- Stablecoin reserves on derivatives exchanges have surged.

- Until stablecoin volume flows back into spot trading, volatility is expected to persist.

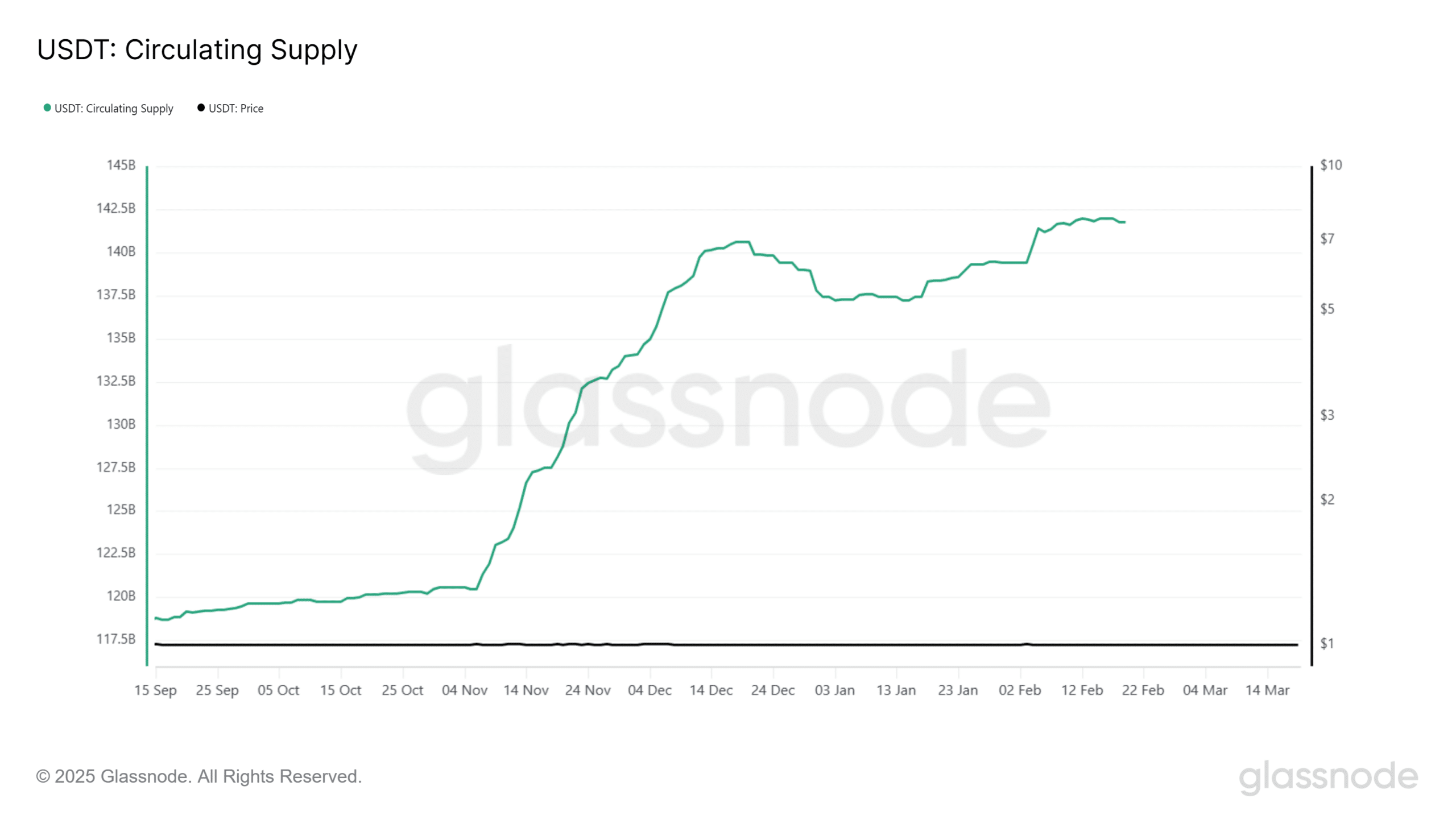

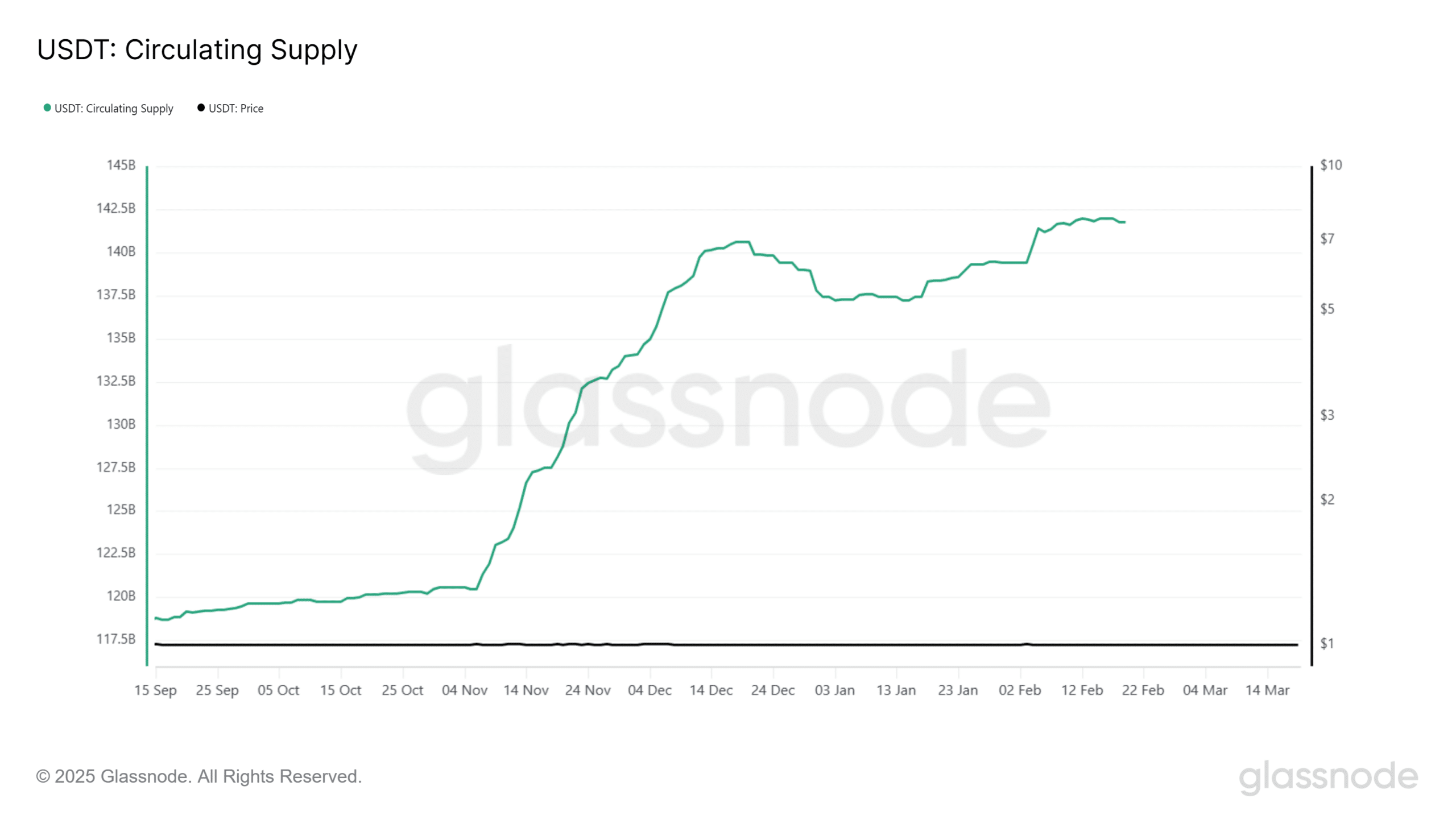

Since November, there has been a significant increase in the supply of stablecoins, coinciding with Bitcoin’s [BTC] bullish rally.

However, this liquidity has predominantly flowed into derivatives markets rather than spot markets.

This report analyzes the implications of this trend. Is the market overleveraged, and could excessive high-leverage trading put Bitcoin’s short-term price action at risk?

Leveraged bets lead the way in stablecoin use

A growing stablecoin supply typically indicates increased buying power. However, its diversion into derivatives suggests traders are favoring leveraged positions over direct BTC accumulation.

Since November, traders have added around $20 billion in Tether (USDT) to circulation, coinciding with Bitcoin’s climb to its all-time high of $109k.

Source: CryptoQuant

While this surge pointed to heightened USDT liquidity in the market, particularly in BTC buying pressure, data from CryptoQuant revealed much of this liquidity was funneled into high-risk leveraged trading.

As the derivatives market saw a spike in buy orders, Open Interest (OI) soared to an all-time high of $70 billion on the 22nd of January.

