- Bitcoin has dropped 5.6% from its $99,645 all-time high, with retail traders yet to join the rally.

- Exchange inflows and Open Interest revealed insights into market sentiment.

After an impressive rally that pushed Bitcoin [BTC] to an all-time high of $99,645 last week, the asset has now entered a correction phase.

This marks a 5.6% drop from its peak, with Bitcoin trading at $93,602 at press time, a 4.3% decline in the past 24 hours.

The correction comes as Bitcoin inches closer to the psychologically significant six-digit price level of $100,000. Despite the pullback, market analysts continue to analyze key metrics for signs of what lies ahead.

Retail trader current trend

A CryptoQuant analyst, Woominkyu, has highlighted a key observation — retail traders have yet to play a significant role in Bitcoin’s price movement.

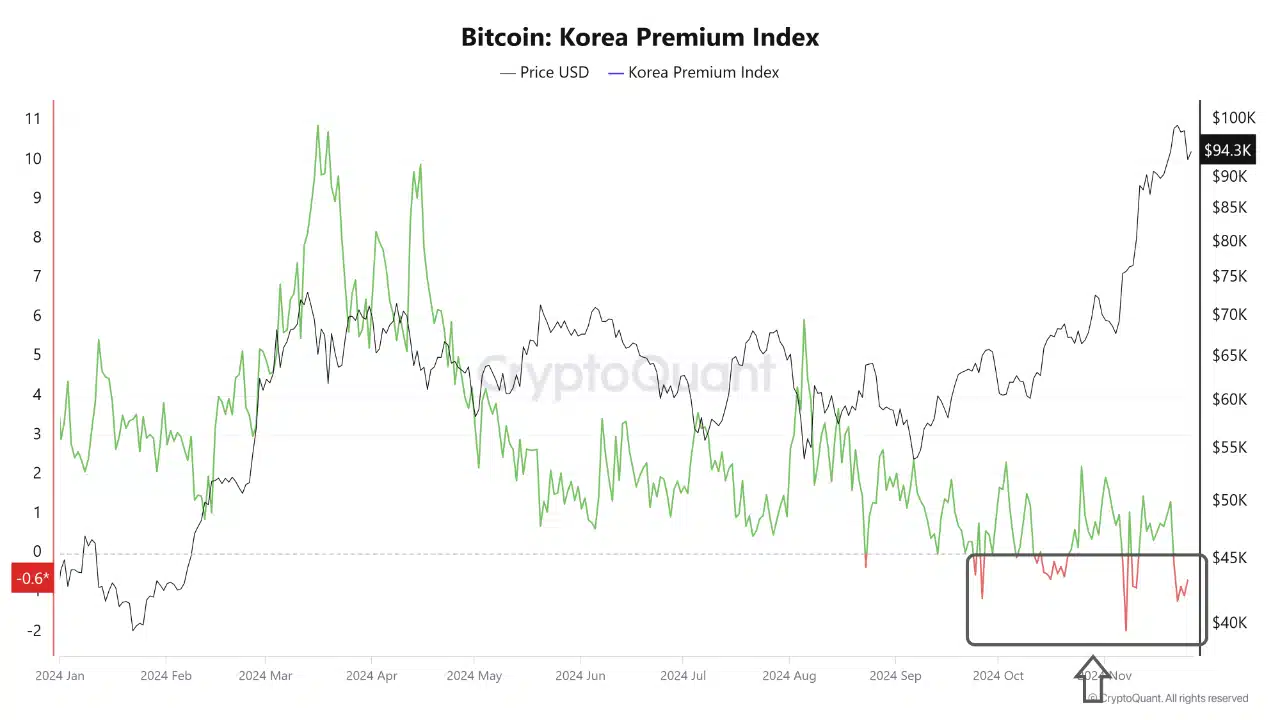

According to the analyst, the Korea Premium Index, which reflects retail participation, remained below -0.5 at the time of writing. Thus, retail activity has not been a major driver of the recent price surge.

Source: CryptoQuant

Historically, the Korea Premium Index has often shown significant spikes before Bitcoin reaches a price peak. Woominkyu emphasized the importance of monitoring this indicator closely to identify potential price tops.

The subdued retail involvement suggests that Bitcoin’s current rally is largely being driven by institutional participation or other factors, leaving room for additional momentum once retail traders reenter the market.

