- Short-term holders are retreating, showing reduced speculative appetite and weak near-term conviction.

- Liquidation clusters build near $80K, increasing risk of cascading sell-offs.

Bitcoin’s [BTC] price was hovering just above $83K as of the 4th of April.

In fact, the entire crypto market is on edge, with signs pointing to a possible drop below $80K. If that happens, technical models suggest a slide toward the $68K zone could follow.

A Bitcoin rally that couldn’t last

In case of BTC, the asset surged to $88,580 after President Donald Trump announced sweeping tariffs. But the rally was short-lived.

Prices fell sharply as traders weighed the risks tied to global trade uncertainty.

Not to mention, markets reacted fast. The S&P 500 dropped 4%—its biggest daily loss since the pandemic lockdowns. Roughly $3 trillion in value was wiped out across U.S. stocks.

Of course, crypto didn’t escape the panic as Bitcoin fell to $82,220 that same day and has struggled to reclaim higher ground since.

Is $80k the new Maginot line?

Recent data shows buyers defending the $80K zone. But technical signals like the death cross are flashing caution.

Source: Glassnode

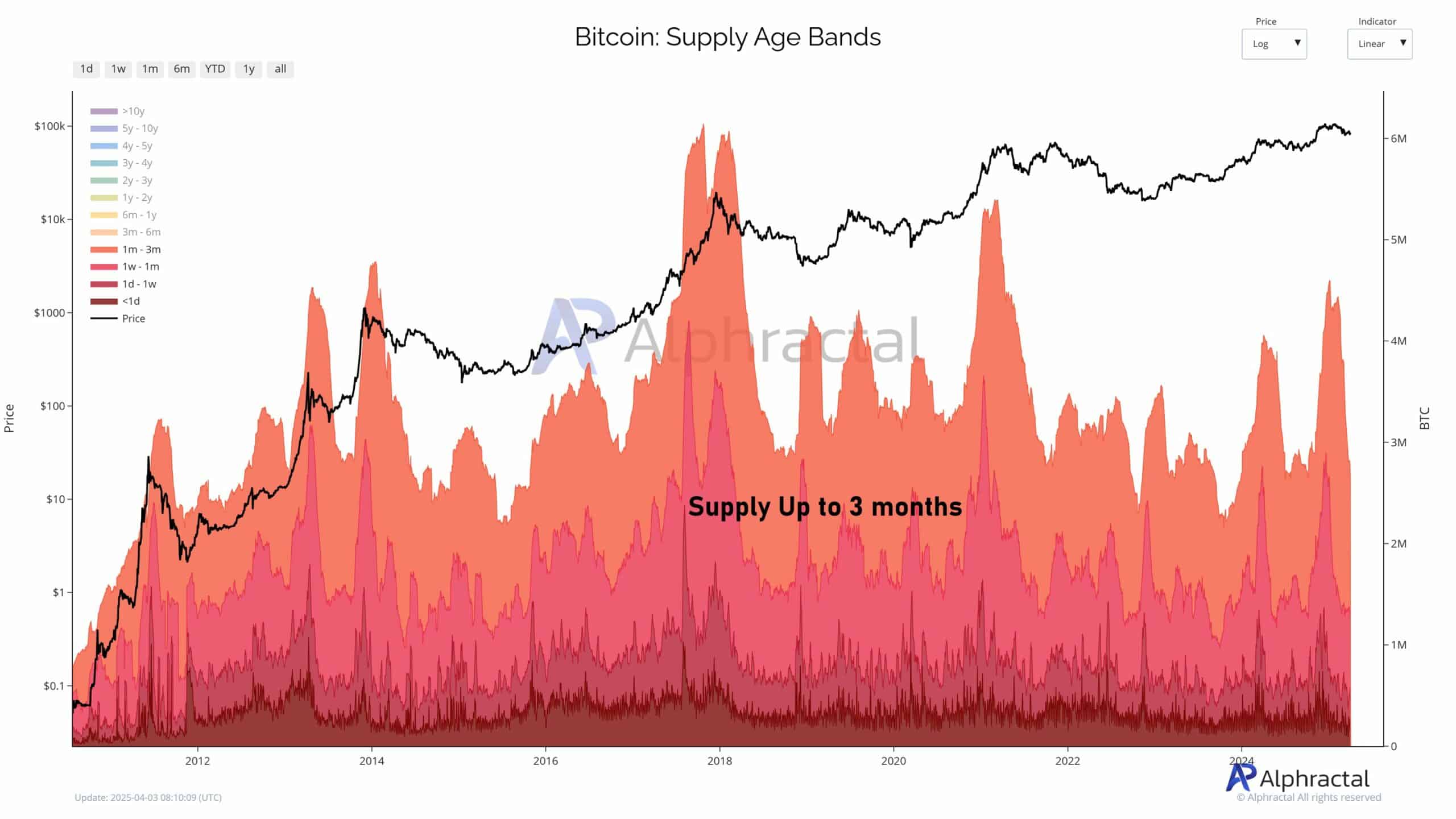

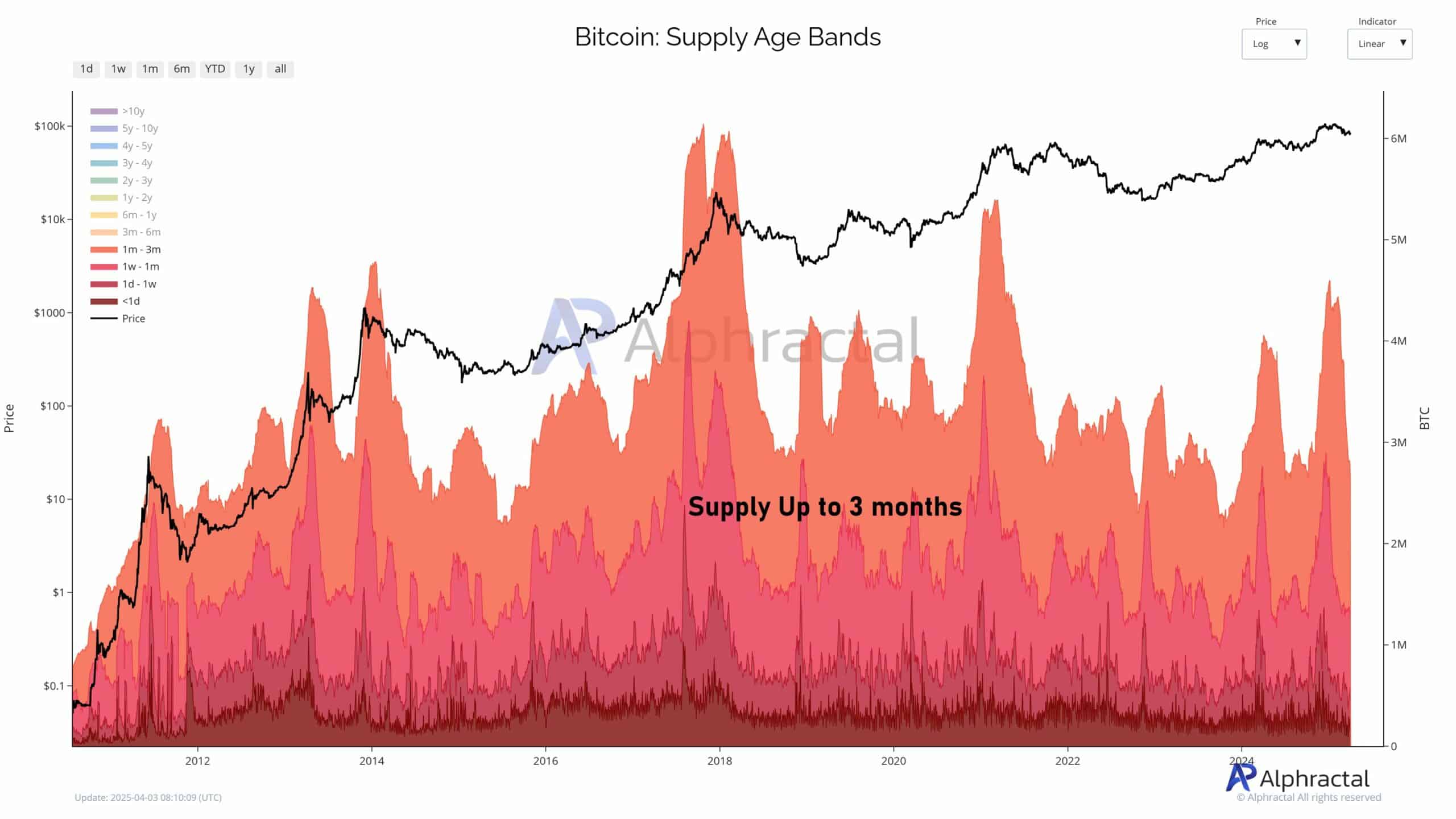

Another concern comes from realized price data.

There’s a steep drop in coins held for less than three months. These short-term holders are historically tied to bullish phases. Yet right now, their accumulation is fading.

In the past, spikes in short-term holder supply led Bitcoin’s biggest bull runs.

At the time of writing, that figure had dropped below 15%. The decline suggests reduced speculative interest and reflects a broader market cool-down.

