- Bitcoin price prediction witnessed a sharp price drop following bearish expectations in the U.S. equities market.

- The drop below the mid-range support could spur a deeper BTC correction to $92k.

Bitcoin [BTC] has shed 5.88% over the past 24 hours. It had pushed as high as $109,588 on the 20th of January according to Binance trading data, but has been in a slump since.

The swift losses in recent hours were likely not a sign of inherent BTC weakness.

The emergence of China’s DeepSeek LLM model has begun to impact the U.S. stock market. The Nasdaq 100 futures were down 2.9% at press time, and would reportedly see $1 trillion wiped from the U.S. equity market at open.

In turn, this panicked sentiment affected crypto and Bitcoin. The market could also be de-risking ahead FOMC meeting later this week.

Bitcoin price prediction — Range formation will have a play role

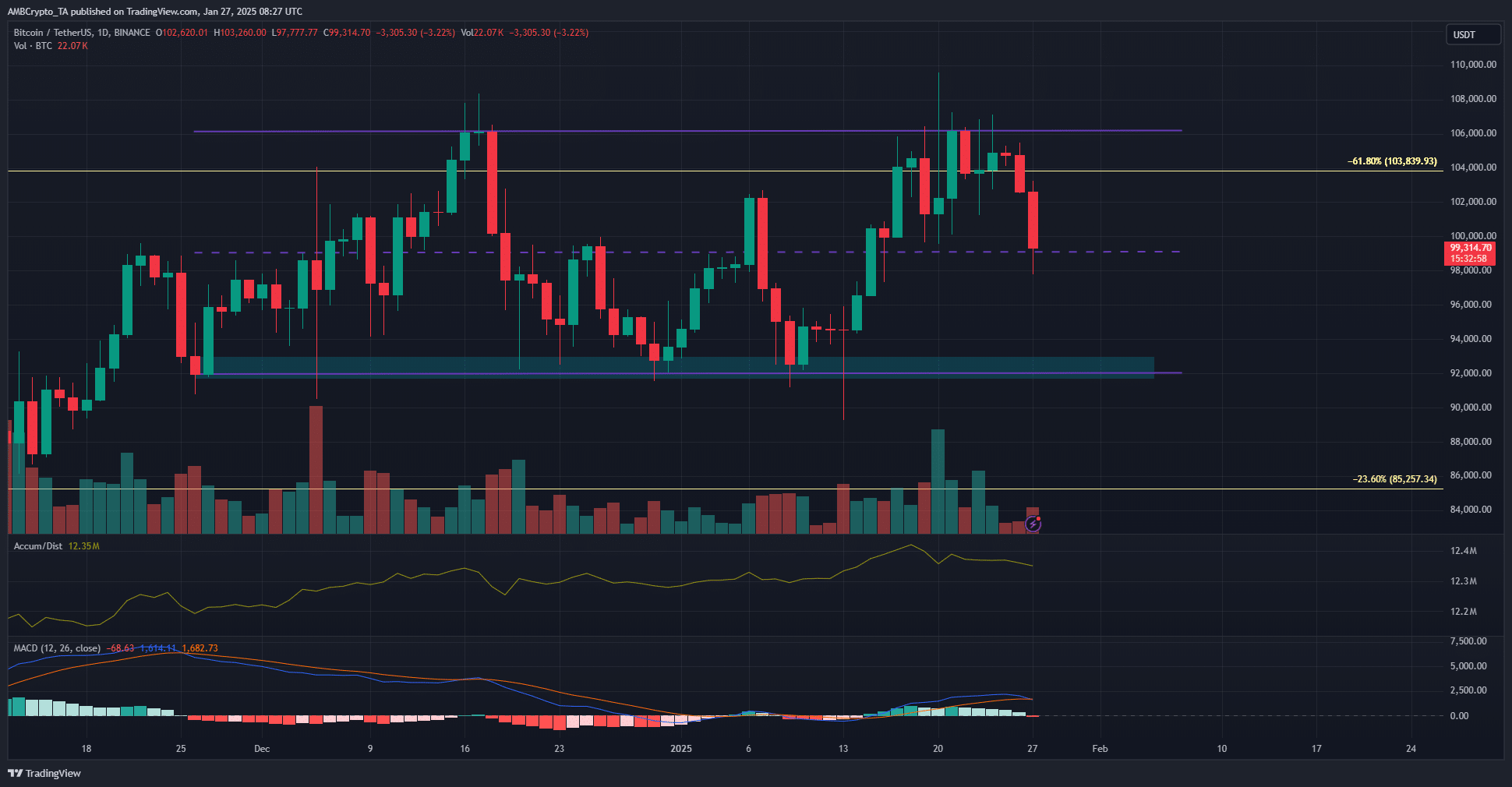

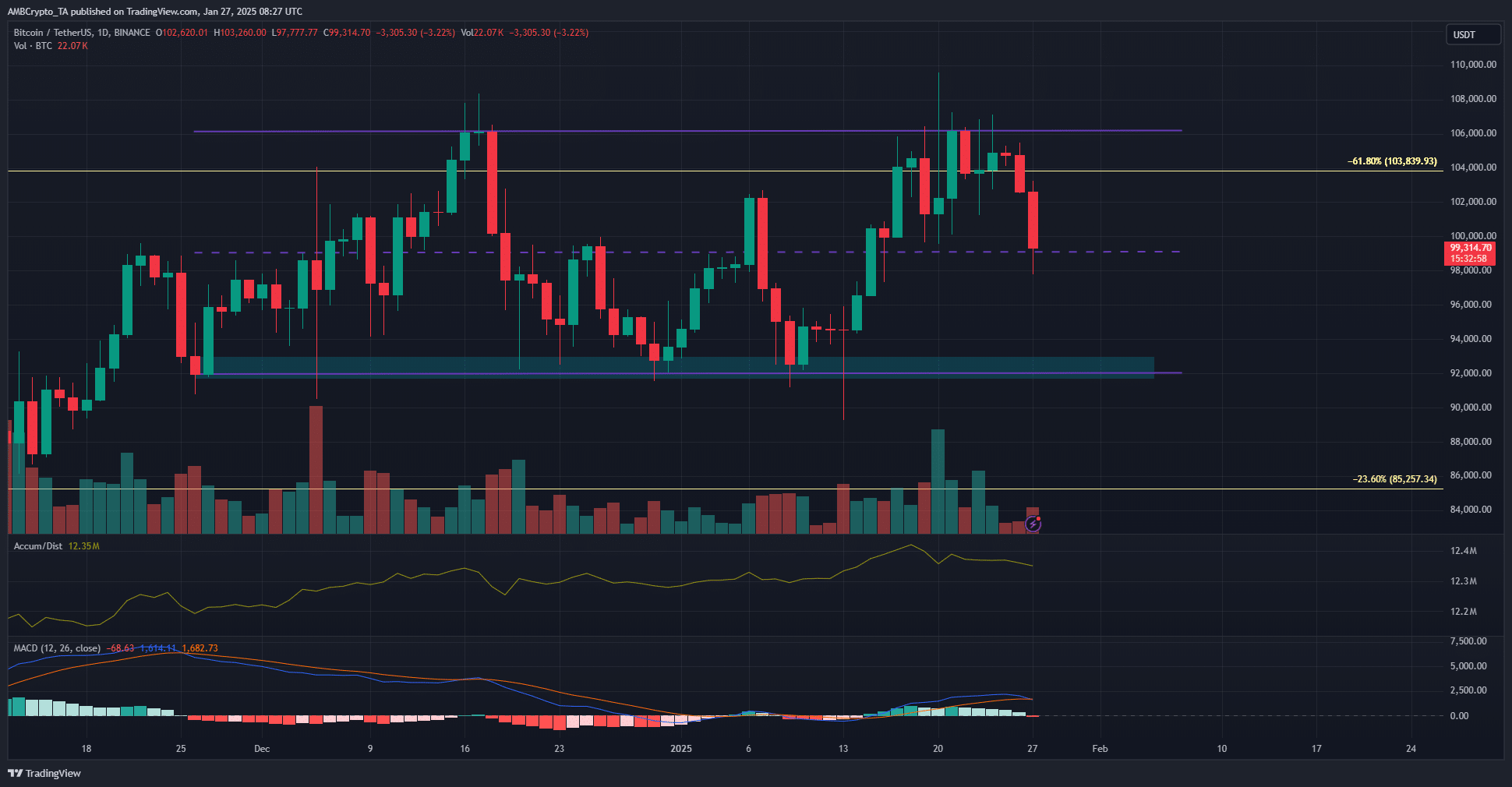

Source: BTC/USDT on TradingView

Over the past two months, Bitcoin has traded within a range that extended from $92k to $106k. The mid-range level at $99k has been crucial in recent weeks as a support/resistance level.

The selling pressure in recent hours brought BTC to the mid-range support.

It must be noted that the trading volume remained muted, but this could change during the New York trading session open. Hence, traders must remain cautious in the short term.

A drop below the mid-range level would likely see a deeper price correction to $92k.

Therefore, the Bitcoin price prediction was bearish in the short term. The MACD on the daily chart had formed a bearish crossover to signal bulls were beginning to lose strength.

Conversely, the A/D indicator made higher lows. From the A/D indicator, we can see that the selling pressure was a reaction to the U.S. stock market expectations and not necessarily weakness from BTC.

Is your portfolio green? Check out the Bitcoin Profit Calculator

The Coinalyze data showed bearish sentiment had been strong in recent hours. The funding rate fell into negative territory during the quick price drop, while Open Interest saw an uptick as prices fell below $102k.

This implied increased short-selling and bearish sentiment in the derivatives market. Crypto analyst Axel Adler noted in a post on X that panic selling was not underway, as seen on the short-term holder profit loss to exchanges.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion