- Bitcoin’s journey is shaping up to be one of both excitement and caution

- For now, all dips remain prime opportunities to buy

Bitcoin’s price action is at a pivotal juncture right now. Key resistance levels of $90k and $93k have been breached now, clearing the path for higher targets.

In fact, analysts like Willy Woo are still all-in on a bullish outlook, positioning $108k as a likely target, with an immediate goal of $103k in the near term.

So, what does this mean for your portfolio? Is it the perfect time to rethink your entry points and fine-tune those risk strategies?

Dips in Bitcoin are the golden opportunities to stack more

Despite the bullish medium-term outlook, there’s a bit of caution in the air.

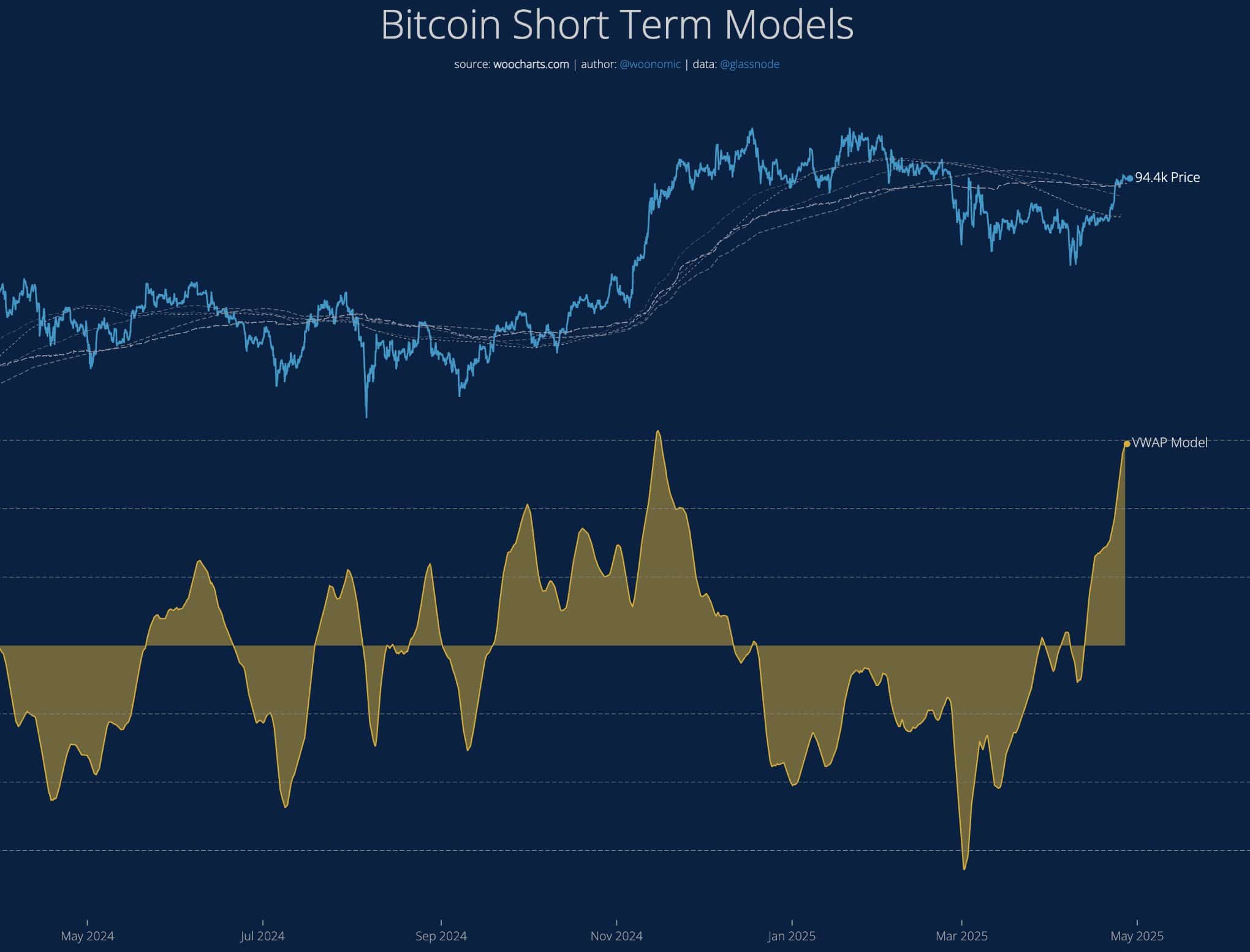

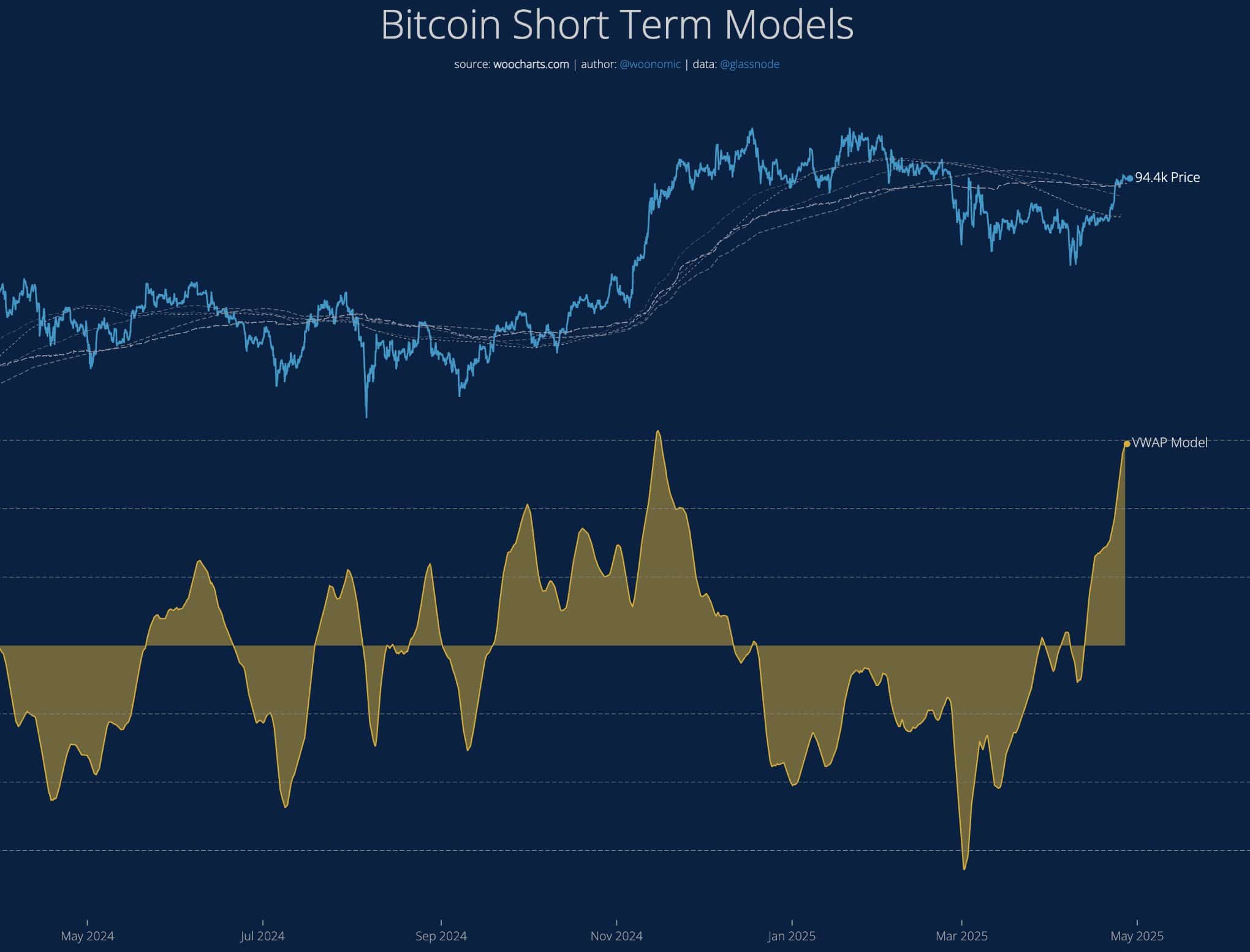

According to Woo, Bitcoin’s on-chain VWAP (Volume Weighted Average Price) has pushed into +3 standard deviations. This means the price might be a tad bit overextended right now.

For those not familiar, VWAP is Bitcoin’s “average price,” but it also takes into account how much trading volume is behind each price move. So, when the price pushes too far away from this average, it can mean that the market might be overbought or oversold.

Source: X

In other words, while we might see some sideways action – or in the best-case scenario, a slow and steady grind upwards – don’t expect fireworks just yet.

For his part, Woo is bracing for a few dips as the market cools off.

