- BTC miner reserves were shrinking, signaling selling pressure even as Bitcoin price trended upward.

- Bitcoin’s Hash Rate remained high, but declining reserves suggest miners are uncertain about future prices.

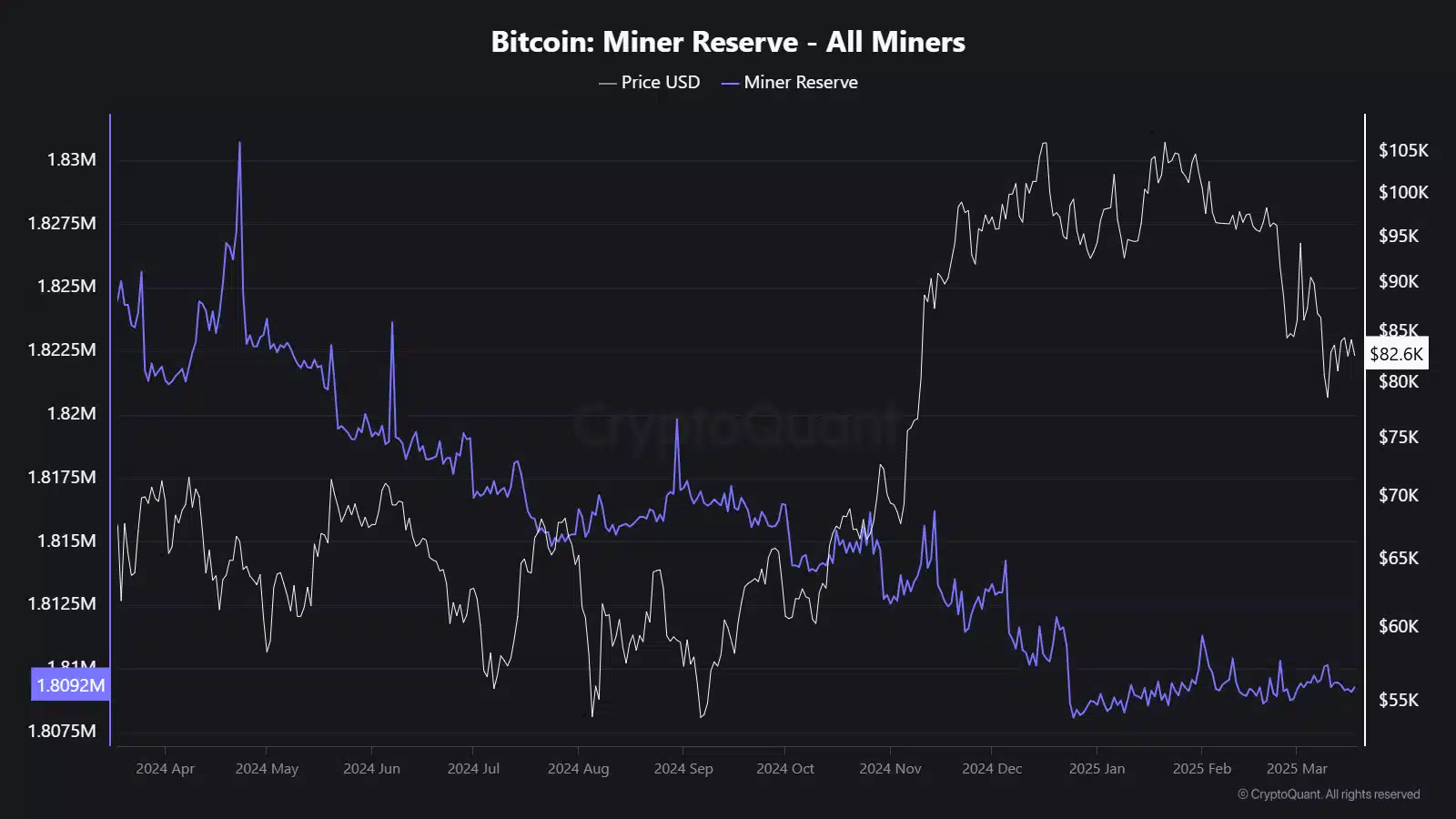

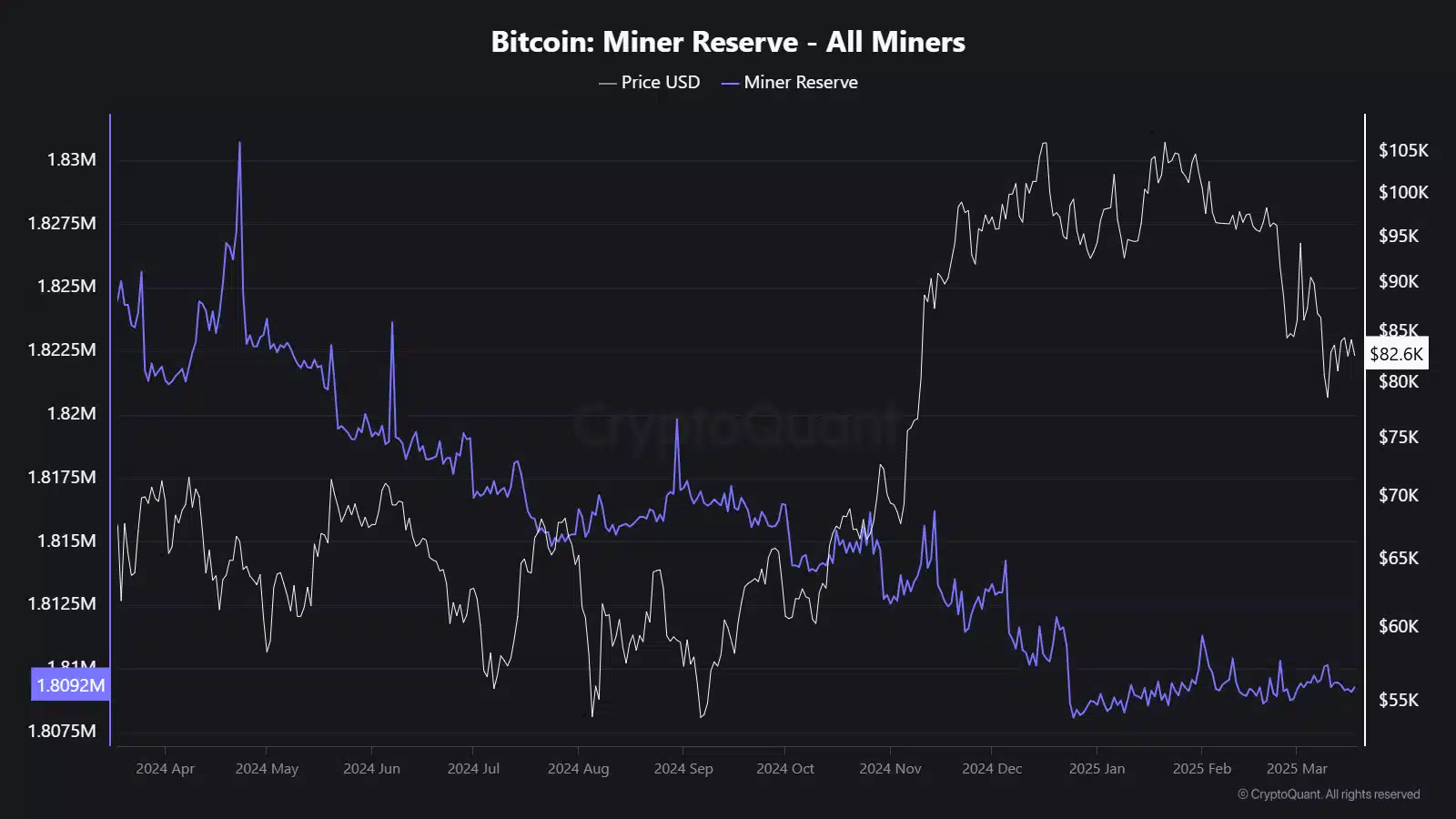

Bitcoin [BTC] Miner Reserves have been shrinking since mid-2024, signaling increased selling pressure even as prices continue to rise.

