- Bitcoin is going through a deleveraging process, and prices could drop in the short-term.

- However, seller exhaustion could occur the longer BTC consolidates around $100k.

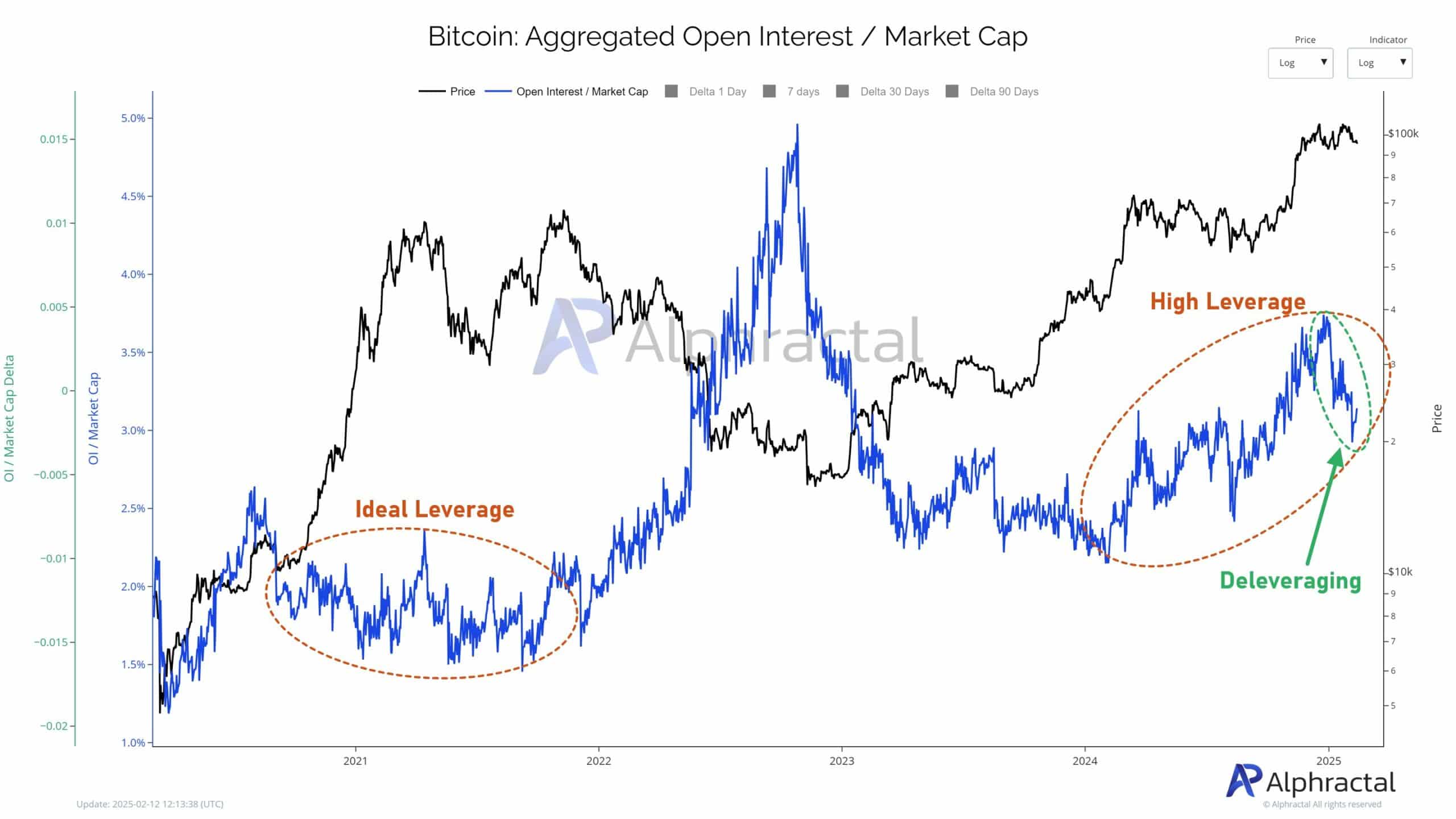

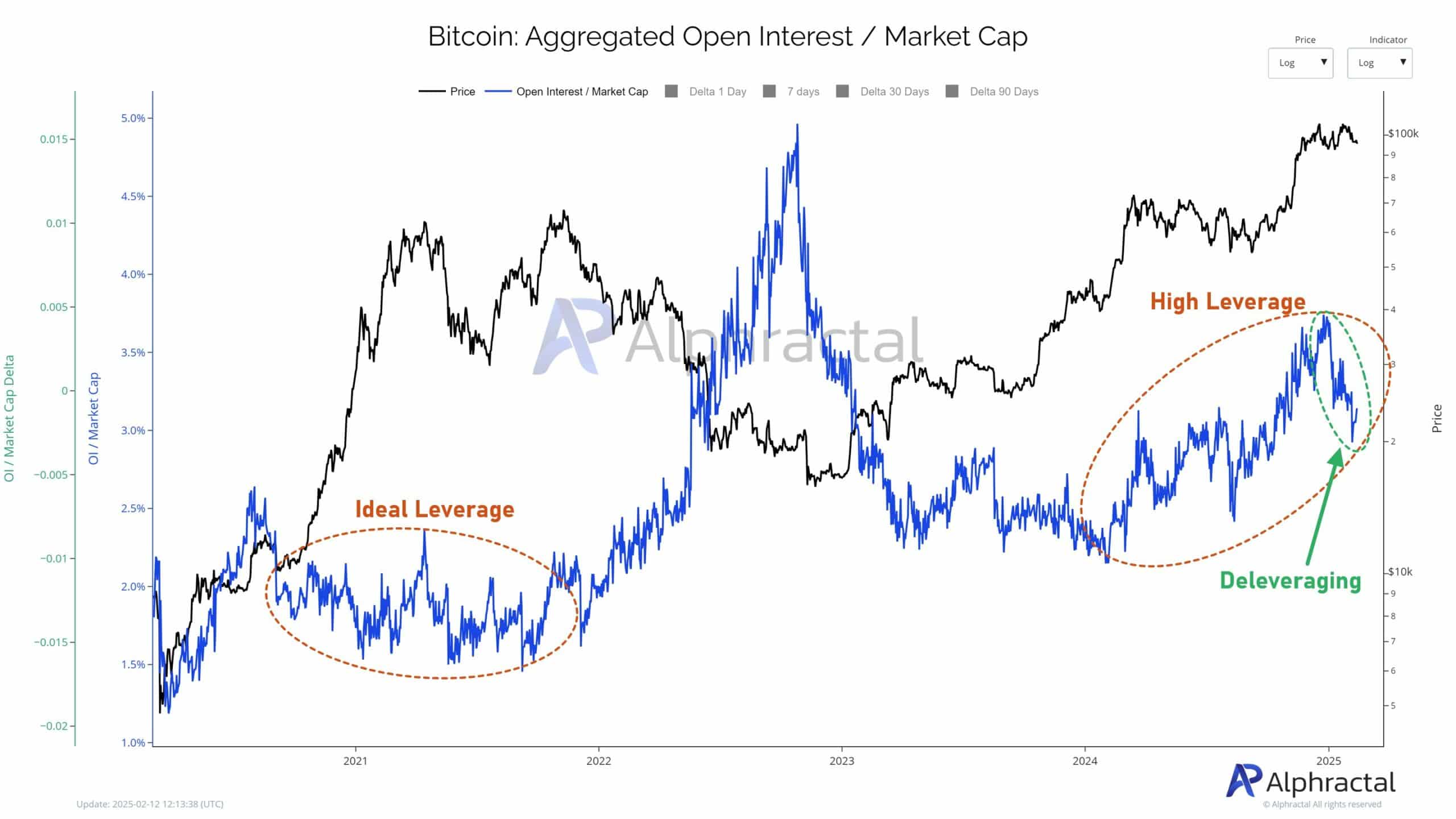

Bitcoin [BTC] is currently in a deleveraging process, as indicated by the 90-day Aggregated Open Interest Delta across 17 major exchanges.

This trend is often followed by price drops or extended sideways movement in response to closing or liquidating positions.

Particularly noteworthy is the Open Interest to Market Cap ratio, which has risen markedly since early 2024, suggesting increased Bitcoin market risk compared to the more balanced conditions during the 2021 Bull Run.

Source: Alphractal

Recent activities show significant deleveraging, signaling a BTC wave of liquidations and the closure of institutional positions—akin to a liquidity reset.

This higher ratio could elevate the risk of further price drops, impacting those in long positions.

