- Bitcoin briefly dropped below $100K before rebounding to $101,496, marking volatility post-FOMC announcement.

- Coinbase sees $1.1 billion Bitcoin outflow, signaling strong institutional demand and ETF-driven accumulation.

Bitcoin [BTC] has experienced significant major price fluctuations in the past day, primarily influenced by the Federal Open Market Committee (FOMC) meeting outcomes and Federal Reserve Chair Jerome Powell’s speech.

The asset saw a steep decline, falling to as low as $98,000—a drop of over 5% in just a day. However, the cryptocurrency appears to have quickly rebounded, reclaiming the $100,000 mark and briefly reaching a high of $105,000 earlier today.

At the time of writing, Bitcoin was trading at $101,496, reflecting a 2.6% decrease over the past day and a 6.1% drop from its all-time high (ATH).

This dramatic price movement highlights Bitcoin’s continued volatility, but it also highlights the resilience of investor sentiment. Analysts seem to have been closely monitoring these fluctuations, with attention turning to institutional activity and its impact on market trends.

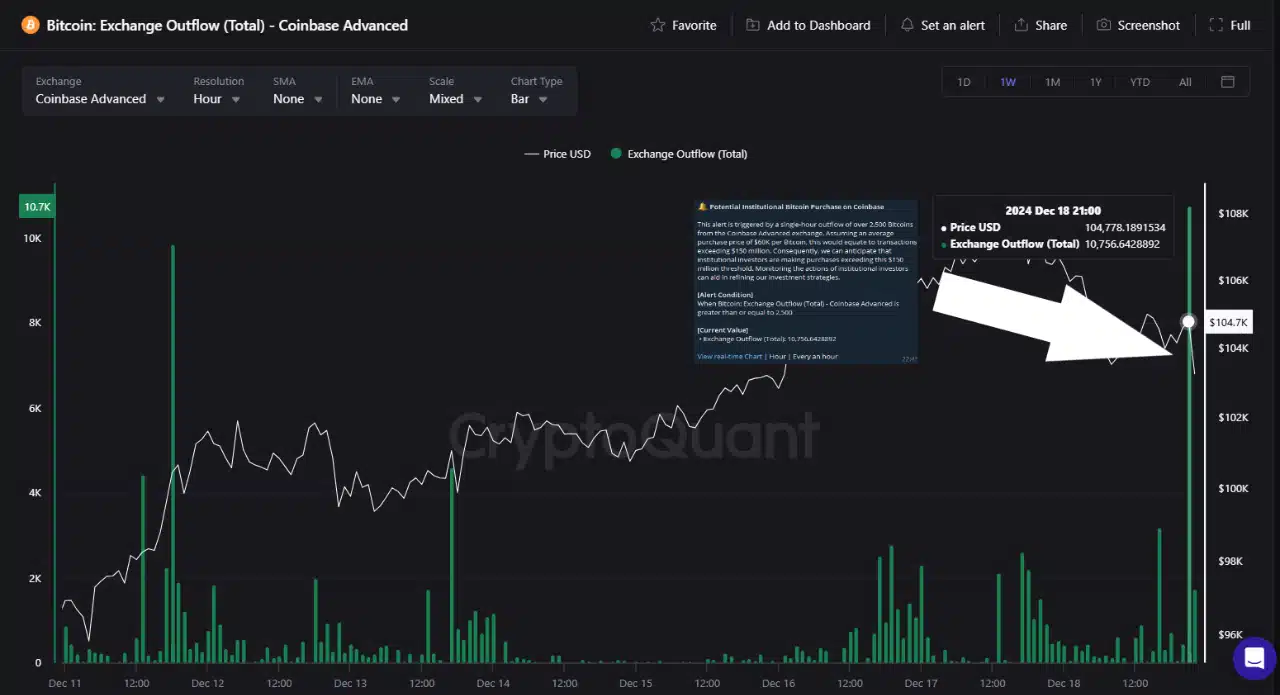