Meanwhile, market data from CryptoQuant suggested that miners have been offloading Bitcoin, raising questions about whether this trend could trigger a price correction or set up the next rally.

Bitcoin Miner Reserves have followed a downward trend, with many miners selling more BTC instead of holding.

The decline likely indicates profit-taking, with miners capitalizing on rising prices. Additionally, some may be selling to cover operational expenses or mitigate financial risks.

Source: CryptoQuant

Although Bitcoin’s price rallied at the end of 2024 and early 2025, reserves have stayed low, indicating miners continue selling into strength rather than accumulating.

Recently, reserves have moved sideways, suggesting some miners might be waiting for more favorable price conditions before making additional moves.

Miner outflows drop sharply

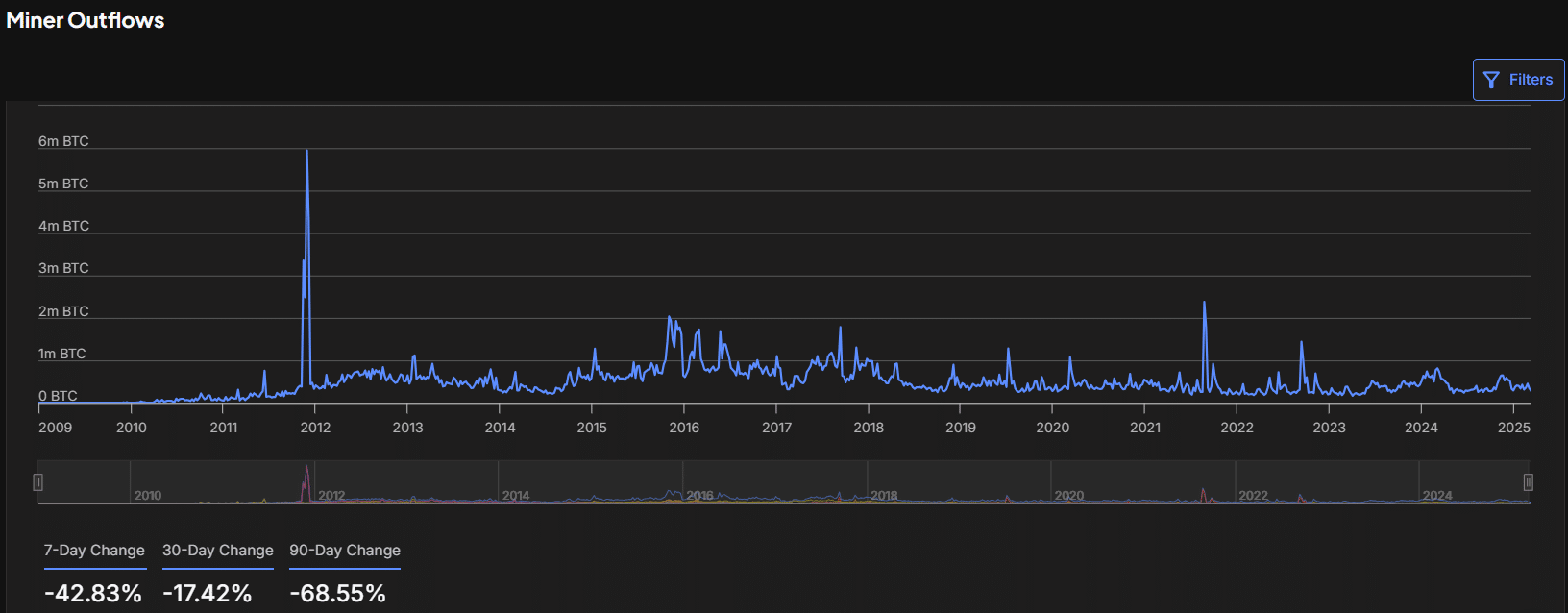

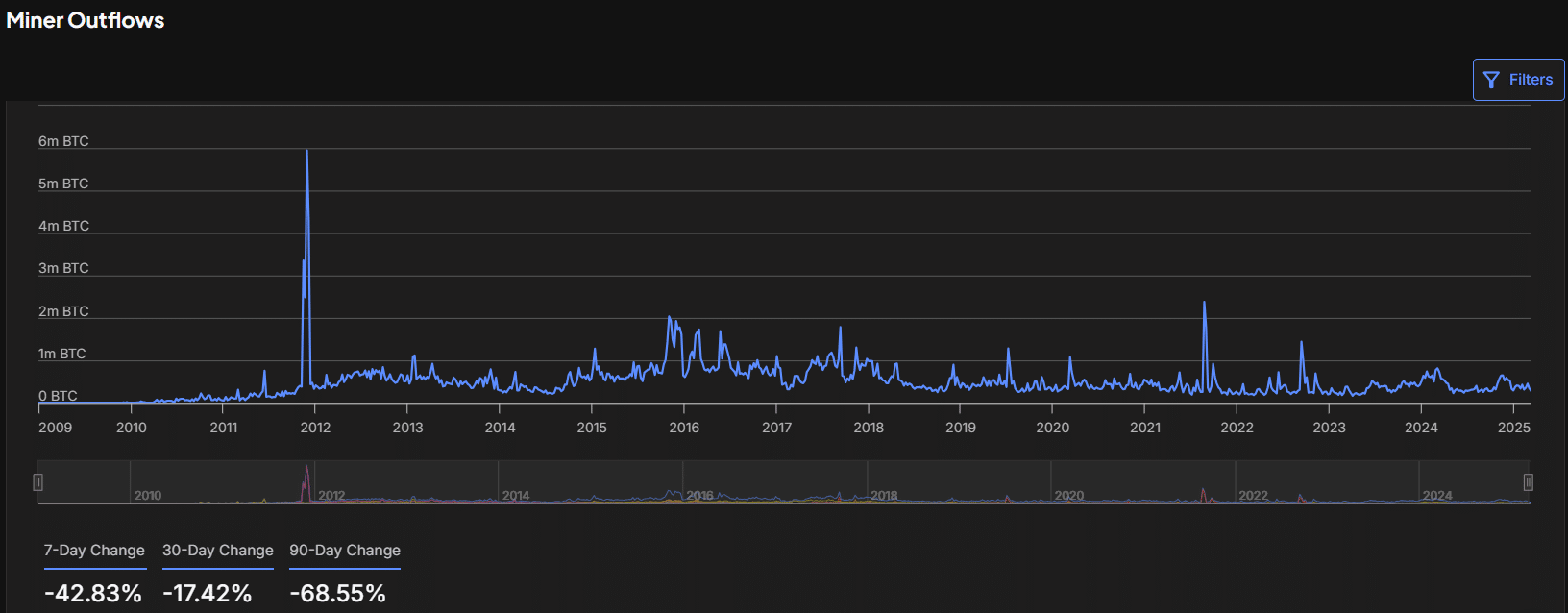

Recent data from IntoTheBlock revealed a sharp decline in miner outflows over the past few months.

Over the last seven days, miner outflows fell by 42.83%, by 17.42% over 30 days, and by 68.55% over 90 days. This indicates a significant reduction in selling pressure compared to previous months.

Historical trends show that large miner outflows have coincided with key Bitcoin cycles. Notable spikes include early 2012, with over 5 million BTC, followed by smaller peaks in 2016, 2021, and 2022.

Since 2023, miner outflows have shown a gradual decline, stabilizing at lower levels over the long term.

