- Bitcoin’s spike in exchange CDD inflow has historically produced non-linear outcomes.

- The key factor? Market sentiment and macro liquidity trends.

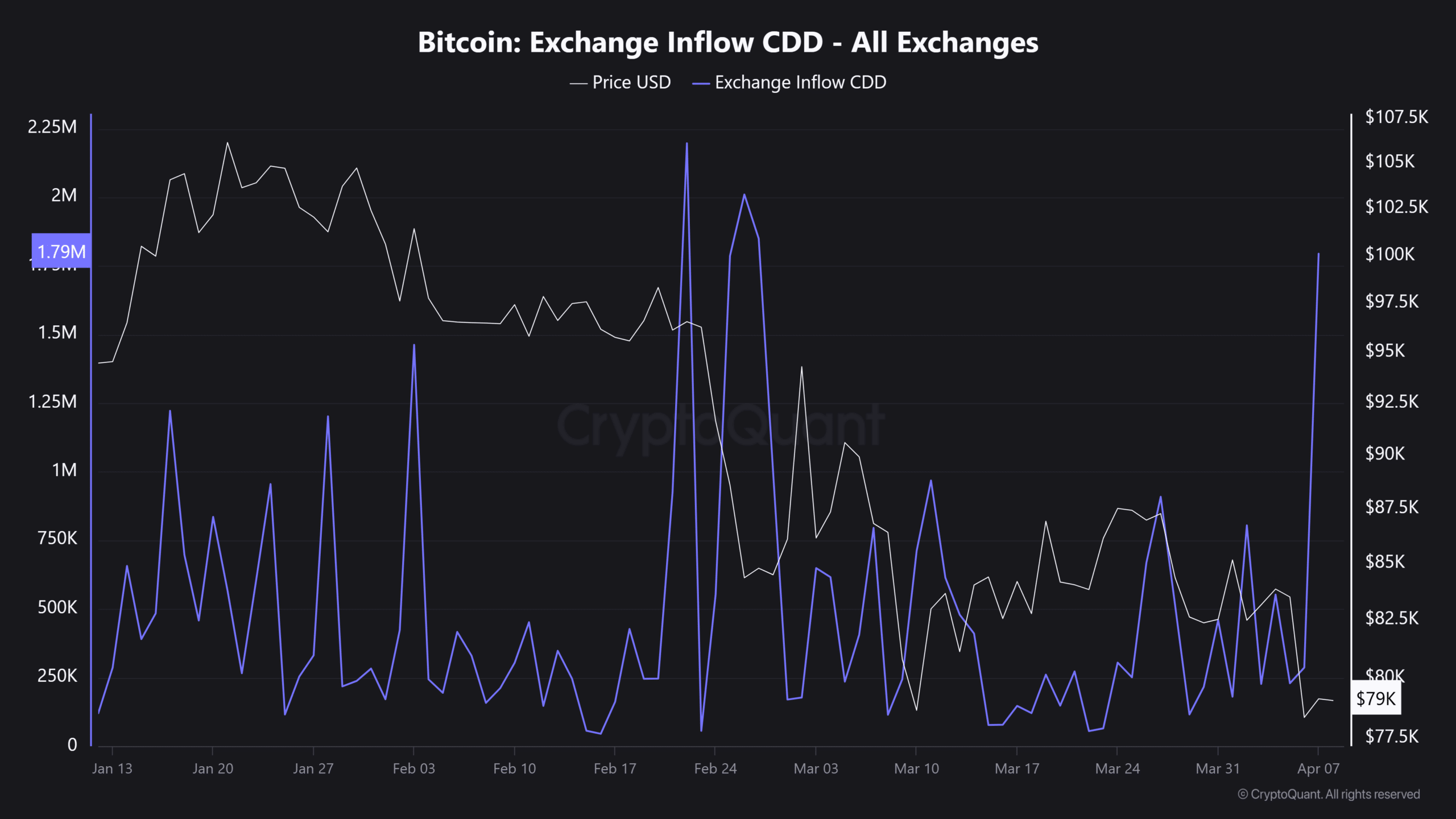

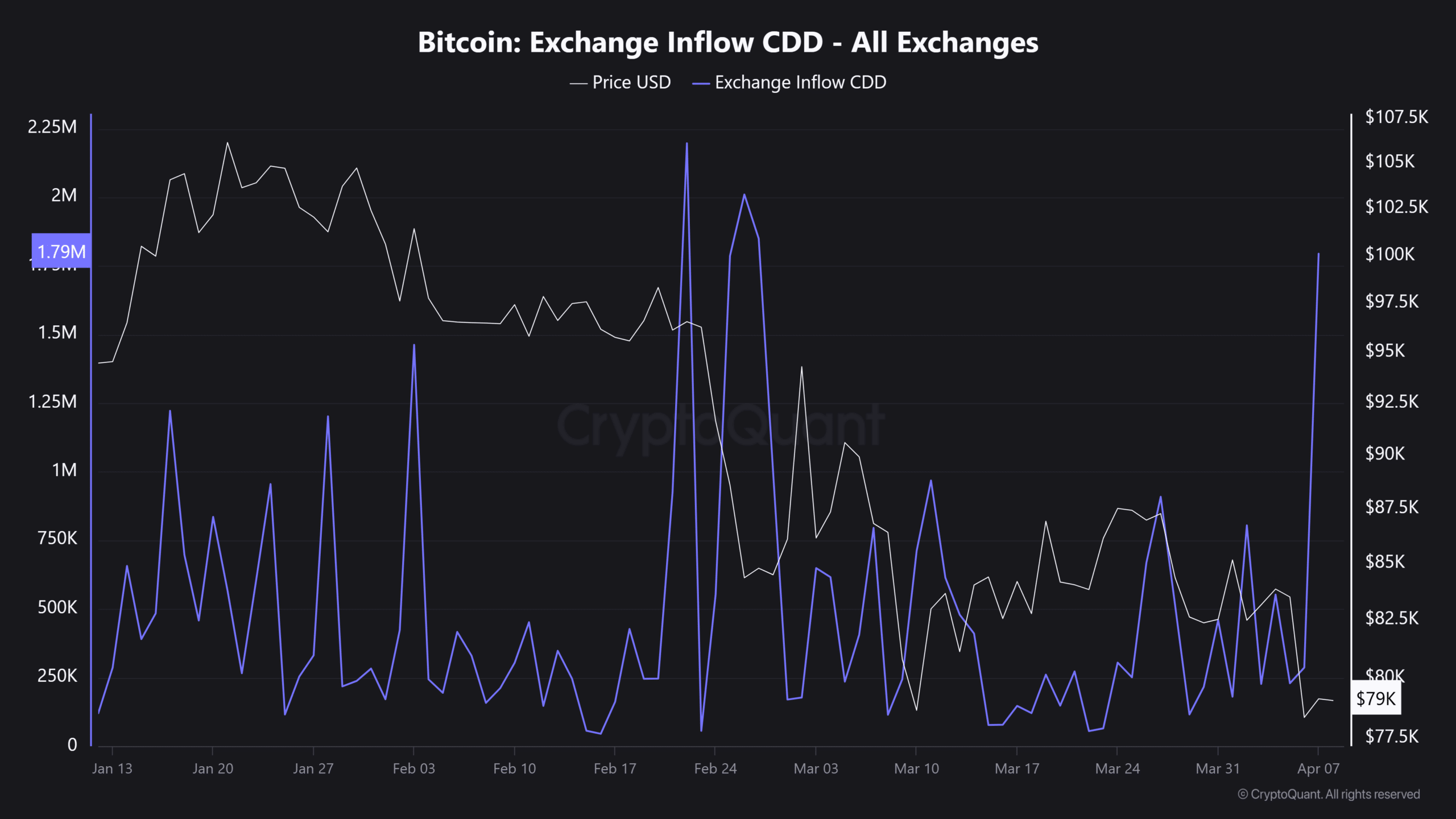

Bitcoin [BTC] just dipped below $75k, its lowest in five months, right as Exchange Inflow CDD spiked. This raises a key question: Are long-term holders losing confidence, or is this a tactical liquidity shift?

A rising CDD often precedes sell-offs, but it can also indicate capital rotating into derivatives for hedging or leverage.

If inflows stay elevated, selling pressure could build. But if this is just repositioning, Bitcoin might be gearing up for its next high-volatility move.

Historical CDD spikes and their market impact

Historically, CDD spikes have had mixed outcomes. While they sometimes precede sharp corrections, there have also been cases where Bitcoin rallied post-spike.

Consequently, signaling smart money repositioning rather than panic selling.

On the 22nd of February, for example: A notable CDD surge aligned with BTC’s 19% drawdown from $96,186 to $78,173 within a week. On-chain data confirmed a 12k BTC drop in Long-Term Holder (LTH) supply, reinforcing a distribution event.

Source: CryptoQuant

However, on the 5th of March 2024, Bitcoin rallied to its then all-time high of $73k, marking a 16% surge within a week. Notably, this rally followed a 6.4% single-day red candlestick.

Hence, suggesting a potential exhaustion shakeout before price continuation. It is a common market behavior where price dips to shake out weak hands before reversing higher.

However, there’s a key development. Similar to the February rally, LTH supply saw a sharp decline, indicating that Bitcoin was being moved to exchanges. Yet, BTC’s price appreciation defied expectations.

