- Bitcoin nears a critical $63K support level, risking a break in its four-year price pattern.

- A drop below $63K could shake long-term holder confidence and trigger heightened market volatility.

Bitcoin [BTC] is teetering at a pivotal juncture. As it approaches the $63K support level — a historically strong zone that has marked key bottoms — investors are watching closely for signs of resilience or breakdown.

For years, one of Bitcoin’s most consistent patterns has been its refusal to revisit prices from four years prior. But if $63K support fails to hold, that streak could end.

A decisive drop below this level may rattle long-term holder conviction and usher in a period of heightened volatility. With 2025 still unfolding, this moment could prove critical in shaping Bitcoin’s next major move.

Where Bitcoin could find its footing

Source: Alphractal

Bitcoin has been hovering just above two key levels — active realized price at $70,730 and true market mean price at $64,480.

These levels have previously marked major inflection points: the May 2021 sell-off, the January 2022 bear market low, and the 2023–2024 accumulation zone.

The active realized price reflects market behavior through absorbed profits and chain activity, while the true market mean price offers a deeper structural anchor tied to investor capital and active supply.

Together, they form a high-probability bottom range that could stabilize BTC in the short term.

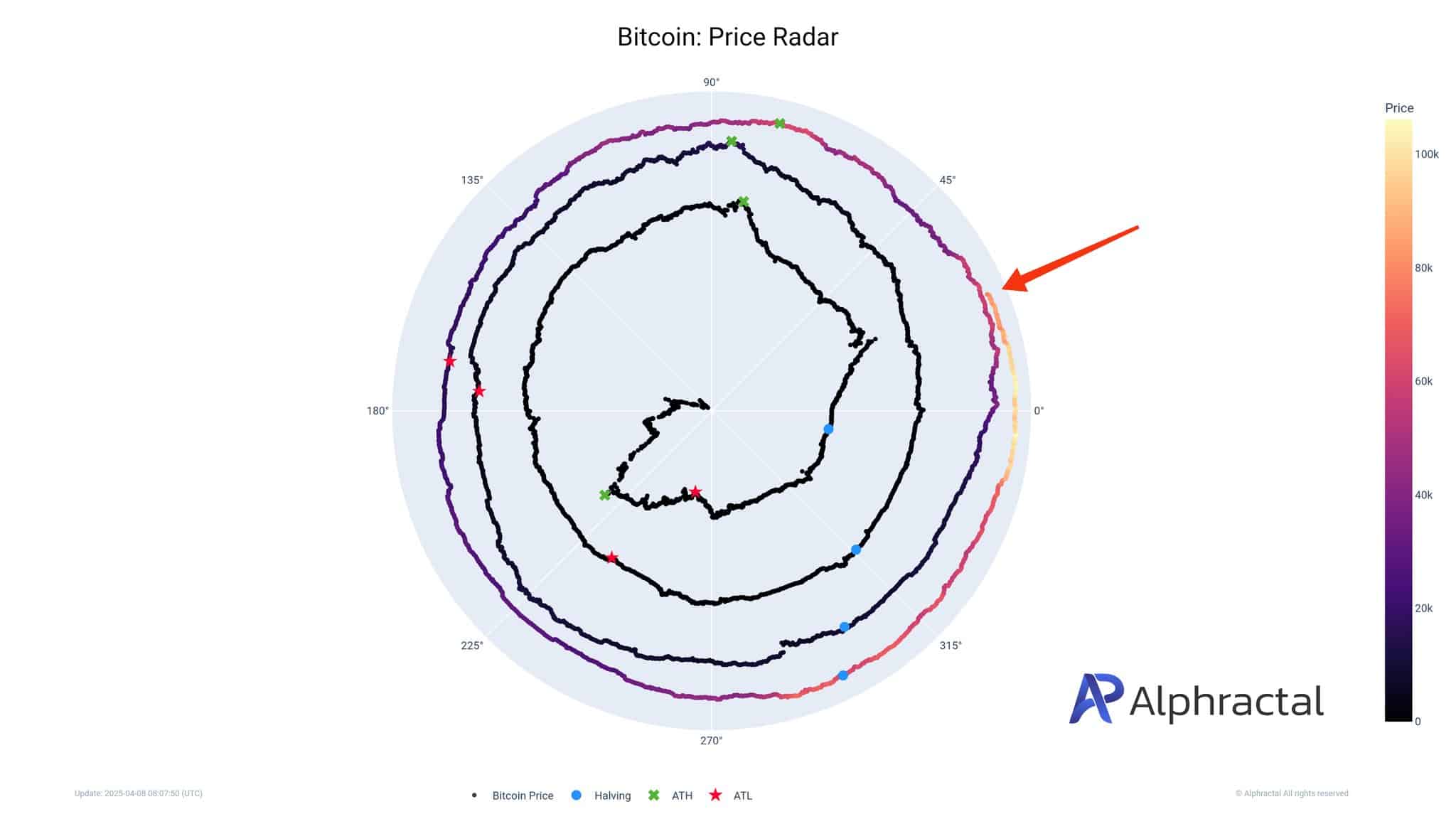

