- Bitcoin’s strength was evident as ERC-20 altcoins saw sharp declines, with the sector shedding $234 billion in just 14 days.

- Altcoin markets faced a rare historical devaluation.

Bitcoin [BTC] continued to showcase its resilience amid a broader market downturn, significantly outperforming ERC-20 altcoin sectors over the past week.

The latest data revealed a pronounced decline across multiple subsectors, emphasizing a stark divergence in market performance.

With altcoin valuations experiencing one of their largest devaluations in years, the broader crypto market is facing heightened volatility.

Bitcoin holds firm while altcoins plunge

Despite market-wide weakness, Bitcoin has maintained a stable position, outperforming all ERC-20 altcoin sectors.

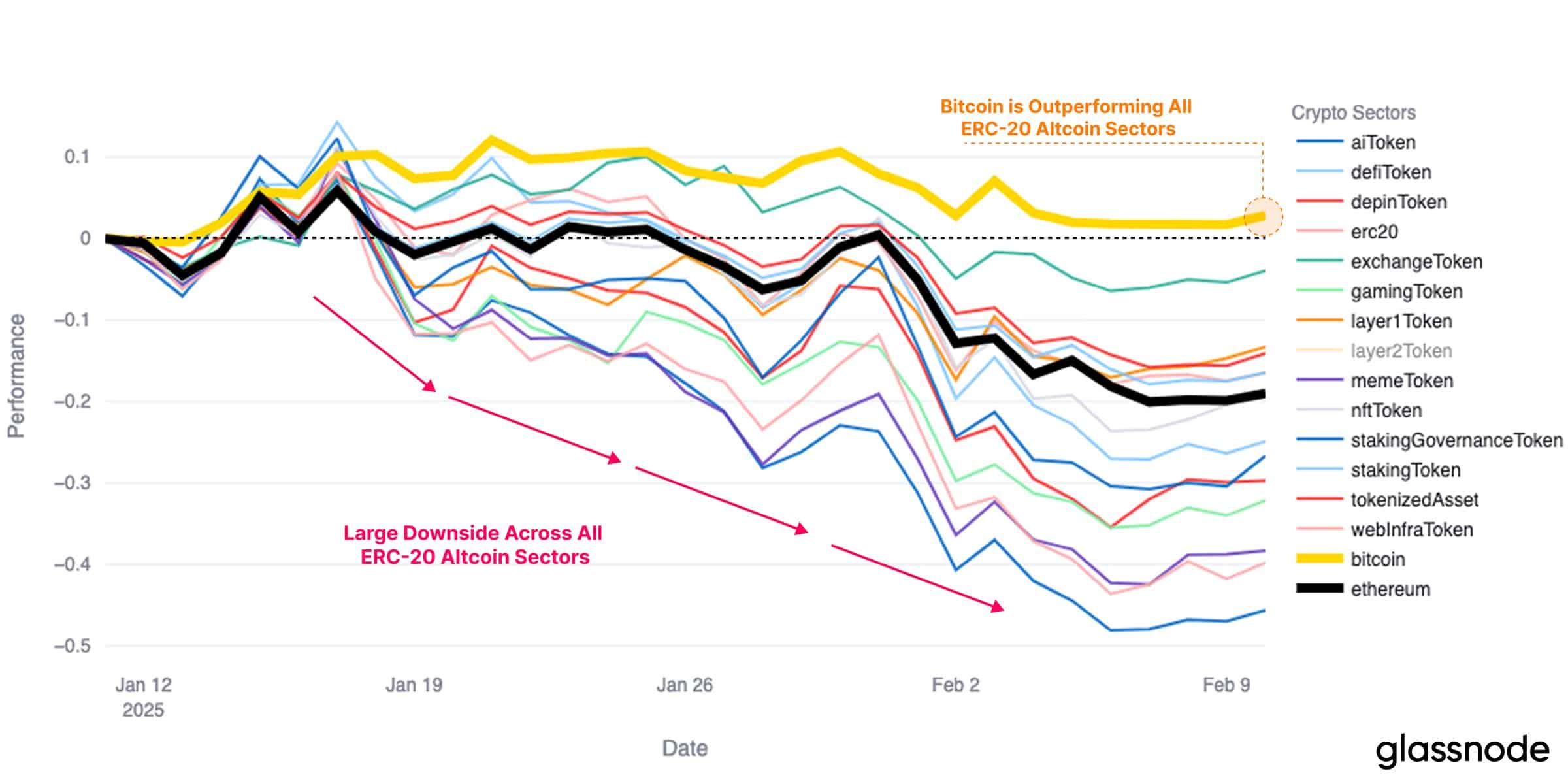

According to Glassnode’s performance chart, Bitcoin [yellow line] has held above the neutral threshold, maintaining relative stability compared to Ethereum [ETH] [black line] and various altcoin categories, which have suffered substantial declines.

Source: Glassnode

A major takeaway from this trend is the extensive downside seen across ERC-20 subsectors, including DeFi tokens, gaming tokens, and meme tokens, all of which have trended downward since mid-January.

The sharp drop suggests waning investor confidence in altcoins, with capital rotation favoring Bitcoin. This shift highlights BTC’s role as a safer asset during uncertain market conditions.

