- BTC dipped by 2.55% over the past day.

- Bitcoin saw a surge in institution demand as the Coinbase Premium Index flips to positive.

Over the past week, Bitcoin [BTC] has continued to trade Between $95k and $98k. In fact, as of this writing, Bitcoin was trading at $95936. This marked a 2.55% decline on daily charts with an extension to this bearish outlook on weekly charts by 1.56%.

With Bitcoin struggling to maintain an uptrend and reclaim higher resistance, investors especially institutions have taken this opportunity to buy BTC.

Inasmuch, popular crypto analyst Ali Martinez has suggested a rising institutional demand, citing the Coinbase Premium Index.

Bitcoin institutional demand surges

With Bitcoin’s continued consolidation, institutional demand has surged. Over the past week, the Coinbase Premium Index has remained positive.

When positive, it suggests stronger buying pressure on Coinbase than on Binance, implying that U.S. investors are dominating the market.

Source: X

As such, institutions have taken advantage of the current price stagnation to accumulate Bitcoin at lower rates.

This rising buying pressure from institutions reflects bullish sentiments as they anticipate prices to rebound in the near term.

What BTC charts suggest

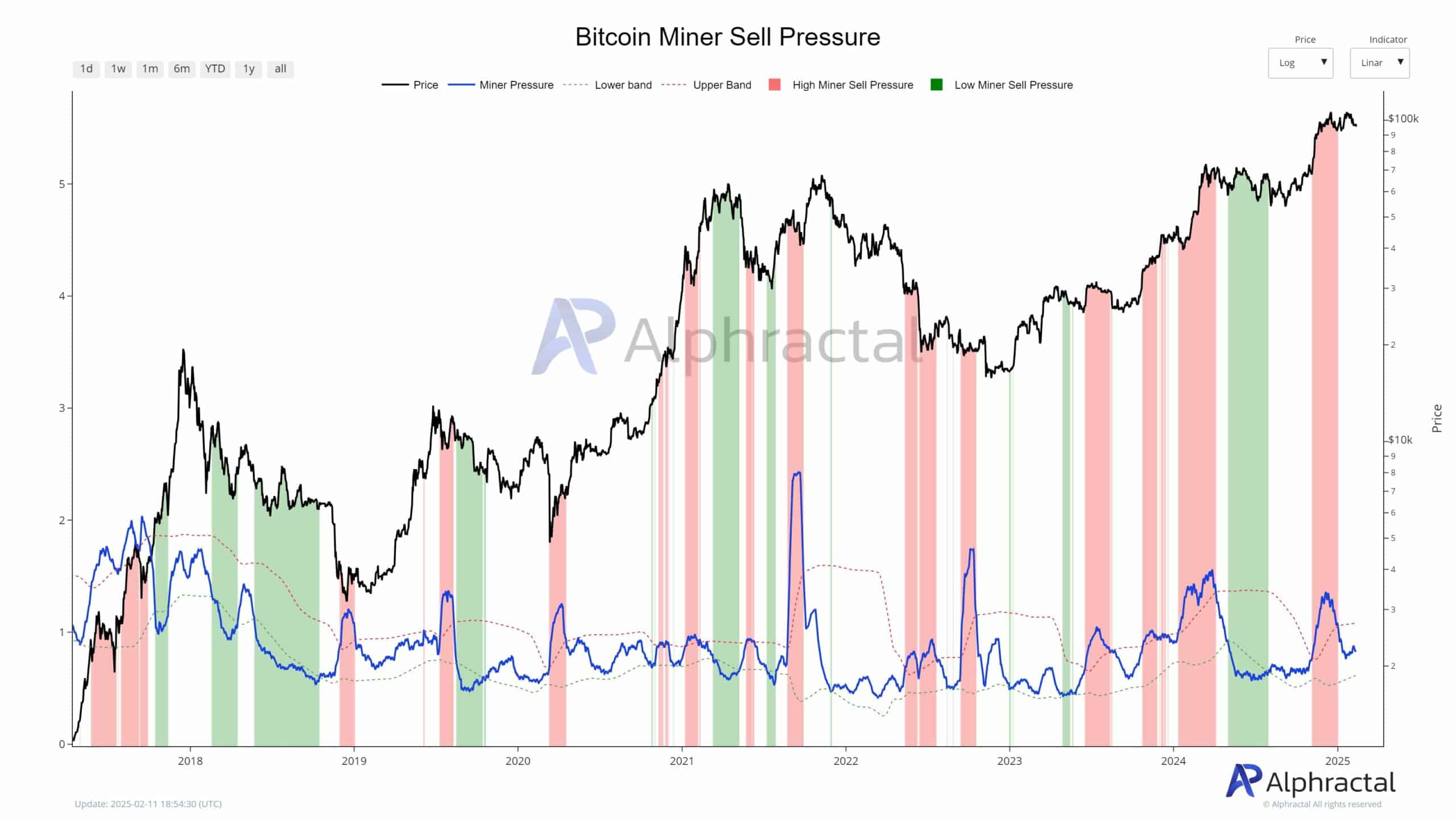

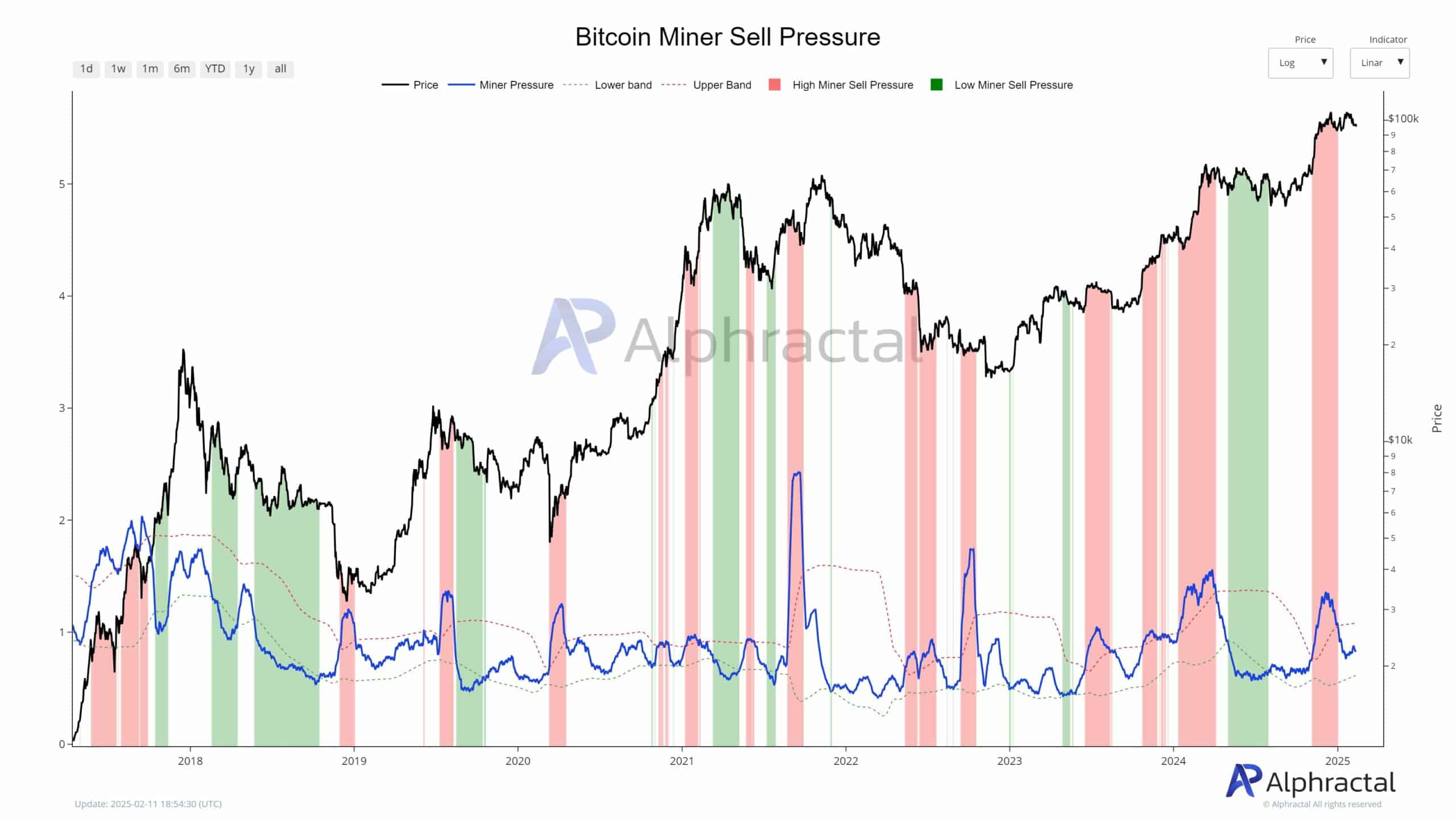

Source: Alphractal

With institutional demand rising for BTC, it reflects bullish sentiments from this group. For starters, we see this bullishness among institutions as selling pressure from miners is reducing. According to Alphractal, miners’ selling pressure has dropped, reducing the BTC supply from miners.

Therefore, after a period of high selling from miners, values are now below average, suggesting a pause in miner liquidations.

