Contents

- Bitcoin’s short-term holders show restraint, reducing selling pressure and signaling potential for stable growth.

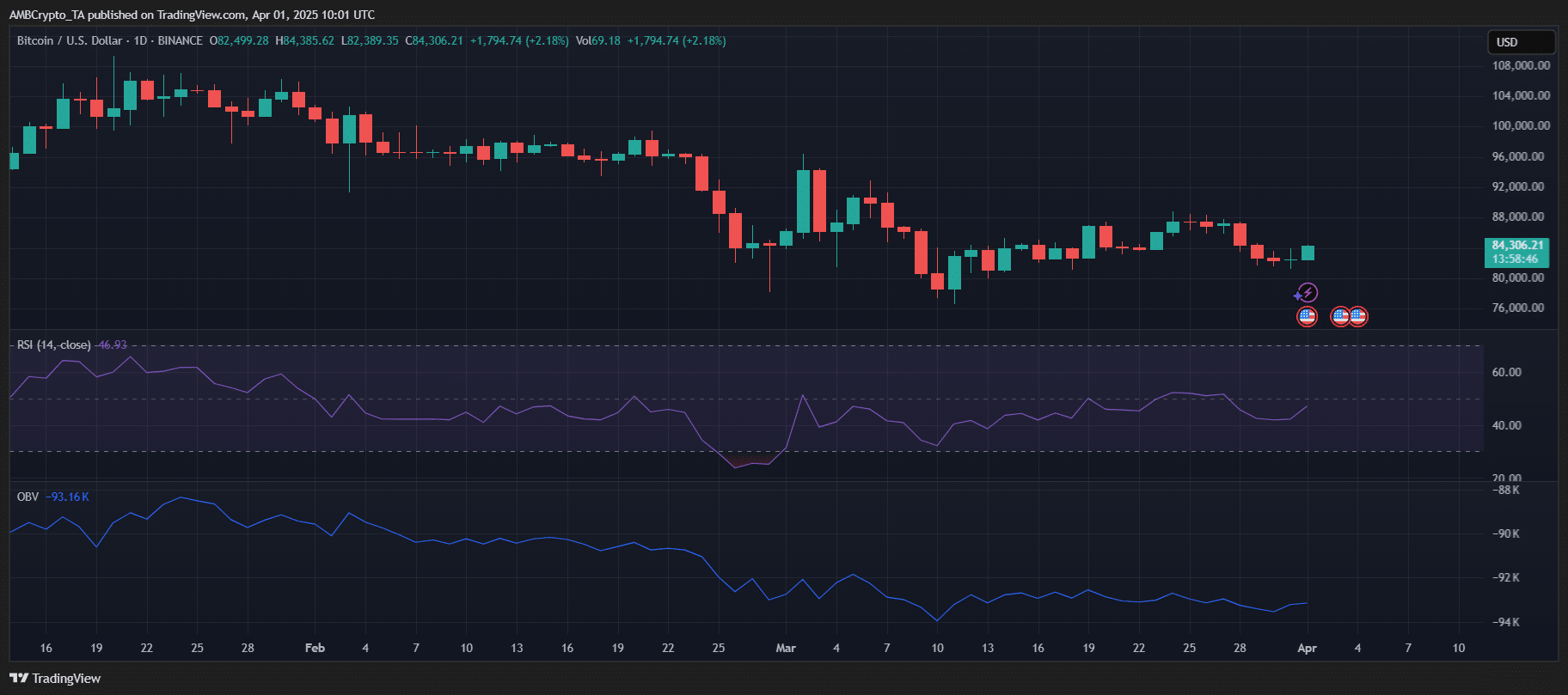

- With less speculative capital, Bitcoin’s market is becoming more resilient, indicating reduced downside volatility.

