- Bitcoin gained traction as a macro hedge, supported by surging ETF inflows amid broader investor rotation.

- Kansas City Fed LMCI declined for a second month, reinforcing rising recession risks across the U.S. economy.

The American economy may be steering into turbulent waters.

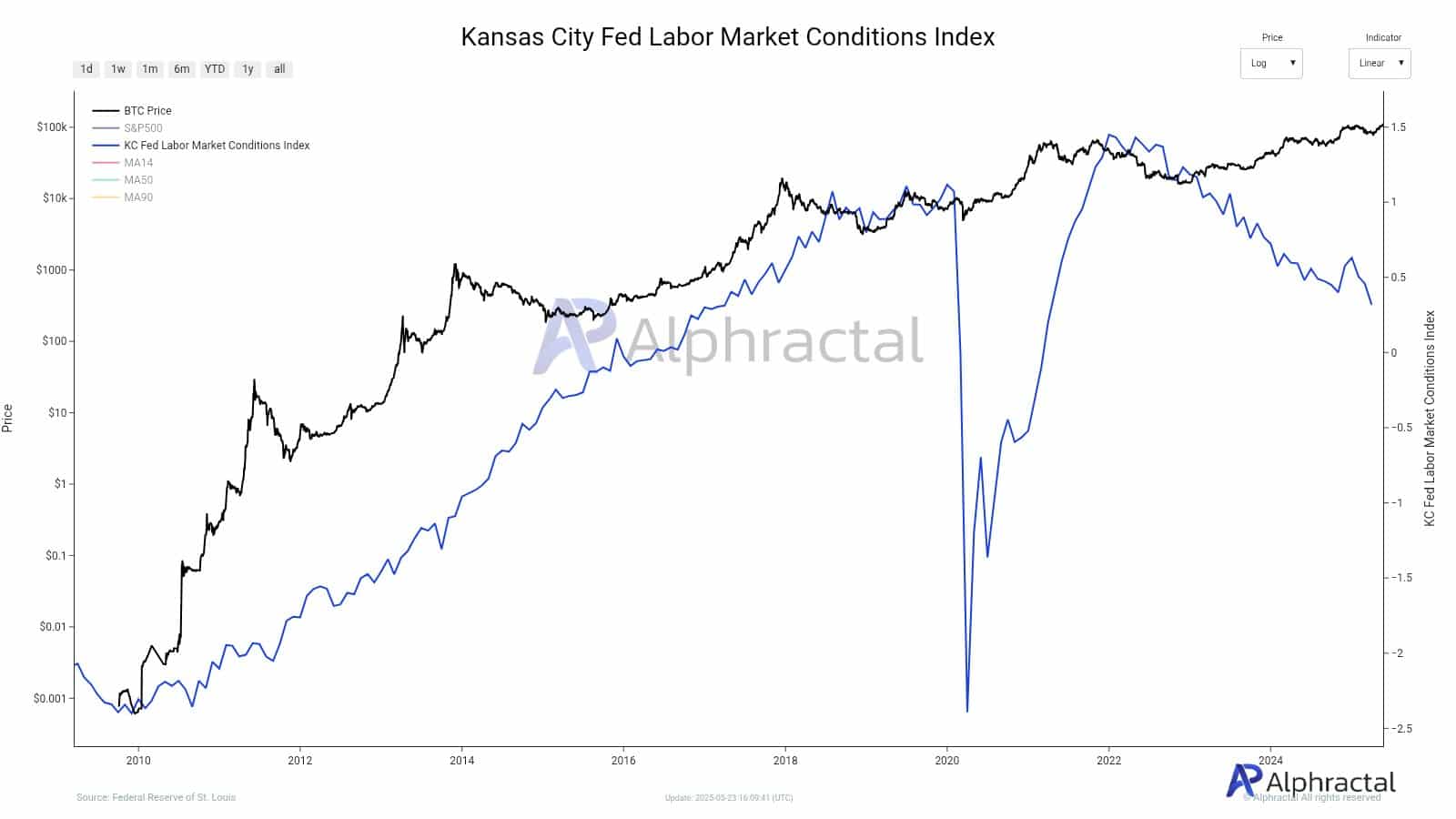

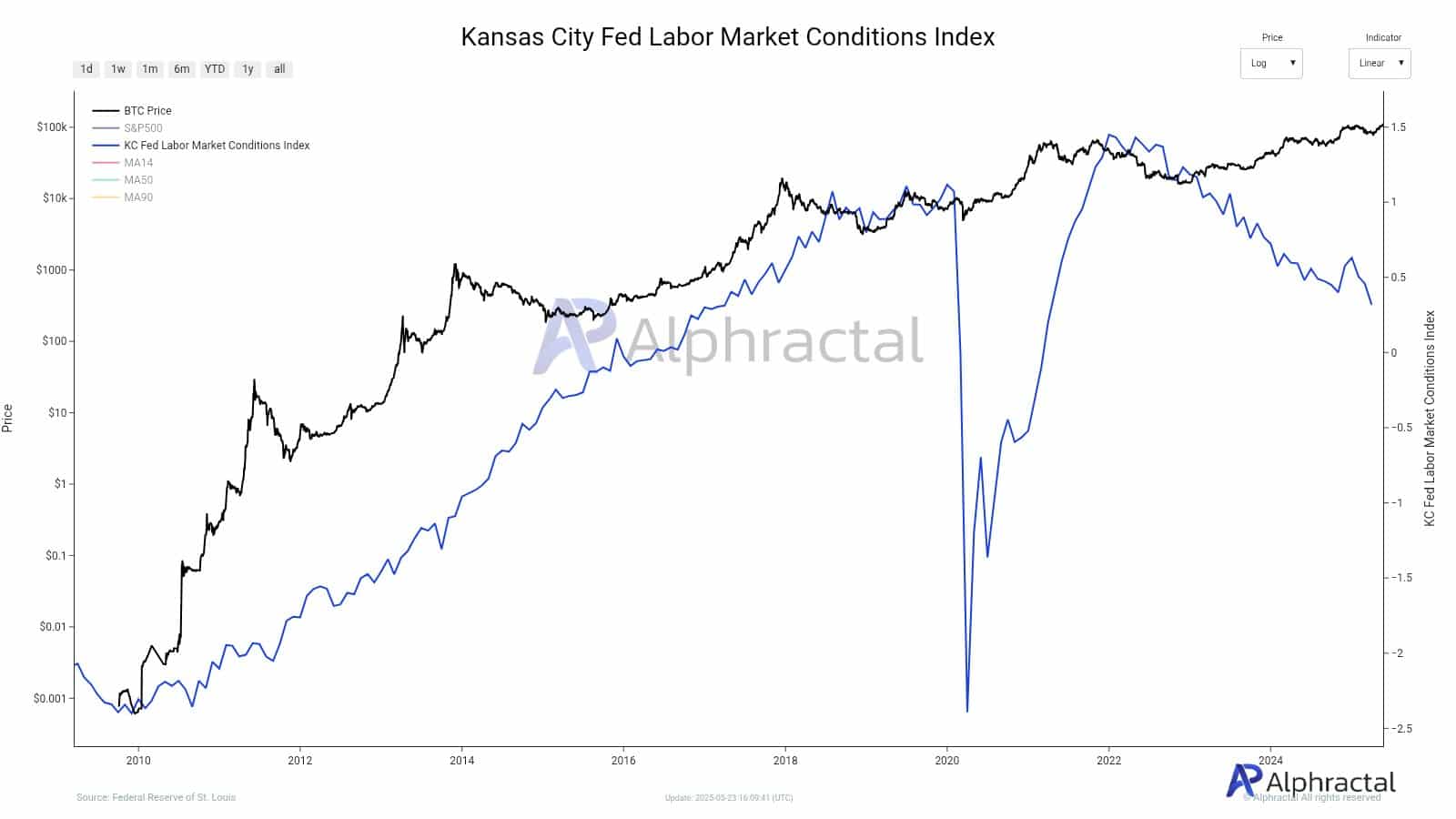

The Kansas City Federal Reserve’s Labor Market Conditions Indicators (LMCI) fell for the second successive month, showing even more weakness in the job market.

The fall is the latest of a series of warning signs that predict the probability of a looming recession.

While the traditional markets start to buckle under the weight, Bitcoin [BTC] may be in the gain. The most recent figures show a boom in BTC ETF inflows, which indicates growing investor demand.

Is the digital coin’s “safe haven” status then the principal driver behind its subsequent bull run? Let’s find out!

Labor market flashing red again

The LMCI is a comprehensive gauge of U.S. labor market momentum and activity.

Falling LMCI typically points to falling job creation, slowing wages, or less aggressive hiring practices. This further decline supports the view that labor conditions are deteriorating more aggressively than expected.

Economists closely monitor the LMCI as it generally moves before overall macroeconomic indicators.

If the indicator is moving down, it could be a sign that the Federal Reserve’s tight interest rate policy is starting to bite deeper into the real economy.

Source: Alphractal

A sign of investors portfolio rotation

In the meantime, Bitcoin appears to be gaining from this volatility.

Recent figures for BTC ETF showed a steep rise in inflows, with institutional money flowing into the asset increasingly.

This is a sign of a noticeable change in investor sentiment, from traditional equities to digital assets like Bitcoin.

More than just a short-term hedge, Bitcoin’s positioning as “digital gold” is getting renewed validation.

During times of economic crisis, investors seek refuge in securities that are scarce in supply, liquid and decentralized.

BTC fits here and has increasingly found use as a vehicle for diversification during times of macroeconomic stress.

Source: BitBO

Recession narrative fuels Bitcoin’s demand story

Of course, if labor metrics continue to slump and macro risk grows, investor appetite for Bitcoin could accelerate.

We’ve seen this playbook before—shrinking job markets often lead to speculation about Fed rate cuts.

If that chatter grows louder, risk assets like BTC may catch a fresh bid, especially as capital rotates out of equities and into non-correlated digital assets.

With inflows into BTC ETFs picking up speed, the market may be witnessing the initial stages of a more global risk rebalancing.