- Bitcoin absorbs LTH selling as Strategy tightens supply.

- July’s bullish track record and institutional demand hint at a potential breakout.

Bitcoin [BTC] LTHs are steadily distributing their coins, yet the market is absorbing the supply without breaking stride — a sign of strength in disguise.

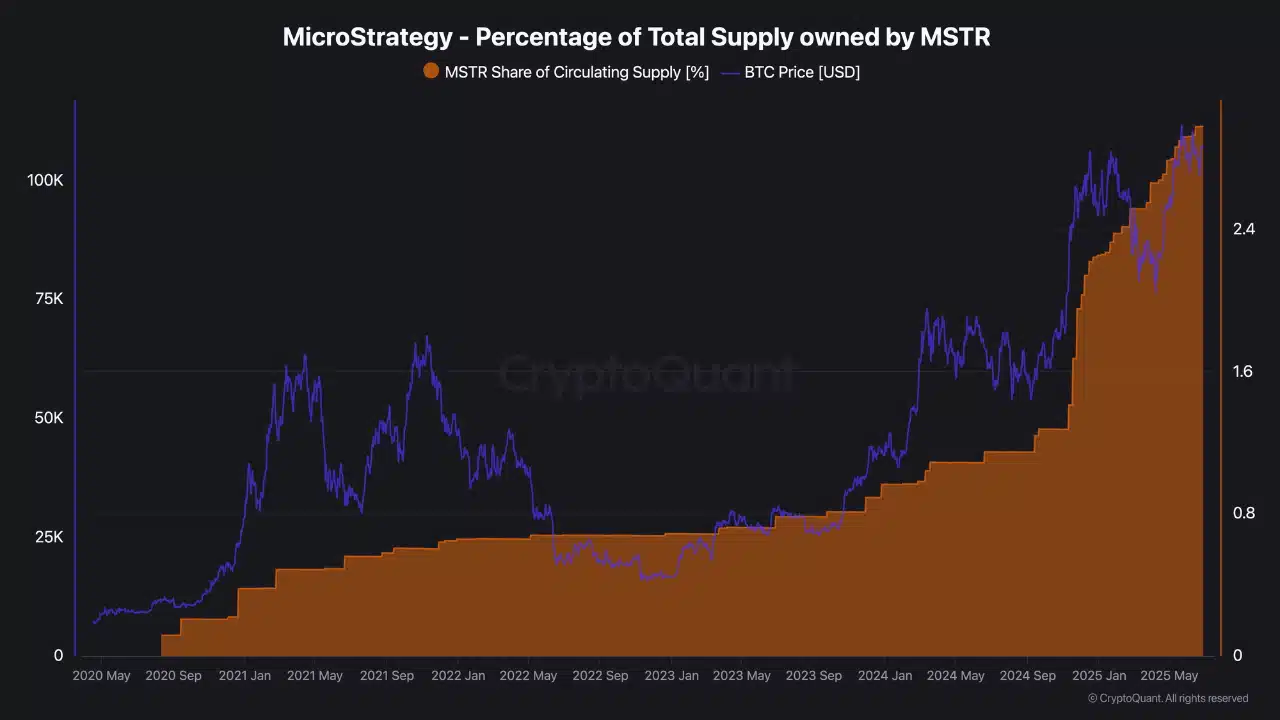

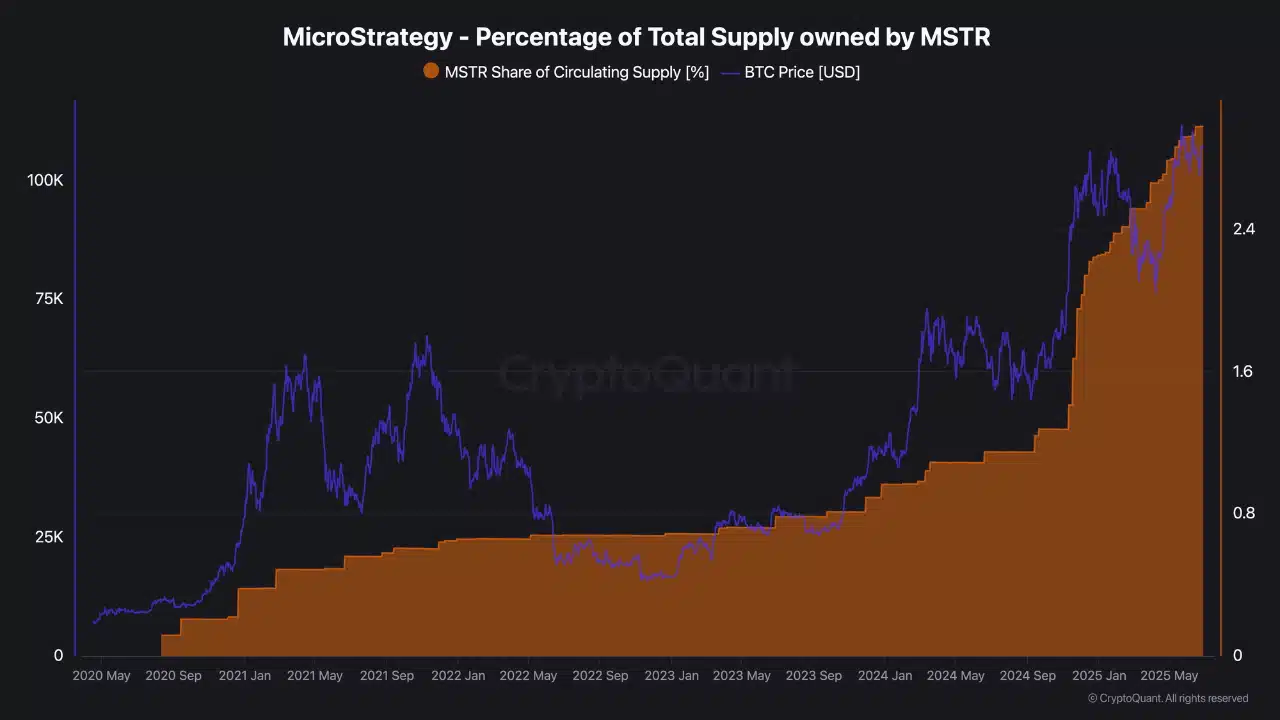

Meanwhile, Strategy’s (formerly MicroStrategy) aggressive accumulation, now commanding 3% of Bitcoin’s total supply, shows a broader institutional appetite building.

This could be fuel for Bitcoin’s next major move.

LTH selling without panic?

MSTR: 3% of Bitcoin supply is now held by one firm!

Strategy’s latest buy — 4,980 more BTC — brings its total holdings to 597,325 bitcoins, now accounting for 3% of Bitcoin’s circulating supply.

The firm’s pro-cyclical accumulation strategy has intensified over the past two years, aligning its largest purchases with bullish sentiment.

Source: CryptoQuant

CryptoQuant’s chart confirmed the rising share of supply held by MSTR, and while some criticize the centralization risks, many see this as institutional conviction on full display.

July is coming—and so is a breakout?

Historically, July has been one of Bitcoin’s strongest months, with a median return of 8.9% and a positive close in 8 of the last 10 years.

Source: X

This now converges with two major bullish forces: LTHs steadily rotating supply into strong hands, and institutional demand tightening float.

If the market continues absorbing this supply as it has over the past month, a decisive breakout may be in sight.

With July’s track record and current structural support, perhaps a surprise, even for the bulls, is in order.