- Bitcoin is edging closer to a high-stakes showdown. A massive $332 million short at 40x leverage is on the line.

- Is a liquidation-fueled squeeze incoming?

While the market takes a breather, one trader placed a highly leveraged 40x short on Bitcoin [BTC]. The trader has risked an entire $8.3 million account to open a $332 million position.

Currently, the short is sitting on an unrealized loss of $1.3 million, with a liquidation price set at $85,290. With Bitcoin trading near $83,245, the position hangs in a delicate balance.

If Bitcoin pushes higher, a short squeeze could fuel a breakout. But if bears defend resistance, a sharp pullback could follow. However, the battle won’t be easy.

Crossing this range puts 699.2K BTC in focus, as profit-taking pressure builds. A key stakeholder pool that bought BTC at a peak of $86,391 could be ready to cash in.

Source: IntoTheBlock

For bulls to take control, this sell-side liquidity must be absorbed by strong demand. Unlike Bitcoin’s drop to $78K – where 46k BTC flowed out, signaling strong spot demand – its $84k price level saw no such capital influx.

This raises concerns about buyer strength, especially with Short-Term Holder Net Unrealized Profit/Loss (STH-NUPL) still in the capitulation zone, meaning many short-term holders remain underwater.

If BTC hits $85K–$86K, profit-taking could intensify, leading some holders to capitulate and break even rather than HODL, increasing sell pressure and risking a long squeeze.

With supply likely to outweigh demand, this trader has positioned the short around a critical resistance zone. If bears hold their ground, a pullback to $81K looks increasingly probable.

Volatility in Bitcoin derivatives market

Despite weak demand, Open Interest (OI) surged by $2 billion in just two days, signaling aggressive positioning in Bitcoin derivatives.

