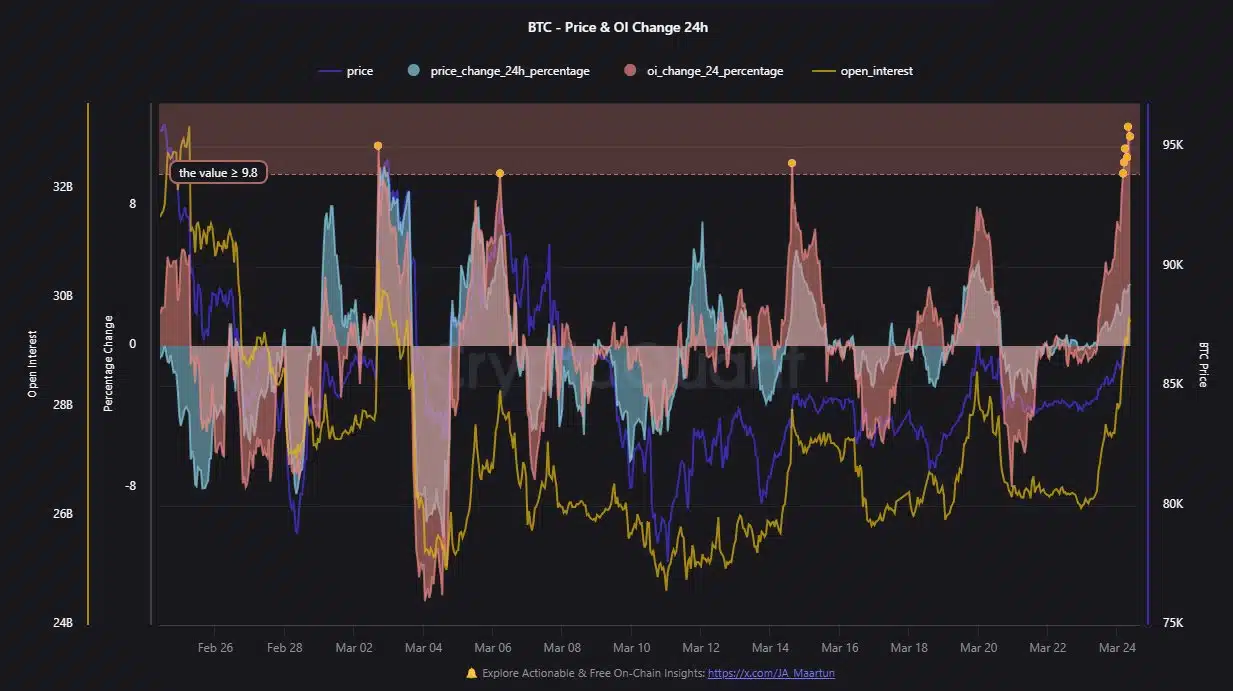

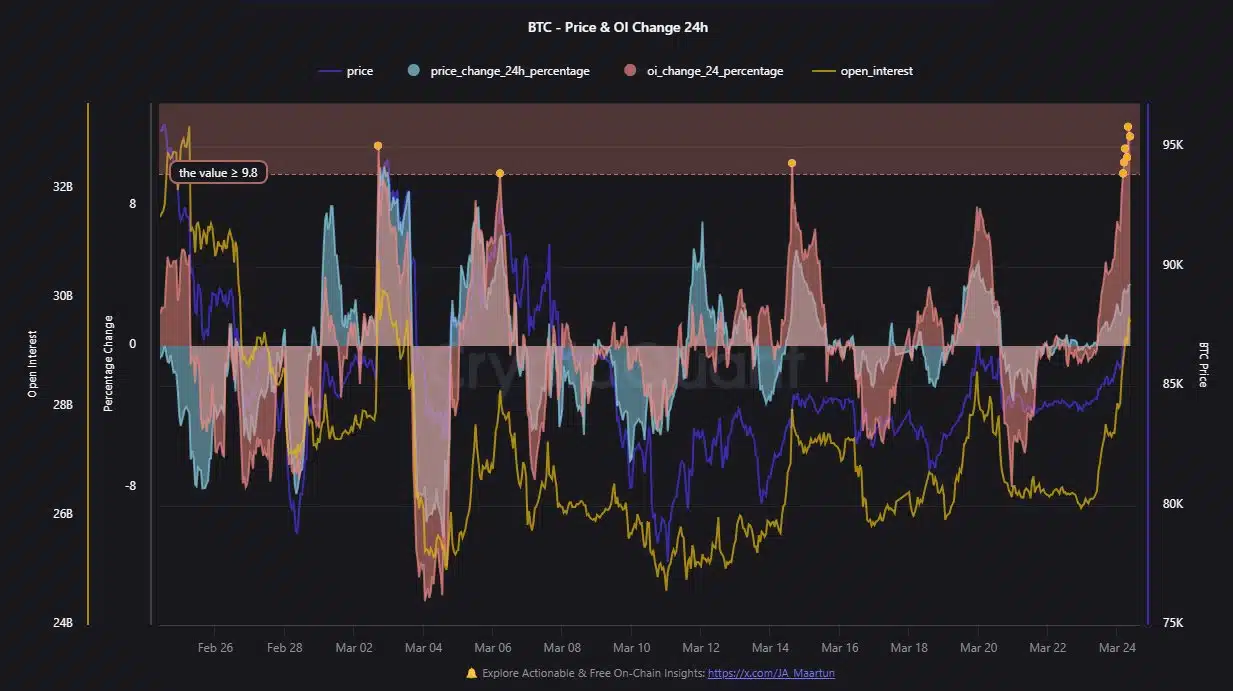

Bitcoin’s price surged toward $95K, but the 24-hour chart reveals heightened volatility, with OI reaching record levels above $32 billion.

Source: Cryptoquant

In the last 24 hours, Bitcoin saw a significant price increase, accompanied by notable inflows of leveraged positions. OI trended upward alongside price, suggesting traders are betting on further gains.

However, OI spikes exceeding 9.8% have historically been a precursor to sharp corrections. If price momentum falters, overleveraged positions could unwind, causing rapid sell-offs.

Bitcoin leverage: Breakout or breakdown?

As OI crosses $32 billion, the growing leverage fuels Bitcoin’s rally. However, this influx of capital creates a fragile setup where even minor pullbacks could trigger liquidations.

A rapid price increase combined with excessive leverage heightens the risk of cascading liquidations, creating the potential for amplified price swings.

If bullish momentum persists, Bitcoin could enter a parabolic phase, pushing prices beyond current highs. On the other hand, if the price drops suddenly, it could spark a wave of liquidations, leading to a sharp correction.

Monitoring shifts in OI and funding rates will be key to assessing market sentiment and identifying potential trend reversals.

FOMO may be driving Bitcoin higher, but at what cost?

Bitcoin’s ascent toward $87.5K has ignited a wave of FOMO, with traders rushing in to capitalize on the momentum. This heightened speculation has further increased OI, signaling growing leverage in the market.

While this emotional buying spree could push Bitcoin into uncharted territory, it also raises the risk of a sharp correction if sentiment shifts.

History warns that such leverage-driven rallies are often followed by quick reversals.

If sentiment shifts or leverage unwinds, the same traders driving prices up could quickly find themselves on the wrong side of a rapid correction.

As the rally continues, closely monitoring funding rates and OI shifts will be critical for anticipating potential reversals.