- Bitcoin’s price has appreciated by 3.34% over the last 24 hours

- CPI fueled $500 million stablecoins inflows on Binance

Bitcoin [BTC] has seen a strong upswing on its charts lately, one that has pushed it past $100k. In fact, at the time of writing, Bitcoin was trading at $102,048 following a hike of over 7% over the week.

Needless to say, this price pump has left the crypto community talking about what’s behind it. One analyst believes that the latest CPI report may have been the driving force behind the crypto’s market recovery.

CPI data boost propels Bitcoin past $100k

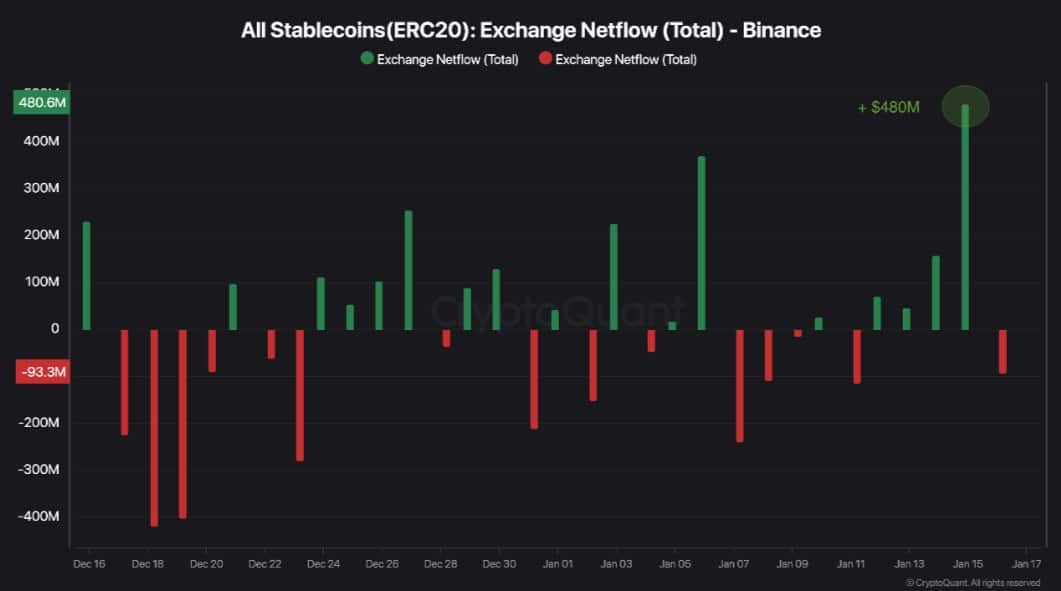

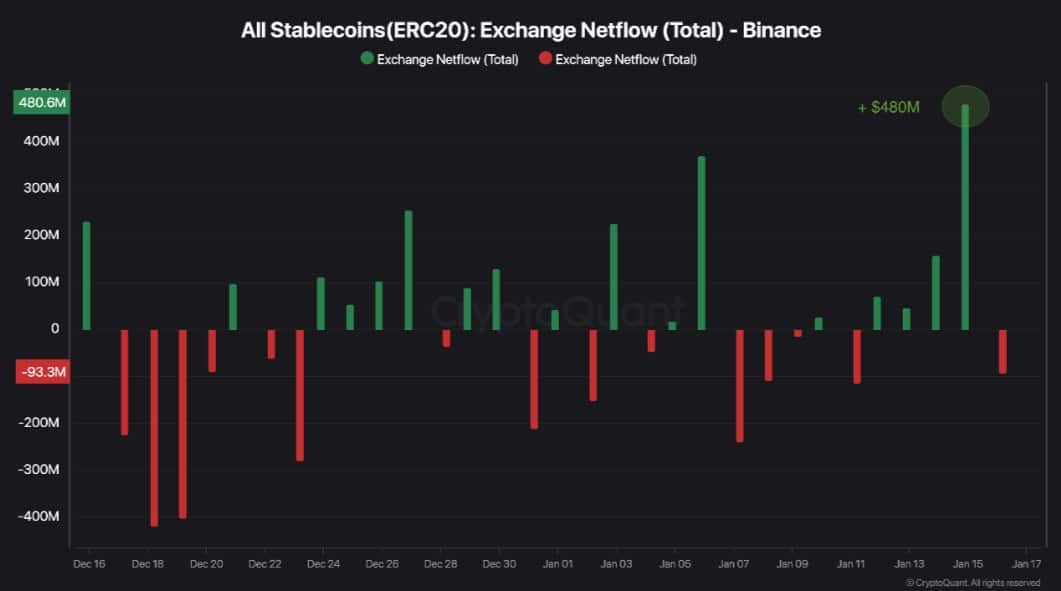

According to CryptoQuant analyst Fost, the CPI boost has fueled stablecoin inflow worth $500 million on Binance. This cash inflow has turned into good news for Bitcoin, pushing it past the psychological level of $100,000.

Source: CryptoQuant

After the release of CPI inflation data which went better than expected, market sentiment has shifted significantly to positive. This sentiment was reflected through stablecoin inflows on Binance.

This surge in inflows is because investors interpreted the news as being a positive signal that the prevailing market trend for BTC is likely to continue.

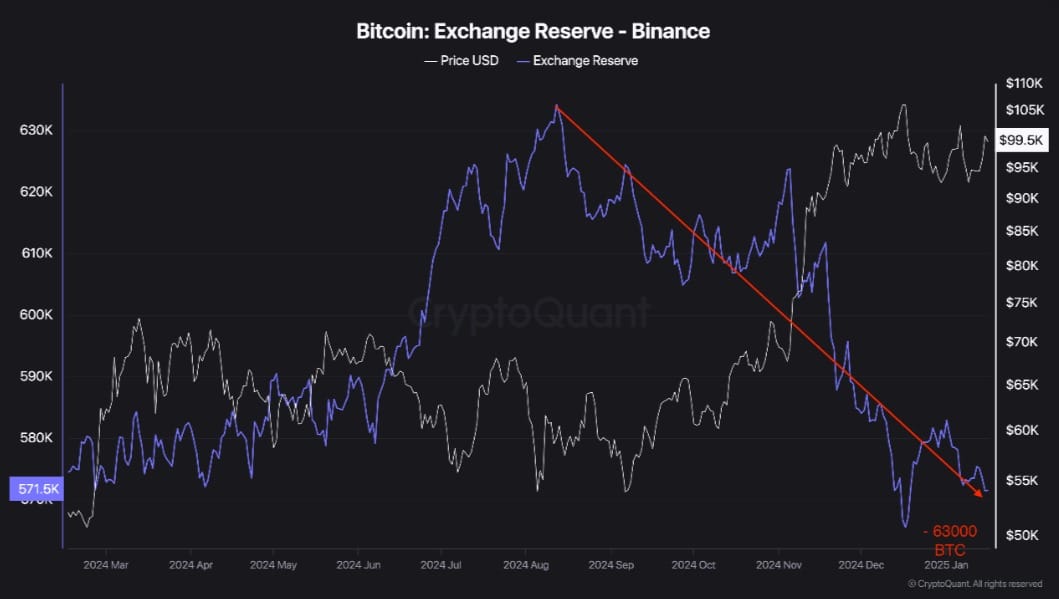

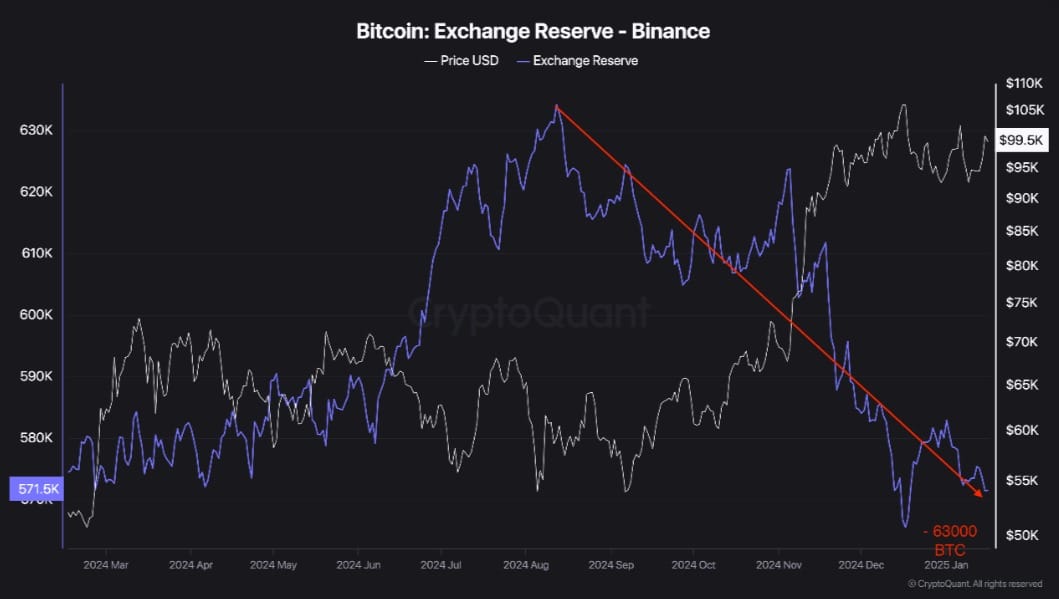

Source: CryptoQuant

Additionally, the capital inflows on Binance were mostly used to acquire Bitcoin, pushing its price back above the critical $100k threshold. This resulted in a strong decline in Bitcoin’s reserve on Binance.

Since 12 August, more than 63,000 Bitcoins have left Binance’s reserves. This is a sign that investors remain highly confident in Bitcoin’s current trend and are likely positioning themselves for the long term.

Can it sustain these gains?

With inflation data reinforcing market optimism, Bitcoin could see more gains soon. Especially as the U.S market expects the inauguration of a pro-crypto President.

Owing to the same, the prevailing market conditions could set Bitcoin up for more gains on the price charts.