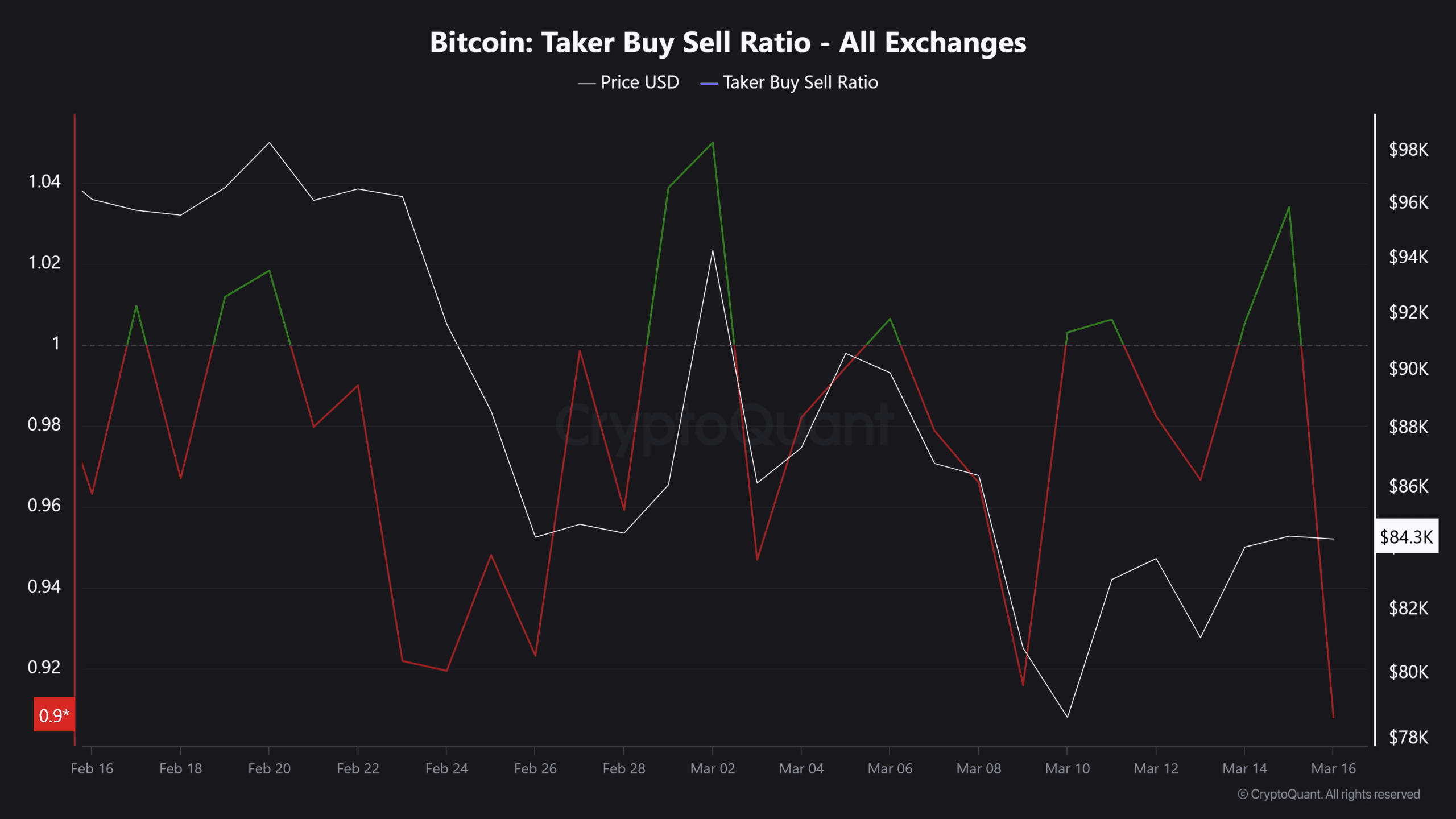

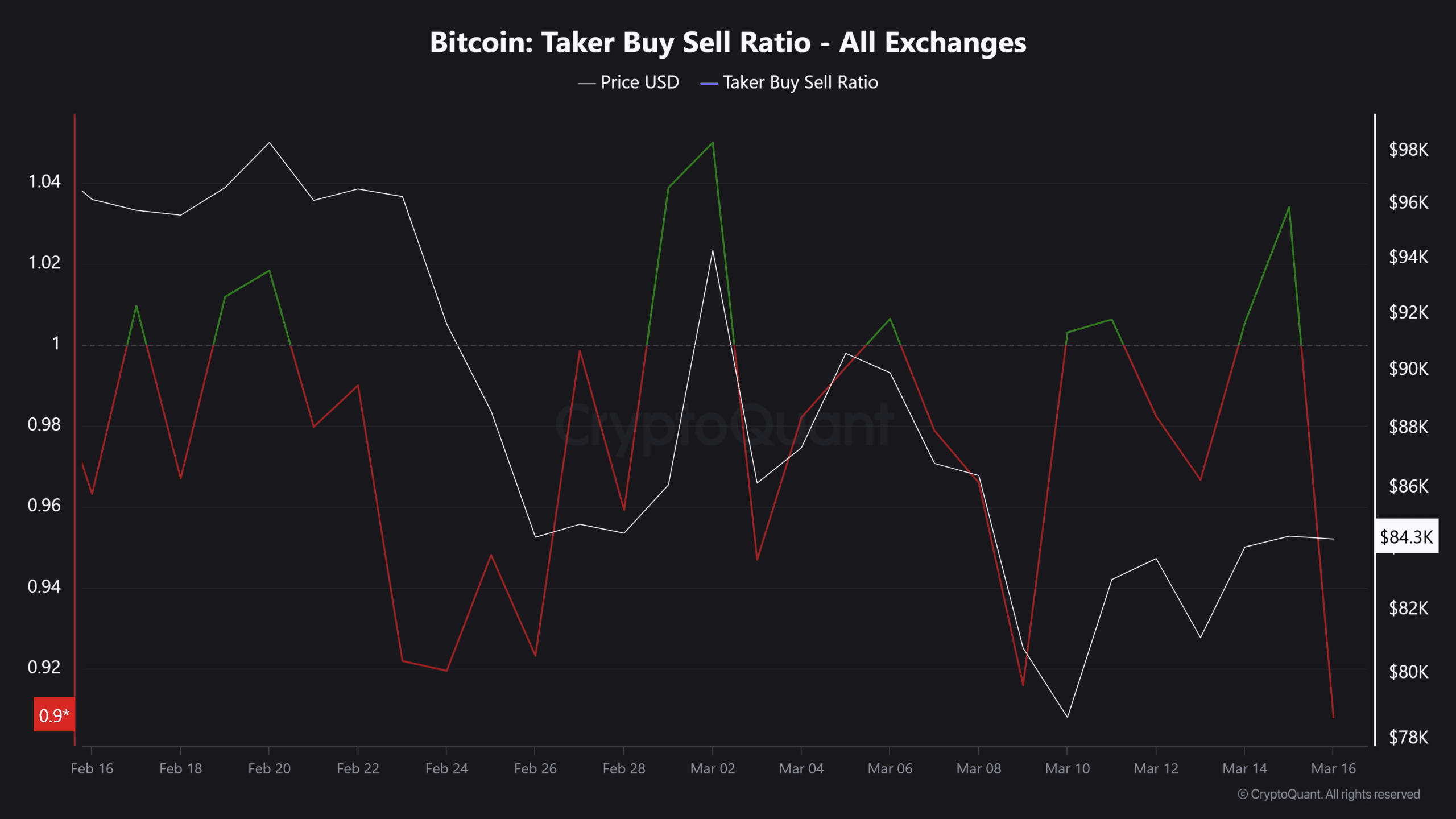

However, with the Taker Buy/Sell Ratio still below 1, sell-side liquidity continues to dominate in perpetual markets.

Source: CryptoQuant

This suggests traders are front-running a potential reversal, with many positioning for profit-taking. If momentum weakens, a wave of OI liquidations or closures could amplify volatility in the days ahead.

To trigger a short squeeze on the $332M short position and break the $85K–$86K resistance, strong spot and futures demand is needed.

However, with taker buy/sell ratio still below 1, sell-side dominance signals bearish control.

If market conditions shift, a short squeeze could propel Bitcoin higher. Otherwise, a pullback to $80K–$81K remains a strong possibility.