- Bitcoin’s price action and market structure align with previous bull cycles.

- While historical trends support a bullish outlook, investors should remain cautious of external risks.

Bitcoin’s [BTC] current price action mirrors its March 2017 cycle, where BTC was still nine months away from its peak.

If history repeats, BTC could enter its next “extreme greed” phase by Q4 2025, signaling the final leg of its bull run.

In that case, what is BTC’s long-term price target if this cycle follows past patterns?

Bitcoin’s RSI signals a repeat of 2017 cycle

A recent X (formerly Twitter) post highlighted that Bitcoin has returned to critically low RSI Bollinger Band % levels.

When BTC’s RSI Bollinger Band % reaches critically low levels, it suggests the asset is deeply oversold within its volatility range, often signaling a potential rebound.

This pattern is similar to what happened in 2013, 2016, and 2020, just before Bitcoin reached new all-time highs.

Notably, RSI Bollinger Bands now mirror 2017, when Bitcoin bottomed below $1,000 before surging 1,500% to $19,086 by Q4.

Source: X

However, at $83,078, BTC’s price action remains uncertain.

Analysts warn that a local bottom hasn’t formed yet, with institutional outflows accelerating and long-term holder supply dropping to pre-election lows – signs of short-term weakness.

Despite this volatility, Bitcoin’s historical cycle patterns remain intact. If history repeats, could HODLing still prove to be the best long-term strategy?

Identifying the next market top

While a definitive bottom hasn’t formed, there are no strong signals of a market top either.

