- Sentiment across the crypto sphere has been bearish and fearful, but the crowd isn’t always right

- Short-term indicators remain bearish, but an uptick in accumulation is encouraging

Bitcoin [BTC] was trading at $94.5k at press time. It had faced its third rejection in a month at or above the $100k zone on Tuesday, 07 January. Hence, market participants were fearful and speculated if this dip would send BTC into a full fledged downtrend and usher in the next bear market.

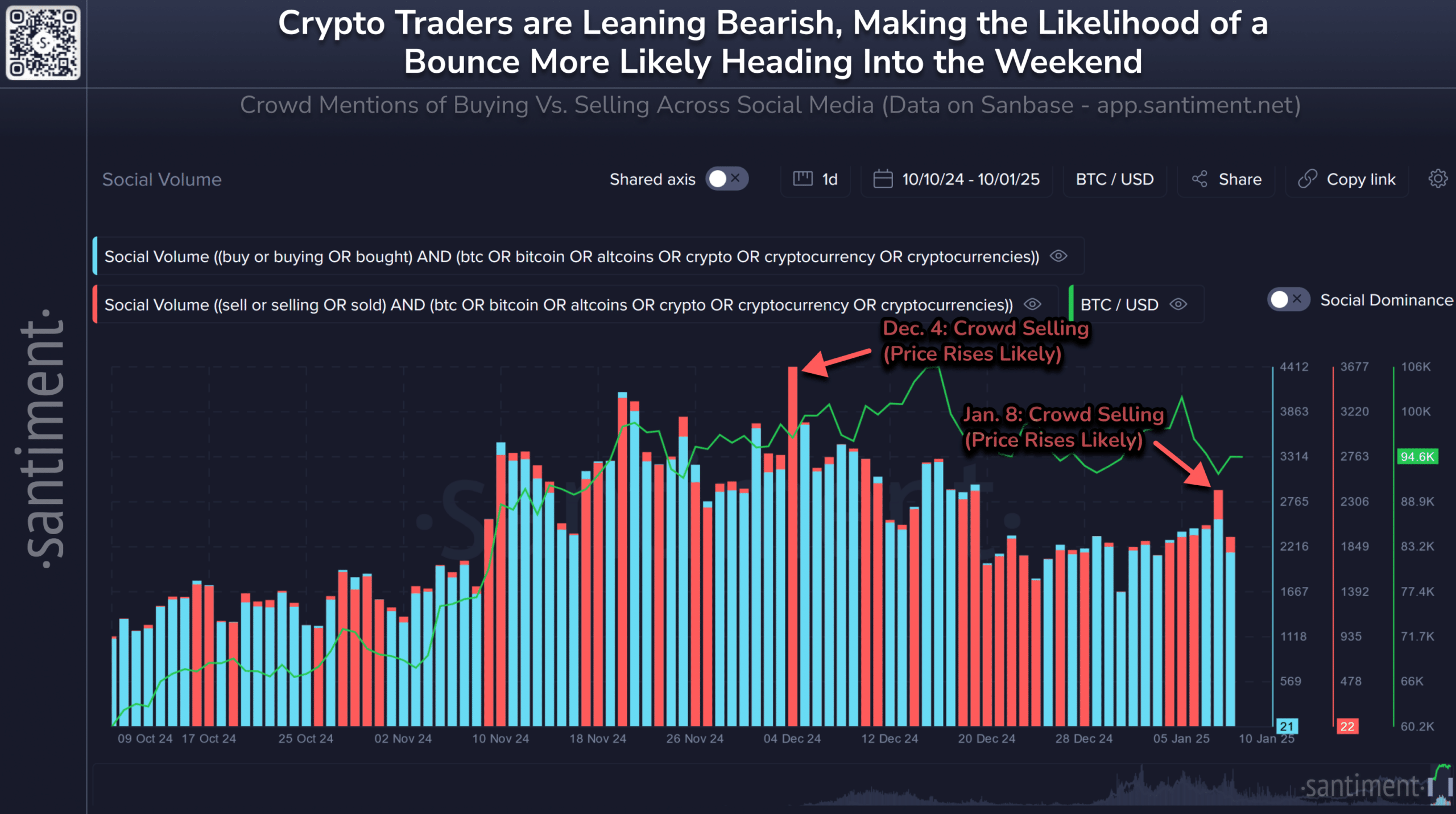

Source: Santiment Insights

The social volume metric from a Santiment Insights post revealed that crowd selling social volume was noticeably stronger on 08 January. The last time this happened was on 04 December. Back then, the price rebounded higher, eventually hitting the $108.3k all-time high.