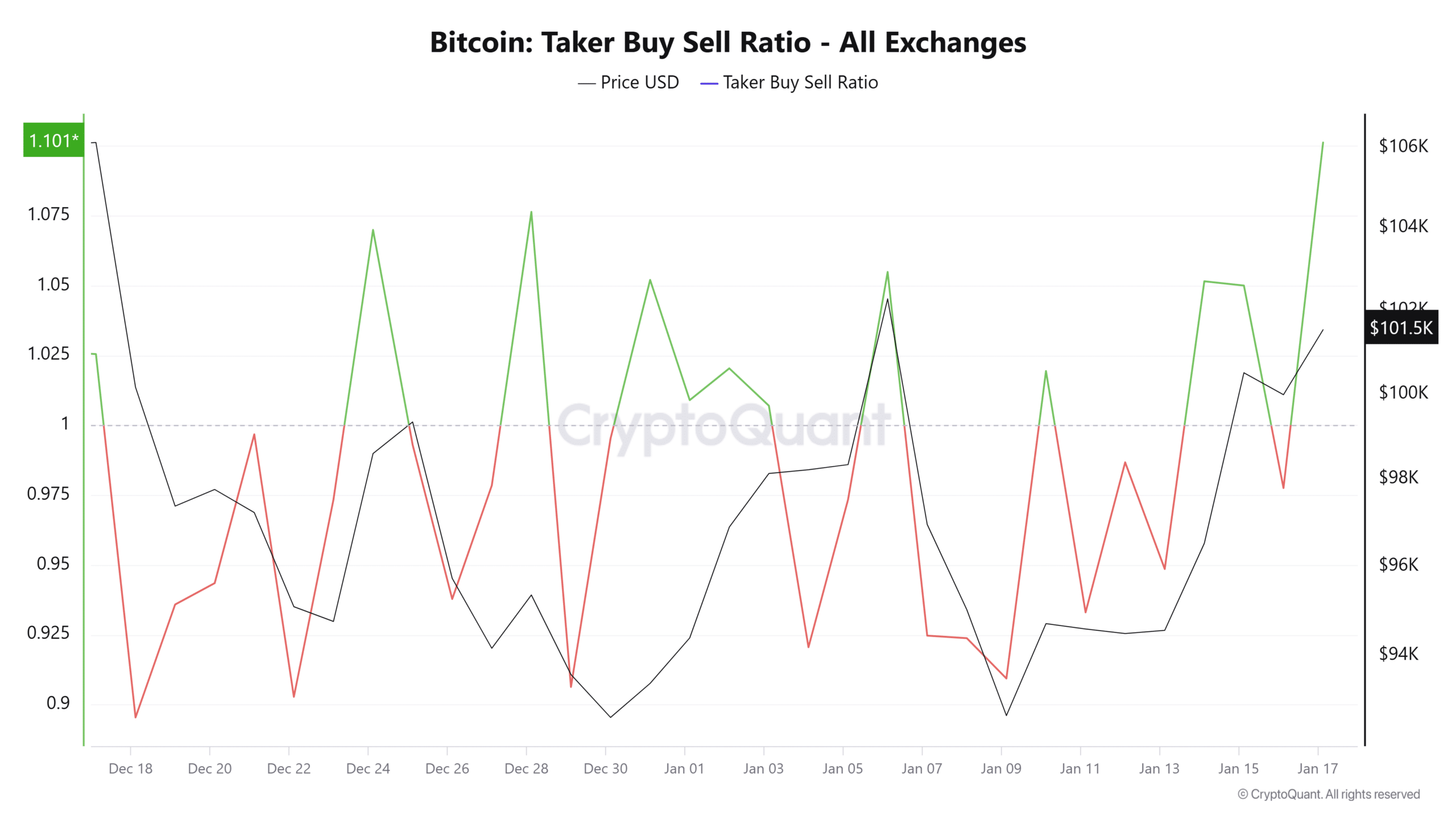

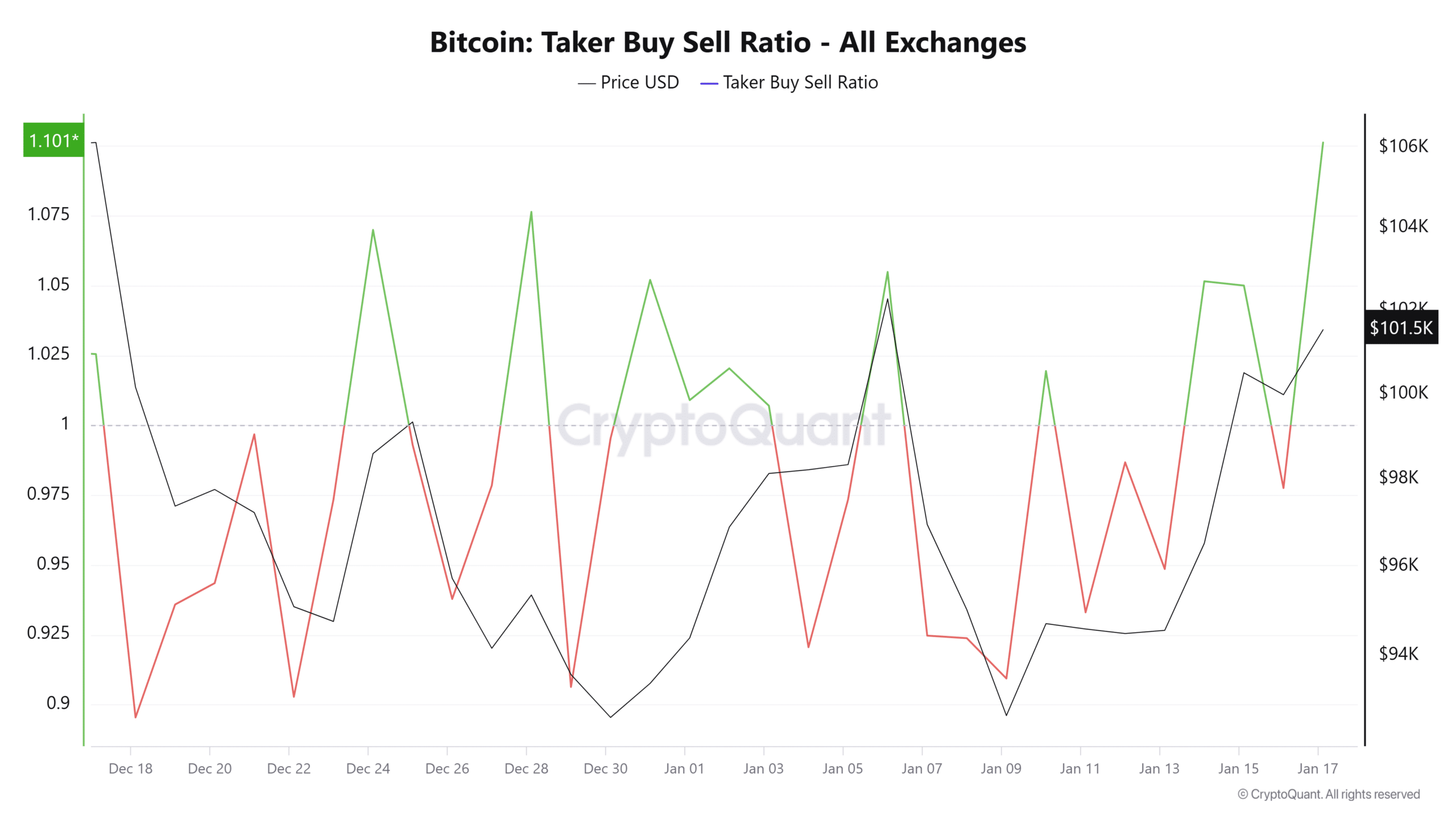

Source: Cryptoquant

For starters, Bitcoin’s Taker Buy Sell Ratio has surged over the past 3 days to settle at 1.116 at press time.

When the Buy sell ratio is above 1, it means that buyers are dominating the market. By extension, what this means is that the recent price gains have been driven by high demand.