However, he’s still all about buying those dips. In his view, this is just a temporary cool-down before the next big push up, and the long-term outlook is as bullish as ever.

Market forces back Woo’s bullish vision

The big takeaway from Willy Woo’s analysis? Bitcoin may be gearing up for a fresh shot at smashing all-time highs.

Woo also highlighted that if things keep playing out as expected, a breakout around $96k could be right around the corner.

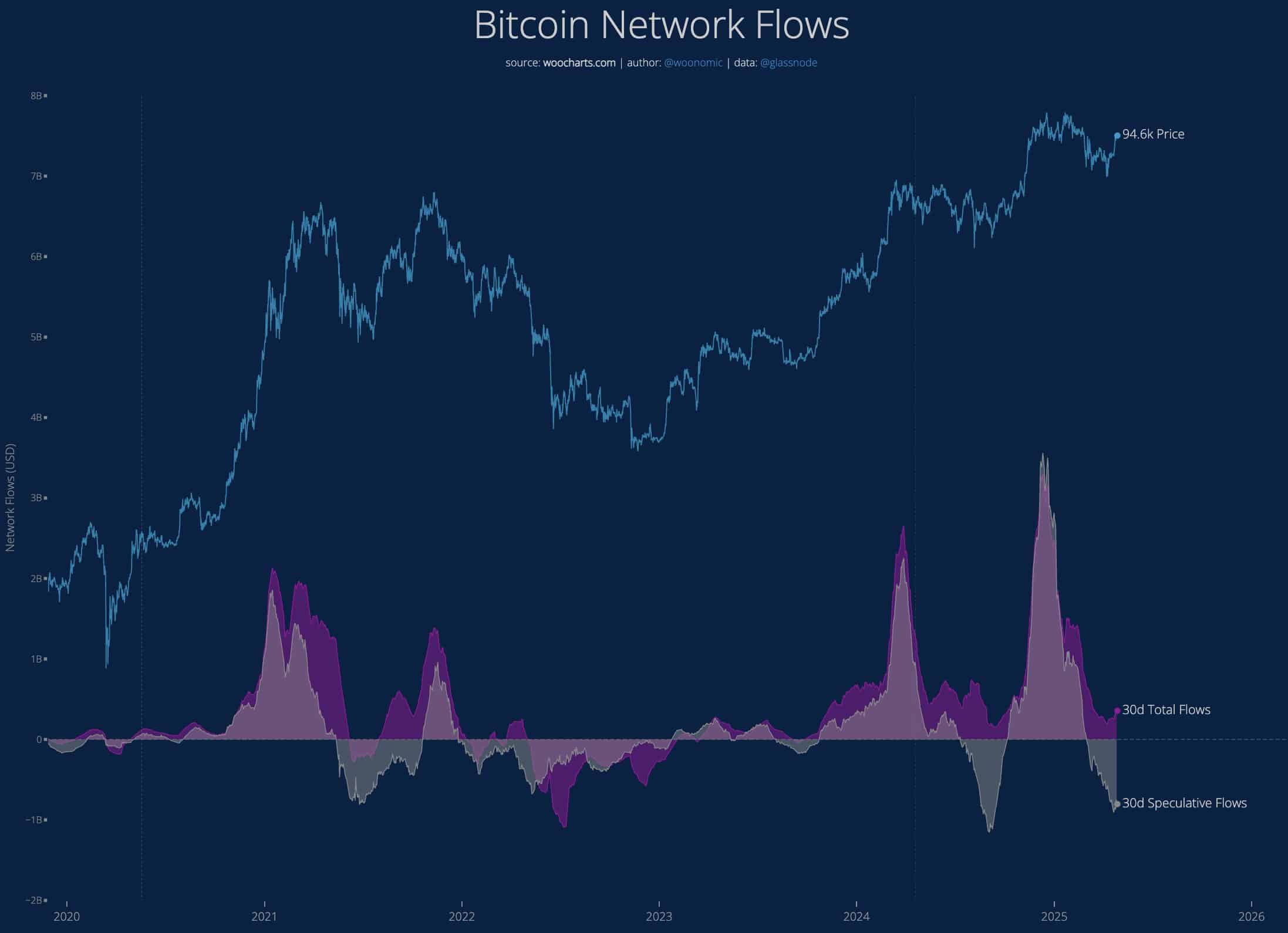

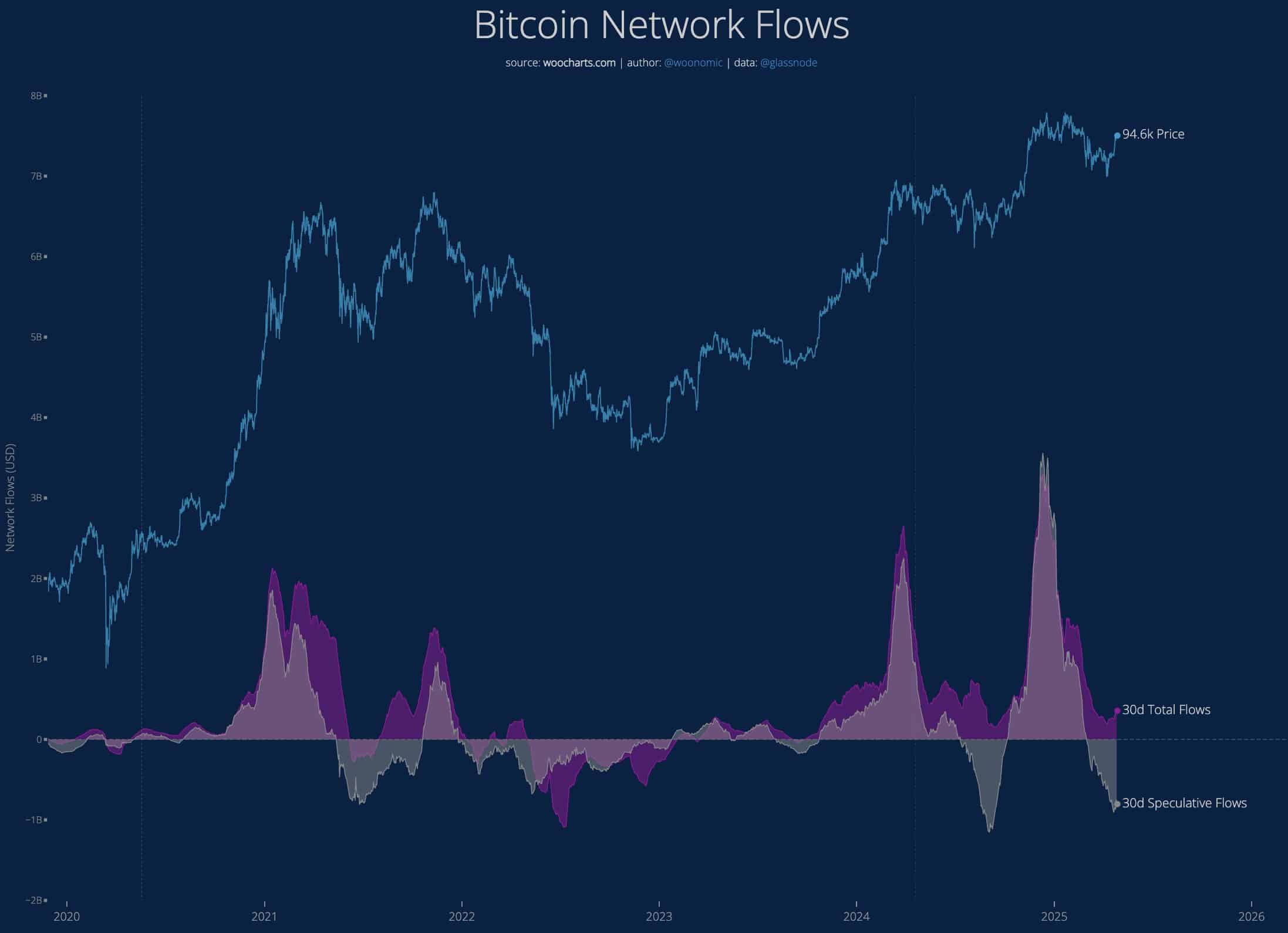

Additionally, as evidenced by the attached chart, both total capital and speculative flows hit their bottoms and are now heading north.

Source: X

According to AMBCrypto, when this flow picks up, it would underline a growing confidence in Bitcoin’s long-term value. On the other hand, speculative flows are typically more driven by traders looking for short-term gains.

When both types of flows bottom out and start heading upwards, it signals a healthy, balanced market ready for sustained growth.

And it gets even better! At press time, overall market sentiment was still in the “greed” phase, but it hadn’t quite hit “extreme greed” yet. This suggested that there’s still plenty of room for Bitcoin to keep climbing, without running into an immediate top.

With such a bullish backdrop, all dips remain prime buying opportunities. Hence, the $108k target will be almost inevitable.