Source: IntoTheBlock

A sustained drop in outflows may indicate that miners are holding onto BTC, expecting higher prices.

On the other hand, lower outflows could also mean that fewer new Bitcoins are entering the market due to reduced block rewards.

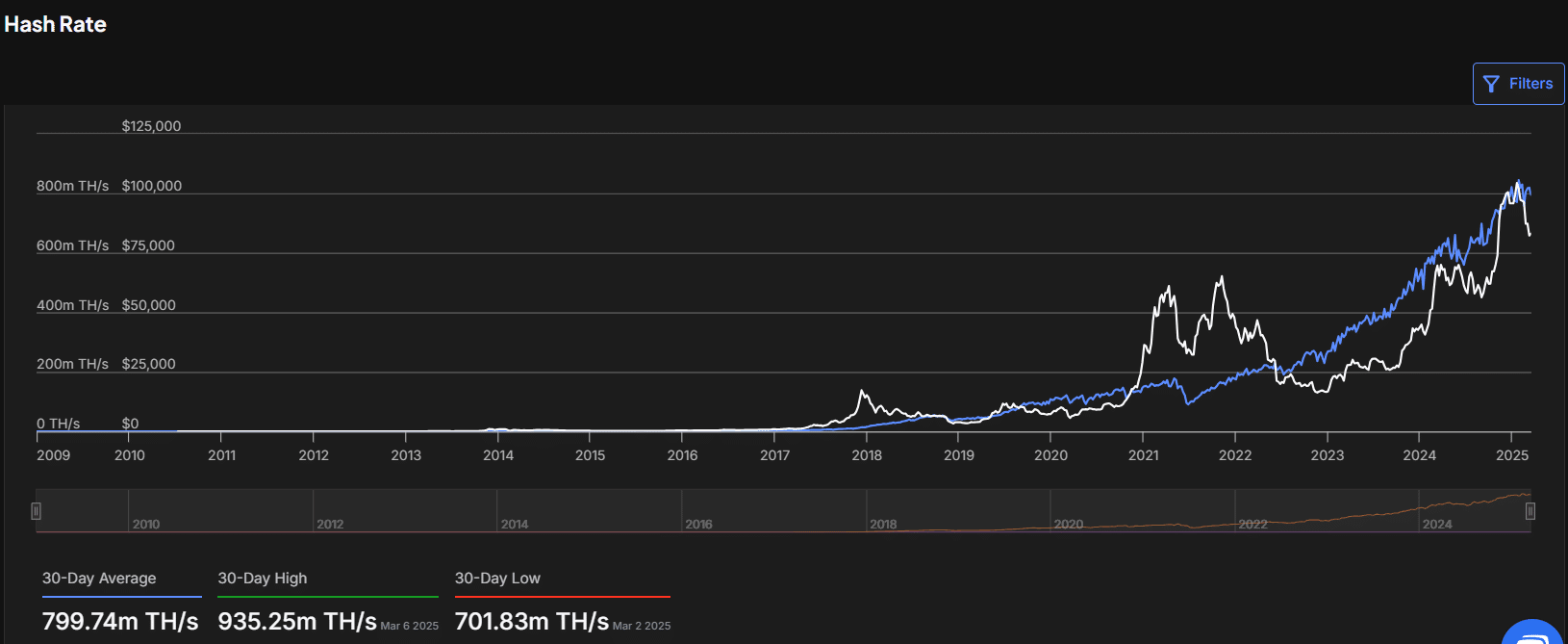

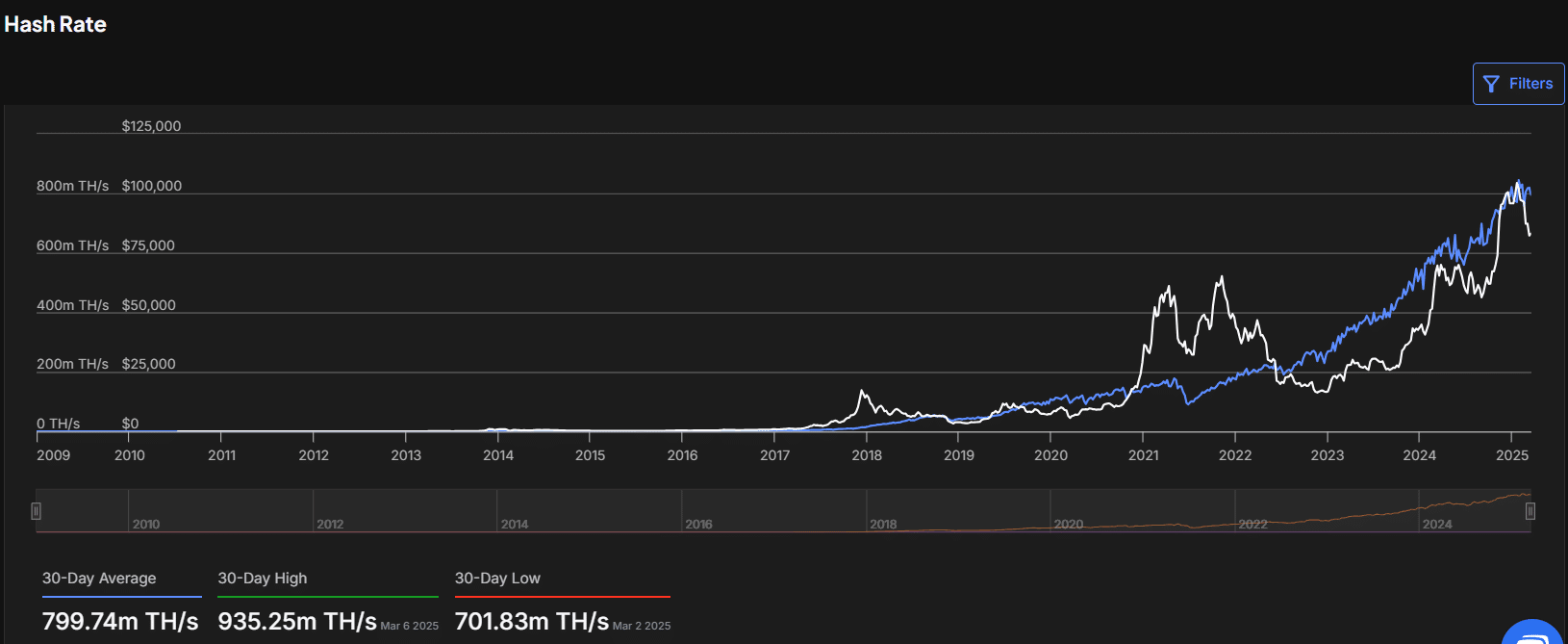

Hash Rate trends and mining activity

At the time of writing, Bitcoin’s 30-Day Average Hash Rate stood at 799.74 million TH/s, with a high of 935.25 million TH/s on the 6th of March 2025, and a low of 701.83 million TH/s on the 2nd of March 2025. The rising Hash Rate reflects strong mining participation and network security.

The Hash Rate has historically followed Bitcoin’s price, with major surges in 2021, 2024, and early 2025. However, recent declines could indicate miner capitulation or temporary adjustments in mining difficulty.

Despite this, the overall trend remains upward, reflecting continued network strength.

Source:IntoTheBlock

Market watching miners’ behavior closely

At press time, Bitcoin was trading at $83,163.55, with a 24-hour volume of $23.21 billion. The price has increased 0.37% in the last 24 hours and 2.12% in the past week.

With miner reserves at lower levels and outflows declining, investors are closely monitoring whether miners will continue selling or holding their BTC.

In short, if reserves start increasing, it could indicate confidence in future price growth. However, if selling resumes, Bitcoin may face renewed downward pressure.