- Bitcoin’s halving schedule reduces mining rewards, enhancing scarcity-driven value.

- How much supply is really left for the rest of the market?

Bitcoin’s [BTC] edge over fiat isn’t just that it’s decentralized, it’s that there will only ever be 21 million coins.

Unlike regular money, which governments can print endlessly and watch lose value, BTC’s supply is locked in, making it more likely to appreciate over time because it’s becoming scarcer.

With the next Bitcoin halving approaching, a reduced supply could impact price action, potentially driving stronger bullish momentum.

The countdown to Bitcoin’s ultimate scarcity

Glassnode reported that Bitcoin has now mined 900,000 blocks since its inception. Each mined block releases new Bitcoin, increasing the supply.

However, due to halvings, block rewards are cut in half every 210,000 blocks. This means Bitcoin’s issuance slows significantly as it approaches the 21 million supply limit.

Source: Glassnode

To put that into perspective: miners process Bitcoin blocks every 10 minutes, generating about 6 blocks per hour—totaling 144 blocks daily.

Before the halving, each block rewarded 6.25 BTC, resulting in 900 new BTC entering the market per day.

After the halving, rewards dropped to 3.125 BTC per block, cutting daily Bitcoin issuance to 450 BTC—nearly half.

Since then, BTC has surged 47%, reflecting the impact of reduced supply.

Only 1.7 million left, and it’s drying up fast

Notably, miners expect the next halving to hit around block height 1,050,000 in 2028, slicing the block reward down to 1.5625 BTC.

Run the numbers, and that’s just 1.5625 BTC × 144 blocks = 225 BTC per day hitting the market, half of today’s already-thin issuance.

That’s a major supply cut. With only 1.7 million Bitcoin left to mine before we hit the 21 million cap, each halving makes Bitcoin even scarcer. And when you look at the top wallets, the supply squeeze feels even tighter.

