- Bitcoin whales cashed out $800 million, signaling a potential shift in market sentiment.

- Key support levels and declining indicators point to possible Bitcoin price correction.

Bitcoin whales have recently cashed out nearly $800 million in profits, marking a substantial shift in market activity.

At press time, Bitcoin [BTC] was trading at $96,153.51, reflecting a 2.07% decrease in the last 24 hours.

This significant profit realization coincides with a noticeable price increase, prompting speculation about market sentiment.

The surge in profit-taking by long-term holders raises important questions about the possibility of a price pullback or the beginning of a new market phase.

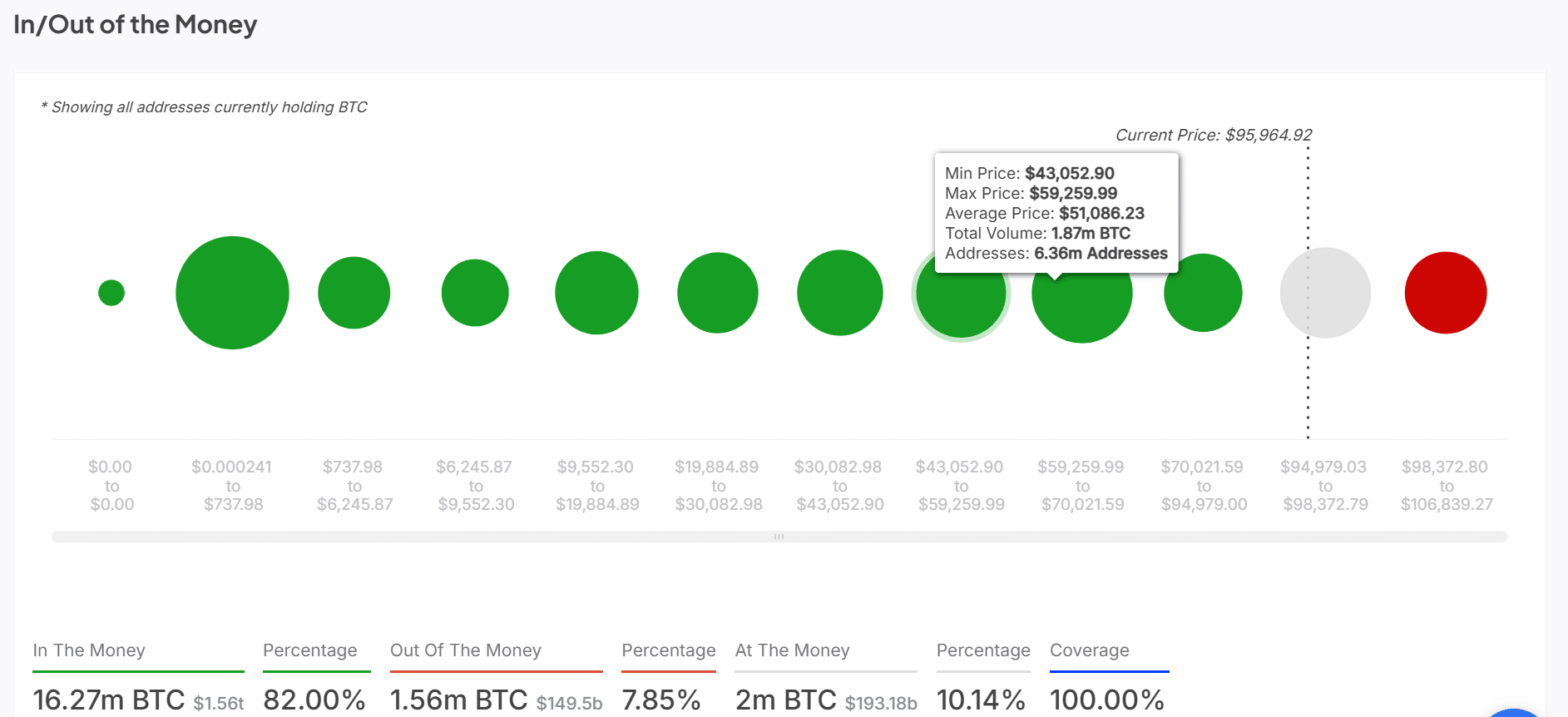

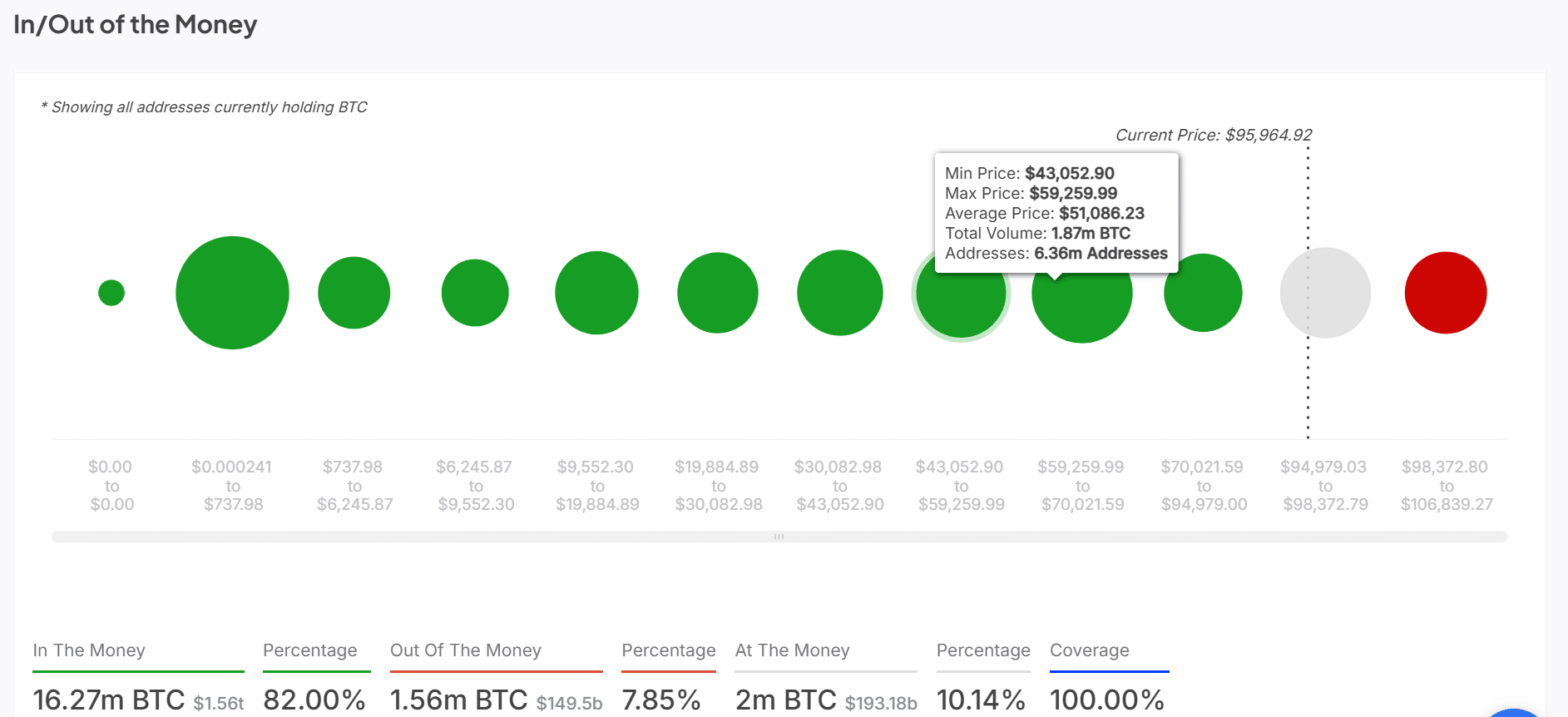

BTC in/out of the money: Are most holders in profit?

Bitcoin’s in/out of the money analysis shows that 82% of Bitcoin addresses are currently in profit, with the average price for these holders at $51,086.23. This large percentage of profitable holders indicates widespread optimism among Bitcoin investors.

However, there are still 7.85% of addresses out of the money, meaning a portion of holders may experience losses if the price continues to drop.

As more addresses become profitable, the likelihood of increased selling pressure grows, possibly influencing the overall price trend.

