- Bitcoin volatility has fallen, reaching long-term lows.

- U.S. inflation is predicted to rise amid growing concerns over Donald Trump’s tariffs.

Although Bitcoin [BTC] has recently rallied to hit a new all-time high, BTC volatility remains at historical low levels.

According to CryptoQuant’s analyst Axel Adler, Bitcoin’s volatility has dropped to 200 Average True Range (ATR) as investors await key U.S. inflation data.

Source: CryptoQuant

The drop to a 200 ATR level suggests that Bitcoin’s price movements are currently calm, with volatility reaching long-term lows.

At these levels, the market appears to be in “wait and see” mode, as on-chain activity slows.

Low volatility typically signals smaller, more stable price swings, and this often leads to reduced capital inflow—from both retail and institutional investors—as many choose to stay on the sidelines.

Source: CryptoQuant

This reduced momentum, indicated by Bitcoin’s Mean Coin Age, climbed steadily and sat at a yearly high of 1.617k, at press time. This indicating that coins are staying untouched as more investors shift toward HODLing.

As this holding trend strengthens, the Mean Coin dollar Age is approaching 18 million, further reinforcing the long-term sentiment.

At the same time, investors are also reducing leverage, particularly in the futures market, signaling a more cautious and risk-averse approach as they sit tight and wait for clearer momentum.

Why are investors taking a step back?

According to CryptoQuant, Bitcoin investors are currently in wait-and-watch mode ahead of the U.S. inflation data release.

The Consumer Price Index (CPI) report from the Bureau of Labor Statistics is scheduled for release today, June 11, 2025.

This announcement has sparked widespread speculation about the potential market impact.