The 8% slump since Tuesday means fear has been prevalent in the market. A liquidity sweep below $92k could spark a recovery, as could a “Trump pump” post inauguration. The dollar index [DXY] has trended higher over the past month, helping explain the bulls’ woes.

Bitcoin traders – Buy the fear, sell the greed

The common adage, so often repeated it sometimes has listeners roll their eyes before the phrase is completed, does hold true sometimes. Context is also important and, on-chain metrics for Bitcoin do not yet signal a market top is in.

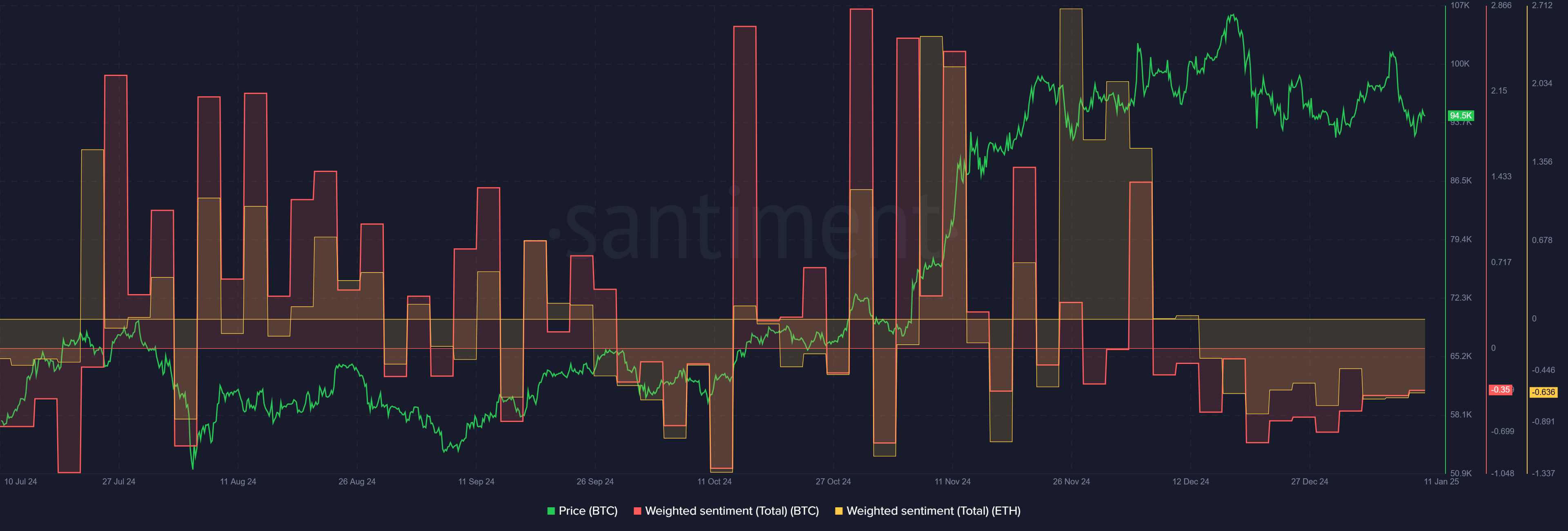

The weighted sentiment for BTC and ETH were compared side-by-side. The comparison showed that both sets of traders and investors had a bearish outlook on the market since the price drop on 19 December. Neither asset has recovered on the price front so far.