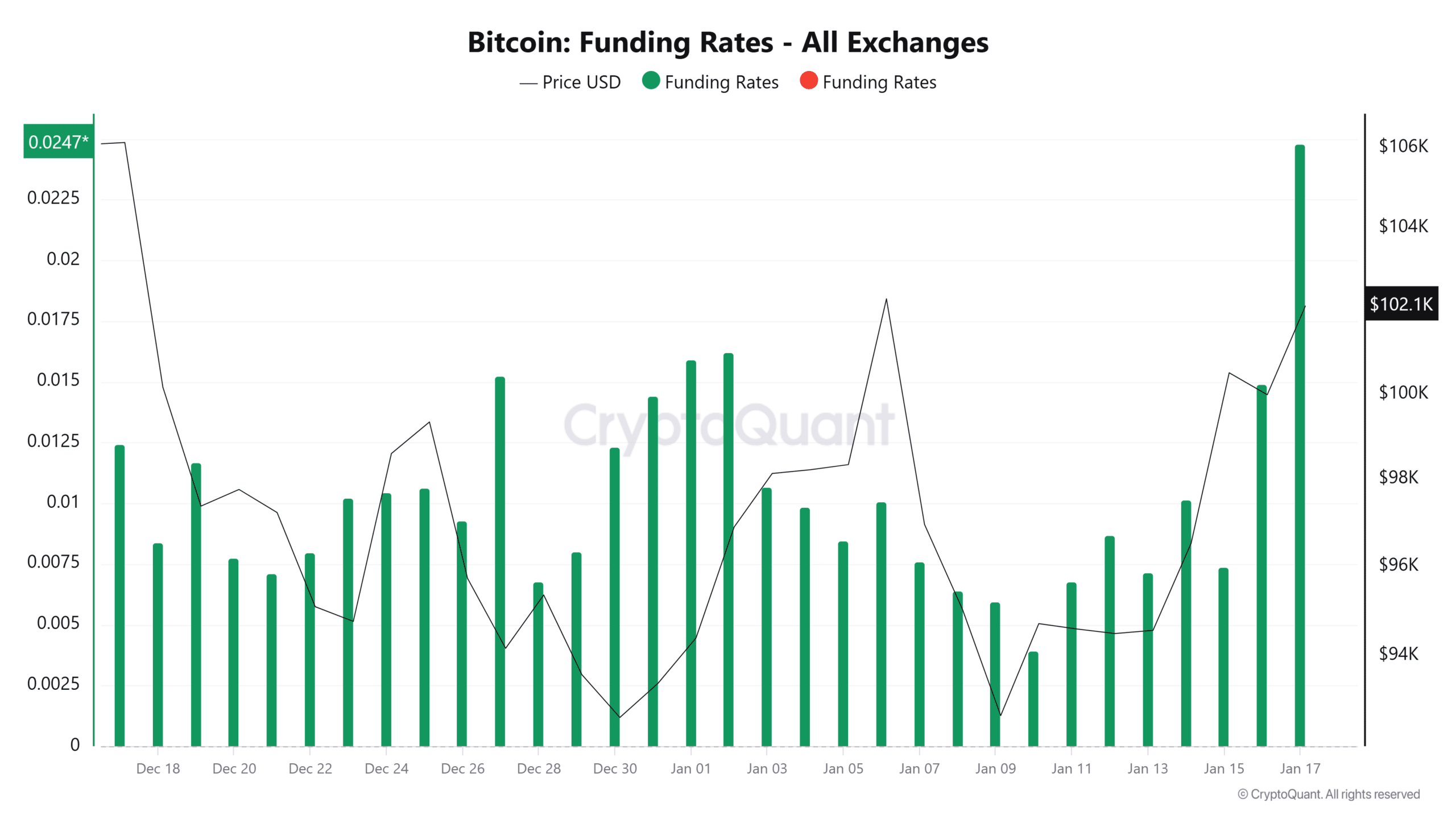

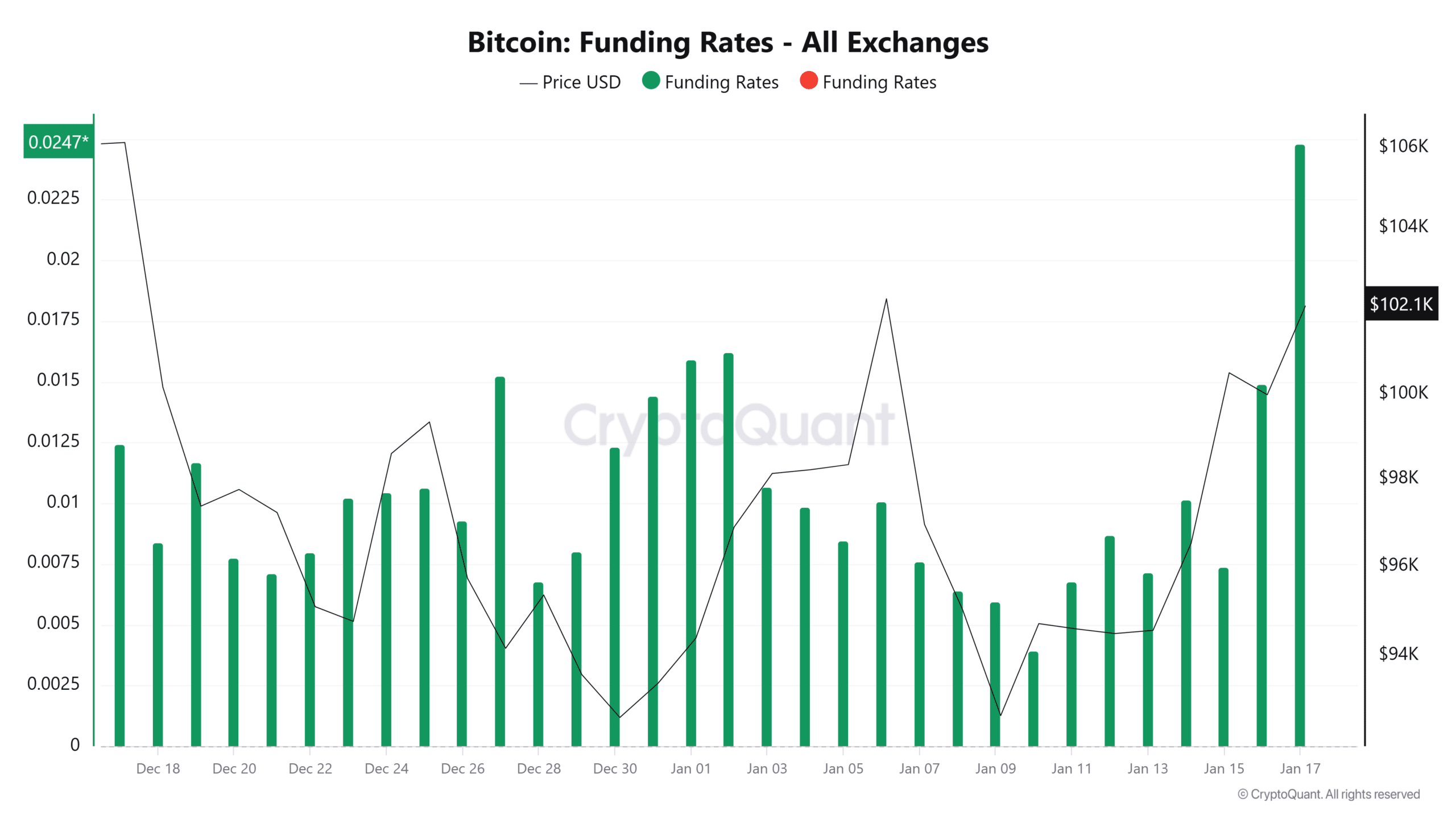

Source: Cryptoquant

Additionally, we can see that buyers are mostly taking long positions, as evidenced by a rising funding rate.

BTC’s funding rate spiked over the last 24 hours to hit a monthly high of 0.0247. When the funding rate rises, it implies that investors are bullish and expect the price to rise even further on the charts.

