- BTC dropped by 0.88% as it remained stuck within a consolidation range.

- The market price is yet to reach the bottom, as indicated by the Long/Short Ratio.

Over the past week, the wider crypto market has experienced heightened volatility. As such, both altcoins and Bitcoin have experienced high price fluctuations. In fact, over this period, Bitcoin’s[BTC] has continued to trade sideways, consolidating between $94k and $100k.

Therefore, the prevailing market conditions have left key stakeholders wondering if the crypto market has reached the bottom.

Why the market’s bottom is not yet…

In their analysis, Alphractal suggested the market price bottom has not yet been reached, citing a Long/Short Ratio crossover.

Historically, market price bottoms occur when Bitcoin’s Long/Short ratio crosses the Average Long/Short Ratio of altcoins.

Source: Alphractal

When such a crossover occurs, it suggests that investors are more confident with Bitcoin than altcoins.

At the time of writing, BTC’s Long/Short Ratio was at 1.48, while Altcoins are around 2.55. Thus, no crossover has occurred since September 2024.

Since no crossover has occurred, it suggests that investors are still more confident and bullish on altcoins than Bitcoin.

What BTC’s charts say

While investors are more inclined to altcoins than Bitcoin, BTC holders, and traders remain bullish.

As such, the prevailing market conditions highlight that Bitcoin will be rising with frequent corrections resulting in continued consolidation.

