- Bitcoin moved past $108,000 fueled by bullish whale and institutional activity before crashing.

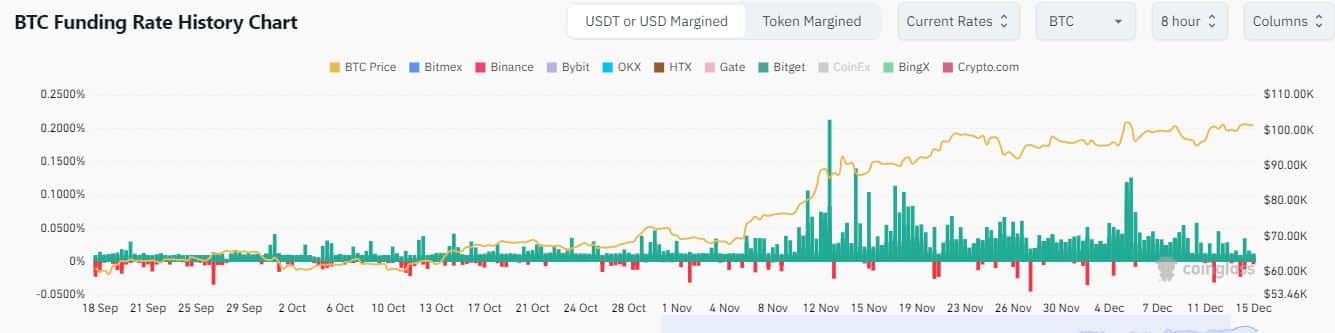

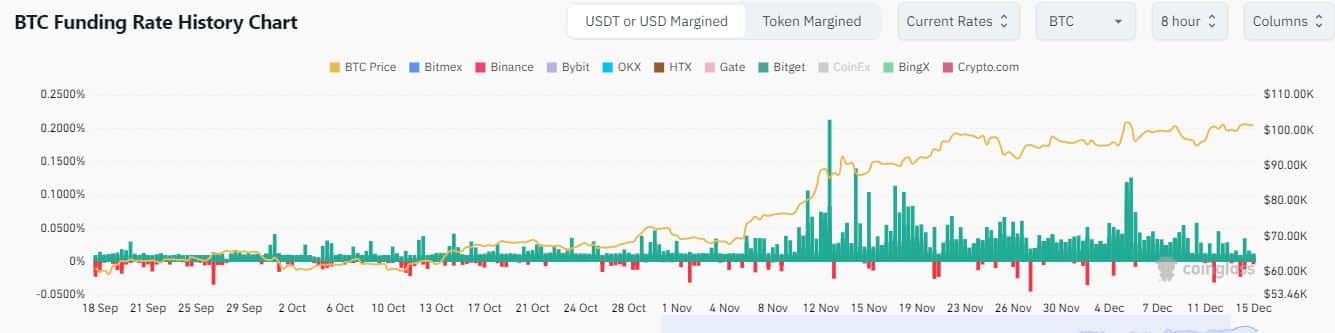

- Funding rates maintain relatively low activity indicating spot dominance.

Bitcoin [BTC] maintained a bullish stance earlier this week judging by its pursuit of price discovery. The cryptocurrency clocked a new all-time high above $108,000 on Wednesday, the 18th of December, and this fresh upside was largely aided by whale activity.

Bitcoin bullish performance earlier in the week raised hopes of potentially soaring to $110,000 before the end of the week if it sustained the momentum. The king of the cryptos attained a new historic peak at $108,364 on Wednesday, proving yet again that the bulls were still in control.