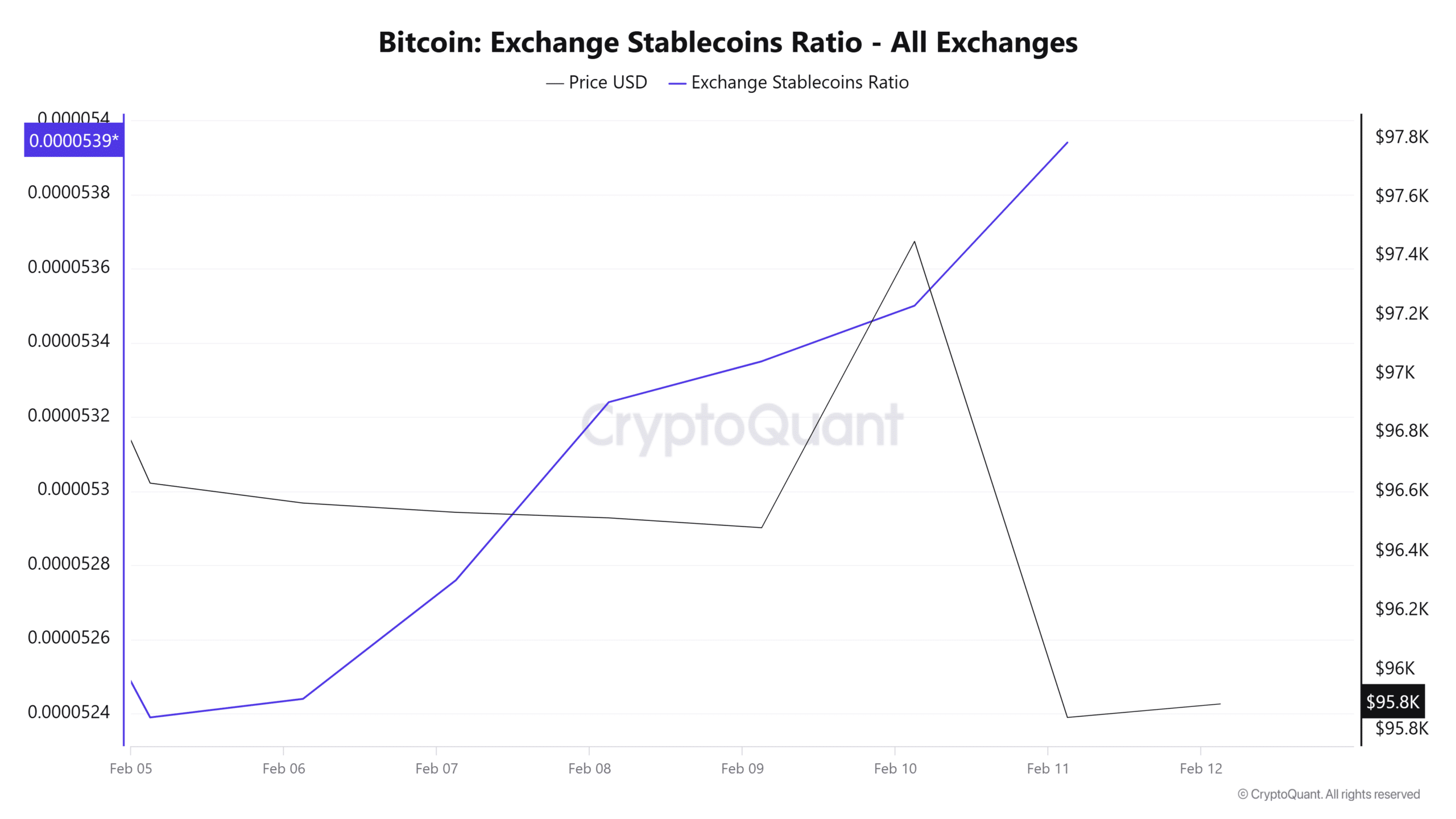

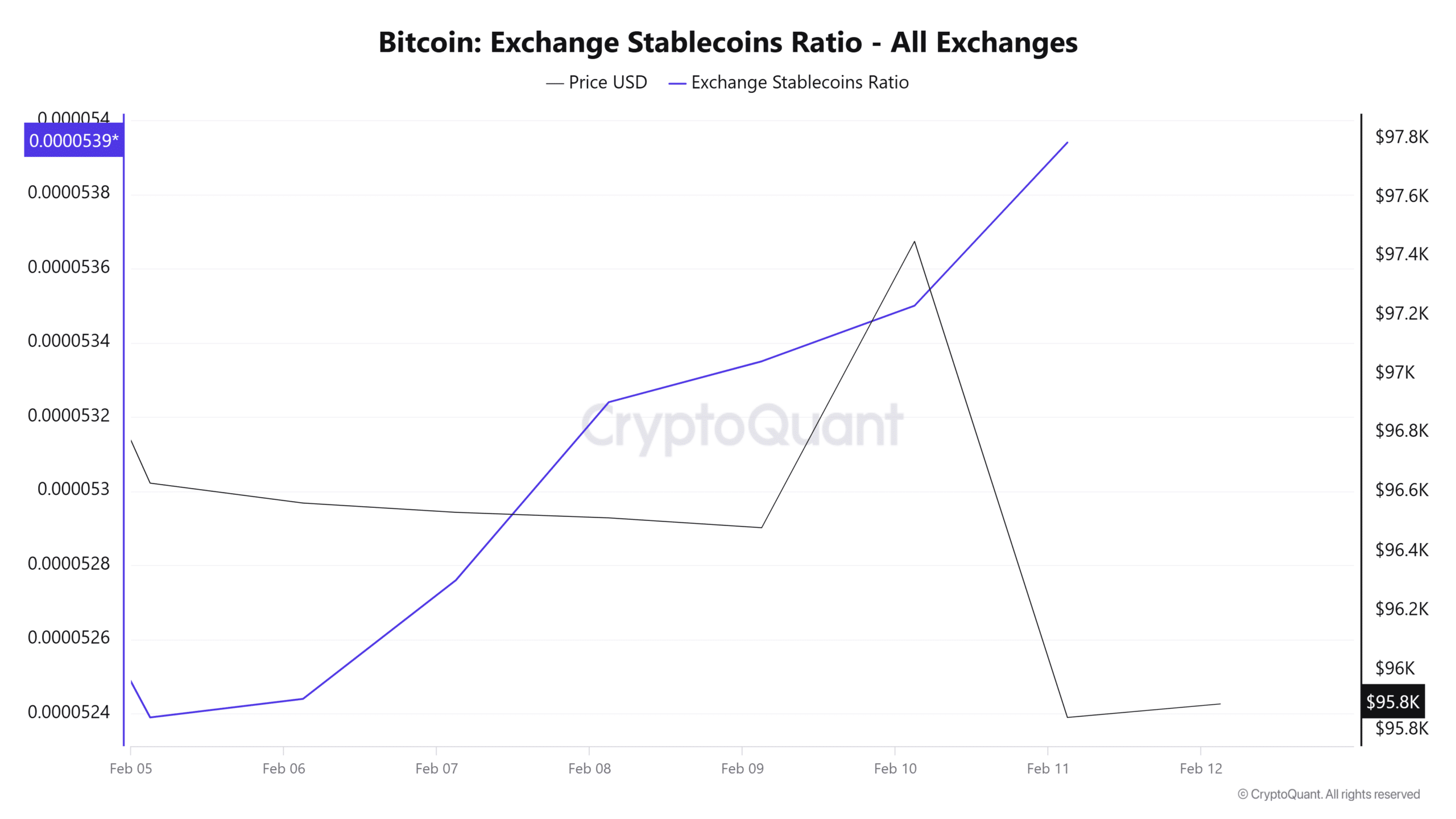

Source: CryptoQuant

Additionally, Bitcoin’s exchange stablecoins ratio has surged over the past week. Often, institutions use stablecoins such as USDT or USDC to buy BTC thus a rising stablecoin supply signals potential buying power in the market.

