- U.S authorities hold 187,236 BTC, raising concerns about government influence on Bitcoin’s future

- Trump’s crypto summit failed to deliver, leaving Bitcoin’s market sentiment uncertain and volatile

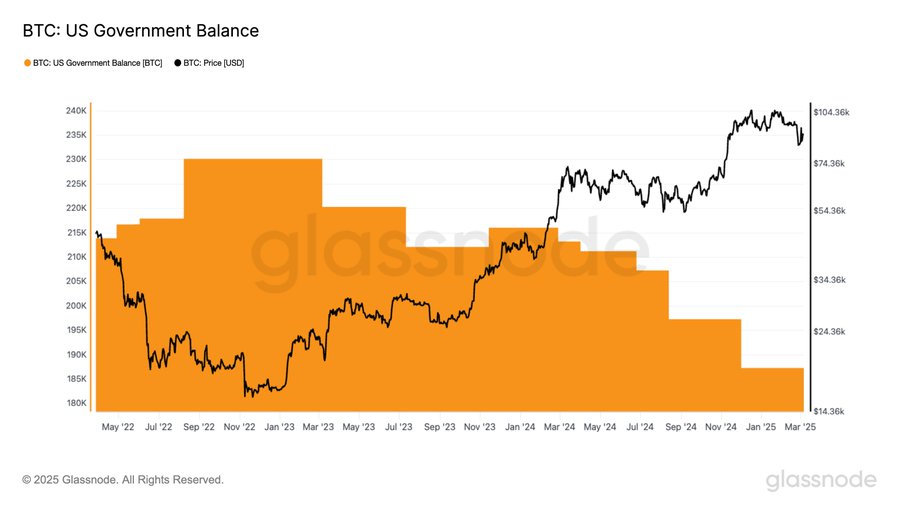

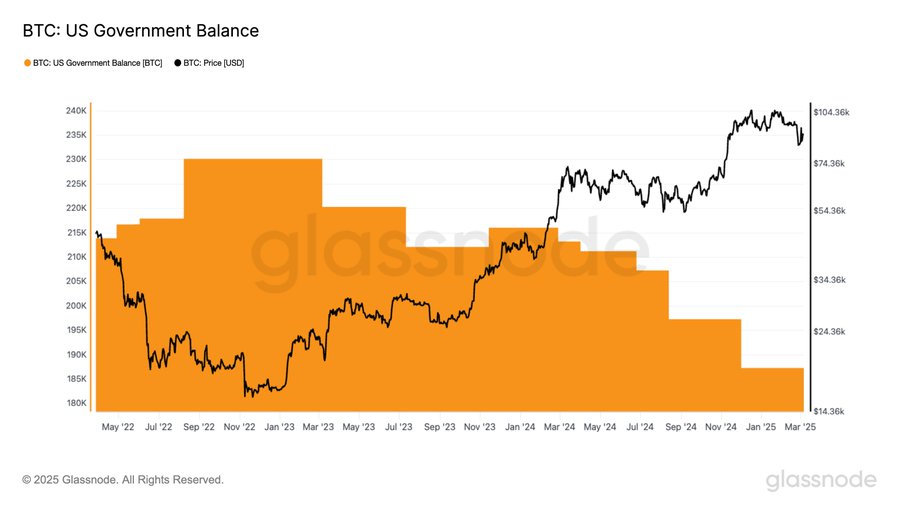

U.S authorities now hold 187,236 BTC, reigniting concerns over government influence in the crypto space. These holdings, largely acquired through asset seizures, have historically contributed to market volatility whenever liquidated. At the same time, Bitcoin’s price dipped following President Trump’s much-hyped crypto summit, which critics say was heavy on praise but light on substance.

In fact, some believe the event signaled a shift away from crypto’s anti-establishment ethos, as industry figures looked to Trump for regulatory relief.

Together, these developments pose fundamental questions about Bitcoin’s future: How will government-controlled BTC affect the market? And is the crypto industry abandoning its core principles in pursuit of political favor?

U.S authorities’ Bitcoin holdings – A market-moving force?

Source: Glassnode

Despite liquidations, however, the government remains a major BTC holder, raising concerns about its growing influence over an asset designed for decentralization. If liquidation strategies shift or reserves are used in policy decisions, the market could face significant disruption.

Trump’s much-anticipated crypto summit was expected to address these concerns. Instead, it left the industry questioning its priorities.

Trump’s crypto summit – What went wrong?

The White House Crypto Summit was hyped as a defining moment for the industry, but it left many disappointed. Instead of substantive policy announcements, the event was filled with vague promises and effusive praise for Trump.

“That was the most embarrassing thing I’ve ever witnessed,” said NFT trader Clemente. “Is everyone just worshipping Trump now?”