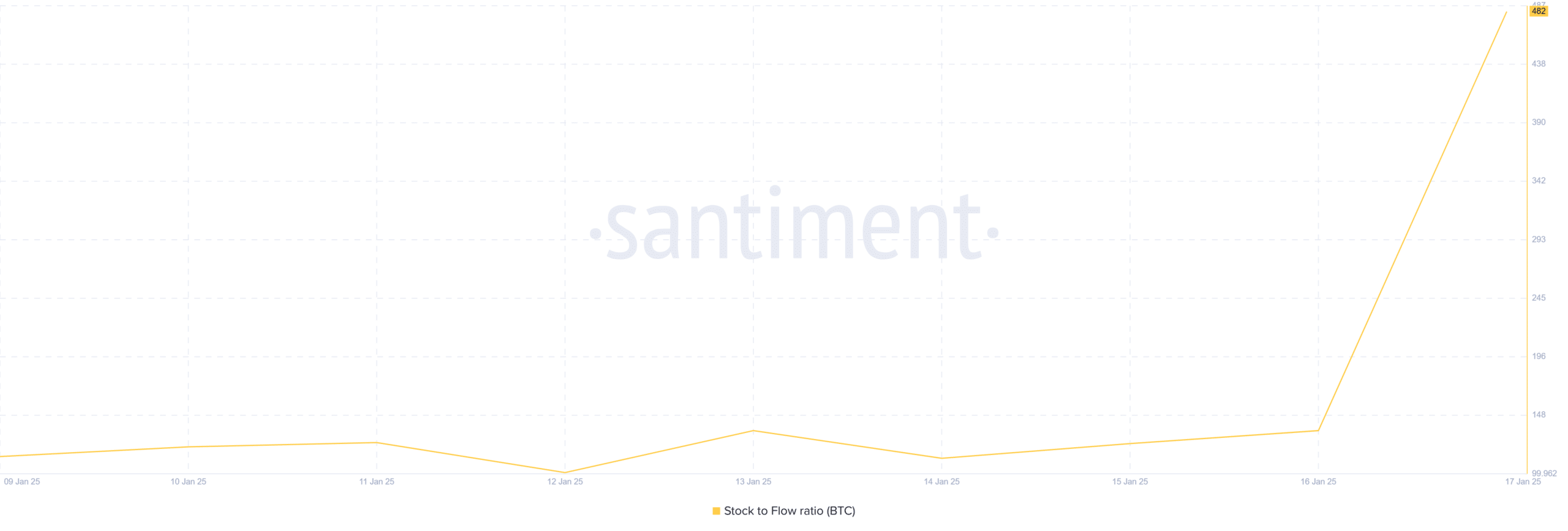

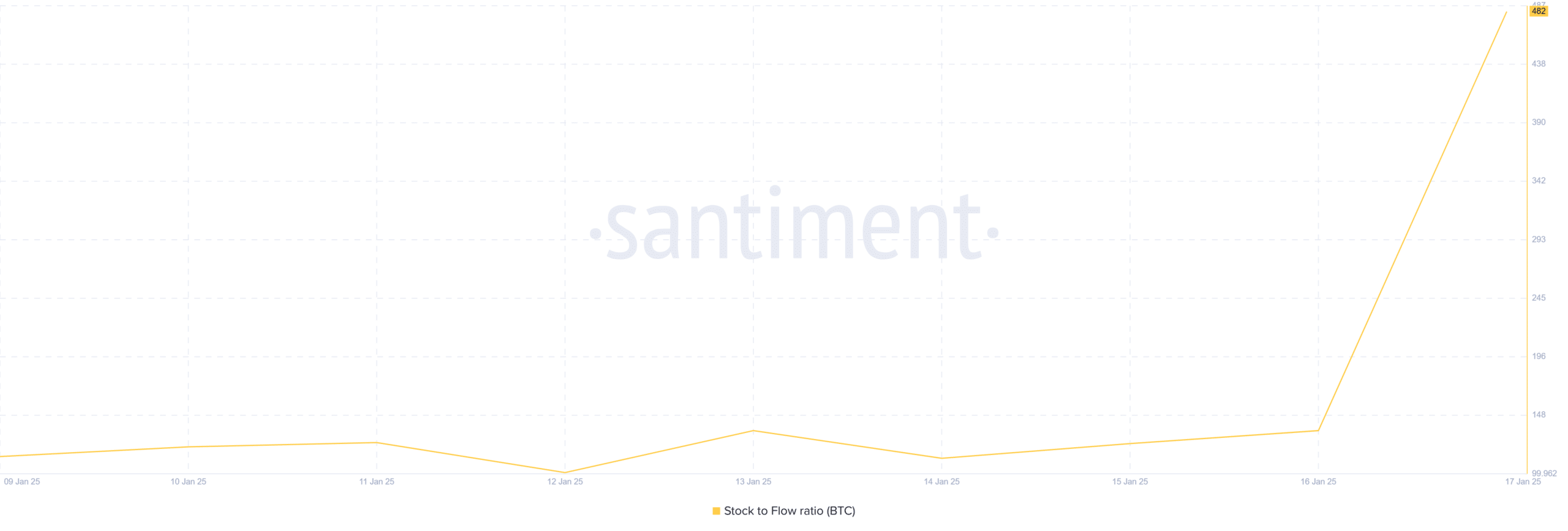

Source: Santiment

Finally, Bitcoin has become more scarce. This scarcity is evidenced by a surging stock-to-flow ratio. When BTC becomes scarce, its value surges as its value is based on the laws of demand and supply. A higher scarcity implies that more holders are storing their assets in personal wallets, reflecting an accumulation trend.

Simply put, the release of positive CPI inflation data has significantly affected Bitcoin’s price performance. As such, investors have turned bullish interpreting the recent data as a sign of a better future market performance.

Therefore, with bullish sentiments prevailing in the market, we can see BTC reclaim $105k. However, a correction could see a drop to $98,900.