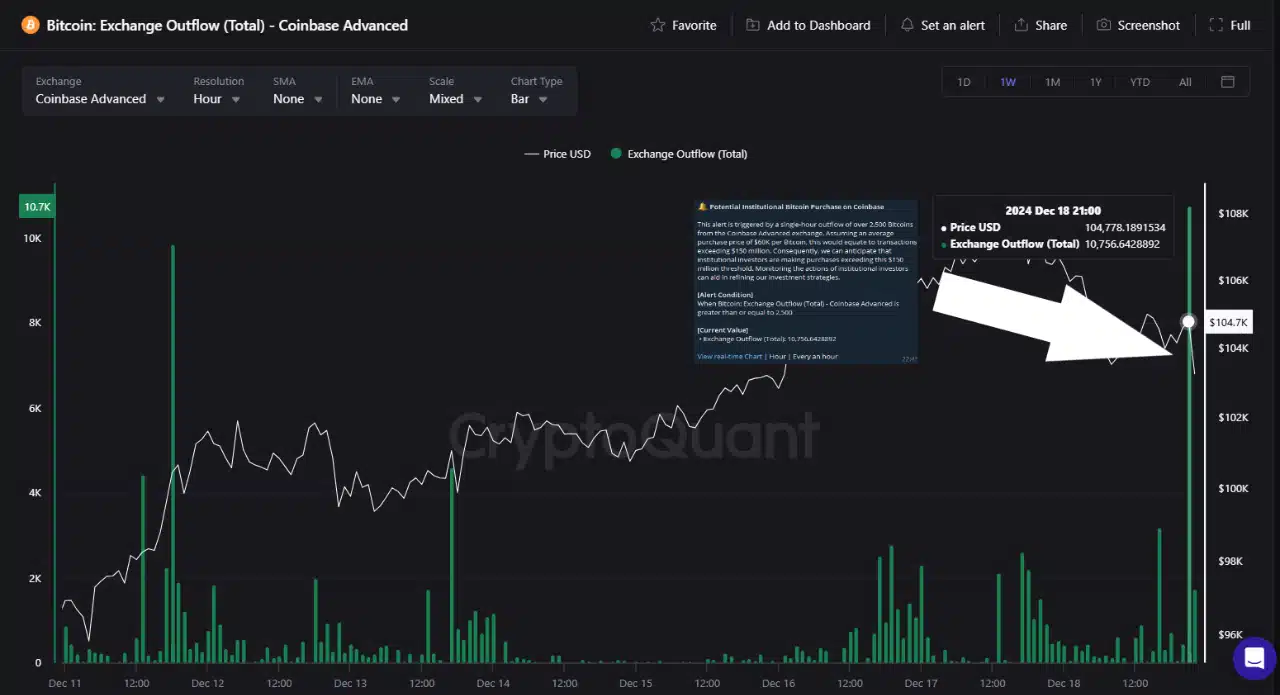

A new report from CryptoQuant analyst Burak Kesmeci sheds light on a significant development in Bitcoin’s market dynamics.

Massive Coinbase outflow signals institutional interest

According to Kesmeci, a record-breaking Bitcoin outflow was observed on Coinbase during the FOMC announcement. Within just one hour, approximately 10,756 BTC, valued at $1.1 billion, were withdrawn from the exchange.

Source: CryptoQuant

The transaction occurred in two major blocks: one involving 8,093 BTC and the other 2,557 BTC. This substantial outflow strongly suggests institutional buying or intermediary purchases likely linked to Spot ETF demand—a pattern that aligns with similar institutional activity over the past year.

Kesmeci emphasized the growing role of institutional investors in Bitcoin’s market structure.

He noted,

“U.S. investors continue to accumulate Bitcoin relentlessly, undeterred by price fluctuations or market downturns.”

The analyst mentioned that these significant transactions underscore the influence of institutions like RIOT and MARA in driving market momentum, particularly during critical events like interest rate announcements.