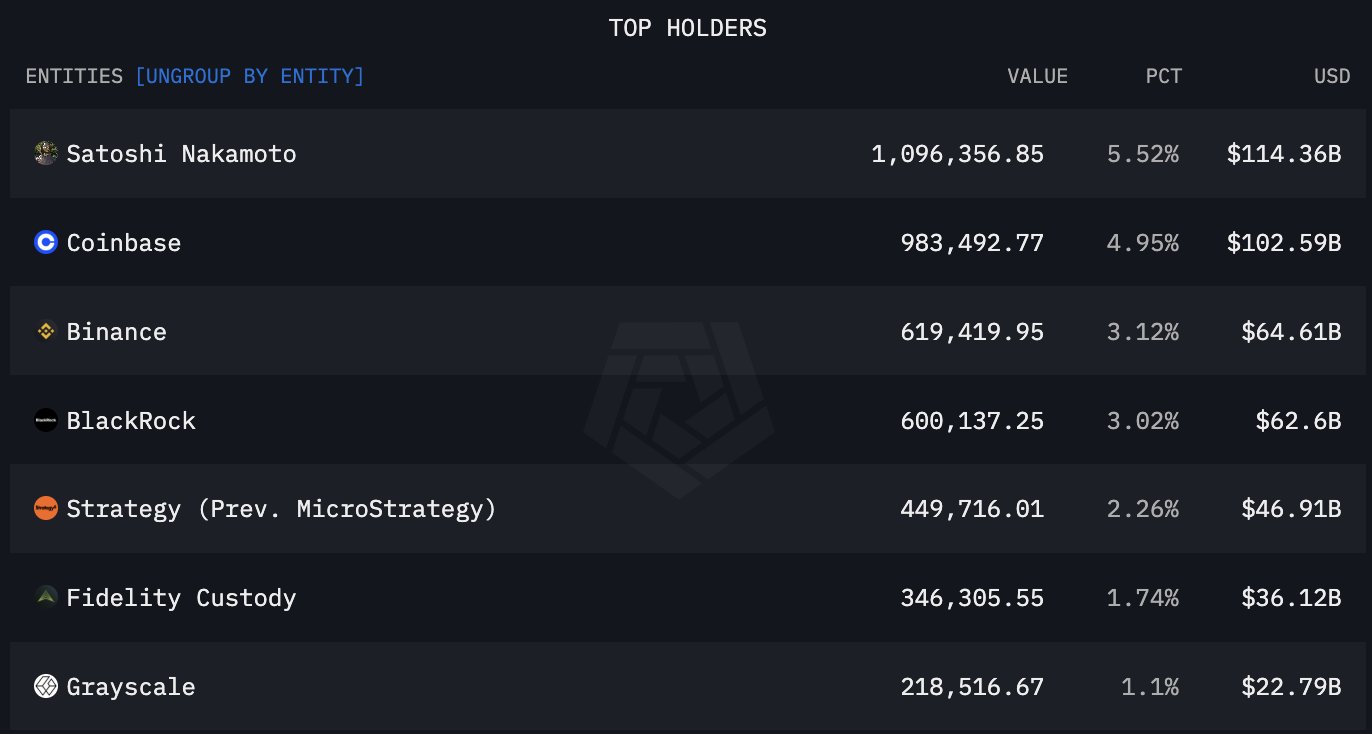

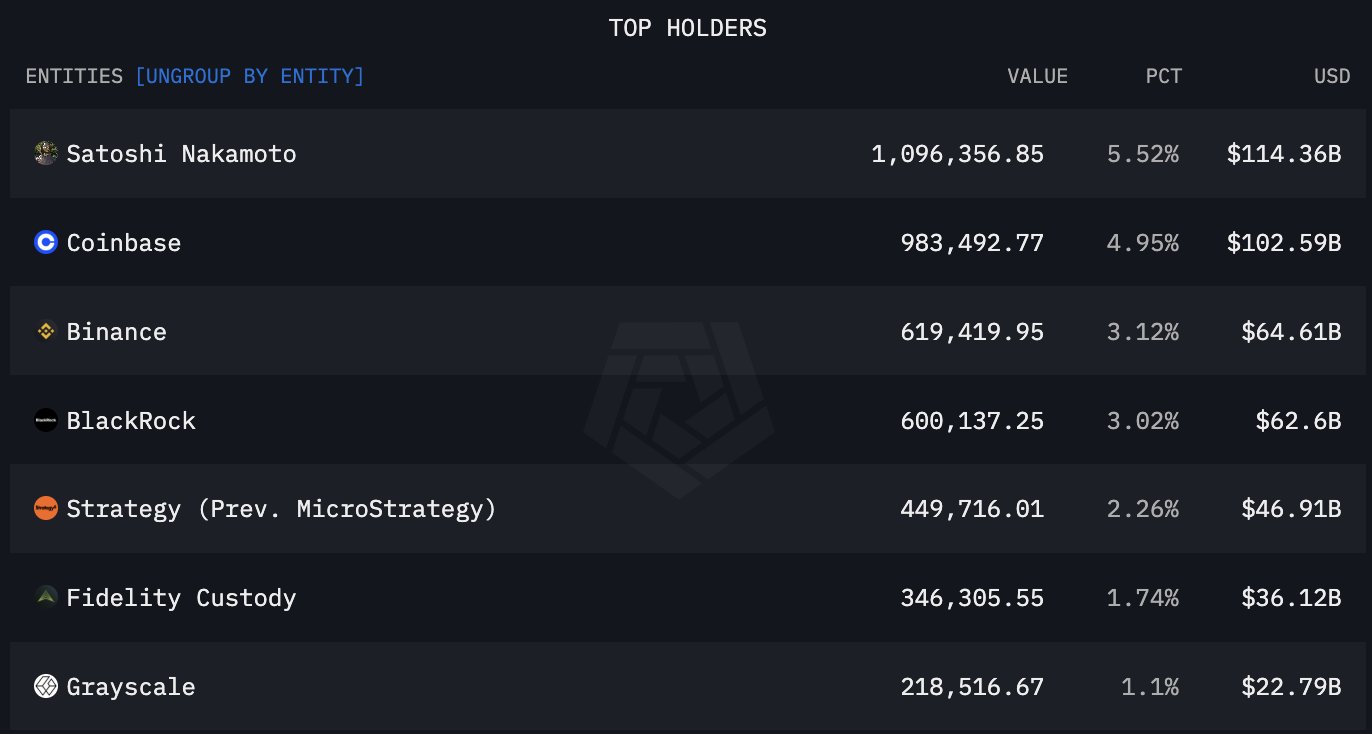

The chart below highlights how the top 8 holders control 4.51 million BTC, holding roughly $471 billion. That means they lock away over 21% of Bitcoin’s total supply, keeping it off the market.

Source: X

But that’s only the opening act. If demand keeps ramping up and Bitcoin’s market cap rockets to $3 trillion or $5 trillion, each BTC could easily soar to $143k, $238k, or even beyond.

Of course, these numbers are rough estimates, but that’s the genius of BTC’s design. It’s like a high-stakes auction with no reserve price: How high can the bids go?

Thus, with supply tightening and big players holding strong, BTC’s “digital gold” story is only getting started. The stage is set for some serious gains over the long haul.