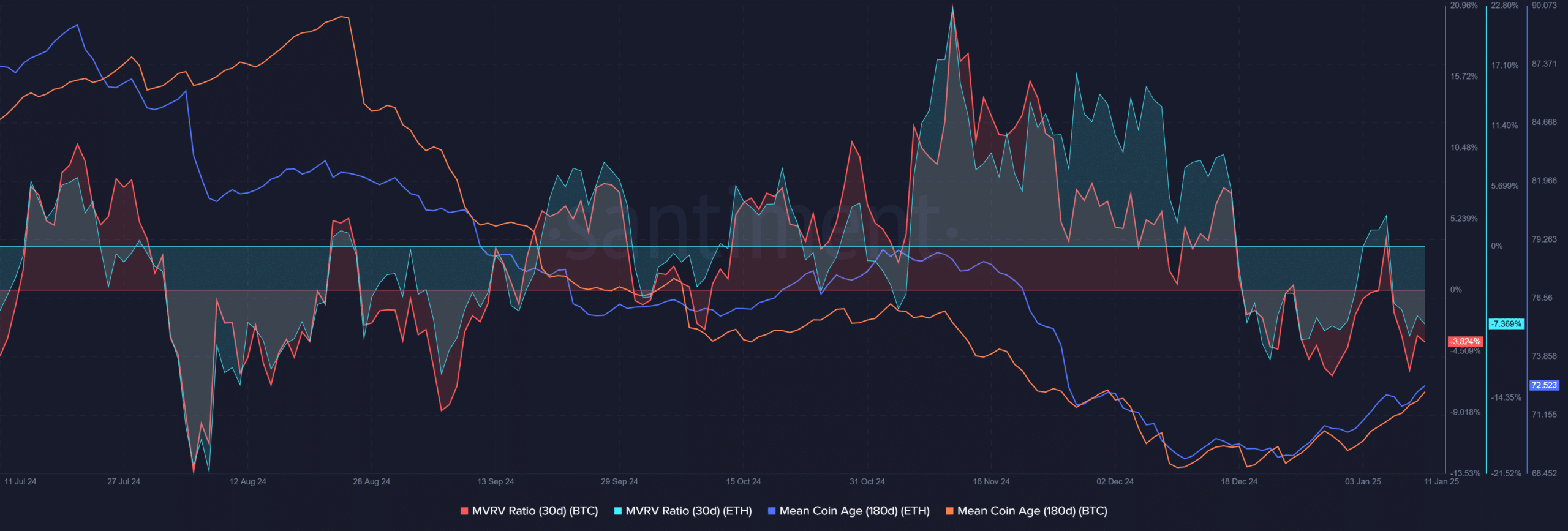

The 30-day MVRV ratios for both leading crypto assets were also negative. This suggested that BTC and ETH short-term holders (STHs) were at a loss. Interestingly, the 180-day mean coin age for both assets began to trend higher over the last three weeks.

This was a signal to buy the dip. Increased accumulation and STHs at a loss alluded to lowered imminent sell pressure, and heightened chances of a recovery.

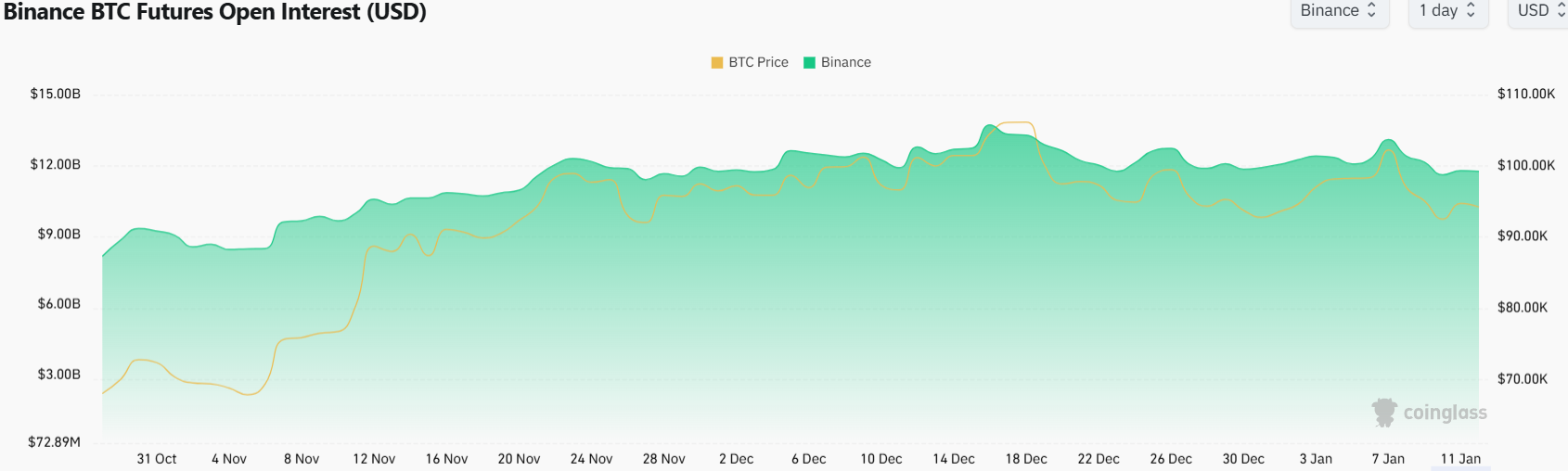

The Open Interest had been trending higher from the start of November to mid-December. Since then, however, there has been a slight drop. The OI has fallen from $13.7 billion on 16 December to $11.72 billion, at the time of writing.

Is your portfolio green? Check the Bitcoin Profit Calculator

This OI drop is another sign that speculative interest has been waning, underlining short-term bearish expectations. By the time these short-term indicators turn around and flash positive signs, the price of Bitcoin might already have initiated its recovery.

Traders must weigh risk against opportunity and decide if they want to enter above the $92k support.