- Bitcoin has surged by 34.39% over the past month.

- An analysts sees potential market correction citing four reasons.

Since hitting a local low of $66,798 earlier in the month, Bitcoin [BTC] has surged to hit an ATH of $93,483.

While the market seems optimistic for BTC to even reach $100k, some analysts are pessimistic. One of these analysts is Ali Martinez who has suggested four reasons why BTC could see a steep correction.

Reasons why Bitcoin could see a correction

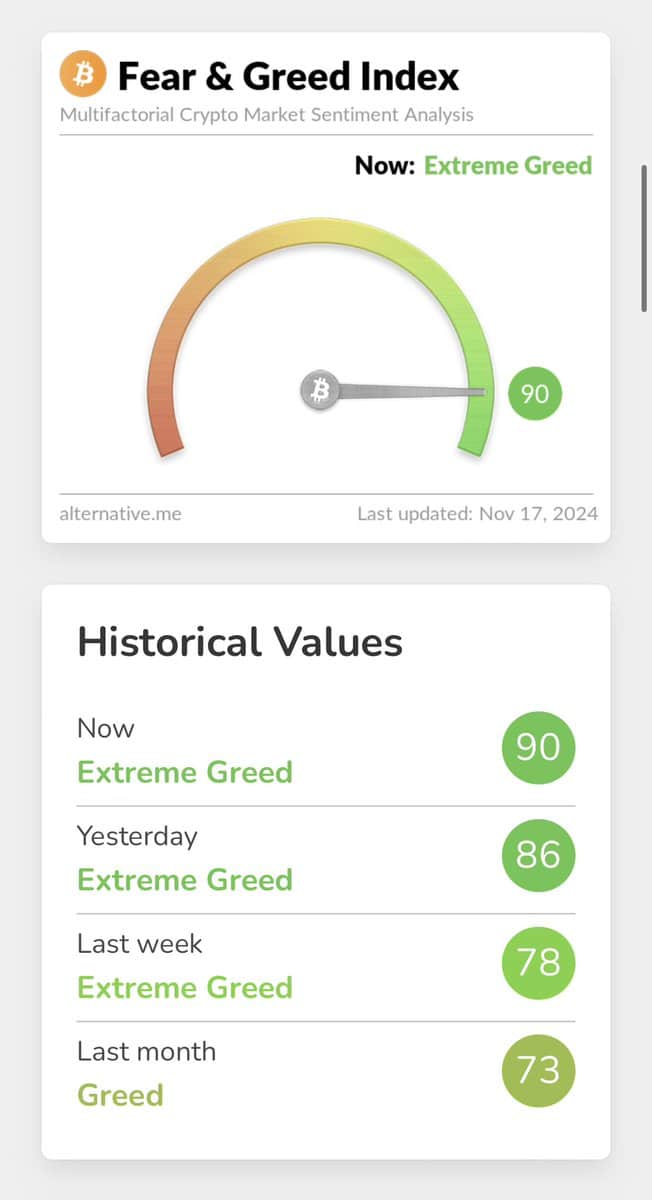

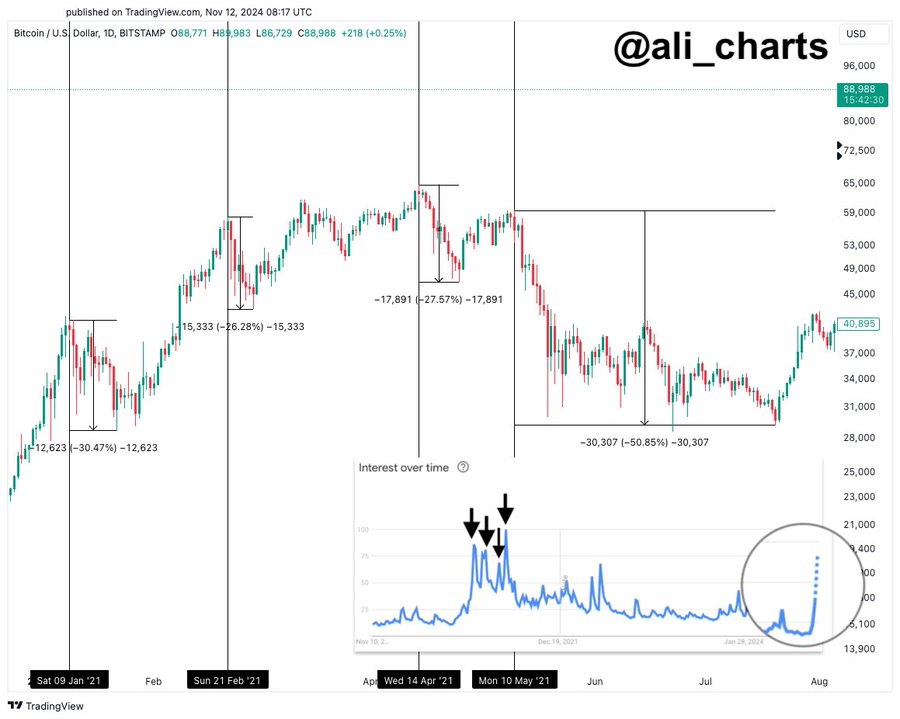

In his analysis, Martinez identified four major reasons why Bitcoin is set for a sharp decline. Firstly, Bitcoin’s crypto enthusiasts are extremely greedy with the greed index at 90%.

Source: X

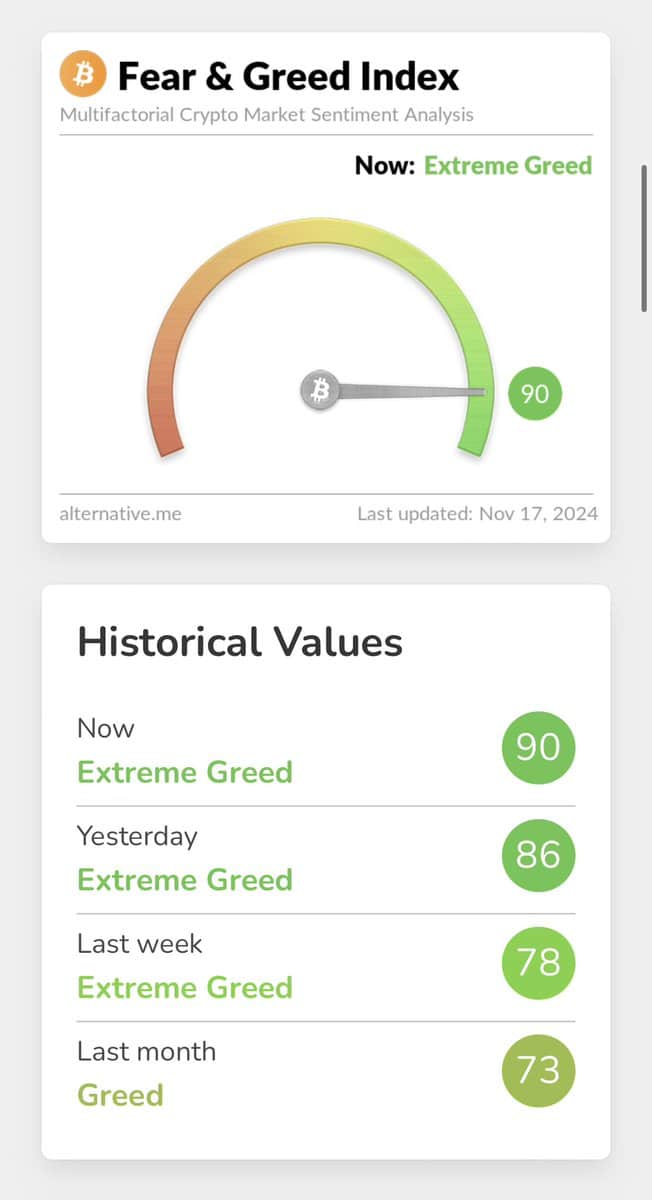

This greed was witnessed among retail investors as shown by the spike in Google search interest for BTC.