Exchange Outflows, Open Interest offer insights

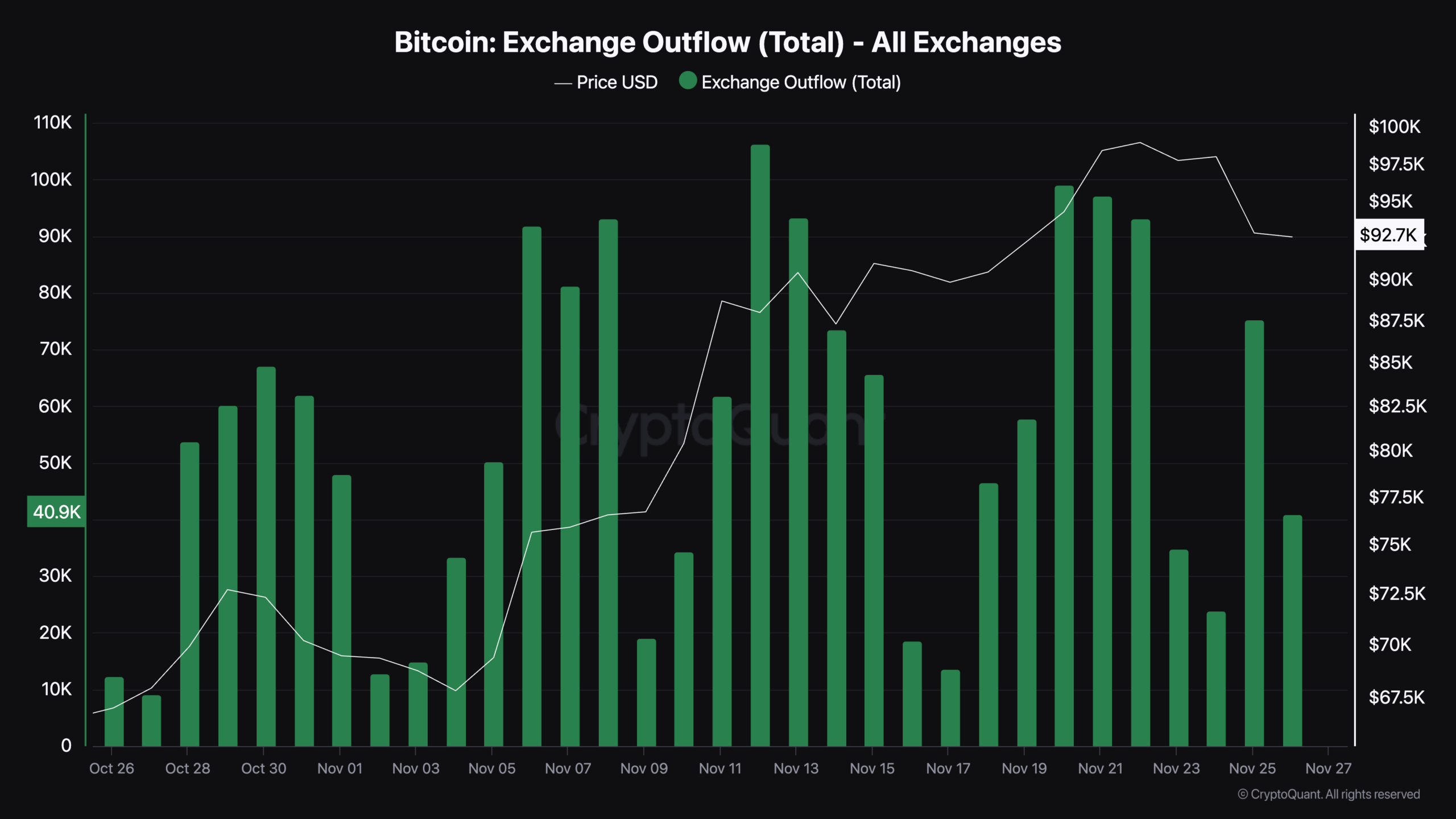

Beyond retail activity, examining Bitcoin’s exchange outflows and Open Interest provides a deeper understanding of market dynamics. Data from CryptoQuant shows a notable trend in exchange outflows.

Source: CryptoQuant

Recently, the metric recorded a significant spike, with more than 75,000 BTC outflowing from exchanges on the 25th of November.

Although this figure has since declined to around 31,000 BTC at press time, the number was still noteworthy, especially considering the day is just starting.

This trend of Bitcoin moving off exchanges indicates that investors may be opting for self-custody, signaling long-term holding intentions rather than short-term selling pressure.