Source: IntoTheBlock

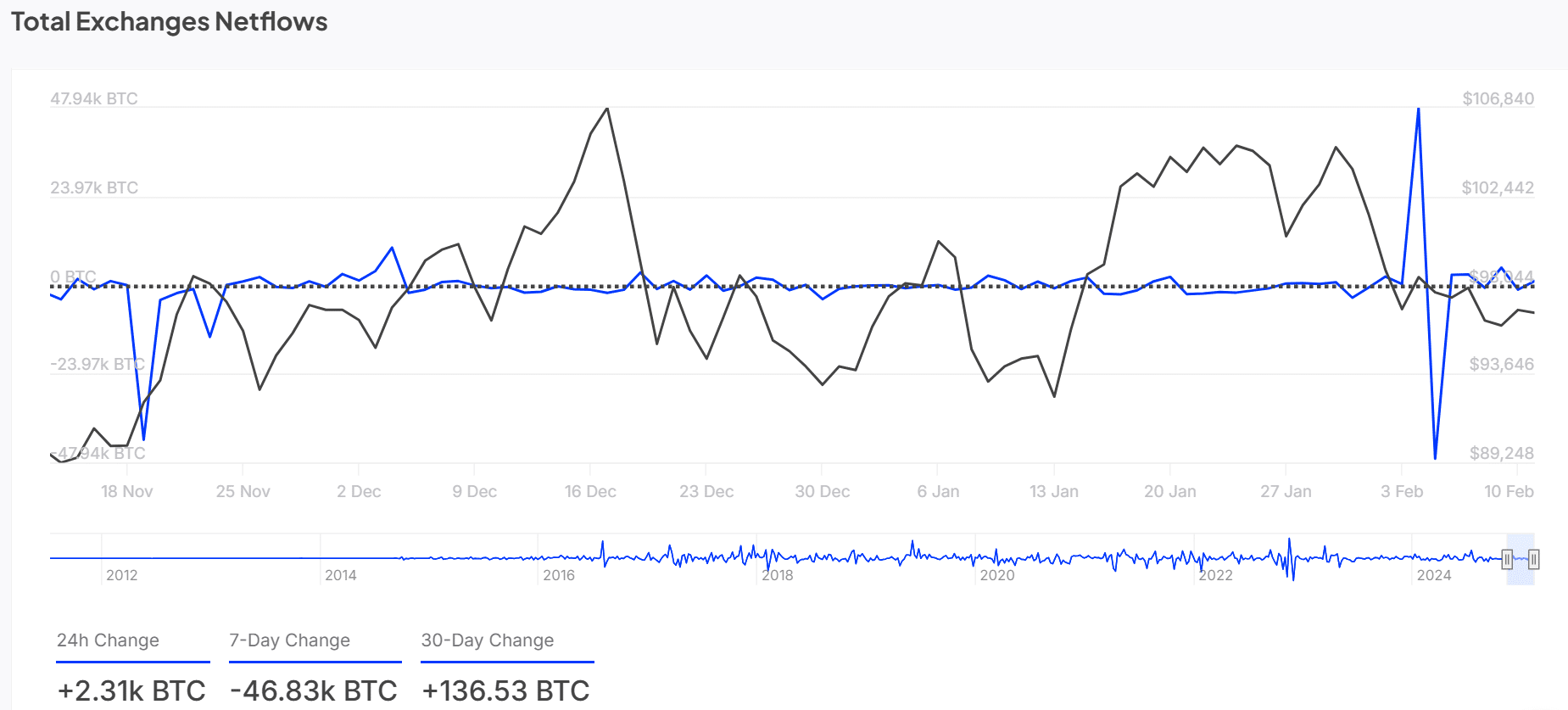

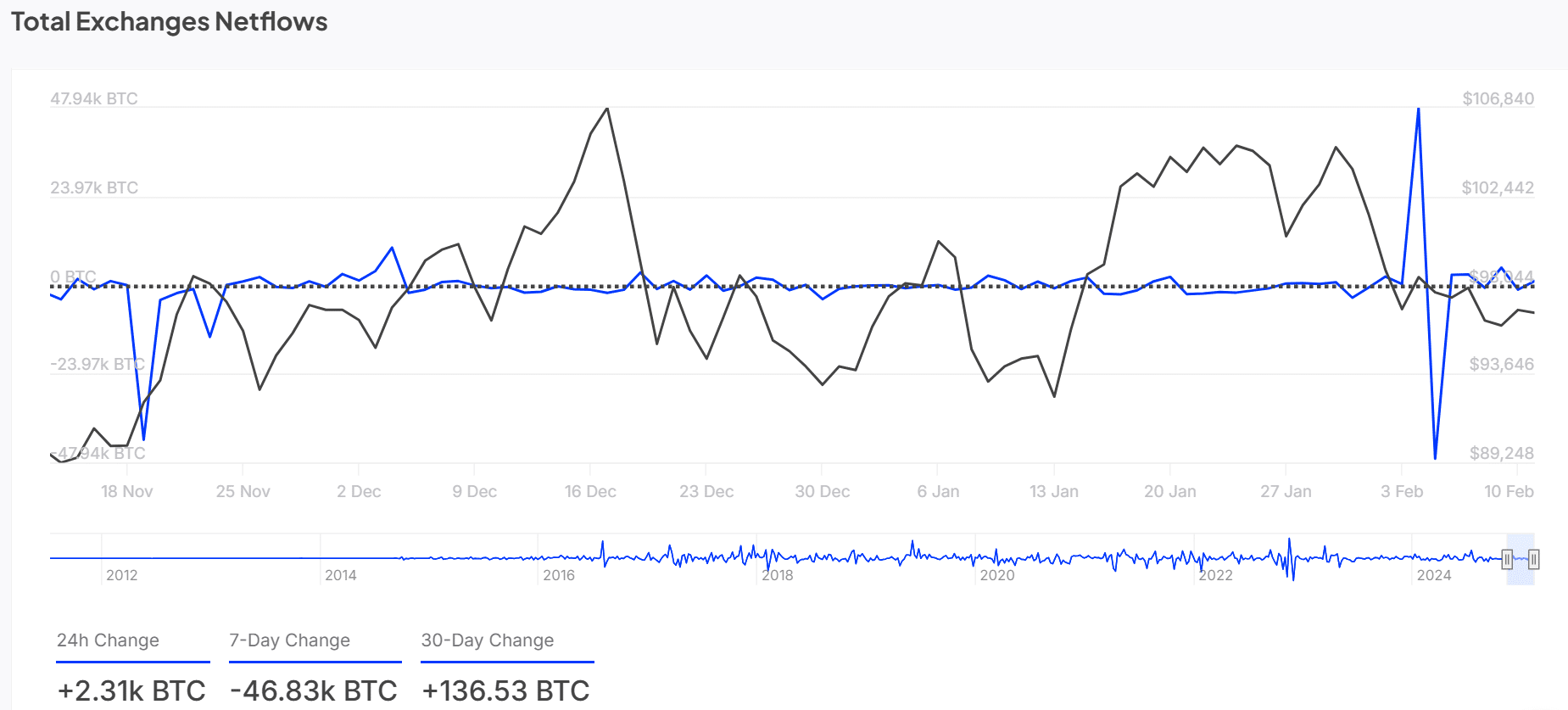

Total exchange netflows: Are traders preparing for more volatility?

Bitcoin has experienced a 24-hour netflow increase of +2.31k BTC, indicating more Bitcoin entering exchanges, possibly in anticipation of selling activity.

Over the last thirty days, netflows have surged by +136.53k BTC, signaling substantial liquidity in the market. This inflow may suggest traders are preparing for potential volatility.

However, it could also indicate a bullish outlook if prices break through key resistance levels.

Source: IntoTheBlock

Testing key support and resistance levels

The Bitcoin chart reveals that BTC is consolidating within a key price range. Support is found at $92,450.82, while resistance levels are seen at $101,441.81 and $109,260.07. These price zones are critical for determining Bitcoin’s next move.

If Bitcoin can break through these resistance levels, it may continue its bullish momentum.

However, any failure to surpass these key levels could lead to a consolidation phase or a potential price correction.

Source: TradingView

Stock-to-Flow ratio and NVT golden cross: Bearish indicators?

Bitcoin’s Stock-to-Flow Ratio stood at 1.2686M, reflecting a 20% decrease over the past 24 hours, according to CryptoQuant. This decline suggests a reduction in BTC’s scarcity, which may impact its long-term value.

Similarly, the NVT Golden Cross has decreased by 29.22% over the past 24 hours, potentially signaling a market top or an impending correction.

These factors indicate that Bitcoin may face pressure in the short term, as the diminishing scarcity and declining transaction volume suggest a slowdown in demand.

Source: CryptoQuant

Conclusion: What’s next for BTC?

Bitcoin’s market activity shows mixed signals, with whales cashing out. In/out of the money figures indicate potential selling pressure. Key technical indicators point to both bullish and bearish possibilities.

The analysis suggests that Bitcoin may face challenges in breaking through resistance levels, while reduced scarcity and declining NVT figures raise concerns about price sustainability.

Therefore, a pullback in Bitcoin’s price seems likely soon as market dynamics shift.