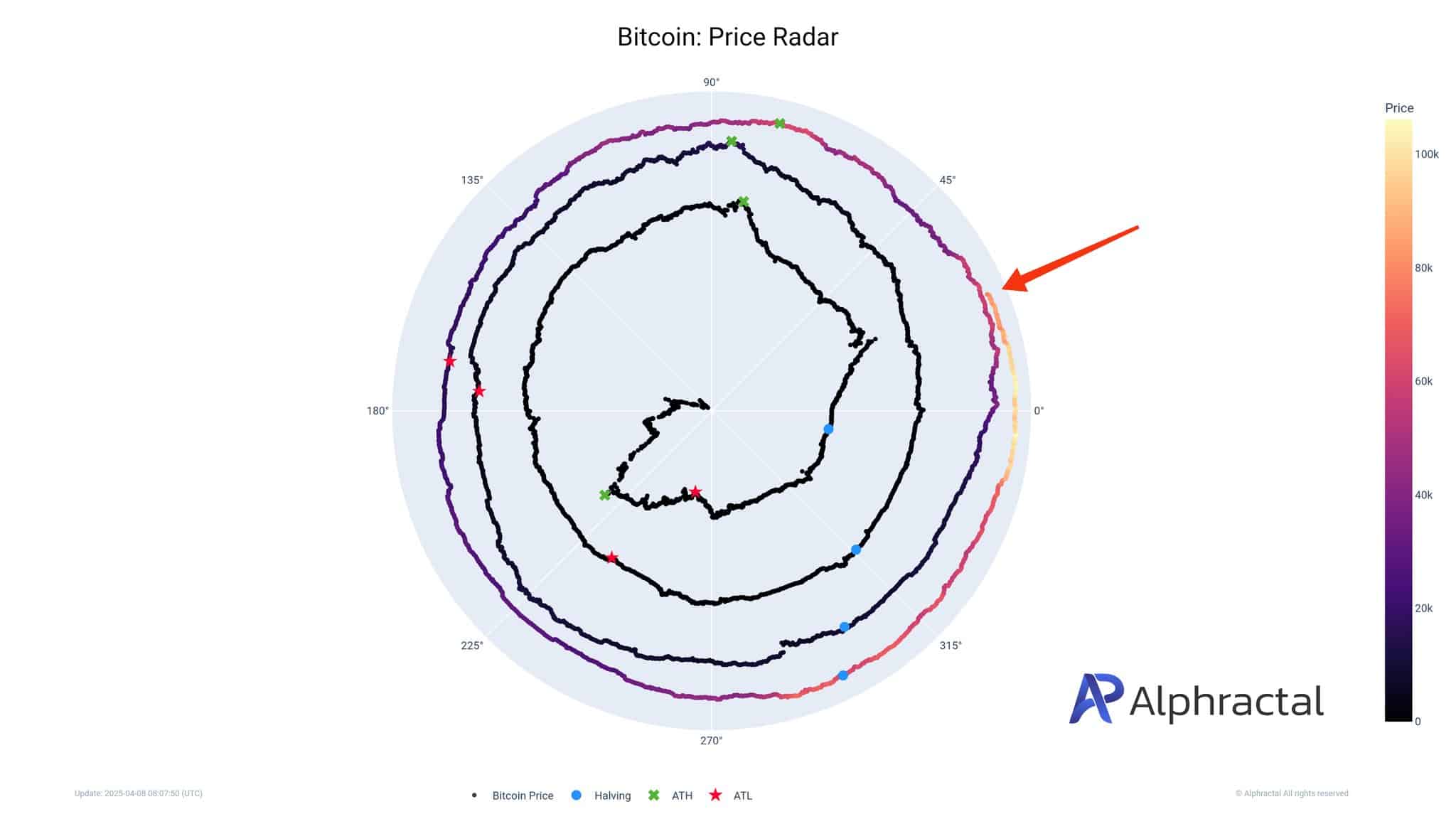

Bitcoin has never revisited four-year prices

Bitcoin has maintained a strikingly consistent pattern: it has never revisited price levels from four years prior.

This rule, visualized in the Bitcoin Price Radar chart above, forms the foundation of Bitcoin’s cyclical nature and long-term appeal.

Each rotation on the radar represents four years, with halving events, all-time highs, and lows marked around the spiral.

Source: Alphractal

As BTC now possibly approaches with the $63K support level, it teeters dangerously close to violating this long-standing principle.

A breach would mark a historical first — breaking the psychological and structural rhythm that has shaped investor confidence and cycle expectations since Bitcoin’s inception.

Implications for LTHs

If Bitcoin dips below $63K, it would break a precedent that has held firm across every halving cycle — never revisiting prices from four years prior.

For long-term holders, this isn’t just a technical anomaly; it’s a psychological shock. Many have anchored their conviction in Bitcoin’s historical consistency, using the four-year rule as a compass for timing and belief.

A breach could introduce doubt, shake long-term conviction, and prompt a reassessment of cycle-based strategies.

In a market driven as much by narrative as by fundamentals, violating this “rule” could unsettle sentiment and inject volatility into an already fragile macro environment.