Assessing liquidity zones and Trader Sentiment Gap

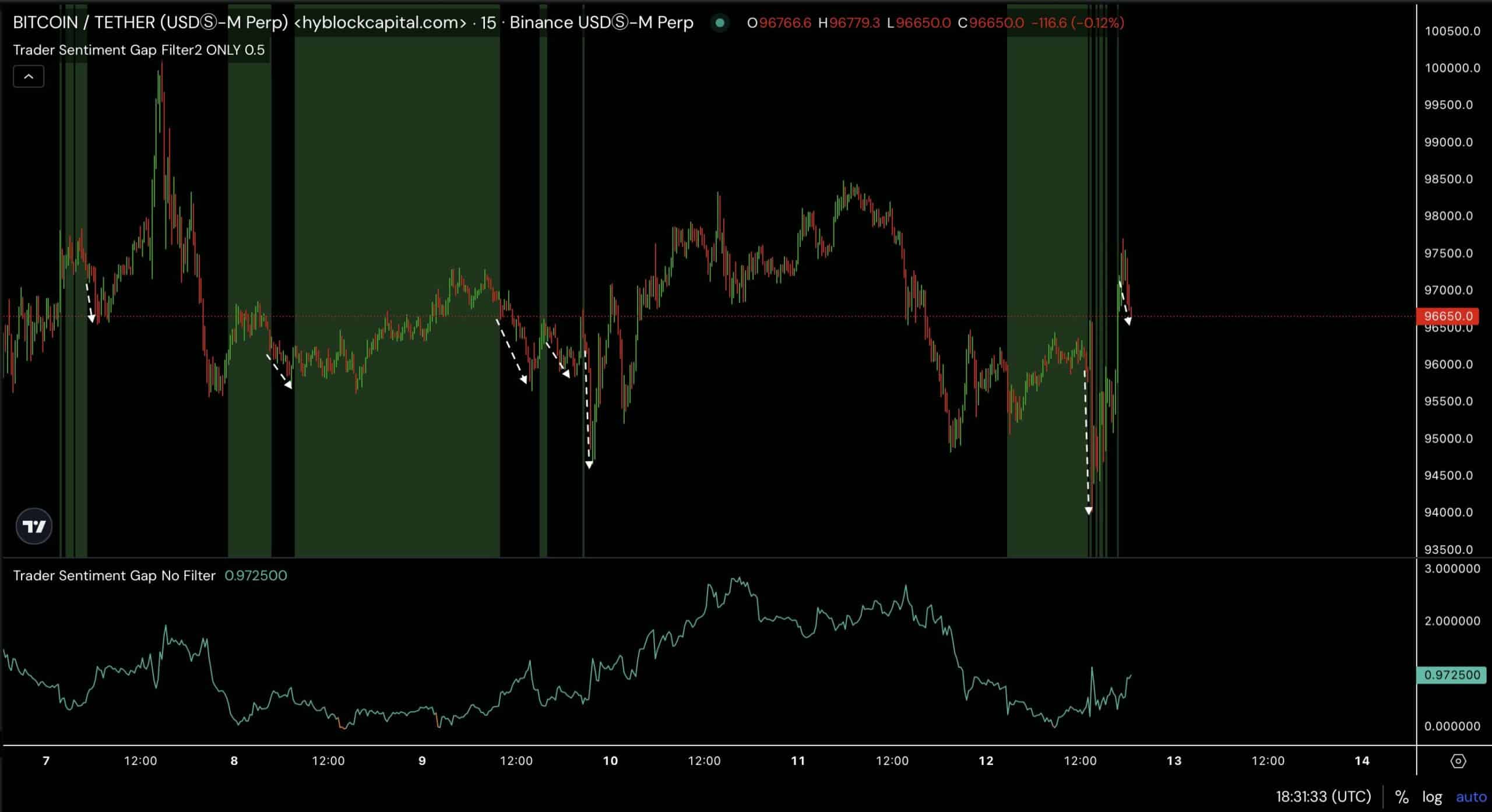

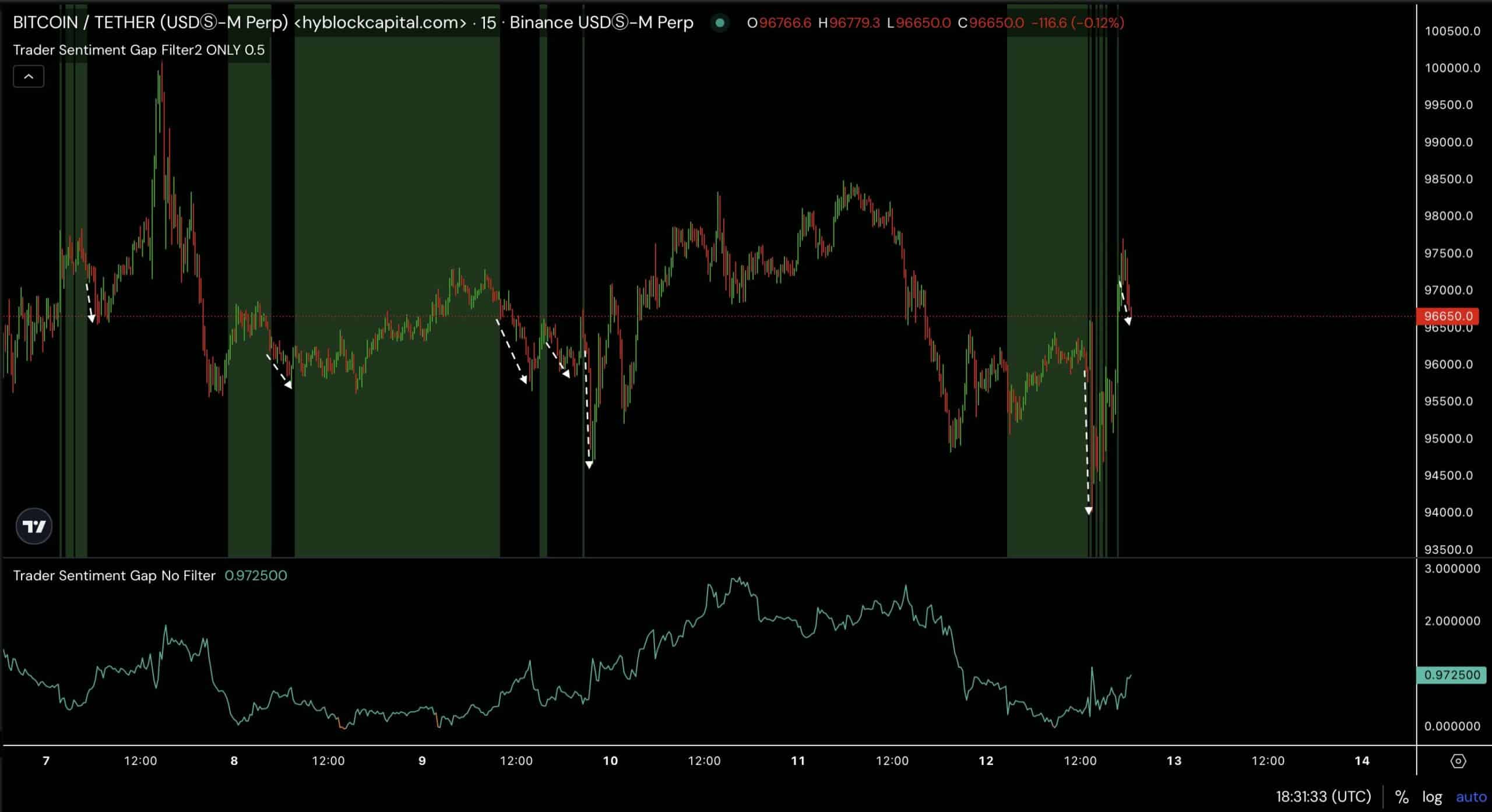

More analysis noted significant liquidity was pooled at $93,700 and $98,800. After yesterday’s news, there was a short-term recovery for BTC followed by a decline.

This initial drop could aim for the $93,700 level to absorb this “liquid liquidity,” where buy orders are waiting.

If BTC does not drop to $93.7K, it might signal strong underlying support or bullish sentiment, where buyers step in at higher levels, preventing a deeper fall. This scenario could lead to a quicker recovery or even a price surge.

Also, the Trader Sentiment Gap on the BTC showed a notable shrinkage to a lower level, particularly when filtered at 0.5, indicative of a minimal sentiment gap between top traders and retail traders.

Historically, such a contraction often precedes a significant price movement. On February 12, following a gap reduction, Bitcoin’s price sharply dropped from $96,650 to a low of $94,000 before rebounding.

Source: Hyblock Capital

This pattern suggested that a narrow sentiment gap may lead to initial price declines, followed by a recovery, reflecting shifts in trader behavior and market dynamics.

This further supports the anticipated drop as per the deleveraging signal.

Given the current low sentiment gap, BTC might see a similar short-term volatility with potential downside followed by an upward correction.

Why accumulation around $100K is crucial for BTC

However, a significant trend where Short-Term Holders (STHs) now possess 4 million Bitcoin has emerged. This represents 46% of the 2017 peak and 86% of the 2021 peak, having accumulated 1.6 million BTC since September.

The increasing number of Short-Term Holders (STHs) contrasts with the declining distribution from Long-Term Holders (LTHs) as seen in their decreasing share of the total BTC supply.

This shows BTC continues to accumulate around the $90K — $100K price range.

Source: Glassnode

This consolidation could suggests seller exhaustion, providing a stable base for a potential continuation of the rally.

As BTC stabilizes, the market could gain confidence, reducing the likelihood of sudden sell-offs. This would set the stage for a sustained uptrend after the deleveraging is over.