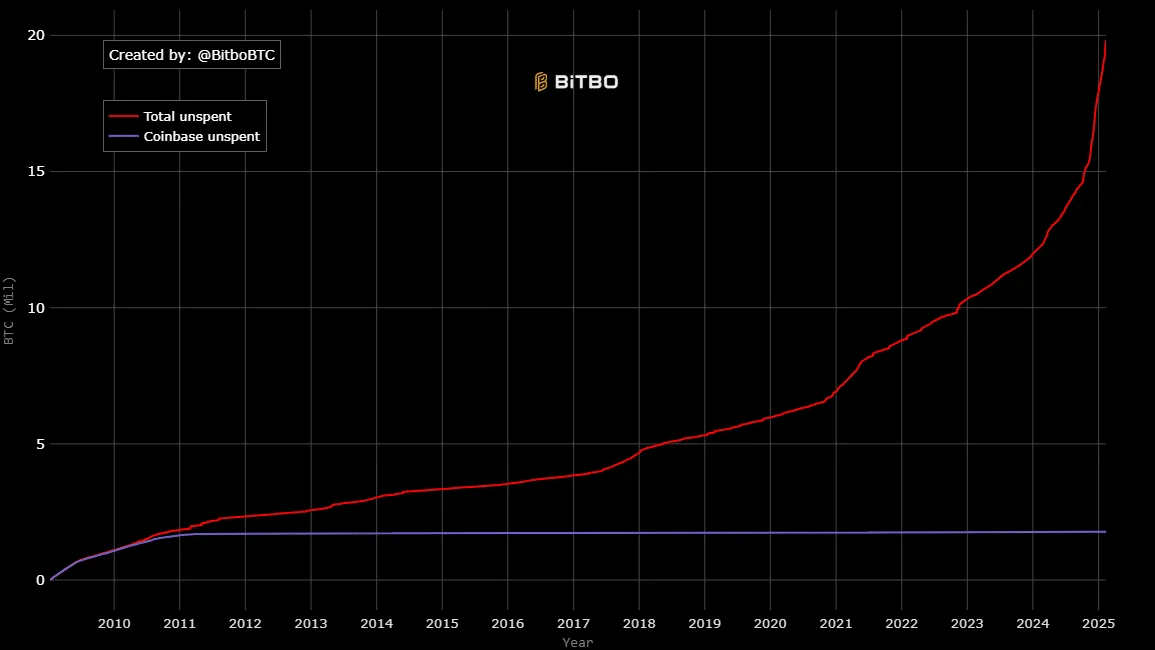

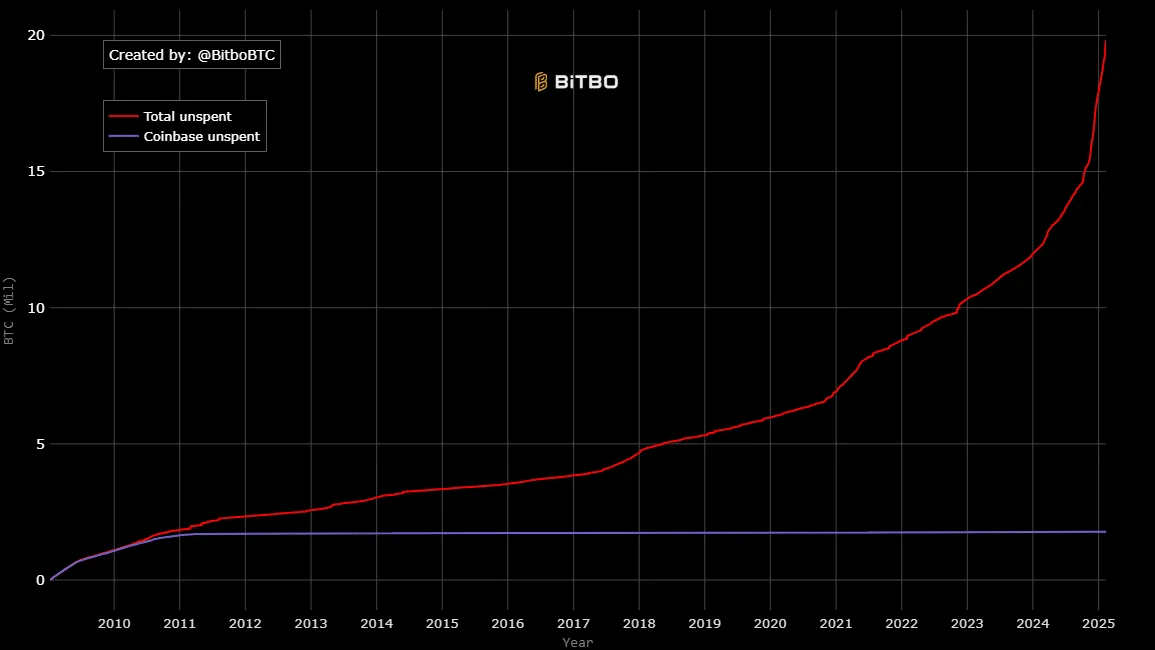

Equally, dormant coins, especially total unspent have experienced a steady rise while Coinbase’s unspent coins have remained the same.

This implies that large and long-term holders are not selling BTC, either through Coinbase or other exchanges.

Source: Bitbo

In conclusion, Bitcoin was experiencing high demand from institutions, evidenced by reduced selling pressure and higher buying activity.

With institutions buying without selling, it reflects strong bullish sentiments as they turn to accumulate.

Therefore, the current market conditions position BTC for more gains on its price charts. If this trend holds, BTC could break out of $98,405 and attempt $100K.

However, with STH sellers still in the market, a pullback could see the crypto retrace to $95,031.