- Altcoins face a -$36B volume gap as Bitcoin dominance climbs past 64%, stifling rotation hopes.

- Despite BTC’s rally, risk appetite for altcoins remains weak, delaying the next altseason cycle.

Bitcoin’s [BTC] surge and consolidation past the historic $100K level has brought about bullish sentiment. Yet, beyond BTC, the broader altcoin landscape remains alarmingly stagnant.

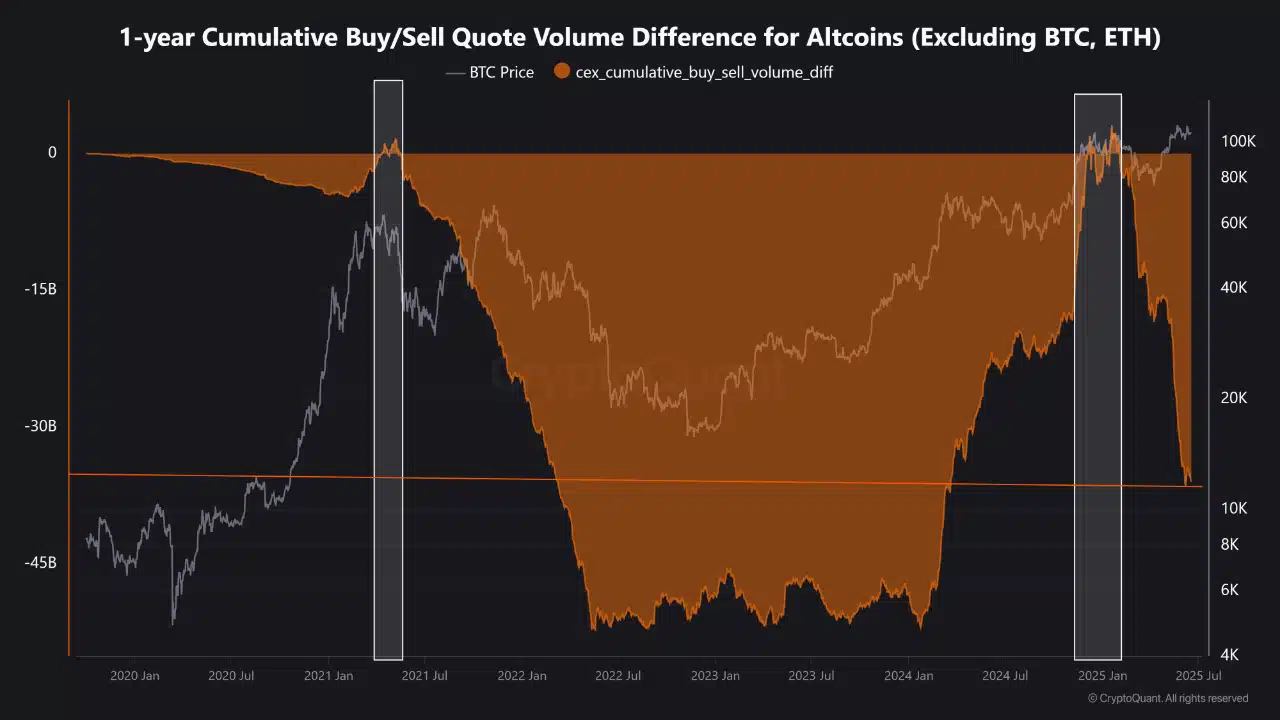

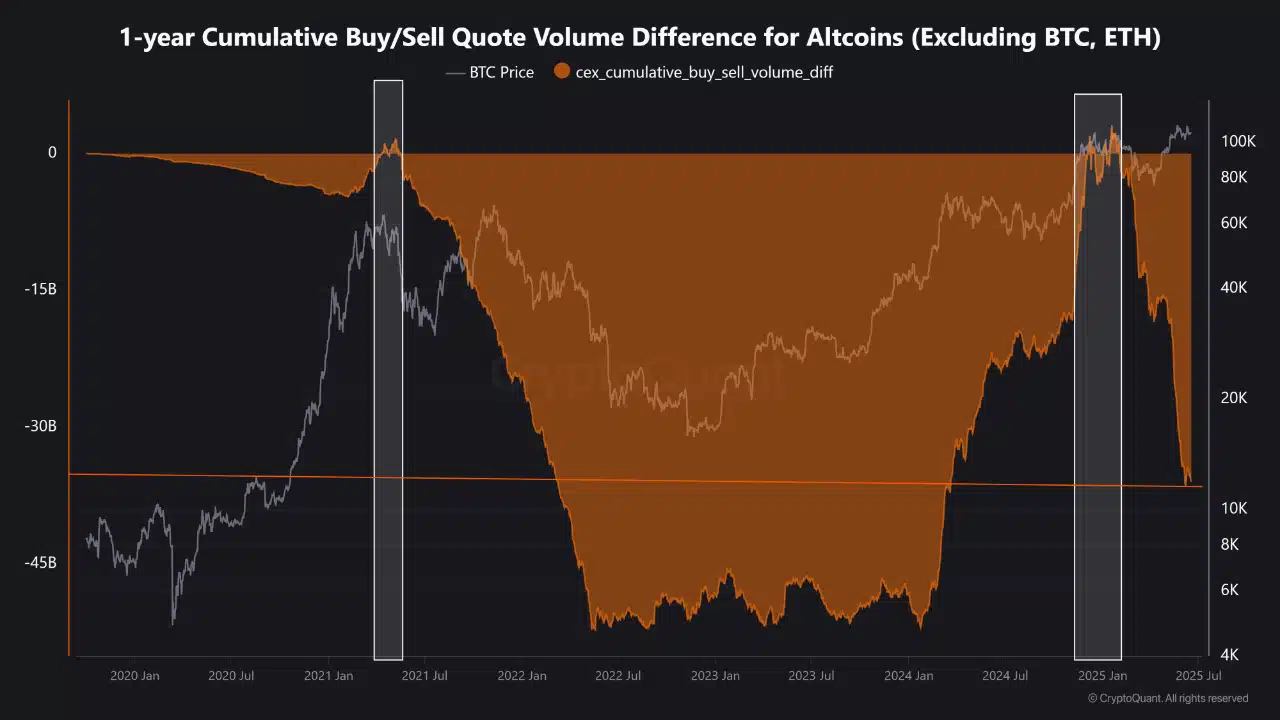

New data reveals a brutal -$36 billion cumulative buy/sell volume gap for altcoins (excluding BTC and ETH) over the past year; a clear sign that liquidity is still bleeding from the sector.

Despite the BTC dominance reaching high levels, altcoin inflows remain conspicuously absent. This casts doubt on whether the long-awaited “altseason” will arrive at all.

Altcoin lag as buy/sell gap deepens

The 1-year cumulative buy/sell quote volume difference for altcoins has plunged to -$36B, its lowest point since 2022. This trend shows a glaring lack of investor conviction in the altcoin space.

Source: CryptoQuant

While Bitcoin has notched new all-time highs, altcoins remain in a net-sell zone, suggesting that most market participants are still risk-off when it comes to anything beyond BTC and ETH.

Positive flips in this metric have coincided with short-lived alt rallies. But as of June 2025, the sustained bleed implies that even in bullish macro conditions, altcoins haven’t shaken off their bear-market inactivity.

BTC.D breaks out, alts get left behind

Bitcoin’s market cap dominance has surged to nearly 65%, climbing over 1% since mid-June and reinforcing its grip on capital flows.