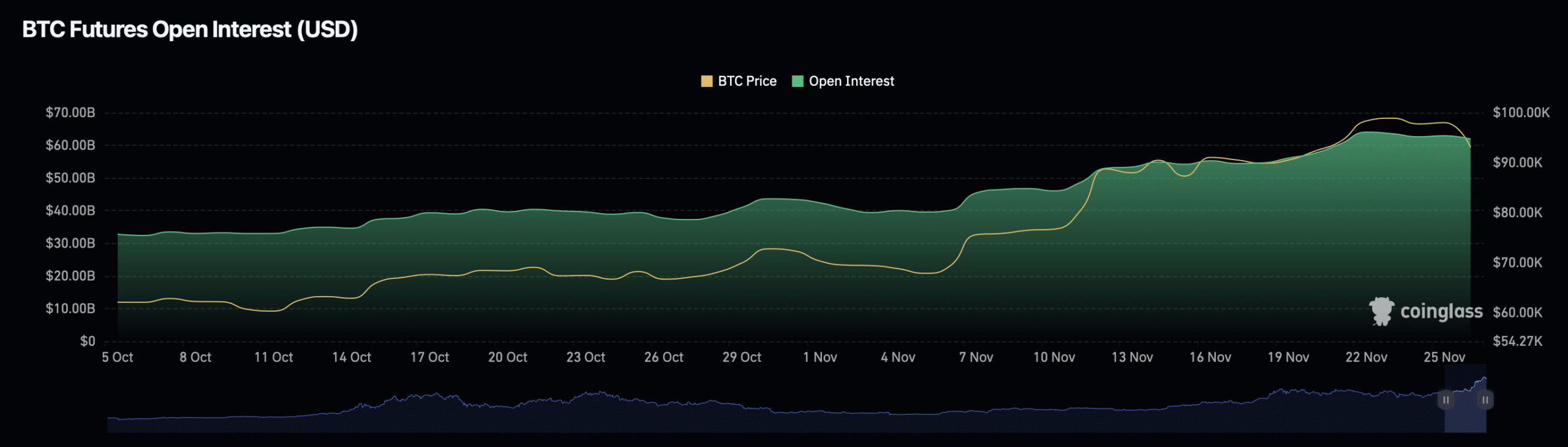

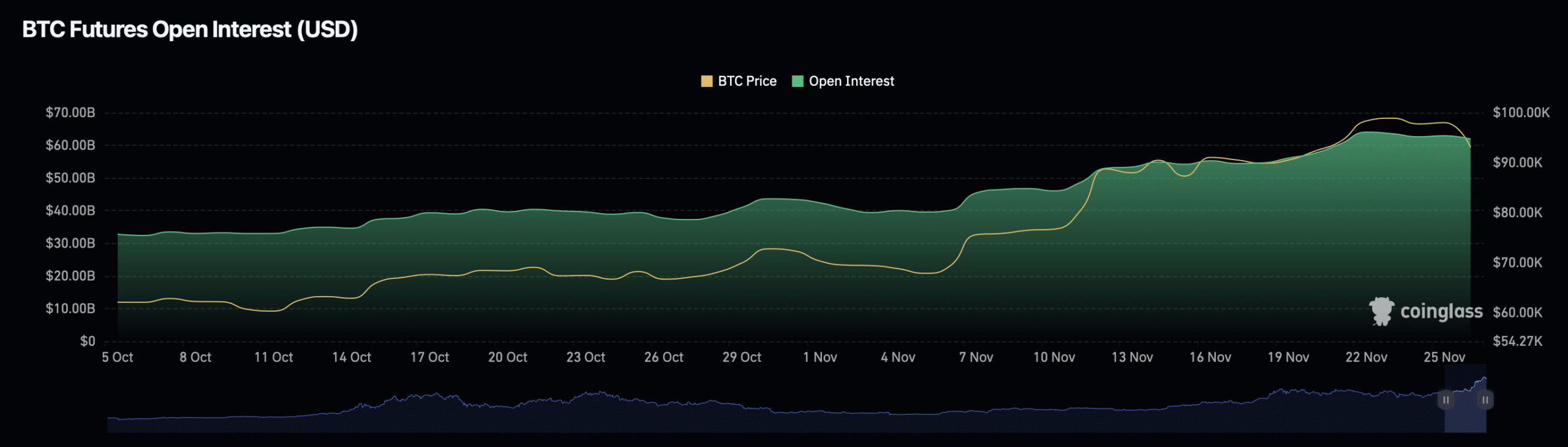

On the other hand, Bitcoin’s open interest metrics paint a mixed picture.

According to Coinglass, Bitcoin’s Open Interest value has decreased by 4.55% to $60.37 billion, signaling a potential cooling in leveraged positions.

However, the Open Interest surged by an impressive 62.58%, reaching $132.86 billion.

Source: Coinglass

This disparity indicates that while the total value of contracts has declined, there is an increase in the number of active positions in the market.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

This rise in volume could suggest heightened market activity, with traders opening positions in anticipation of further price movements.

However, the decline in the overall value of these positions might imply caution among larger investors.