- Bitcoin needs to turn the $85,000 resistance into a support zone for a bullish breakout.

- Monitoring ETF flow trends alongside key technical levels will be essential in assessing BTC’s near-term trajectory.

Bitcoin [BTC] has been range-bound between $81,000 and $85,000, since its decline to $78k a week ago. Turning the $85k resistance into a solid demand zone is now key for a rally.

Technical analysis suggests that if BTC fails to hold the $81,000 support level, it could test lower support zones around $78,446. Conversely, reclaiming and consolidating above the $85,000 resistance could pave the way for higher targets.

Signs of a potential Bitcoin bottom

On the 17th and 18th of March Bitcoin saw a half-billion-dollar inflow into BTC ETFs. This marked the first consecutive institutional influx this month.

Meanwhile, the fear index, shifting from “extreme fear” to fear, has historically signaled a potential bottom, offering a chance to buy BTC at a discount for outsized returns.

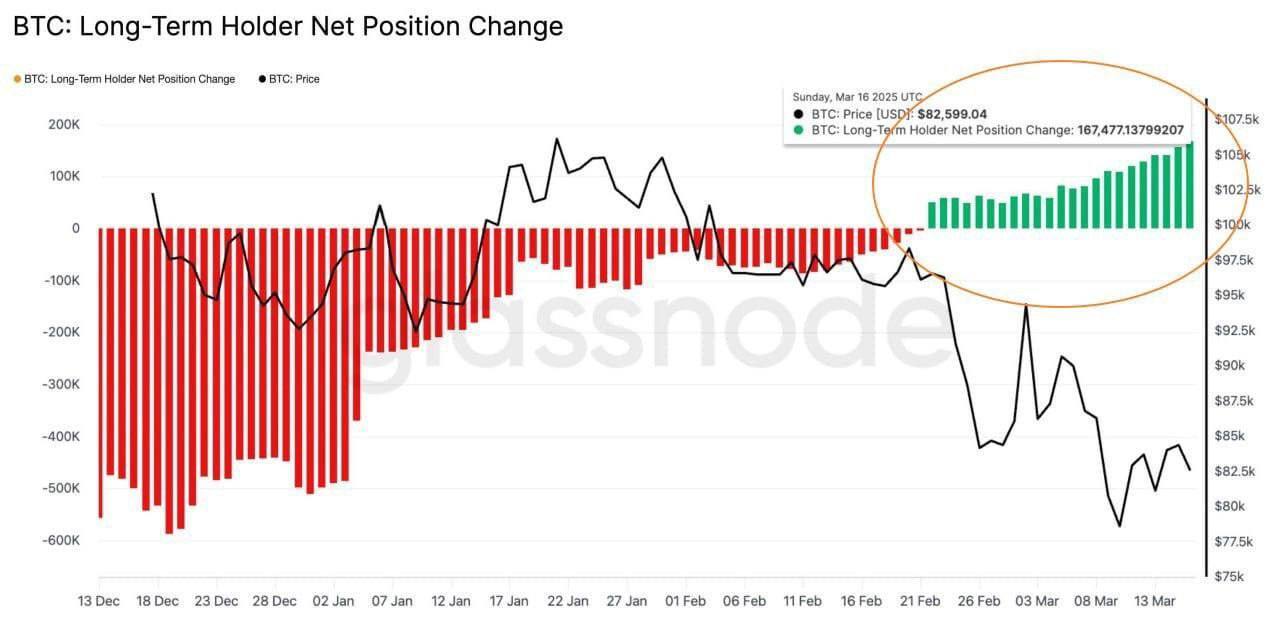

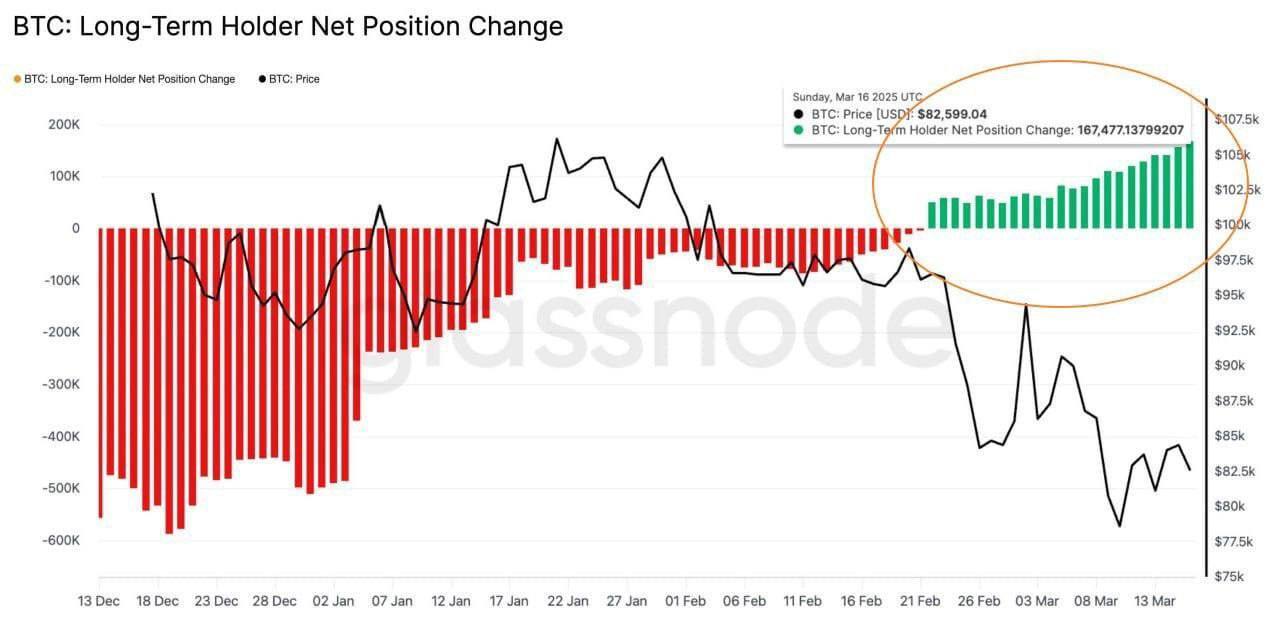

Long-term holders (LTHs) seem to agree. On the 16th of March, they snapped up 167k BTC at $82k.

Source: Glassnode

Yet, despite strong inflows and accumulation, Bitcoin still struggled to break $85k. Heavy leverage at support keeps it above $80k, but fuels liquidations when profit-taking kicks in at $85k.

In other words, each BTC dip sees a spike in leverage and a $2B jump in Open Interest (OI). But as BTC reclaims $85k, liquidations hit, OI unwinds, and the price drops back to $80k.