According to him, although retail interest in Bitcoin signals further capital inflow, spikes in search trends usually align with price decline. For example, in 2021, the top surges in search interest for Bitcoin resulted in a correction of 30%, 26%, 27%, and 50%.

Source: X

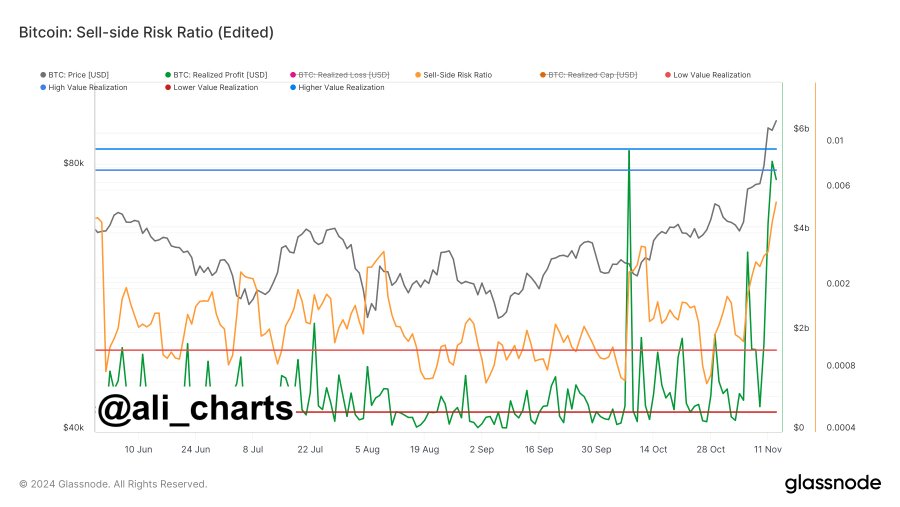

The second reason is that savvy BTC investors have realized $5.42 billion in profits. This has led to a spike in the sell-side risk ratio suggesting that investors are selling to maximize profits.

Source: X

Thirdly, based on a technical perspective, the TD sequential has presented a sell signal on daily charts. This shows that the uptrend is exhausted and a trend reversal will follow especially with many investors taking profits.

Source: Tradingview

The final reason is that the RSI signals that Bitcoin is currently sitting in the overbought territory at 75.91. When RSI reaches overbought, it suggests that an asset could be overvalued and the buyers are losing the momentum.

As such, the analyst pointed out that in the event of a price correction, BTC will find support walls around $85800, $83250, and also $75520- to a low of $72,880.

What BTC charts say

While, the analysis, provided above provides a cautionary tale for investors, it’s essential to look at other market indicators and see what they say.

As observed above by Martinez, our analysis points towards a potential pullback as BTC might be currently overvalued.

