- Bitcoin whales are making massive moves, including a $200M BTC purchase and an 8-year dormancy return

- Whale position sentiment signals potential bearish outlook, suggesting a possible Bitcoin price correction ahead

Bitcoin [BTC] whales are stirring the market once again, with dormant wallets reawakening and massive transactions reshaping on-chain dynamics.

One whale recently accumulated $200 million in BTC, while another, inactive for eight years, moved over $250 million worth of Bitcoin.

As BTC’s price rebounds, whale sentiment appears divided — some doubling down on accumulation, others signaling potential short positions.

The result? A market filled with uncertainty, where every major move could dictate the next trend.

A $200 million Bitcoin accumulation spree

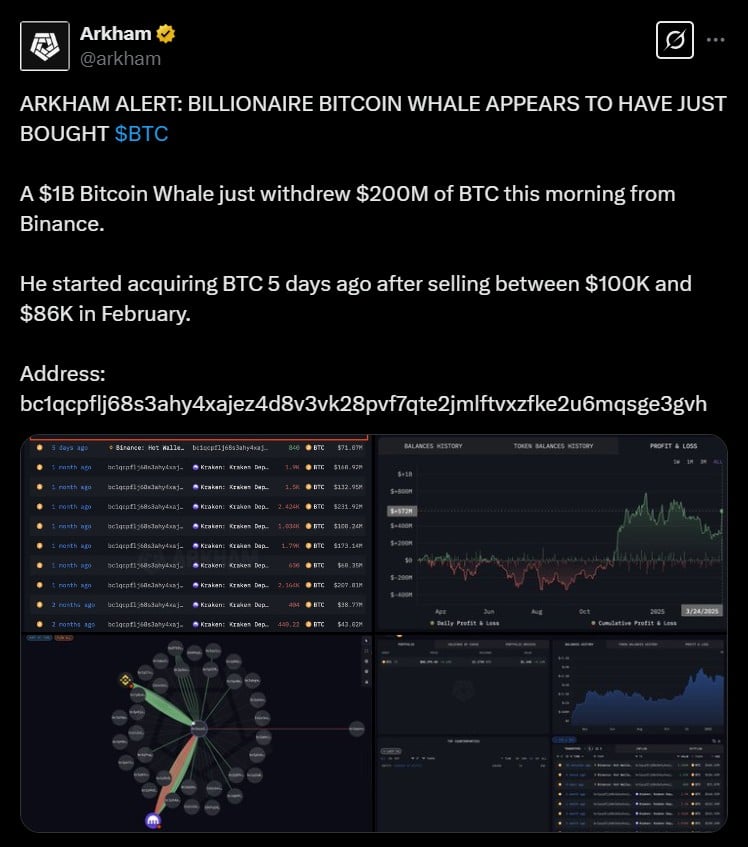

One of the most significant whale moves in recent weeks came on March 24, when a Bitcoin whale withdrew 2,400 BTC — worth over $200 million — from Binance, according to blockchain analytics firm Arkham Intelligence.

This purchase follows months of strategic selling, during which the whale offloaded 11,400 BTC before re-entering the market.

Source: X

Despite trimming its holdings in February, when Bitcoin fluctuated between $100,000 and $86,000, the whale has now increased its position to over 15,000 BTC, valued at approximately $1.3 billion.

The timing of this accumulation aligns with Bitcoin’s price rebound, which has seen BTC trading between $81,000 and $88,000 over the past week.

An eight-year dormant whale resurfaces

While some whales are actively accumulating, others are resurfacing after years of dormancy.

On the 22nd of March, an address that had remained untouched for over eight years suddenly moved 3,000 BTC — worth approximately $250 million — in a single transaction.

Source: X

Arkham Intelligence noted that the whale initially acquired its BTC stack when it was worth just $3 million in early 2017, making this an astronomical gain.

Is this an early sign of long-term holders cashing out, or does it signal a shift in whale strategy? Either way, the return of dormant wallets adds another layer of intrigue to an already volatile Bitcoin market.

Whales betting against Bitcoin at $88K?

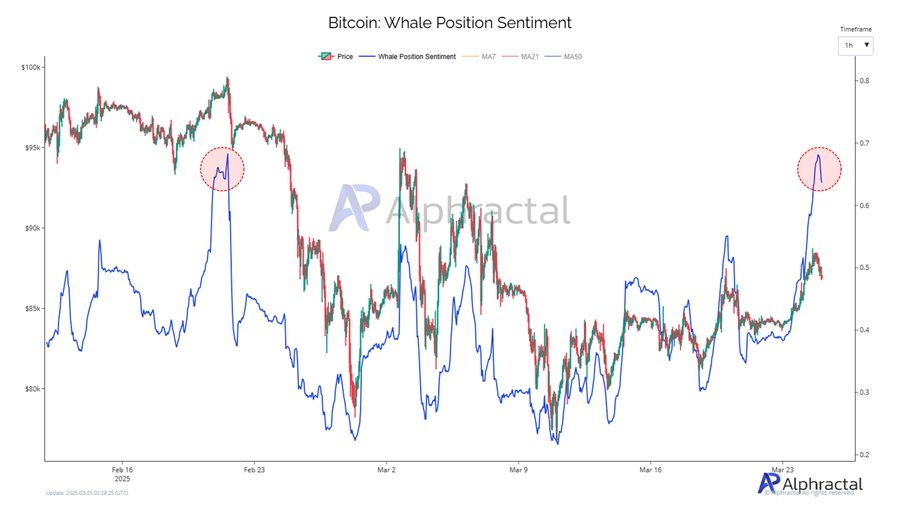

The latest whale position sentiment data reveals that large holders may be shifting bearish despite Bitcoin’s recent rebound.

The metric shows a sharp decline after peaking — historically a sign that whales are entering short positions.

Source: Alphractal

A similar pattern emerged in February when sentiment dropped despite BTC pushing toward $95K, leading to a steep correction.

With Bitcoin around $88K, a drop in sentiment suggests whales may be preparing for a downturn. If history repeats, volatility could follow.

While BTC remains resilient, further declines in whale sentiment may signal an impending correction.