- Rising exchange whale ratio and hike in put options suggested Bitcoin may face selling pressure soon

- Bitcoin’s Options market revealed heightened demand for downside protection

Bitcoin [BTC] may be heading into turbulent waters. A sharp uptick in exchange whale activity and growing caution in the Options market are flashing early warning signs.

As the exchange whale ratio climbs to its highest level in over a year and put options outpace calls in both volumes and premium, traders appear to be bracing for potential downside.

The shift in sentiment suggests that some of the market’s biggest players might be preparing to sell, raising the possibility of greater volatility in the days ahead.

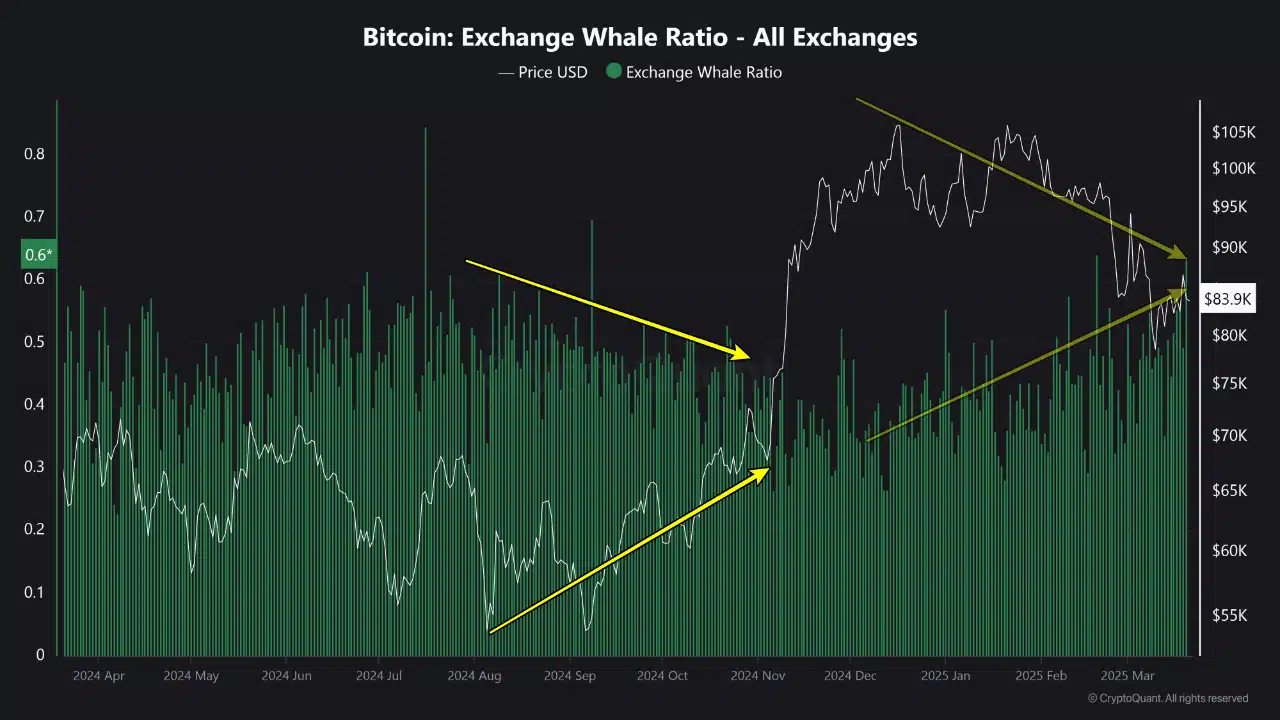

Exchange whale ratio – A signal of potential selling pressure

The Exchange Whale Ratio climbed to 0.6 – Its highest reading in over a year.

This spike indicated that large holders, or whales, are now responsible for a significant share of Bitcoin entering exchanges. Historically, such behavior tends to precede major market moves, often hinting at a hike in selling activity.

Source: Cryptoquant

As is evidenced by the chart, similar spikes in mid-2024 were followed by notable price declines.

The latest hike coincided with Bitcoin’s recent price retracement from its all-time high – A sign that whales could once again be reallocating assets in anticipation of market weakness. If past trends hold, elevated whale ratio levels could spell volatility ahead.

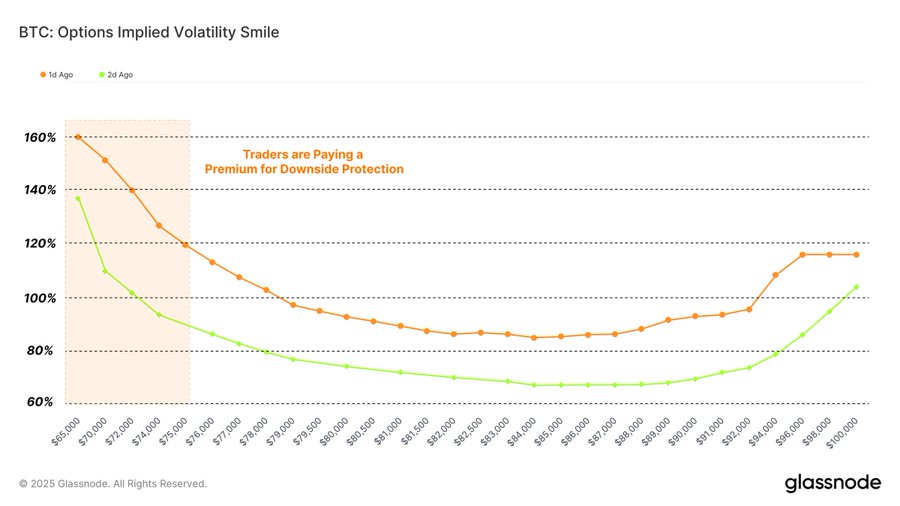

Bitcoin Options market – Growing demand for downside protection

Bitcoin‘s Options market has been flashing signs of caution too.

Options allow investors to hedge against price swings, and the press time positioning revealed a clear tilt towards risk aversion. The implied volatility smile chart highlighted that traders are paying a premium for put options, compared to calls, especially for strike prices below $80,000.

Source: Glassnode

This pattern can be interpreted to allude to growing demand for downside protection as investors brace for potential declines.

The steep leftward skew on the chart hinted at heightened fear of short-term volatility and seemed to reinforce the broader market’s shift toward defensive strategies. This surge in put premiums is also a sign of investor sentiment turning wary, aligning with on-chain whale activity while pointing to a more cautious outlook for Bitcoin in the near term.