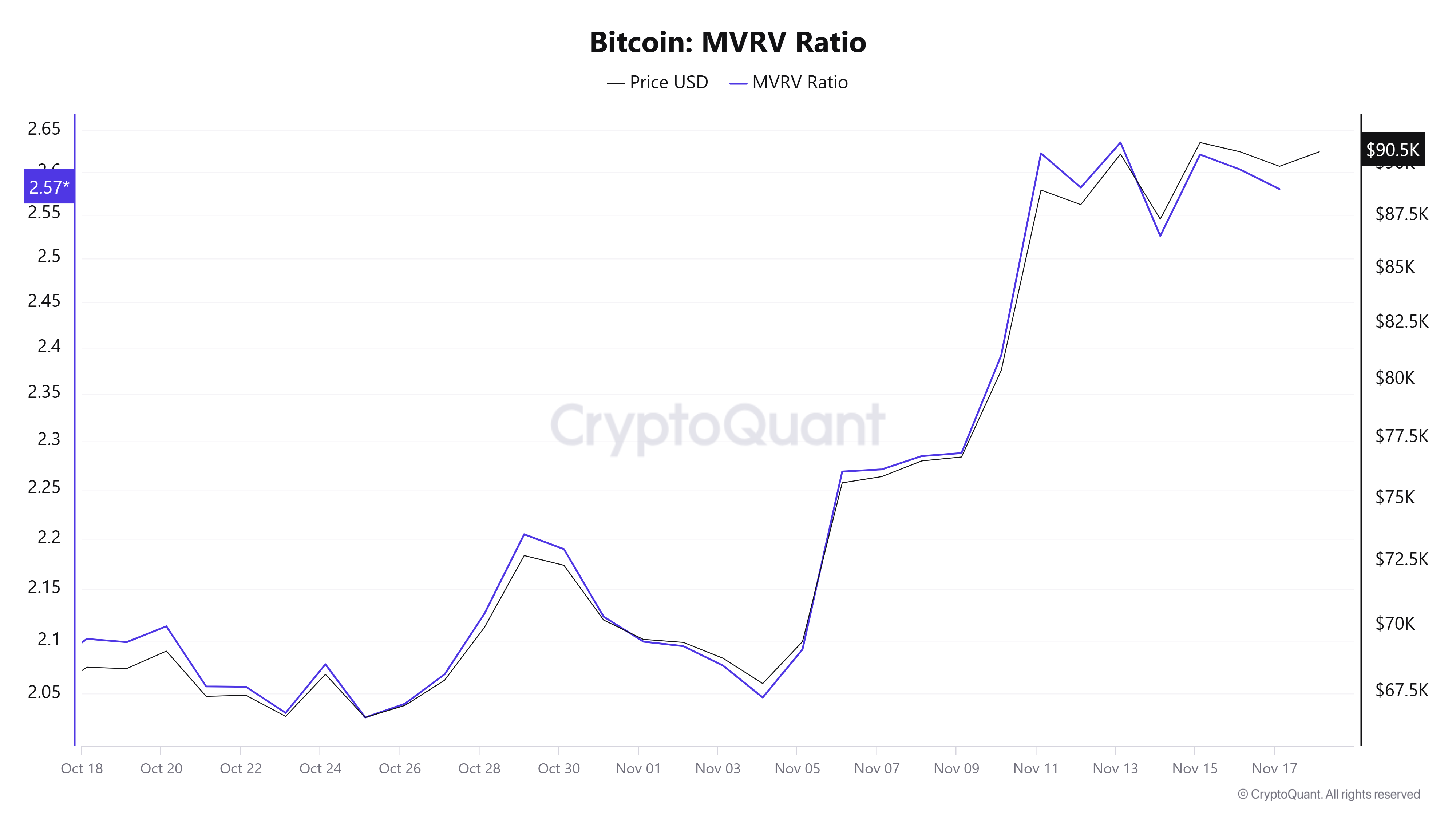

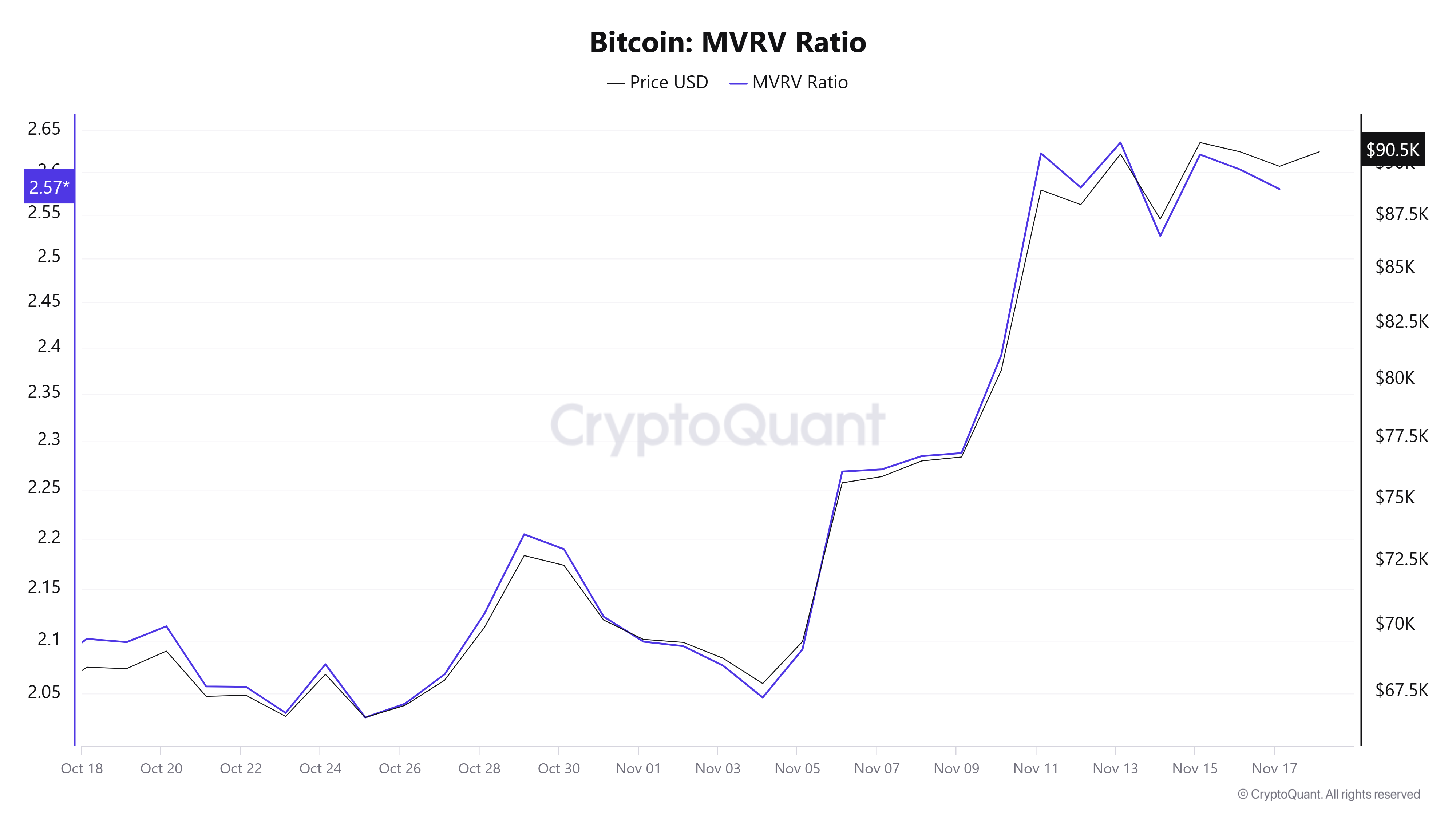

Source: Cryptoquant

For example, Bitcoin’s MVRV ratio has experienced a sustained uptrend to hit a high of 2.5. When the MVRV ratio becomes too high, it suggests overbought conditions.

Historically, high MVRV values have been followed by price pullback as early investors sell to secure profits.