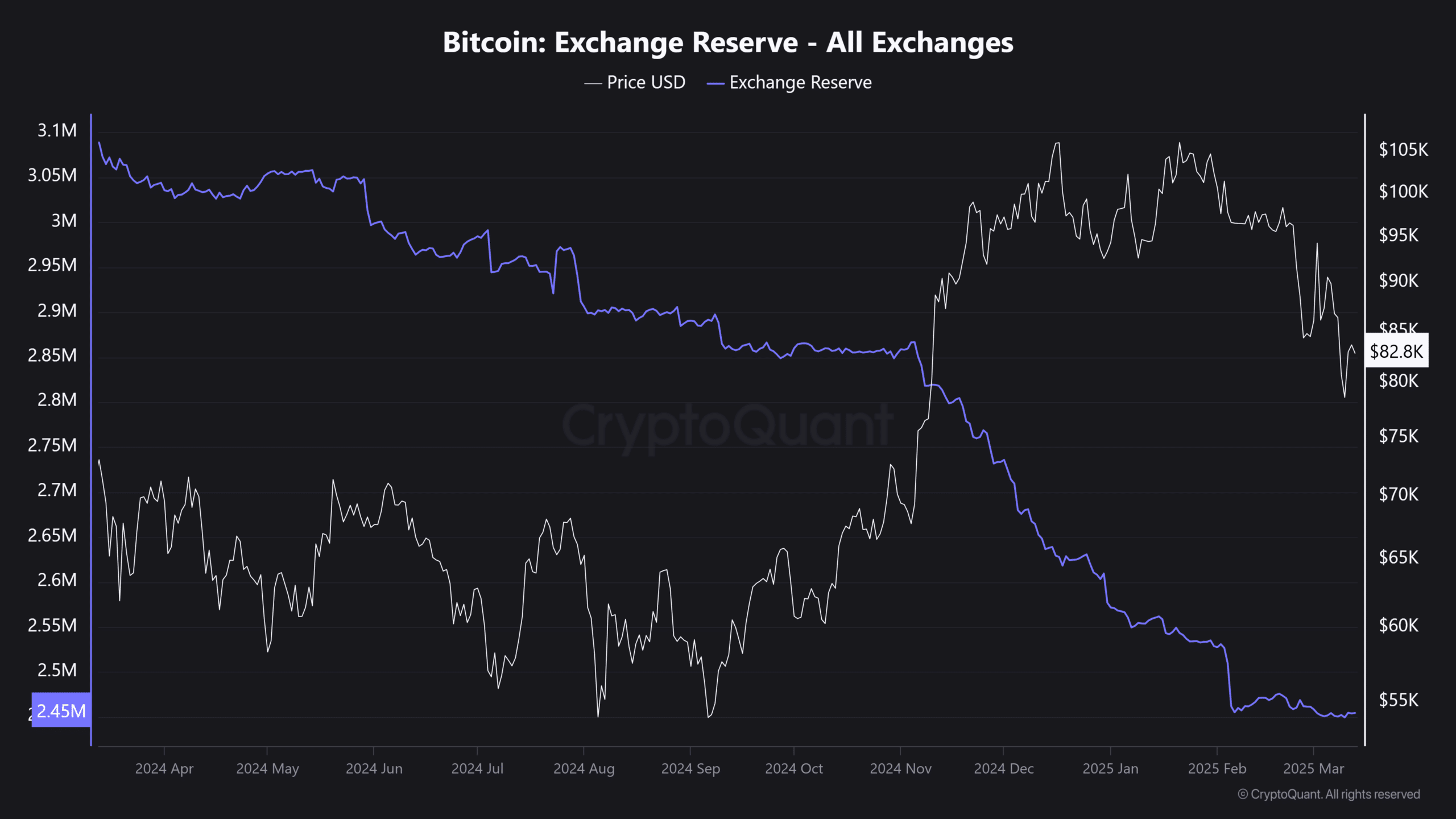

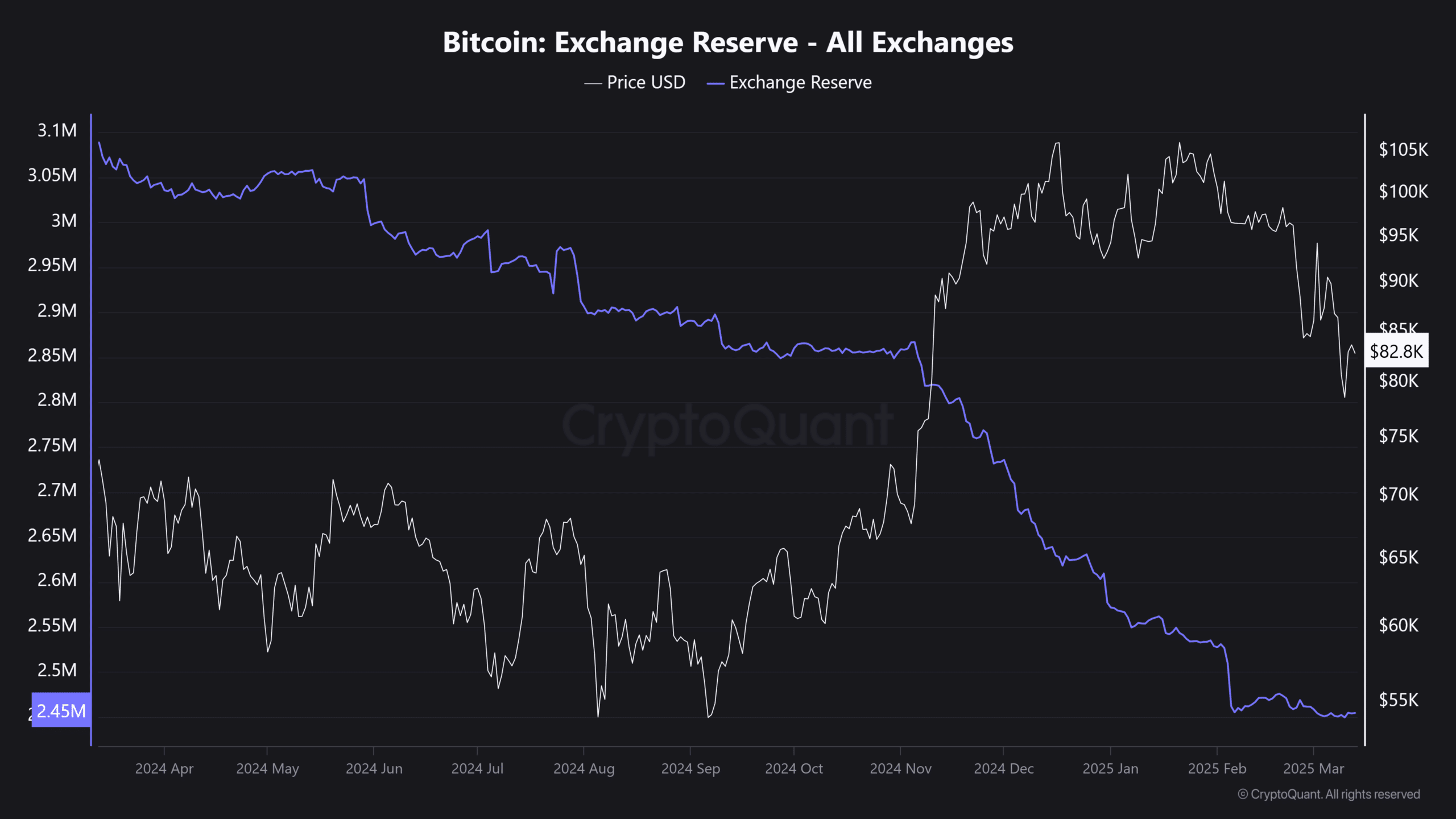

FOMO is steadily rising, with exchange reserves plunging to a one-year low, reflecting persistent long-term accumulation rather than profit-taking.

In fact, despite Bitcoin’s 22% pullback from its $109K peak, BTC supply on exchanges continues to shrink – a sign that investors are holding, not selling.

Source: CryptoQuant

For Bitcoin to replicate its 2017 bull cycle, this accumulation trend must persist. If sustained, historical data suggests the market’s true cycle top could still be nine months away.

Even amid macro uncertainty and stock market liquidations, BTC has maintained its $77K–$80K range, reflecting unwavering investor confidence.

In the near term, breaking past $90K remains the key challenge. But in the long run, sustained accumulation and growing confidence could push Bitcoin into six-digit territory.