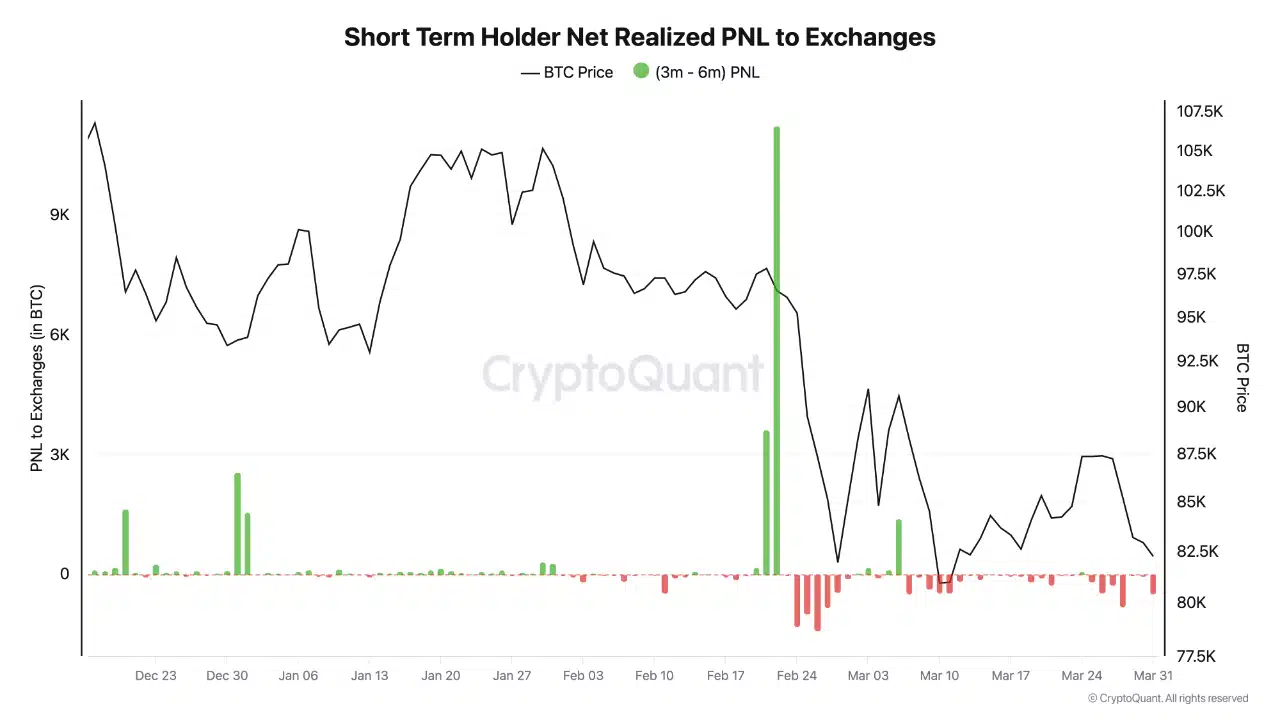

Bitcoin [BTC] is navigating volatile conditions, with a notable shift among short-term holders (STHs), who now control 40% of the network’s wealth.

Despite recent losses, these typically reactive sellers are showing restraint, reducing selling pressure.

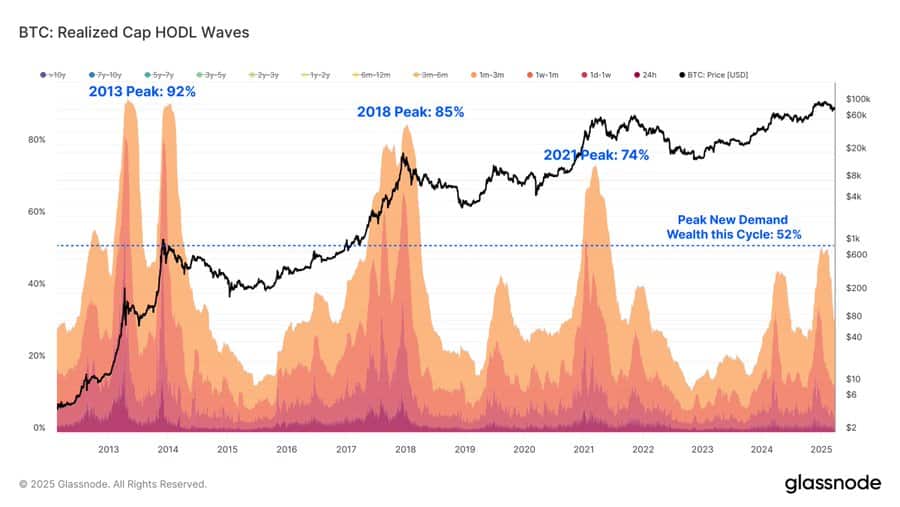

While this is far below past peaks, where new investor wealth reached 70-90%, it signals a more balanced, tempered bull market.

This shift suggests a potential turning point for Bitcoin, with less downside volatility, paving the way for stability and growth.