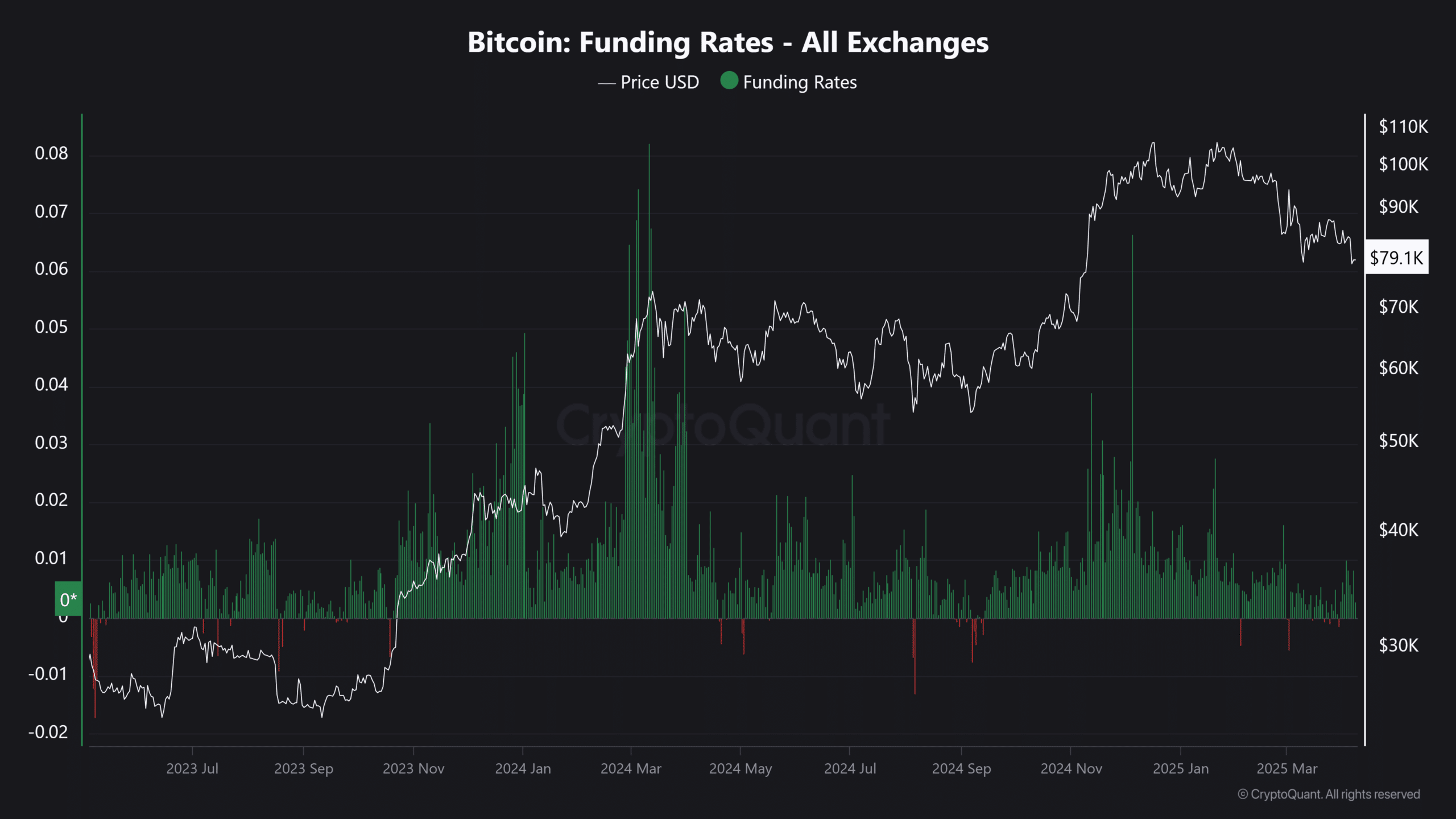

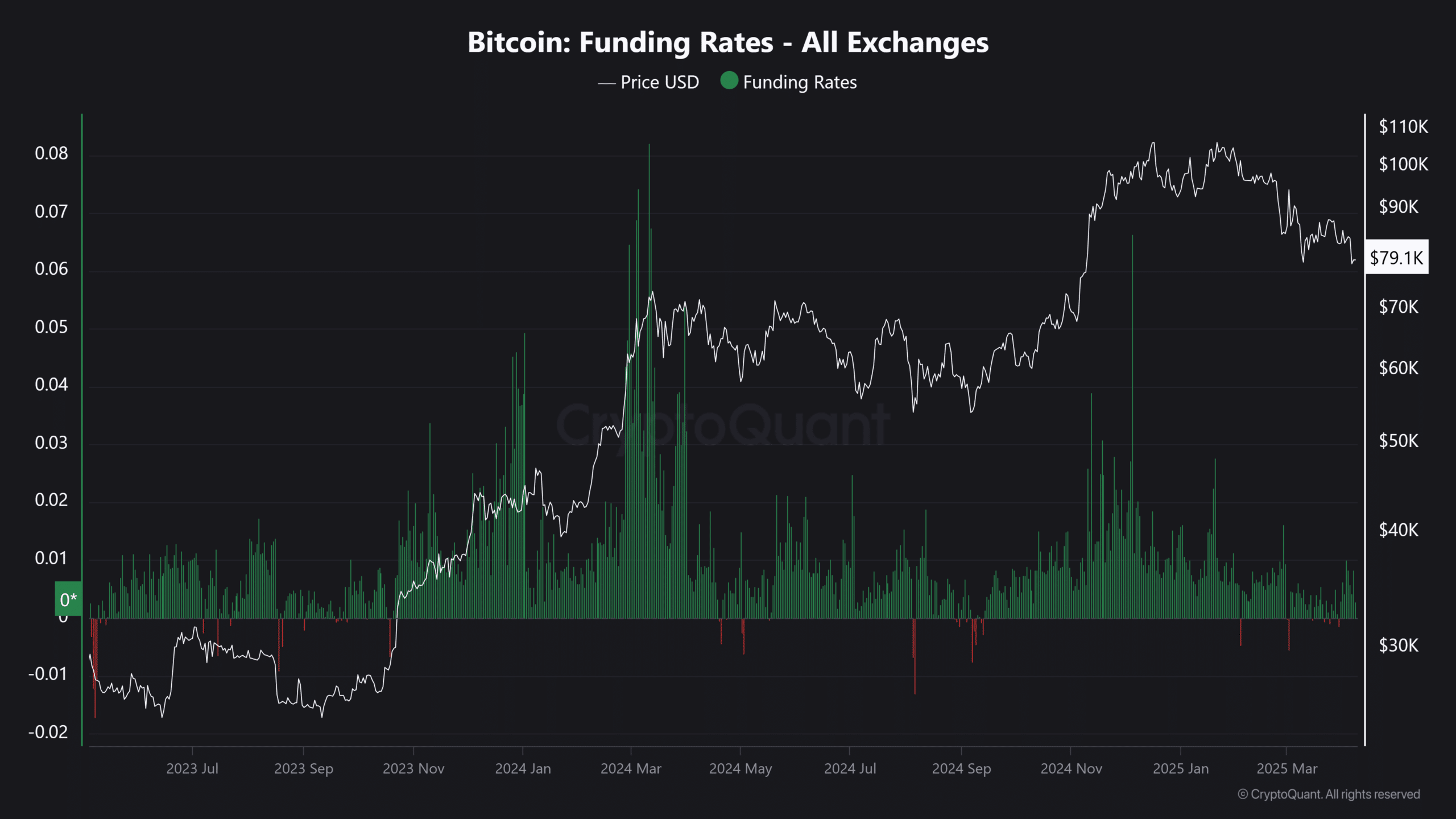

Upon further investigation, a crucial insight emerged. During the March rally, Open Interest (OI) surged from $32.01 billion to $35.81 billion.

This confirms that Futures markets were actively driving price action. In other words, LTH liquidity wasn’t purely spot-driven but fueled by leveraged long positions.

Bitcoin at a decision point: Retest or rebound?

On the 6th of April, Bitcoin’s exchange inflow CDD stood at 286k. Just a day later, it surged to approximately 1.8 million—a massive 529% spike. This indicated that older BTC was being moved to exchanges.

The key question now is whether this spike will lead to a February-style correction or mirror March’s resilience.

Interestingly, the day after this surge, BTC rebounded 1.10% to close at $79,164, suggesting that the market absorbed the initial wave of liquidity.

On-chain trends offer additional insights. Short-Term Holder (STH) supply has dropped to a four-month low, while LTH supply remains steady, indicating that long-term conviction remains intact.

Meanwhile, Funding Rates (FR) are aligning with March levels, reinforcing the idea that derivatives activity is playing a dominant role in price action.

Source: CryptoQuant

Moreover, Open Interest (OI) has reclaimed the $51 billion mark, signaling high liquidity flowing into leveraged trades.

However, with Funding Rates skewed towards longs, overleveraged positions could face liquidation if STHs continue to sell off.

The silver lining? Despite the CDD spike, no major sell-off pressure has materialized—yet. If Bitcoin follows its March rally structure, it could recover lost resistance levels faster than expected.