Source: Alphractal

BTC Open Interest sinks, and so does hope

Moreover, Open Interest has dropped 37.5%, falling from over $80B to below $50B since late 2024—mirroring Bitcoin’s slide from $106K to $84K.

Without leverage, price swings tend to shrink—but when liquidation clusters build, sharp moves can still occur.

Liquidation heatmaps show where leveraged trades could unwind. A recent 7-day heatmap shows a heavy build-up of long liquidations just below $80K.

Source: Alphractal

If Bitcoin loses $80K with volume, a cascade toward $68K is likely, per analyst Joao Wedson.

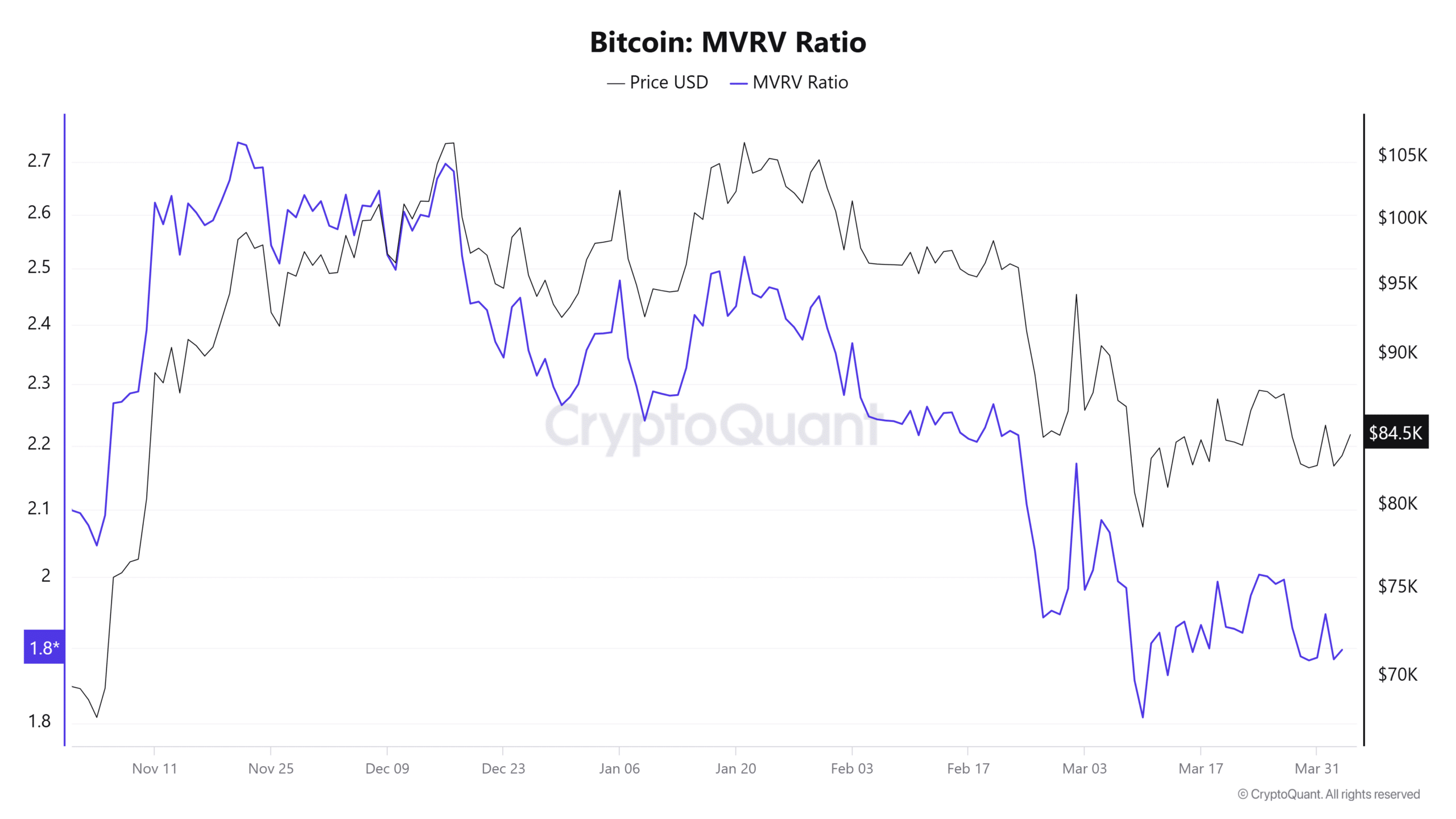

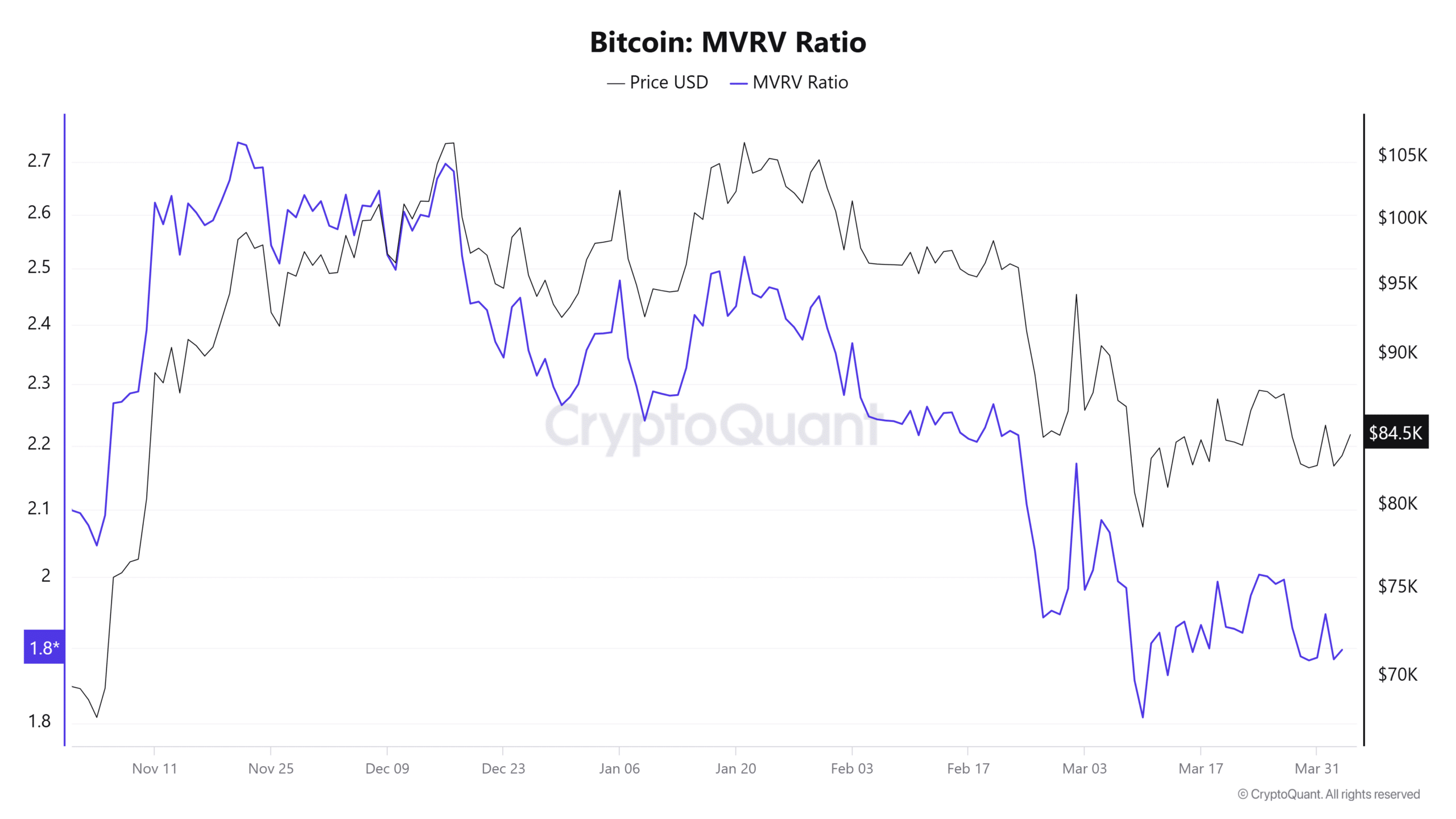

The MVRV wake-up call

Another red flag is the MVRV Ratio. It has fallen from 2.74 in November to below 2.0 in April, signaling fading speculation and a shift toward long-term holding.

Source: CryptoQuant

In fact, exchange netflows tell a similar story. Outflows are extremely dominating, and that, signals that investors are moving coins to cold storage, not preparing to sell.

For example, on the 3rd of February alone, over 60,000 BTC exited exchanges. That’s one of the largest single-day outflows recorded in months.

Source: CryptoQuant

The takeaway? Sellers are not necessarily rushing to exit. But new buyers aren’t stepping in either.

Bitcoin’s position above $80K is fragile. If that level breaks, a move to $68K could follow as bearish signals align.

With leverage fading and macro risks rising post-tariff, the next few days may decide whether this is a short-term dip or the start of deeper consolidation.