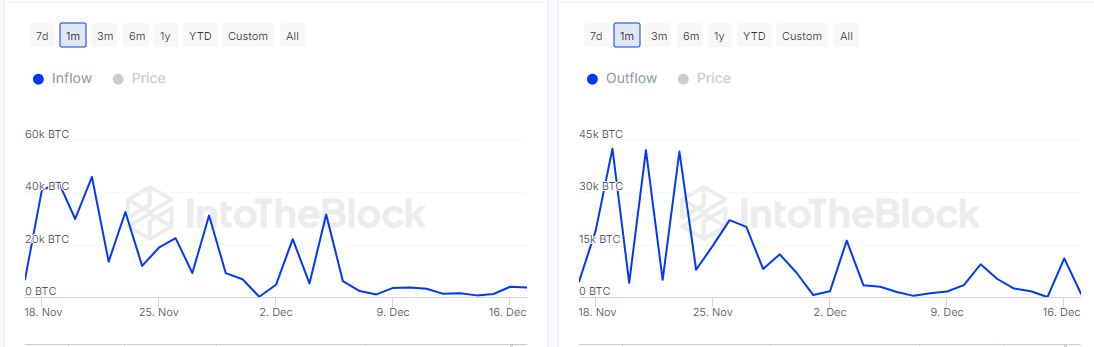

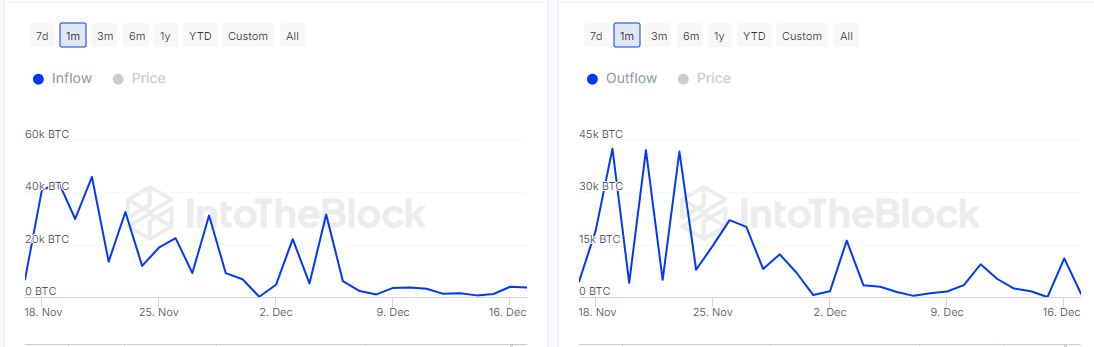

On-chain data confirmed healthy whale activity as large holder inflows grew from 619.43 BTC on 14th December to 3,620 BTC as of 17th December. Meanwhile, large holder outflows dipped from 11,060 coins on 16th December to 917 BTC the next day.

Source: IntoTheBlock

The large holder flows therefore demonstrated a surge in demand at around the same time that sell pressure from whale subsided considerably.

As a consequence, the wave of demand pushed higher. However, there was a notable dip in large holder inflows by roughly half to 1843 BTC as of Wednesday. This was still higher than 473 BTC outflows.

To top things up, Bitcoin also achieved overall positive flows from ETFS. The latest BTC ETFs data revealed that ETF inflows peaked at 275.3 million BTC on Wednesday.

Are Bitcoin bears taking over?

Despite these observations, there were notable outflows from some of the ETFs including Grayscale and Ark Invest. Despite the robust bullish performance, a sizable pullback followed swiftly, ending the day closer to $101,000. This could indicate potential for some profit-taking or more short term outflows ahead.

The pullback was mainly due to the market’s knee-jerk reaction to Fed chair Jerome Powell statement. Powell remarked that the FED was not allowed to own Bitcoin.

Bitcoin spot market flows data revealed that outflows were dominant in the last three days. This was particularly the case on Wednesday during which net outflows spiked to $824.78 million.

source: Coinglass

Why are these observations essential? Well, based on the observations so far, whales and institutions have been driving this week’s rally. An indication that they anticipated higher prices. Meanwhile, retail appeared to be folding under the pressure as price pushed into new territory.

Bitcoin funding rates data reveled relatively subdued activity compared to the first half of December or November. A sign that derivatives traders were moving cautiously this week to avoid liquidations.

Read Bitcoin’s [BTC] Price Prediction 2024-25

In other words, spot demand has arguably been more dominant this week and liquidations were relatively low.

source: Coinglass

Low funding rates could signal lower volatility and potentially low friction in Bitcoin’s bullish attempts. However, traders should be cautious especially now that multiple ETFs have demonstrated outflows.