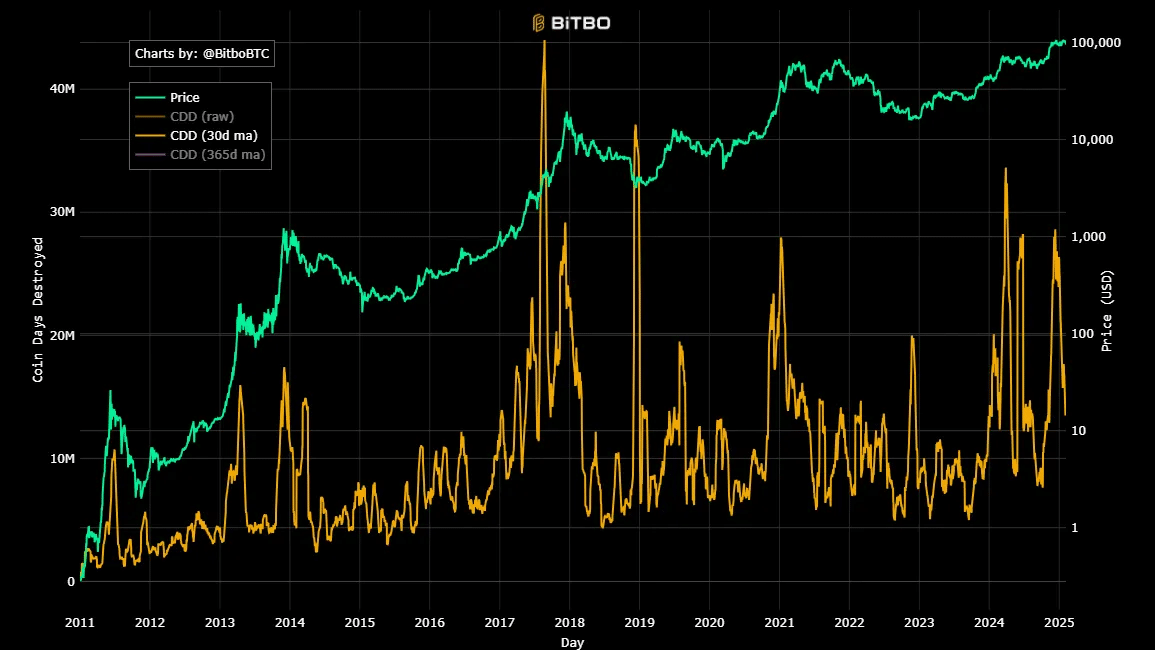

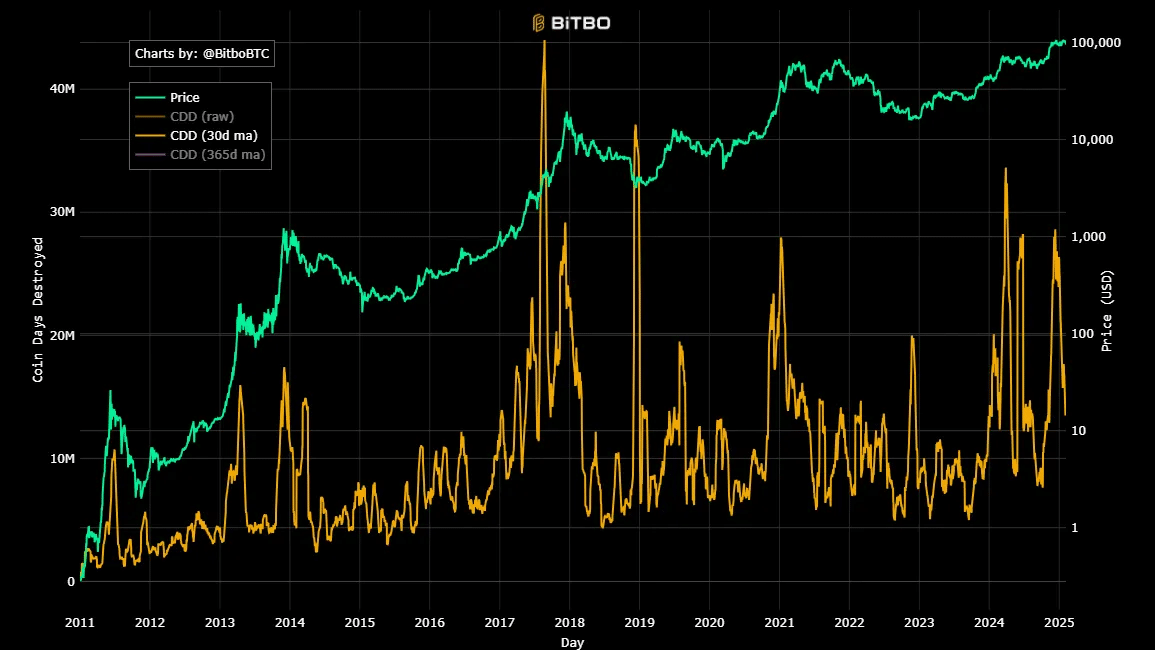

Source: Bitbo

AMBCrypto observed bullishness among Bitcoin holders, as Bitcoin’s CDD has sharply declined over the past week.

When Coin Days Destroyed (CDD) declines, it implies that Bitcoin’s long-term holders are holding onto their BTC instead of selling. This behavior suggests that long-term holders expect prices to rise.

