- The negative trend of the market cap vs. the realized cap is historically a bearish signal

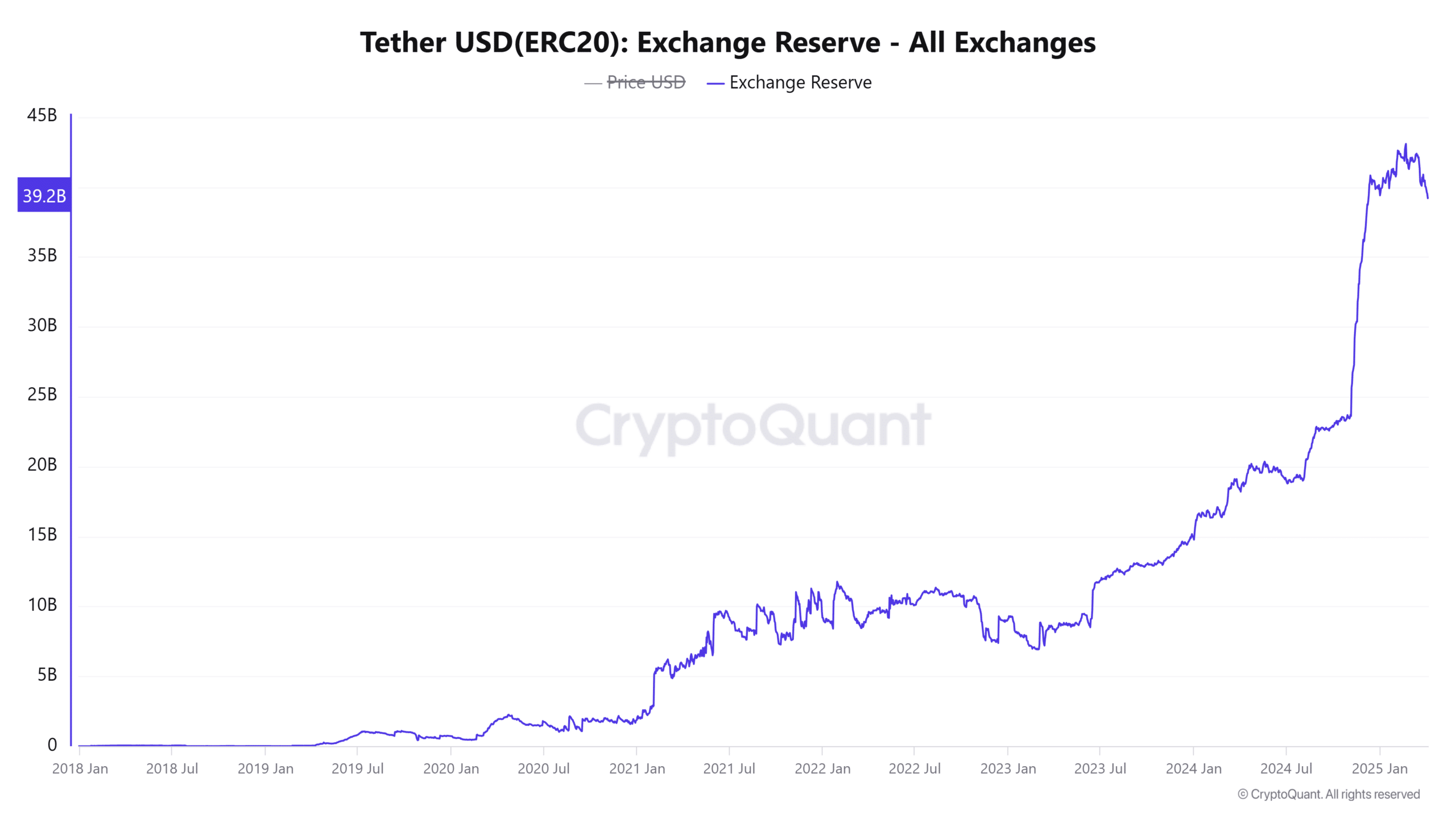

- The halt in the Tether reserve growth pointed to stable, rather than increasing, buying power

The global M2, a money supply classification that includes money market funds, refers to the money supply from major economies such as the U.S.A., China, and the Eurozone.

In a recent report, it was noted that the global M2 money supply went parabolic in 2025 while Bitcoin [BTC] was consolidating.

Historically, such divergences do not last long. Hence, there is a chance for Bitcoin to appreciate.

On the other hand, the trade war initiated by the U.S. has dented investor confidence. China’s retaliatory 34% tariff on the 2nd of April deepened tensions, affecting the crypto market as well.

Assessing the bearish arguments for Bitcoin

The Bitcoin spot ETFs have been weak in recent days. The pessimistic macroeconomic outlook as a result of the ongoing trade wars was a factor here.

Blackrock’s spot ETF IBIT (iShares Bitcoin Trust ETF) saw some inflows in the past two weeks, but most other products have witnessed selling pressure recently. This outlined a bearish short-term sentiment.

Amidst this bearish backdrop, the CEO and Co-Founder of popular crypto analytics firm CryptoQuant stated that the “bull cycle is over”.

Is the BTC bull cycle over?

In a post on X (formerly Twitter), he explained the concept of the Realized Cap to support this argument.

The Market Cap of an asset is calculated by multiplying its circulating supply with its current market price.

In contrast, the Realized Cap measures Bitcoin’s market capitalization based on the value at which each coin was last moved. This provides a more accurate view of the capital flowing into the Bitcoin market.

The analyst used 365-day Moving Averages (MA) for both Market Cap and Realized Cap to calculate the 365-day MA of the delta growth.

A decline in this metric signals a rising realized cap paired with a falling market cap—a trend observed since November-December 2024.

Ki Young Ju emphasized that capital inflows failing to drive price gains indicate a bear market. At the time of analysis, the delta growth’s MA was negative, which aligns with bear market conditions.

A similar situation occurred in December 2021, following Bitcoin’s previous all-time high of $69k and its subsequent decline. Ju also predicted that a short-term rally is unlikely, and this bearish phase could persist for another six months.

According to the realized cap data, the onset of another bear market appeared possible. Meanwhile, on the other hand, the exchange reserve of Tether [USDT] has halted its growth in recent months.

Opposing these views, the rising global M2 mentioned earlier pointed toward rising buying power in the market.

A slowdown in the Tether reserve growth accompanied the previous market top.

The data here suggested another bear market could be underway, but it must be noted that none of the usual cycle-top metrics have yet reached overheated levels mirroring the previous cycle.