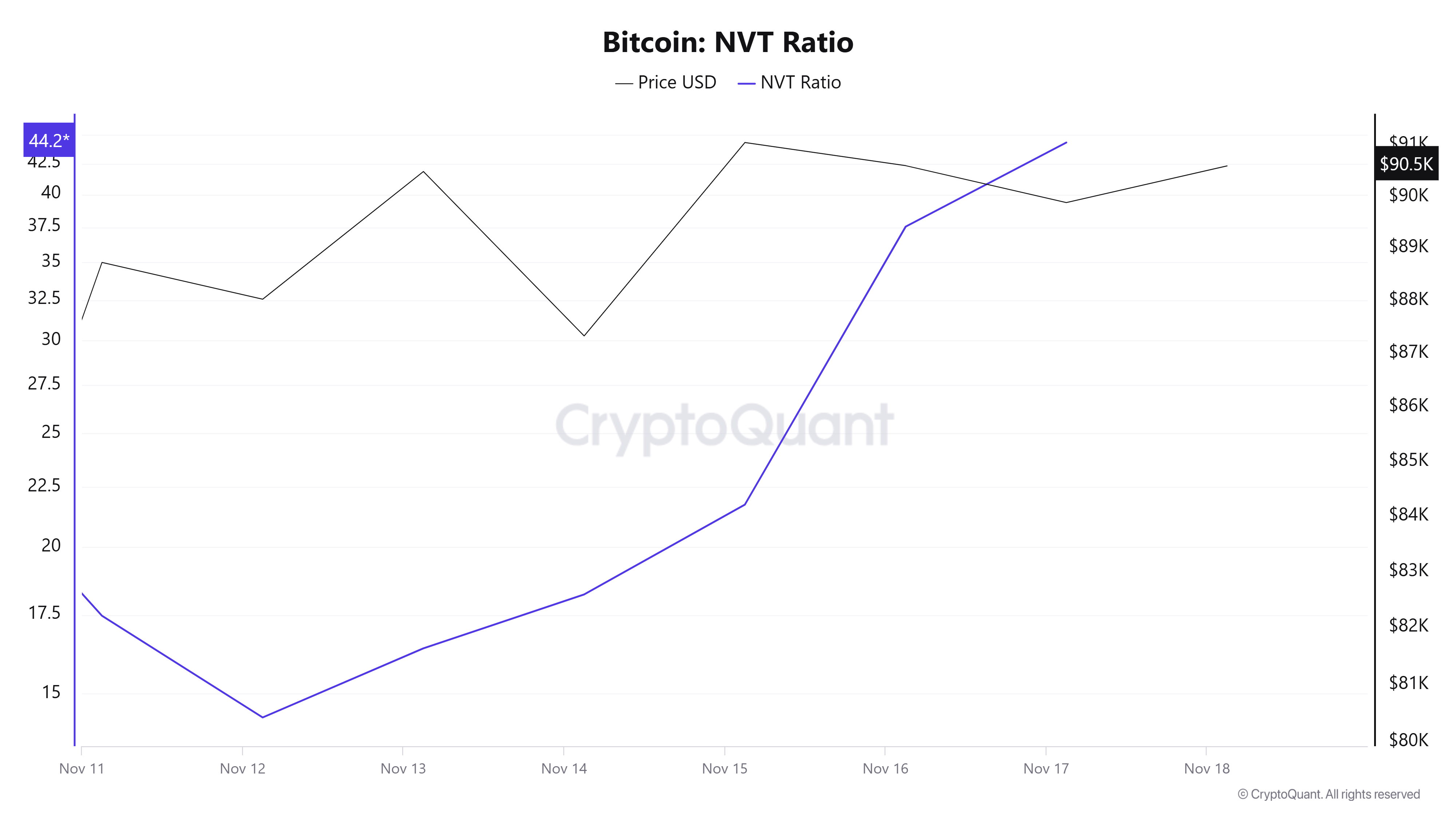

Source: Cryptoquant

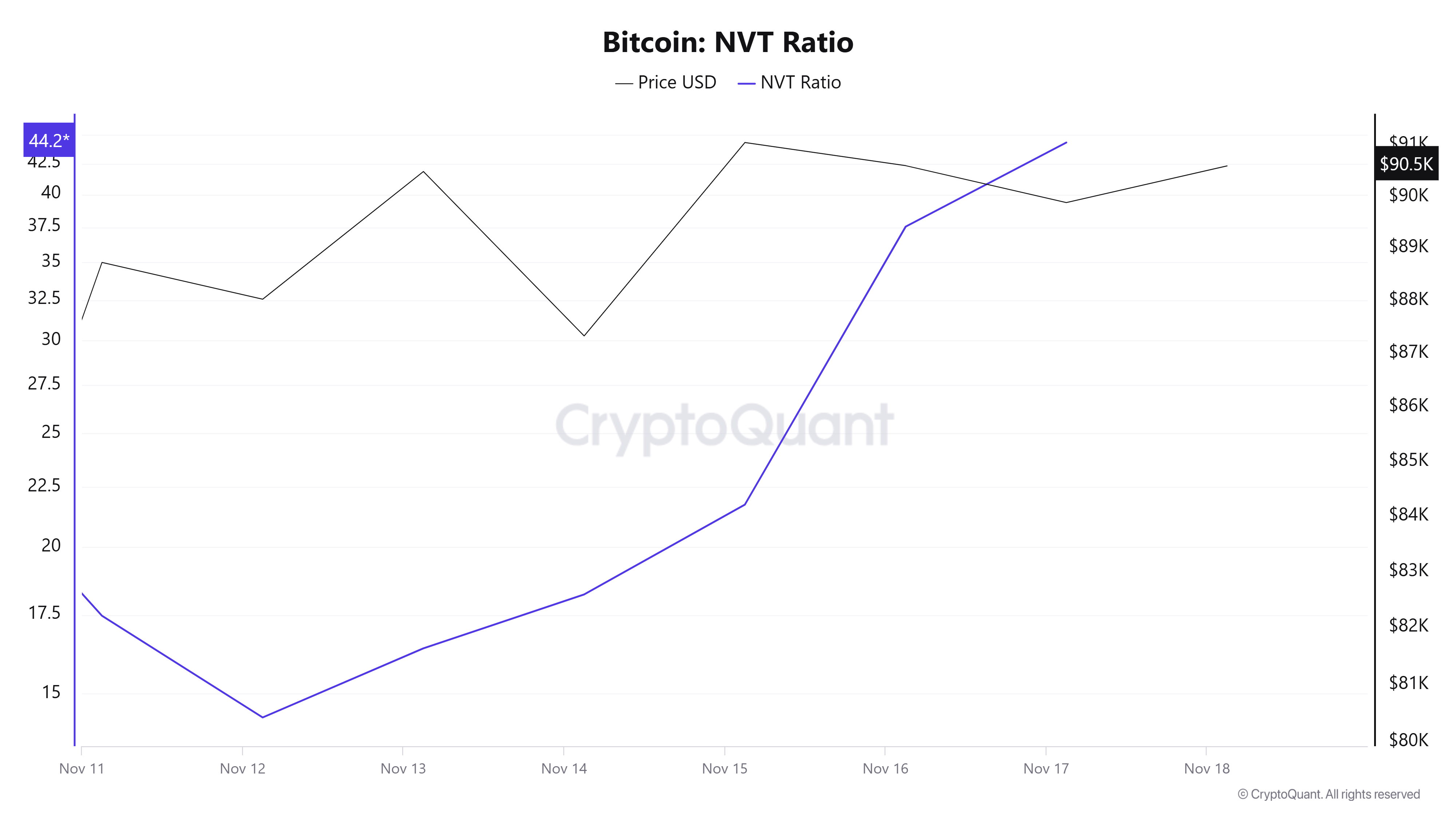

Additionally, Bitcoin’s NVT ratio has surged from a low of 14 to 44 suggesting that while the market cap is rising, the transaction activity is not keeping pace.

Read Bitcoin (BTC) Price Prediction 2023-24

This indicates a speculative price rise without corresponding growth in the network’s value. Thus implying BTC is potentially overvalued as prices outpace its on-chain activity.

Simply put, BTC prices could decline to meet its actual market demand. If it declines, it will find the next support around $87140. However, if $9100 support holds, BTC could continue with the uptrend towards $100k.