Source: Trading View

The data showed a sharp, near-parabolic rise in BTC dominance, driven by Bitcoin ETFs, institutional inflows, and macro hedge demand.

This surge often sidelines altcoins, as capital concentrates in Bitcoin as the crypto “safe haven.”

David Hernandez, crypto investment specialist at 21Shares, told AMBCrypto,

“Bitcoin has firmly cemented itself above $100,000, and its resilience amid geopolitical shocks demonstrates its widespread adoption and developing investment case.”

He went on to add,

“As confidence in a perfectly engineered ‘soft landing’ wanes, and as global financial currents diverge, Bitcoin’s fundamental properties – its scarcity, decentralization, and neutrality – make it an increasingly relevant and compelling asset for investors navigating an uncertain future.”

Historically, rising BTC.D signals weakness for altcoins, and unless it reverses, even strong alt projects may stay suppressed and out of favor.

What will it take for altseason to arrive?

For altcoins to regain dominance, several conditions need to align.

This includes a stall or consolidation in Bitcoin’s rally, renewed risk appetite across retail investors, and a reversal in the 1-year buy/sell volume differential. This would suggest capital rotation is underway.

Altseason typically follows BTC cooling off after a major run. This leads to speculative capital seeking higher returns in smaller caps. But right now, there’s no indication of that shift.

Until alt liquidity improves and BTC.D retreats, hopes for an altcoin supercycle may remain on hold.