- Bitcoin Spot ETFs witnessed $900M in outflows, with a total of $5.4B leaving since February.

- BTC’s price declined nearly 12%, hovering around $77,000, reflecting growing uncertainty in institutional sentiment.

Bitcoin [BTC] Spot ETFs have been experiencing a notable decline in inflows, with over $900 million in outflows recorded in the last five weeks. This sharp drop has fueled speculation about whether investor confidence in Bitcoin is beginning to wane.

As institutional investors adjust their portfolios amid economic and regulatory uncertainty, Bitcoin’s price has also been affected, dipping nearly 12% in the past month.

With market sentiment shifting, a closer analysis of Bitcoin Spot ETF flows, and price trends is crucial to understanding where the market is headed.

BTC Spot ETF outflows: A five-week decline

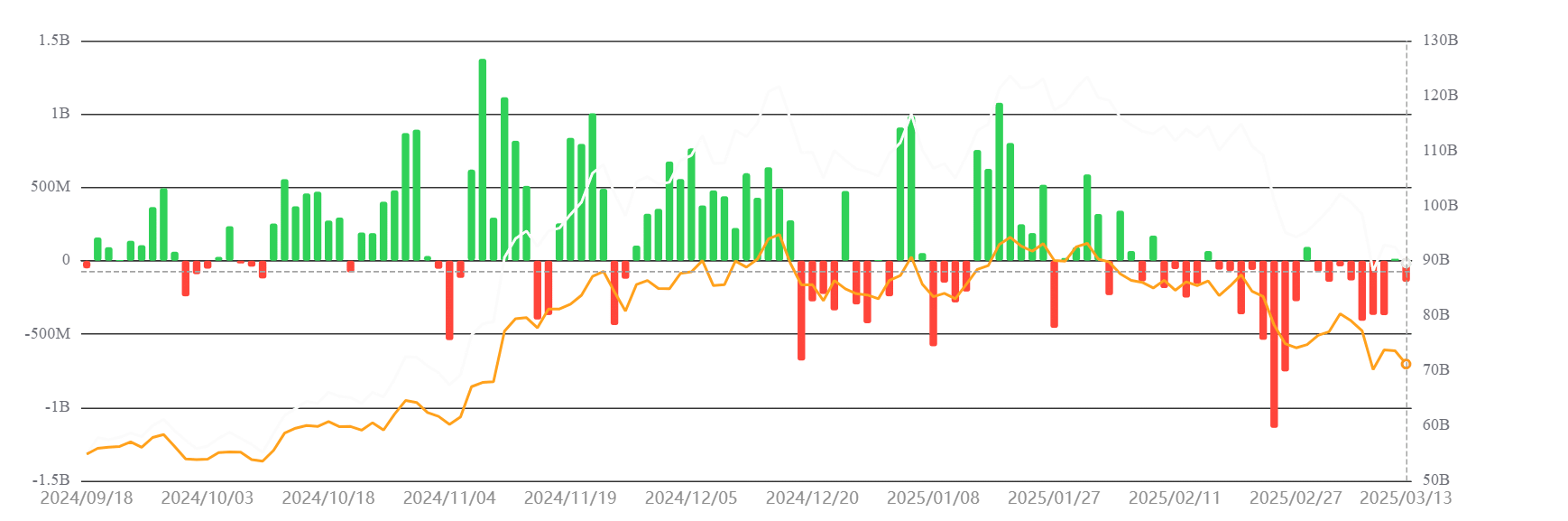

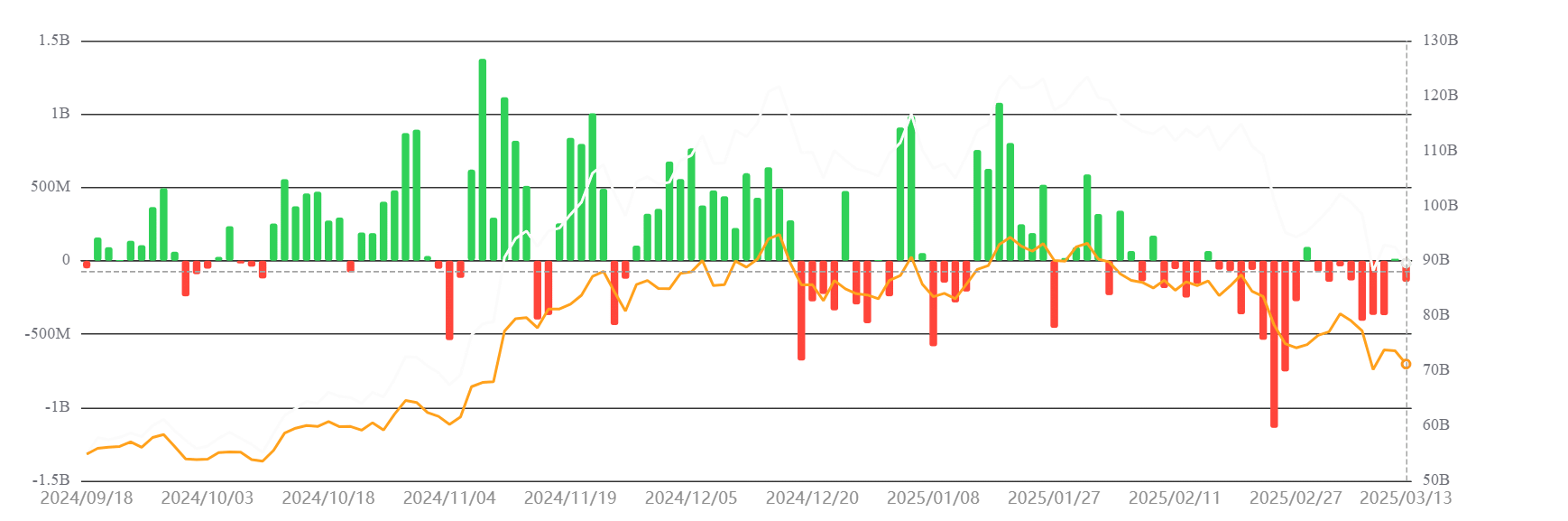

According to recent data from Sosovalue, BTC Spot ETFs have seen sustained outflows, with the latest weekly figures showing a net outflow of $921.4 million.

This marks the fifth consecutive week of declining capital within these funds, bringing the total outflow to approximately $5.4 billion since mid-February.

While BTC Spot ETFs initially saw significant inflows after their approval, recent redemptions suggest a shift in investor sentiment.

Source: Sosovalue

The timing of these outflows has coincided with Bitcoin’s price decline, which has dropped from $84,000 to approximately $77,000.

While broader market factors contribute to Bitcoin’s volatility, the persistent ETF outflows indicate that institutional investors might be more cautious toward Bitcoin allocations in their portfolios.

The role of institutional investors in BTC Spot ETFs

One of the key advantages of BTC Spot ETFs is their ability to attract institutional investors into the cryptocurrency market.