Altcoin market sees one of the largest 14-day devaluations

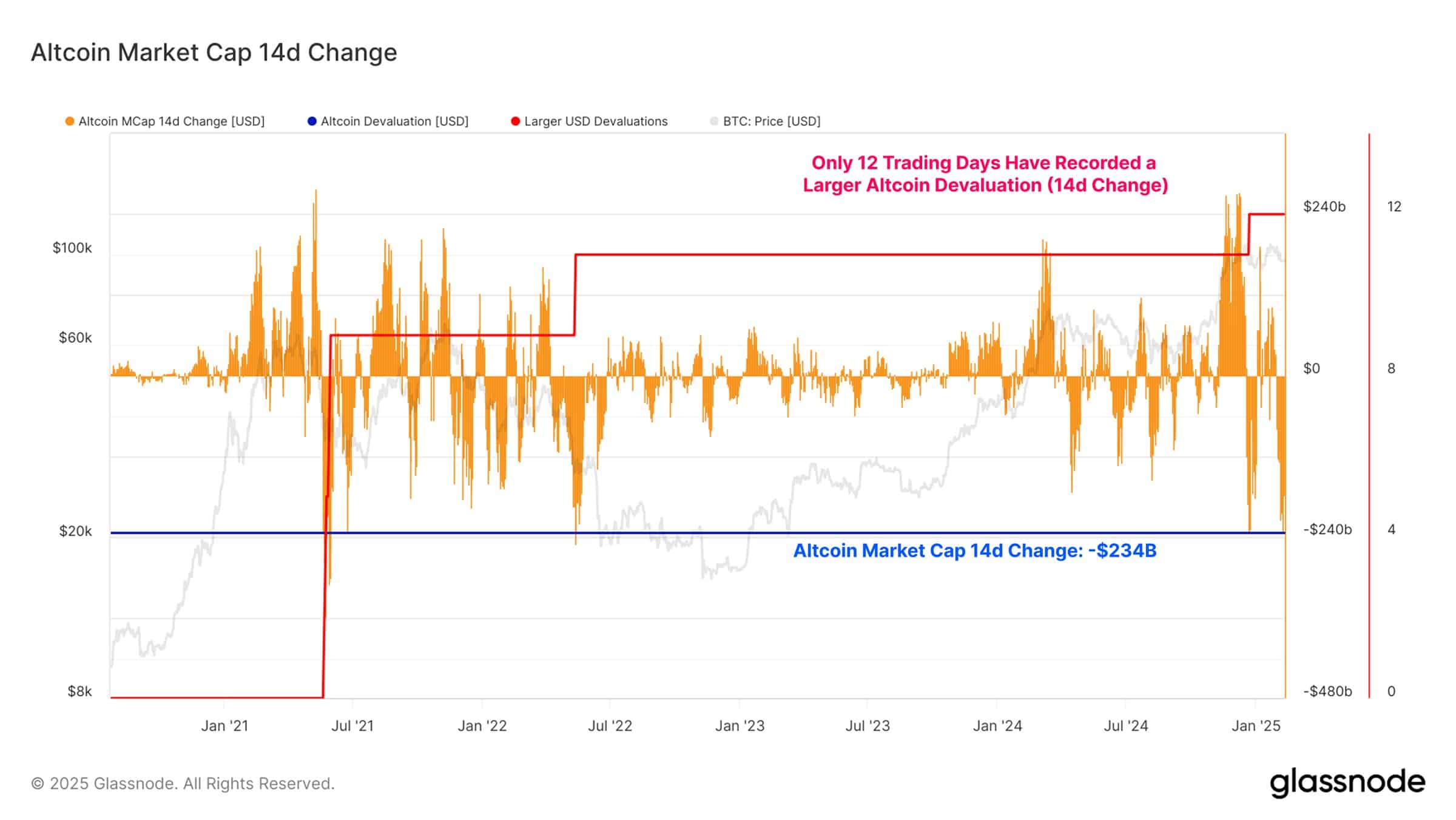

A look at Glassnode’s Altcoin Market Cap 14-Day Change chart reinforced this bearish trend, showing a staggering $234 billion drop in the altcoin market cap within the past two weeks.

Historically, such significant declines have been rare, with only 12 previous trading days witnessing a larger altcoin devaluation.

This level of drawdown suggests that risk appetite in the altcoin space has diminished sharply, with traders offloading positions aggressively.

Source: Glassnode

Notably, these kinds of sharp corrections often coincide with major structural shifts in market sentiment.

If altcoins continue to underperform while Bitcoin holds steady, further capital flight into BTC could solidify its dominance, potentially delaying any broad recovery in the altcoin market.

What this means for the market

The ongoing divergence between Bitcoin and altcoins suggests that investors are positioning themselves defensively, preferring BTC as a more stable asset.

Historically, similar periods of altcoin underperformance have preceded Bitcoin-led market rallies, where capital first consolidates in BTC before later rotating into riskier assets.

However, one crucial factor to watch is whether Bitcoin can sustain its strength amid growing macroeconomic uncertainty. If BTC begins to weaken, the broader crypto market could face further downside pressure.

Alternatively, if Bitcoin stabilizes and starts another leg up, it could trigger renewed speculative interest in altcoins.