Currently, it stands at $52 billion. The closure of these positions has exerted intense downward pressure on BTC’s price, making it challenging for Bitcoin to reclaim the $90k mark.

Weak spot demand puts Bitcoin’s future at risk

The USDT movement on election day shows this shift clearly. On the 6th of November, net outflow of stablecoins from spot exchanges signaled heightened buying activity – typically a bearish indicator.

However, the derivatives market saw an explosive inflow of 1.2 billion in USDT, pointing to a rise in leveraged trading.

While such liquidity influxes in derivatives can indicate bullish sentiment in a strong market, they introduce significant risk in a volatile environment.

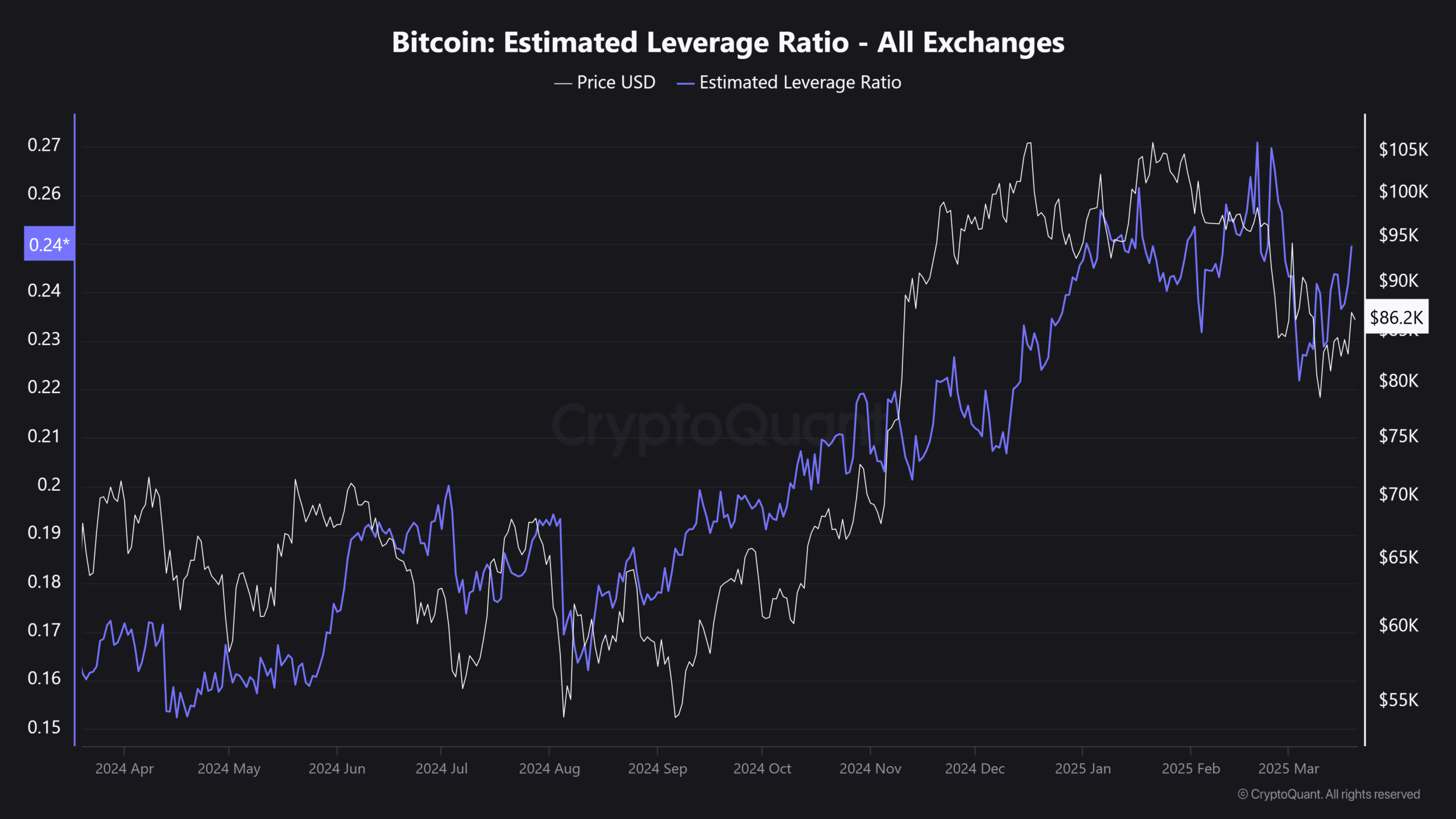

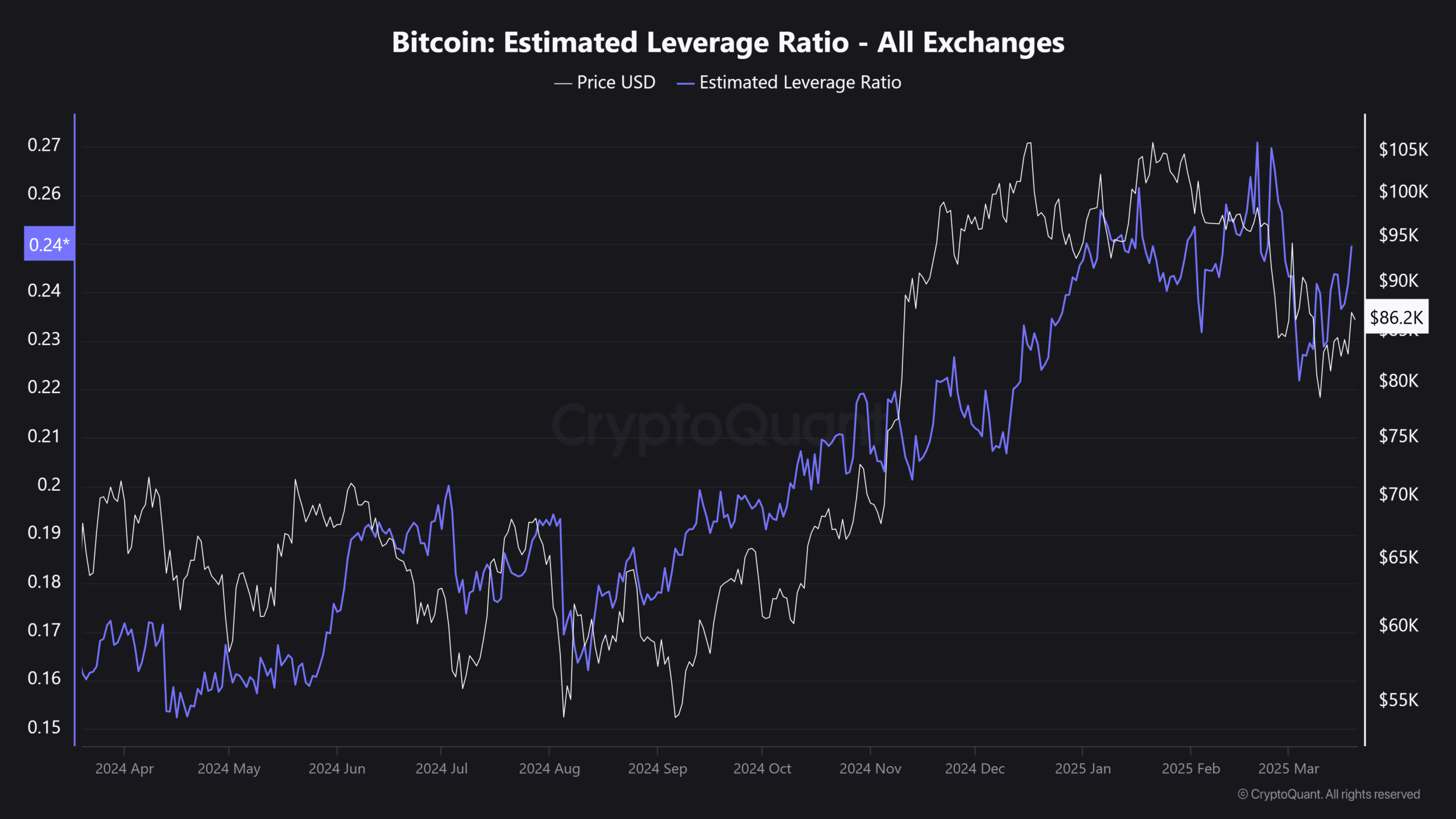

Following the FOMC meeting, which sparked slight optimism for potential rate cuts, Bitcoin’s Estimated Leverage Ratio (ELR) saw a dramatic increase.

Source: CryptoQuant

As expectations for lower borrowing costs grew, traders flocked to high-leverage positions. This trend is one to watch closely as Q2 progresses.

Given the weak accumulation in the spot market, these leveraged positions face a higher likelihood of liquidation.