Prominent asset management firms like BlackRock and Fidelity introduced Bitcoin ETFs, offering a regulated investment option that provided Bitcoin exposure without requiring direct ownership. This led to an initial surge in inflows and contributed to Bitcoin reaching an all-time price high.

However, institutional investors often utilize strategic, short-term capital allocation methods. During periods of market uncertainty, they tend to adjust positions swiftly, potentially explaining the current outflows.

Analysts suggest that institutional investors could be redirecting funds to traditional assets or higher-yield opportunities as global financial markets react to inflation concerns and regulatory changes.

Factors influencing the outflows

There are several contributing factors to the recent BTC Spot ETF redemptions. One of the most significant concerns is macroeconomic conditions.

Rising interest rates and inflation fears have led investors to reevaluate their portfolios, often prioritizing lower-risk assets over volatile markets like cryptocurrencies. With traditional markets offering more attractive risk-adjusted returns, Bitcoin Spot ETFs may face increased competition from traditional investment vehicles.

Additionally, Bitcoin’s price volatility plays a role. Historically, large price corrections have triggered sell-offs, and the current price dip may have led some investors to liquidate their BTC holdings to secure profits or minimize losses.

What’s next for BTC Spot ETFs?

Despite the recent outflows, the long-term outlook for BTC Spot ETFs remains positive. The introduction of these funds has already had a positive effect on the cryptocurrency market, and there are indications that institutional adoption will continue to grow.

However, in the short term, investors will closely monitor macroeconomic trends, regulatory developments, and Bitcoin’s ability to reclaim key price levels.

If Bitcoin can stabilize above $80,000, it may regain investor confidence, leading to renewed inflows into BTC Spot ETFs. On the other hand, if outflows persist and Bitcoin struggles to find support, a prolonged period of market uncertainty could follow.