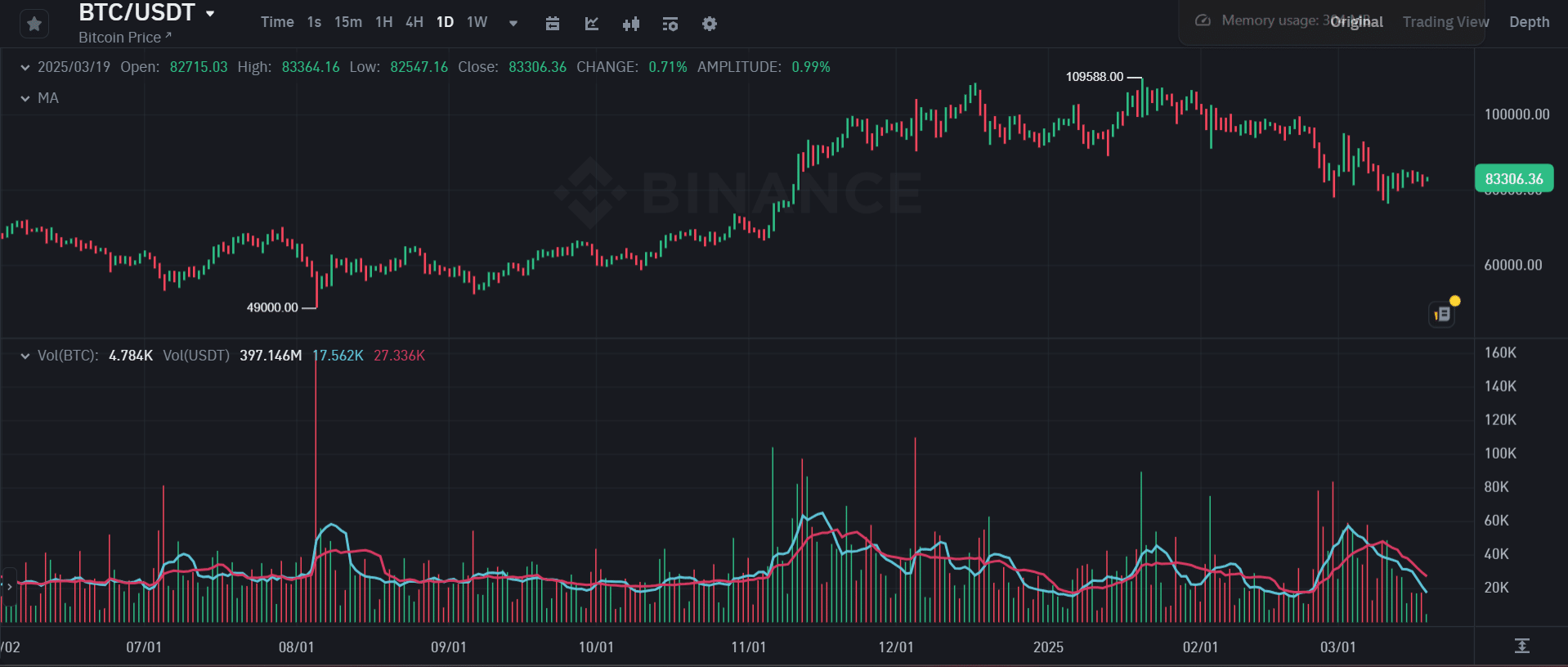

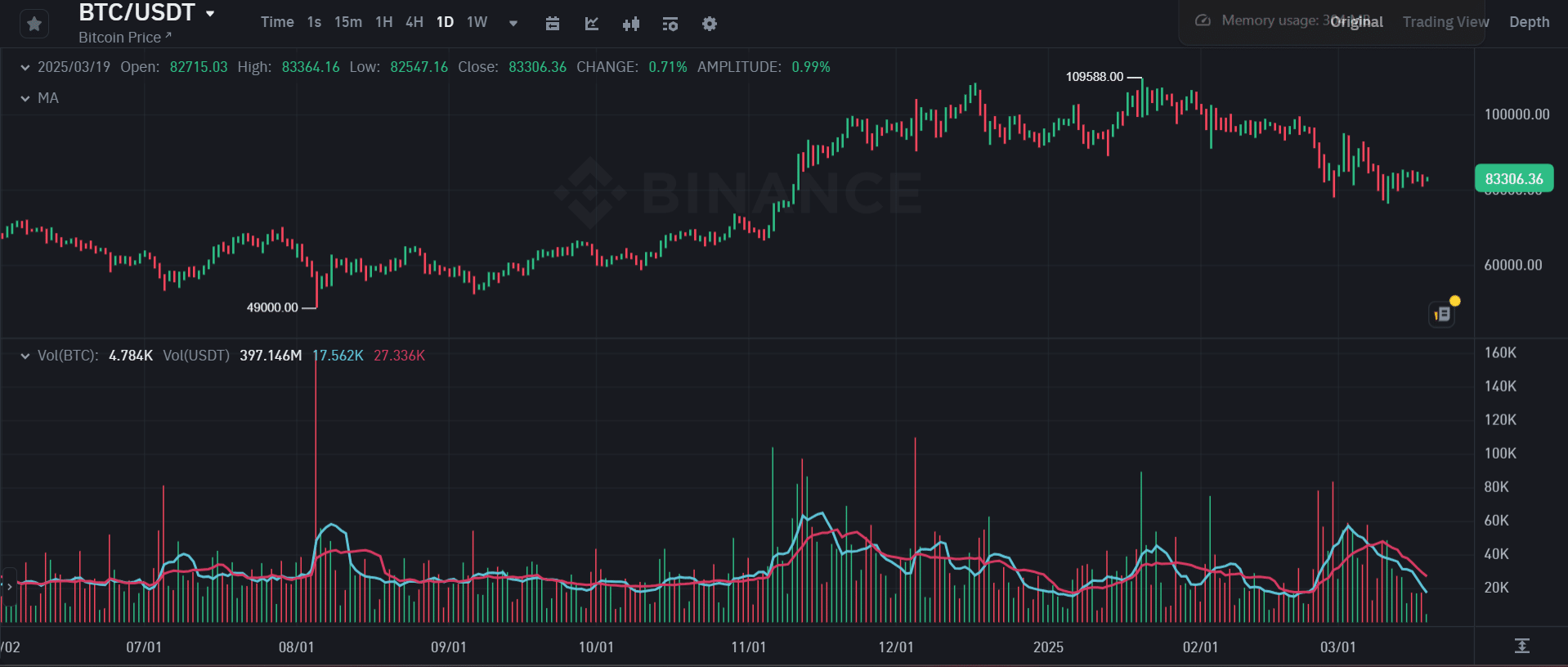

This pattern leaves Bitcoin vulnerable, with a potential pullback amid ongoing macroeconomic risks. Additionally, Binance data reveals low trading volume, with spot markets lacking significant buy orders.