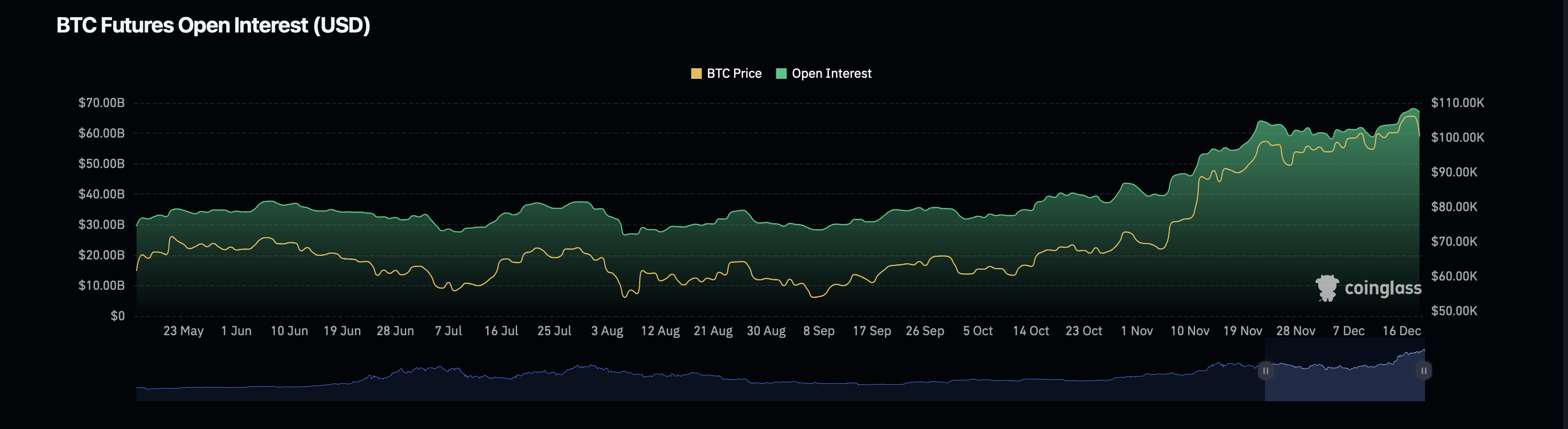

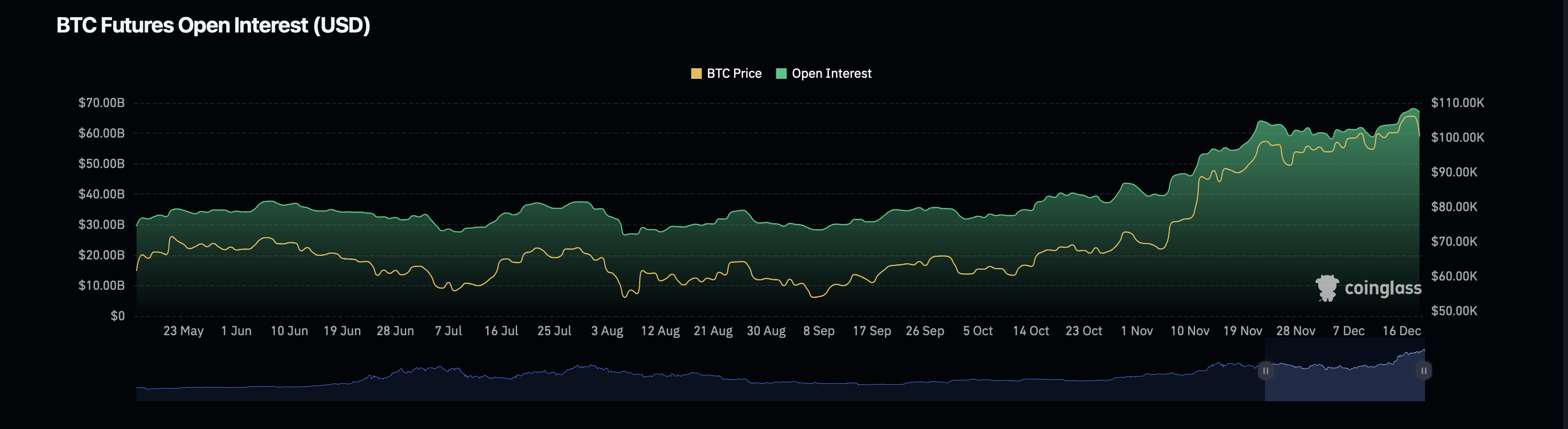

Bitcoin metrics signal mixed short-term outlook

While institutional activity points to long-term bullish sentiment, other key metrics reveal a mixed outlook for Bitcoin’s immediate future.

Data from Coinglass shows a 0.90% decrease in Bitcoin’s open interest, now valued at $68.14 billion. Conversely, Bitcoin’s open interest volume has surged by 36%, reaching $148.57 billion—a sign of heightened trading activity.