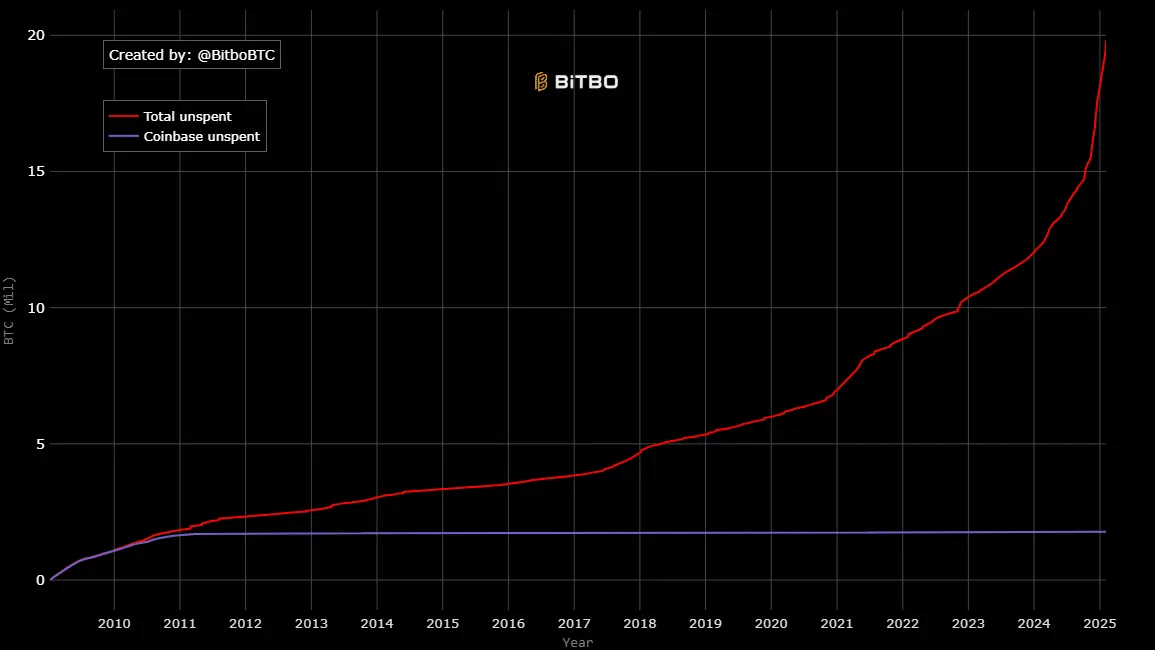

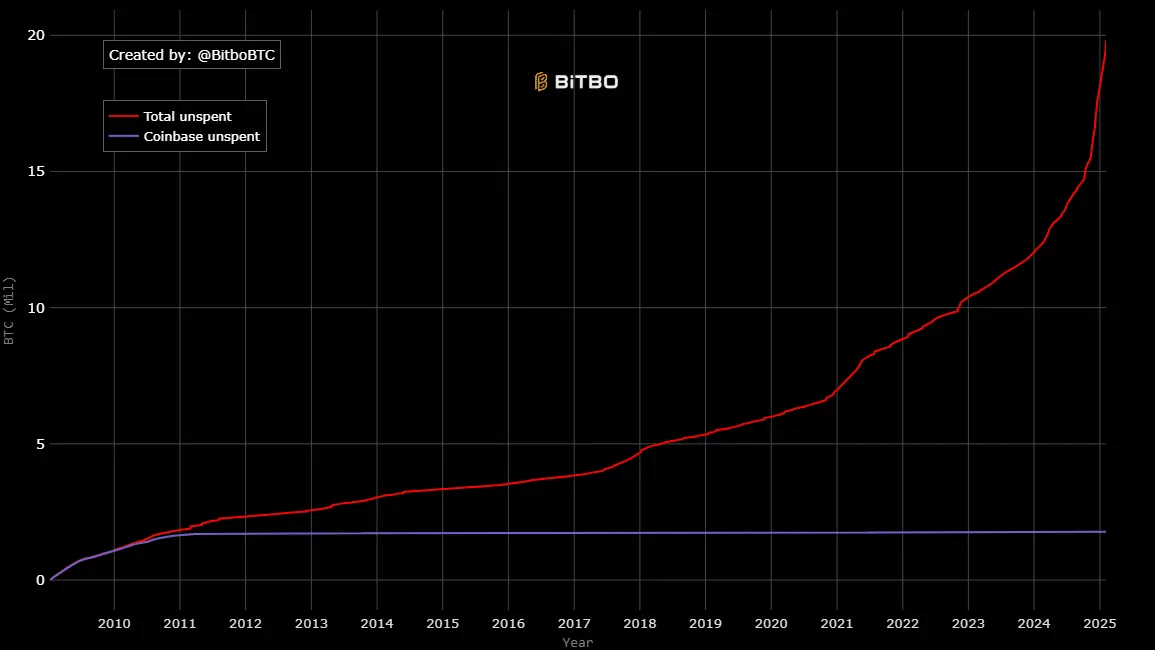

Source: Bitbo

This market sentiments are further confirmed by a surging total unspent of dormant coins. As such, the total unspent has spiked reaching 18.1 million.

Such a spike implies that LTHs continue to hold their BTC.