Source: Binance

Clearly, signs of $85K flipping into support are emerging – but it’s not there yet.

With weak spot demand, another long-squeeze risk remains

This chart shows that a retest of $84,772 could trigger another flush-out, putting 772.4K Bitcoin at risk of sell-offs.

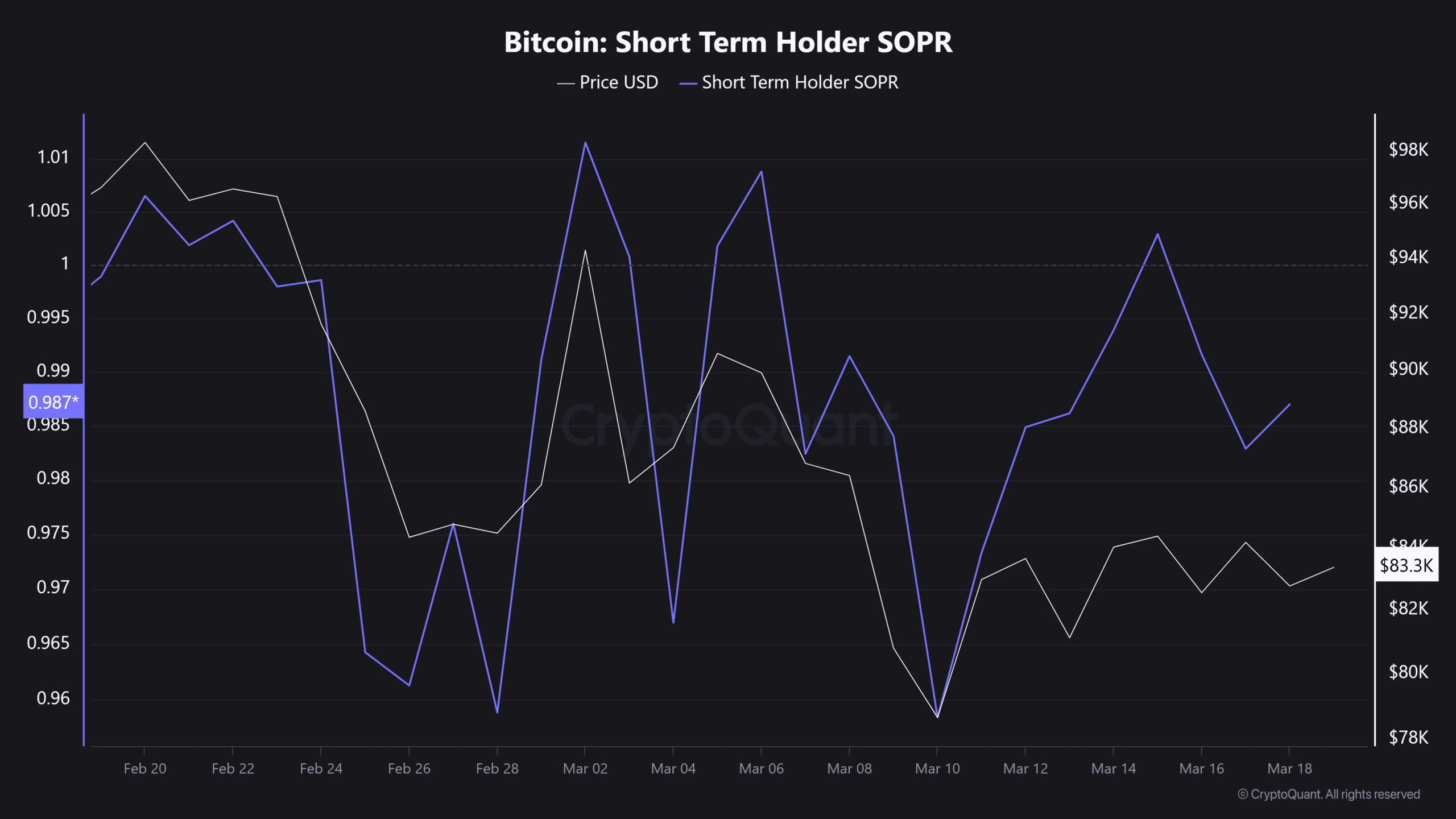

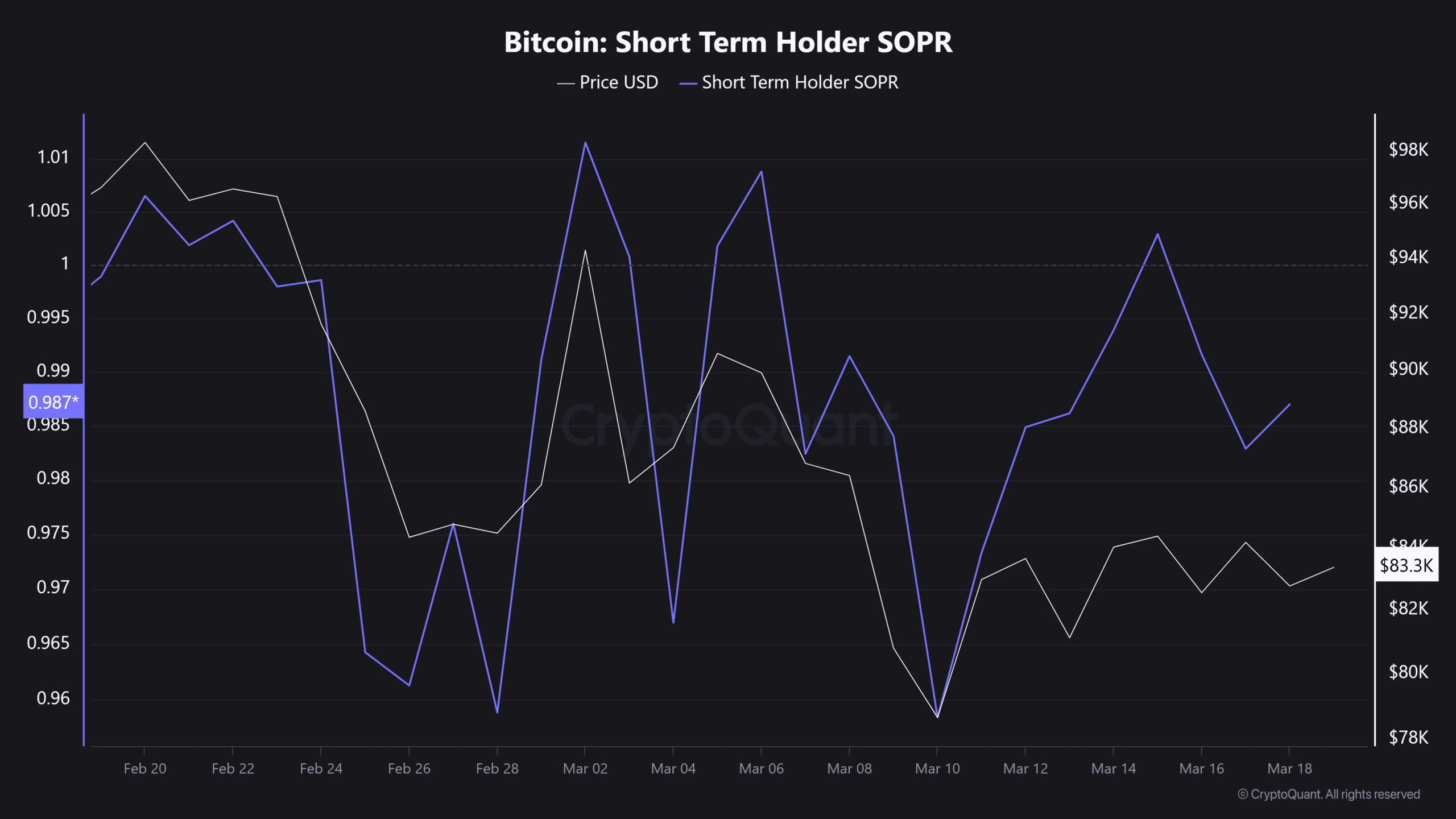

Short-term holders (STHs) remain cautious as volatility persists, with HODLing not the preferred strategy.

The STH Spend Output Profit Ratio (SOPR) has turned negative, indicating that STHs (holding <155 days) are realizing losses, adding to the selling pressure.

Source: CryptoQuant

Leverage trading continues to rise, with OI up 0.64% to $48.80 billion. However, weak spot demand increases the probability of a long squeeze once Bitcoin crosses this level.

Without strong institutional accumulation, sell-side liquidity could rise, leading to mass liquidations of long positions and a potential retrace to the $80k demand zone.

To invalidate this setup and trigger a bear trap, Bitcoin must generate strong buying momentum at $85k to break resistance.