Trump briefly mentioned plans for a Crypto Reserve, floated the idea of a FIFA token, and delayed the timeline for crypto-friendly regulation. While some industry leaders backed his position against federal regulators, others saw the event as a troubling shift. Clemente added,

“He has no idea what he’s reading off of, he’s just riffing on what David Sacks wrote him. We used to be cypherpunks, we used to be anti-government, now we [just] want the price to go up.”

The backlash was swift. Economist Peter Schiff called the summit “a disgrace” and “a blight on whatever legacy Trump leaves.”

Meanwhile, Coinbase CEO Brian Armstrong took a different stance, announcing plans to hire 1,000 U.S employees this year, crediting Trump’s leadership for the decision.

The event has deepened divisions in the crypto space. Some see Trump as the industry’s best chance at regulatory relief, while others worry about the political capture of a movement built on decentralization.

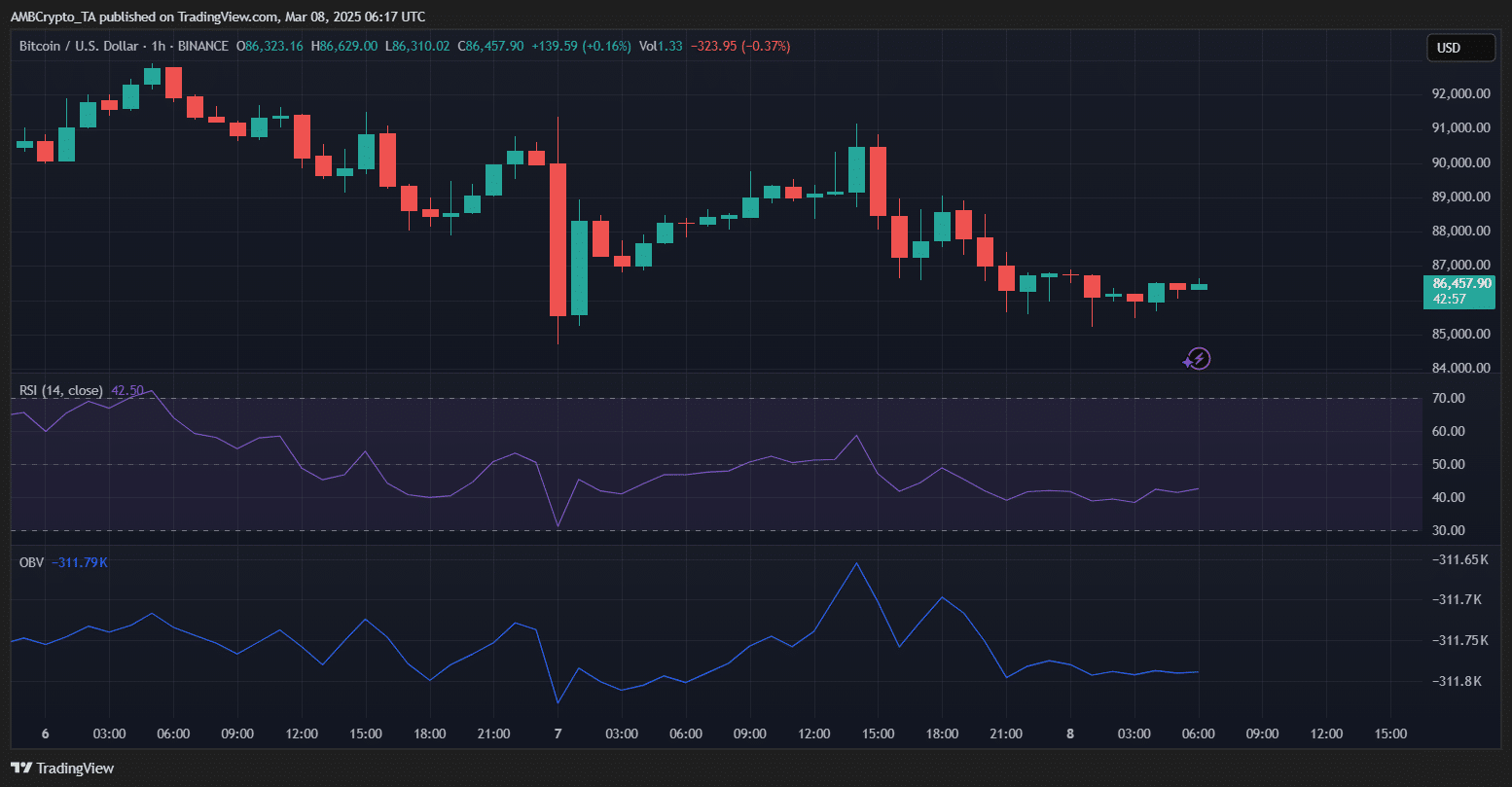

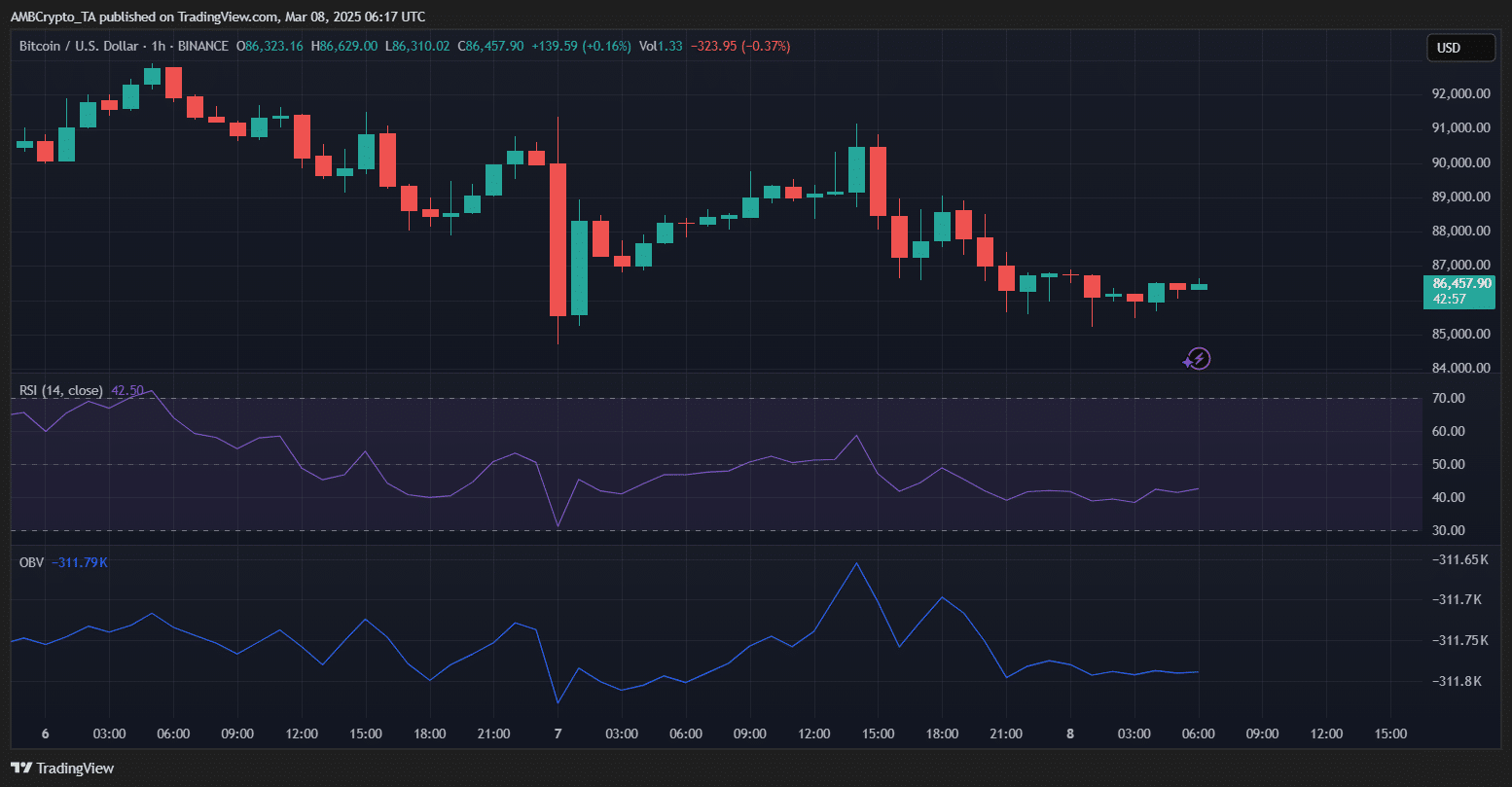

Bitcoin Price Analysis – Post-Summit dip signals uncertainty

Bitcoin’s reaction to the summit has been lackluster, with BTC slipping to $86,457 at the time of writing. The RSI sat at 42.50, reflecting weak momentum and a lack of strong buying pressure.

The OBV remained negative, indicating declining demand across the board.

Source: TradingView

Despite initial hopes that Trump’s pro-crypto rhetoric would spark a rally, the market reaction hinted at disappointment. Traders were positioned for bullish news, but with no concrete policy changes, sentiment cooled down.

For now, Bitcoin is holding near $86K. A resurgence in buying pressure could push BTC back towards $88k. However, if the current trend continues, a drop to $84k will be on the table. The government’s BTC holdings add an extra layer of uncertainty – Should another round of liquidations occur, volatility could spike again.