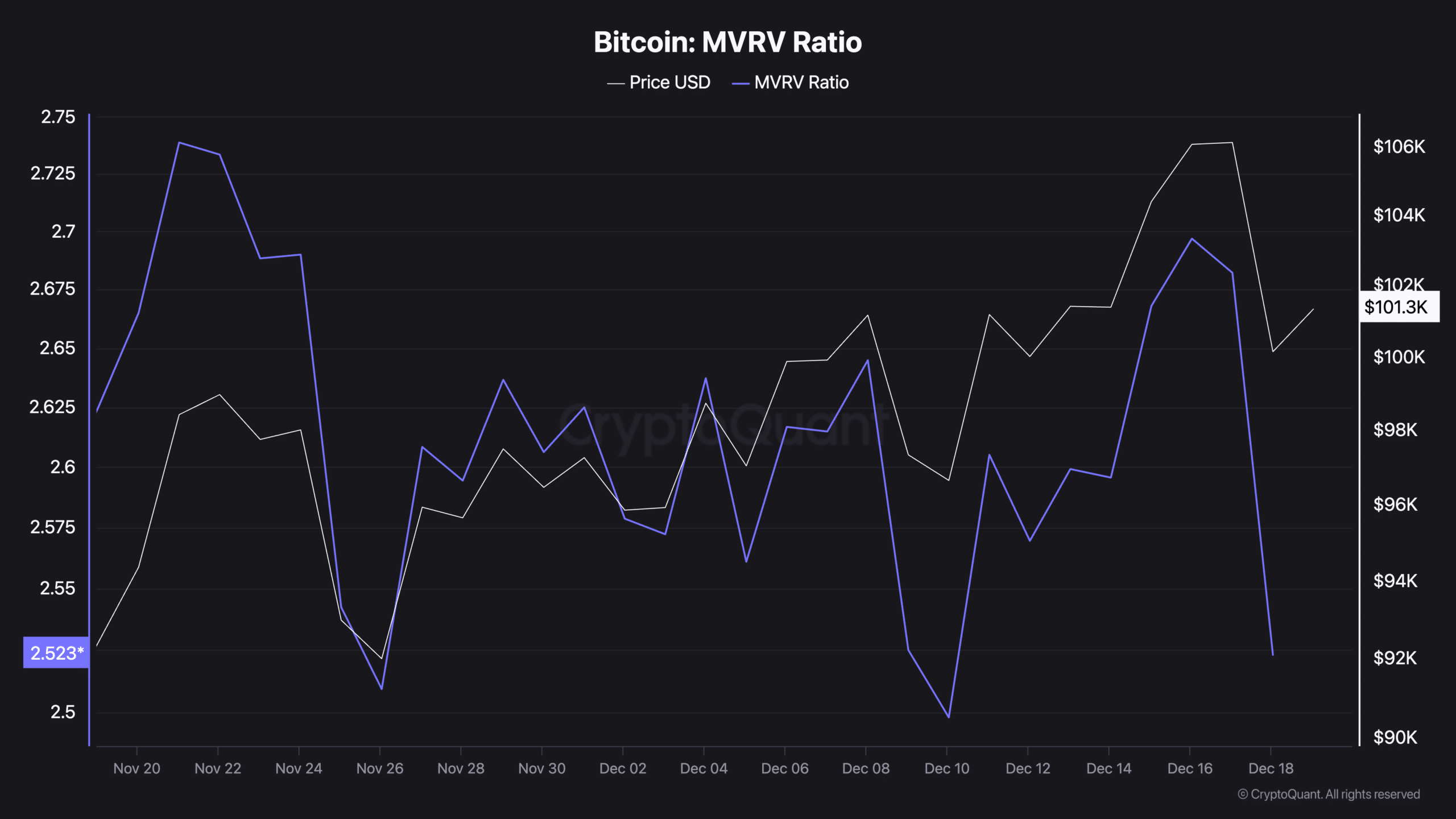

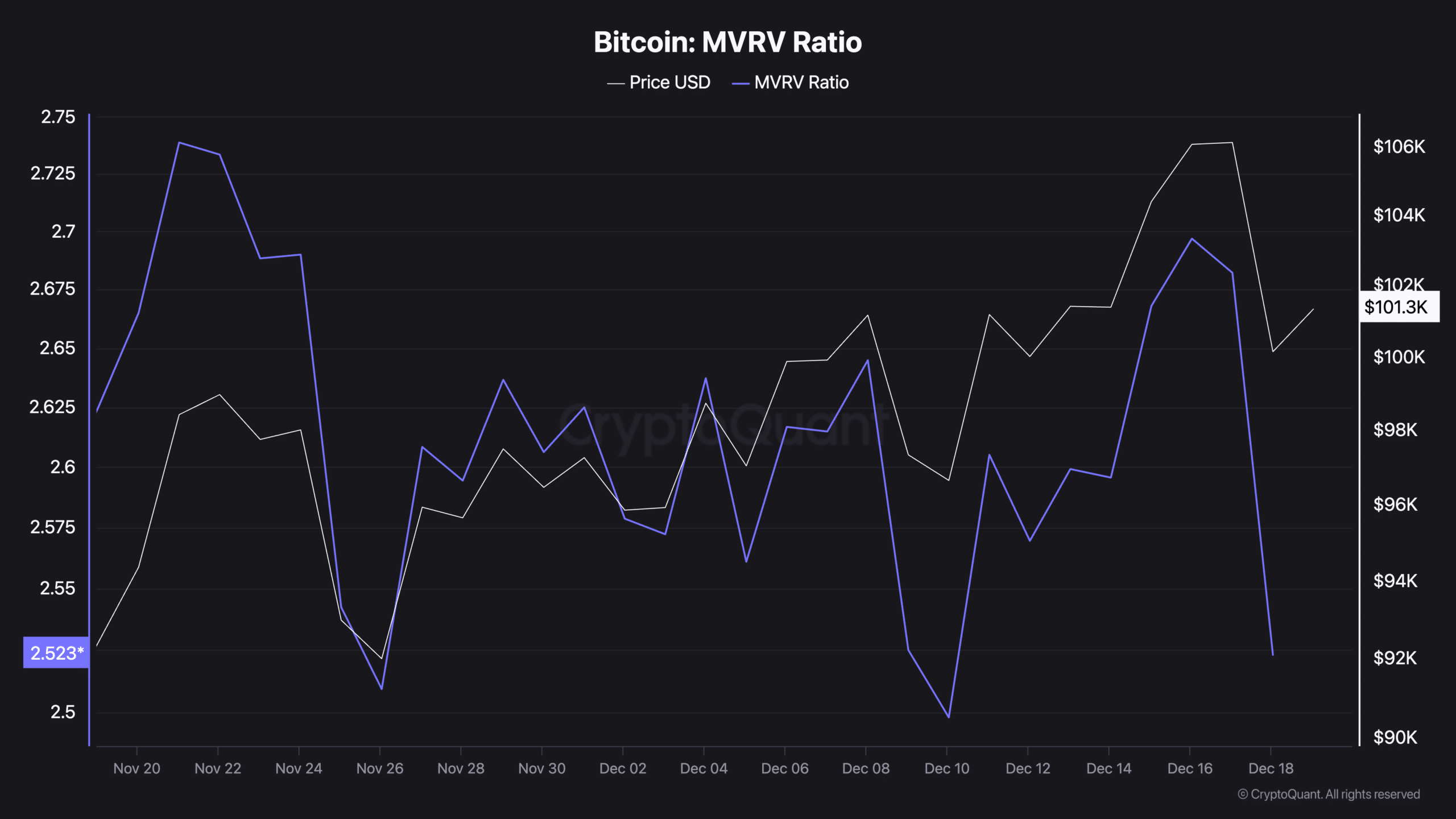

Source: CryptoQuant

Another important metric, the MVRV (Market Value to Realized Value) ratio, has also seen notable changes. The MVRV ratio measures whether Bitcoin is overvalued or undervalued based on its current market price relative to its realized price.

Read Bitcoin’s [BTC] Price Prediction 2024-25

A ratio above 1 generally indicates profitability for holders, while higher values suggest potential overvaluation. Bitcoin’s MVRV ratio recently climbed to 2.69 but has since fallen to 2.52 following the price drop.

This decline suggests a cooling market sentiment, with traders potentially reassessing their positions in the short term.

Source; CryptoQuant