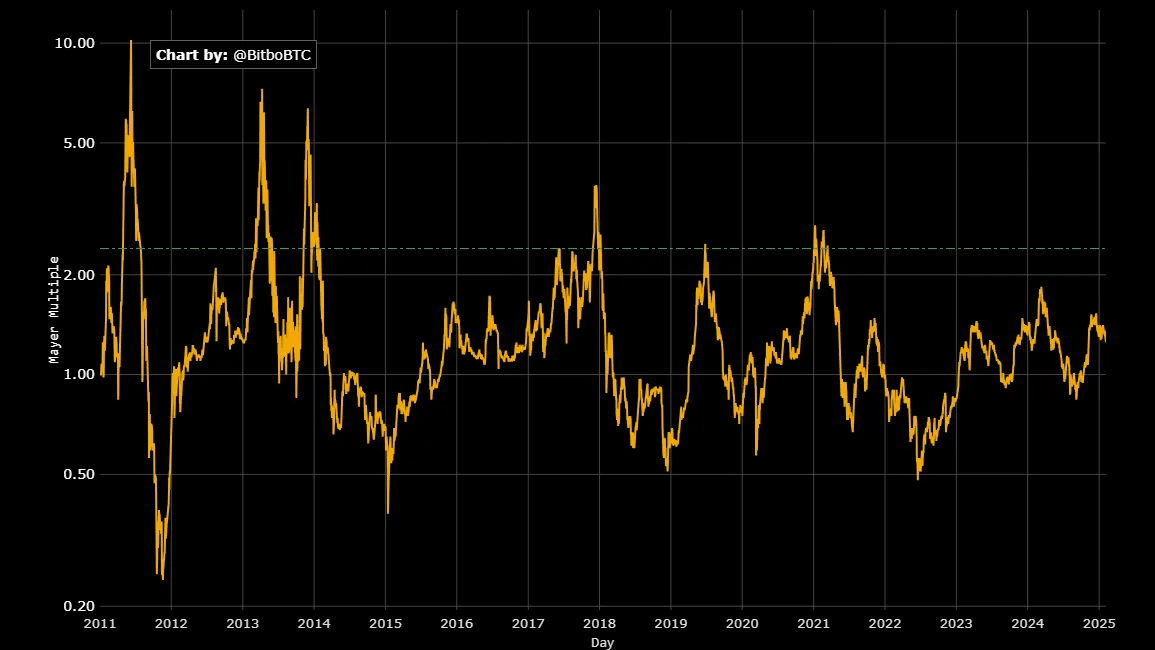

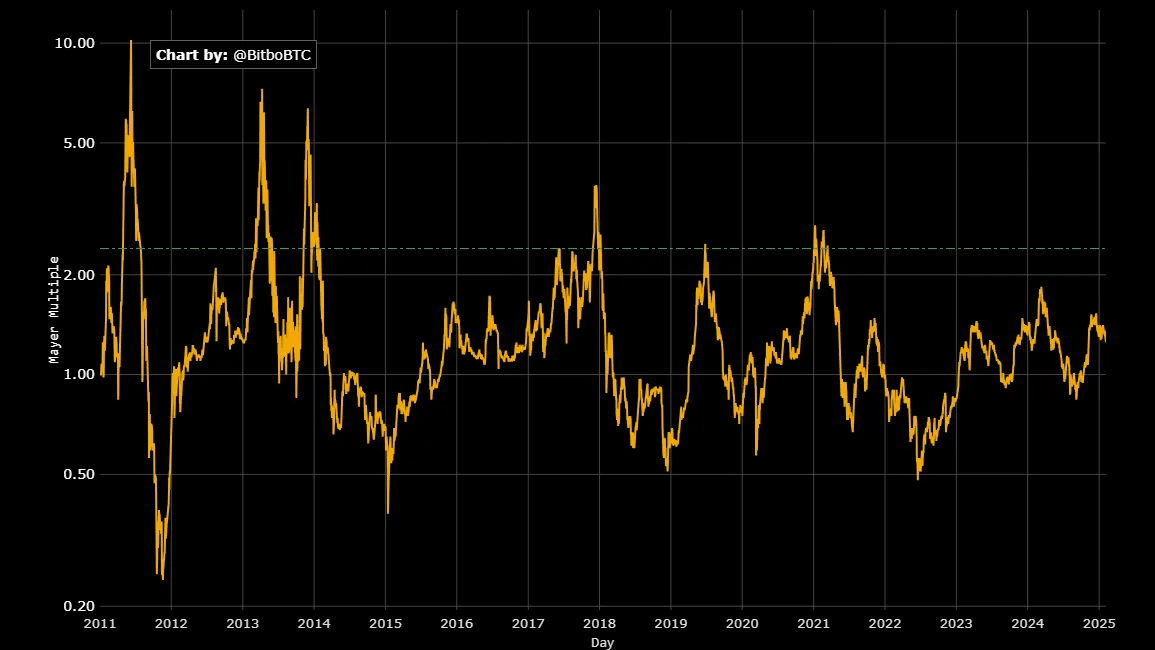

Source: Bitbo

Finally, Bitcoin’s Mayer Multiple has dropped to 1.25. Historically, BTC’s Mayer Multiple has been higher than the 40% observed today.

At 1.25, it implies Bitcoin is trading 25% above its 200DMA, signaling bullish momentum. In previous cycles, bull markets accelerate when it’s between 1.2 and 1.5. At the current level, BTC has room for more upside movement.

In conclusion, while the bottom has not yet been reached, and neither has the top, the crypto market seems positioned for continued rise with frequent corrections.

As such, Bitcoin long-term holders remain optimistic and expect prices to continue rising. If this trend holds, BTC will reclaim $99,500 and attempt a move above $100k again.

– Read Bitcoin (BTC) Price Prediction 2025-26

However, with a drop over the past day, if macroeconomics remains unpredictable, it could drop again to $94k.

Consequently, altcoins will continue to trade sideways as buyers reenter the market every time prices drop.