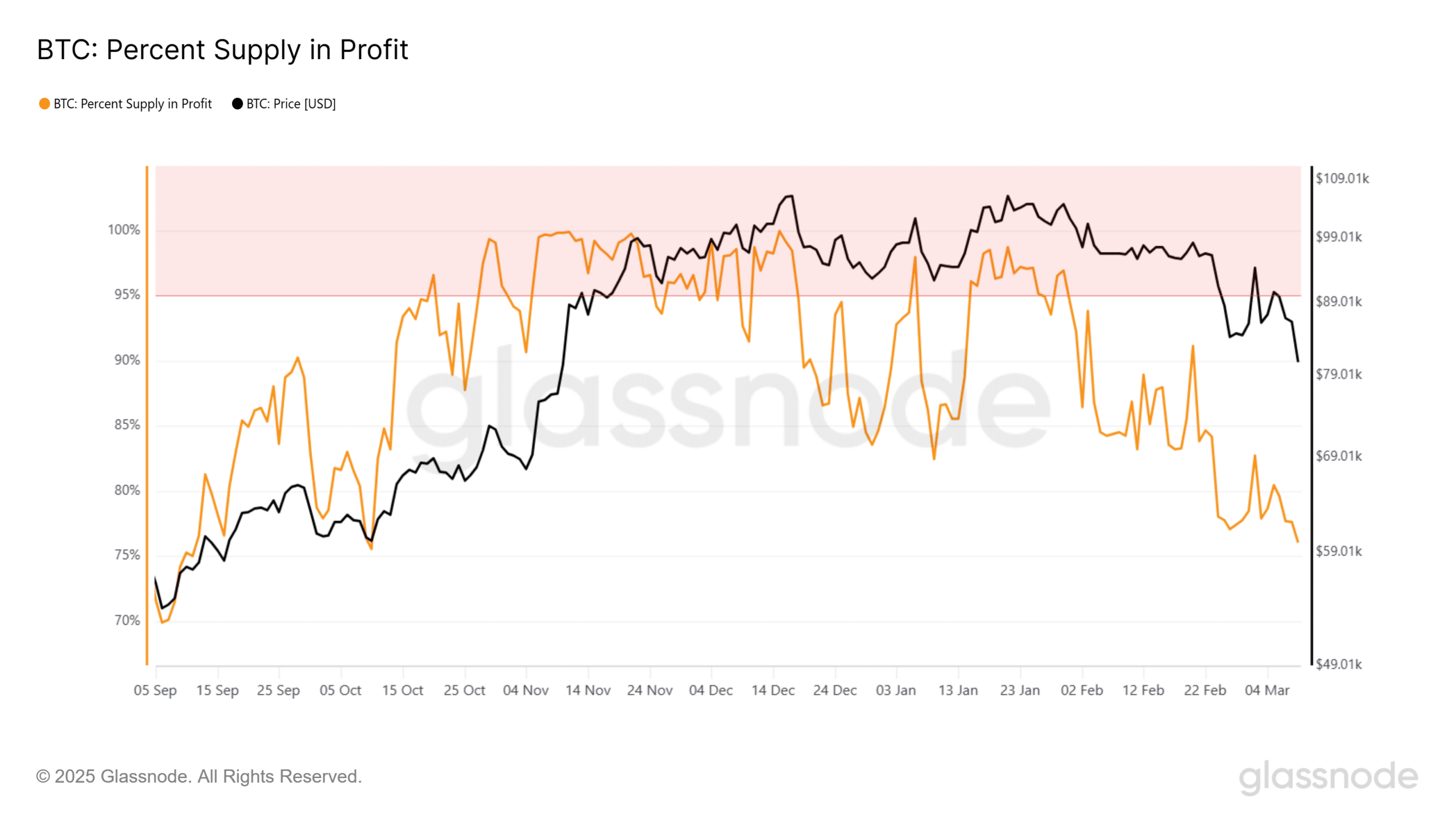

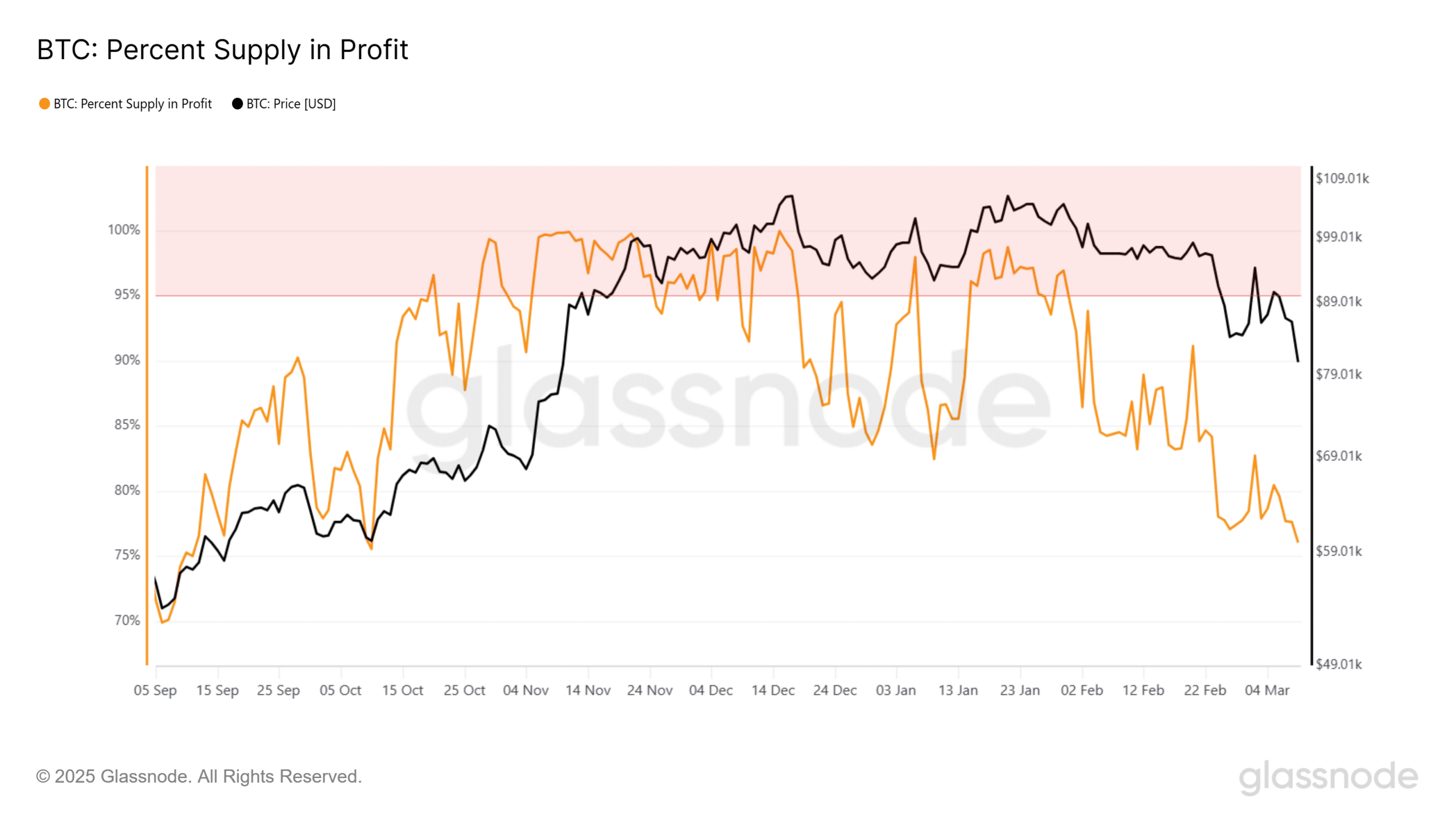

- Bitcoin’s supply in profit from 99% to 76% means that a significant portion of BTC holders are now in unrealized loss.

- Will this profit-taking phase lead to deeper declines, or is this a healthy consolidation before the next move?

As previously highlighted by AMBCrypto, Bitcoin [BTC] faced strong resistance at $97K, triggering a sharp rejection. The subsequent drop to $82K at press time suggests another profit-taking wave.

Despite the pullback, 76.08% of BTC’s supply remains in profit – its lowest in six months – indicating that most HODLers are still in the green.

However, it leaves 23% of the circulating supply in unrealized loss – around 4.56 million BTC. As more Bitcoin holders move into unrealized loss, some holders may decide to sell to limit further losses.

Source: Glassnode

To overcome this sell-side liquidity, volume indicators are key.

Although trading volume has surged 178.22% to $43.12 billion, net deposits on exchanges have risen by 3.96%, highlighting that sell-offs are outweighing buys across major exchanges.

With buying pressure from U.S. investors staying low amid economic uncertainty, it suggests retail buyers aren’t stepping up to absorb the selling pressure.

This could point to the involvement of third-party players, possibly institutions, influencing the market’s next move.

High-leverage risk in Bitcoin derivative trade

Amid weak spot buying, Bitcoin’s Estimated Leverage Ratio (ELR), which had recently dropped to a three-month low, has surged dramatically.

This indicates that derivatives traders are not de-leveraging, but rather increasing leverage to take on higher-risk positions.

Source: CryptoQuant

On the 9th of March, Bitcoin experienced a 6.41% drop to $80K, resulting in $195.86 million in liquidated long positions.

Institutional “dip-buying” is gaining traction, potentially setting the stage for a short squeeze. This could drive Bitcoin to retest the $85K resistance zone in the coming days.

However, breaking through this resistance remains challenging. Escalating sell-offs could lead to further liquidations, pushing Bitcoin below $80K again.

In summary, institutional capital is absorbing sell-side liquidity from traders breaking even after Bitcoin’s 17% weekly decline. Nonetheless, the risks associated with “dip-buying” remain elevated.