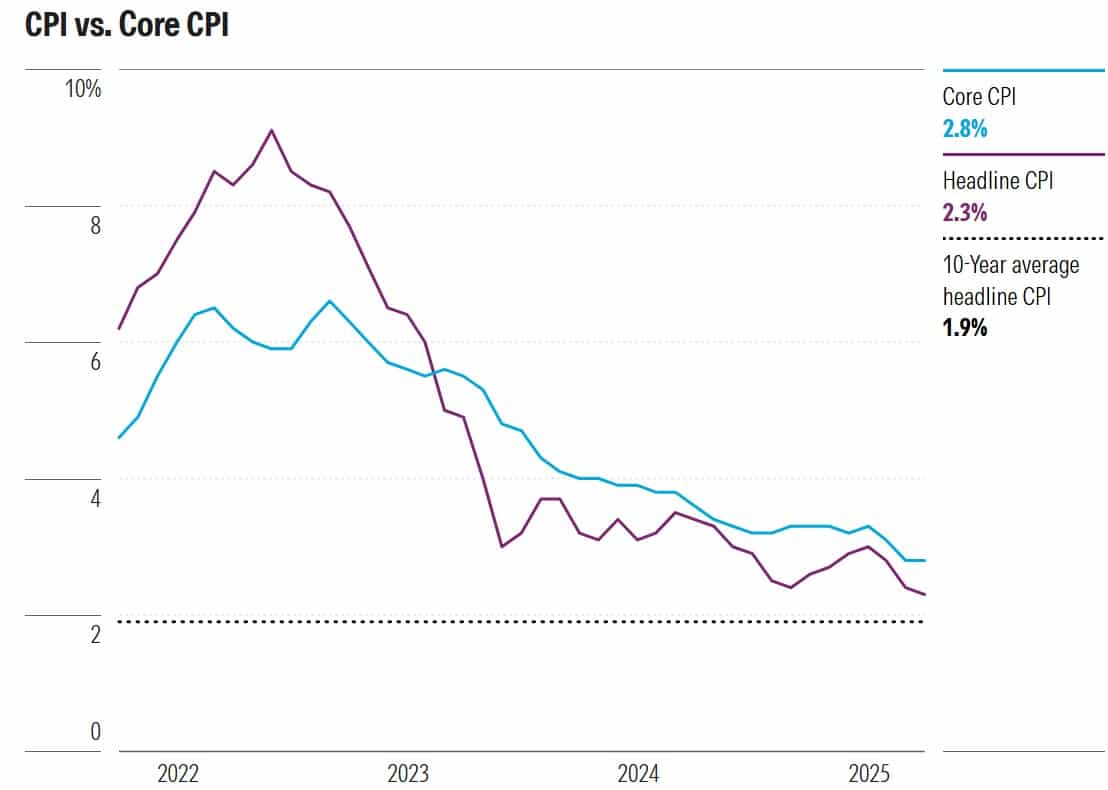

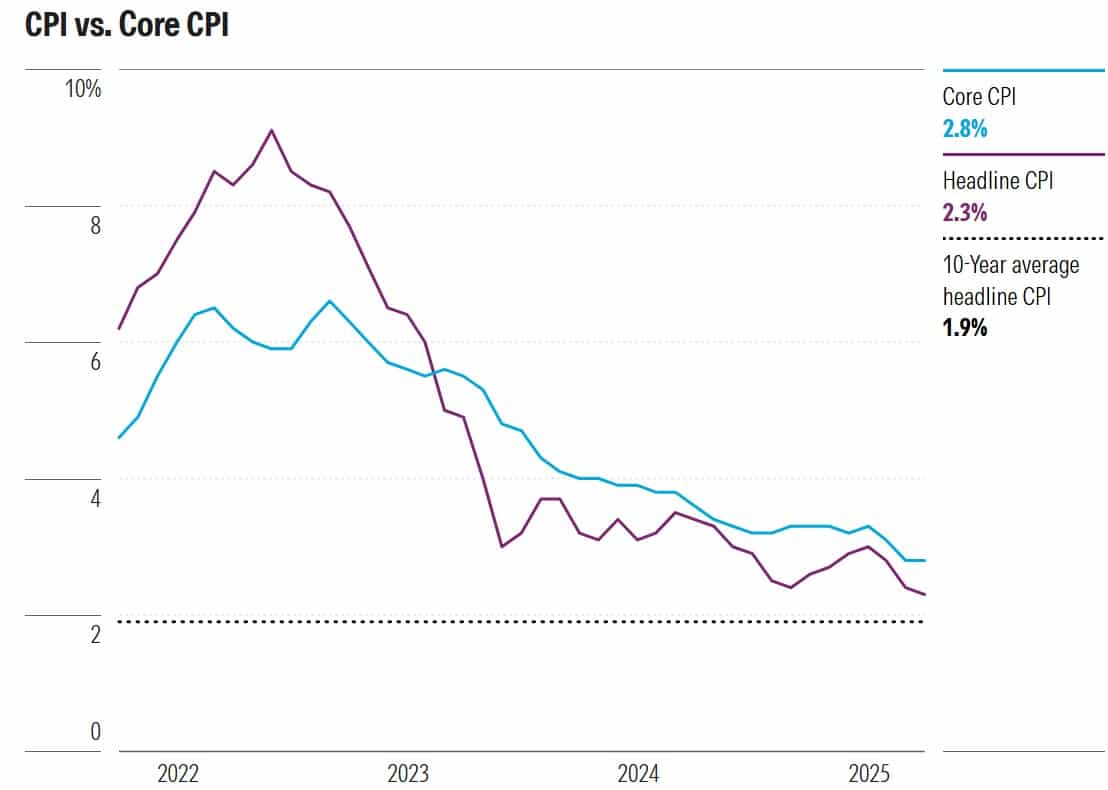

Reuters forecasts that CPI will rise by 0.2% for May, marking a 2.5% increase year-over-year. Meanwhile, Core CPI—which excludes food and energy—is expected to climb 0.3% for the month, with a 2.9% annual increase.

Source: Bureau of Labor Statistics

The upcoming CPI data may show an increase, partly due to Liberation Day tariffs imposed in April. Since many retailers had still been selling pre-tariff inventory, those earlier price hikes likely didn’t affect April’s figures.

Now, economists and retailers expect higher costs, especially for food and energy, potentially pushing prices to a four-month high.

This CPI release is critical—it could reshape the broader economic outlook, including the crypto market.

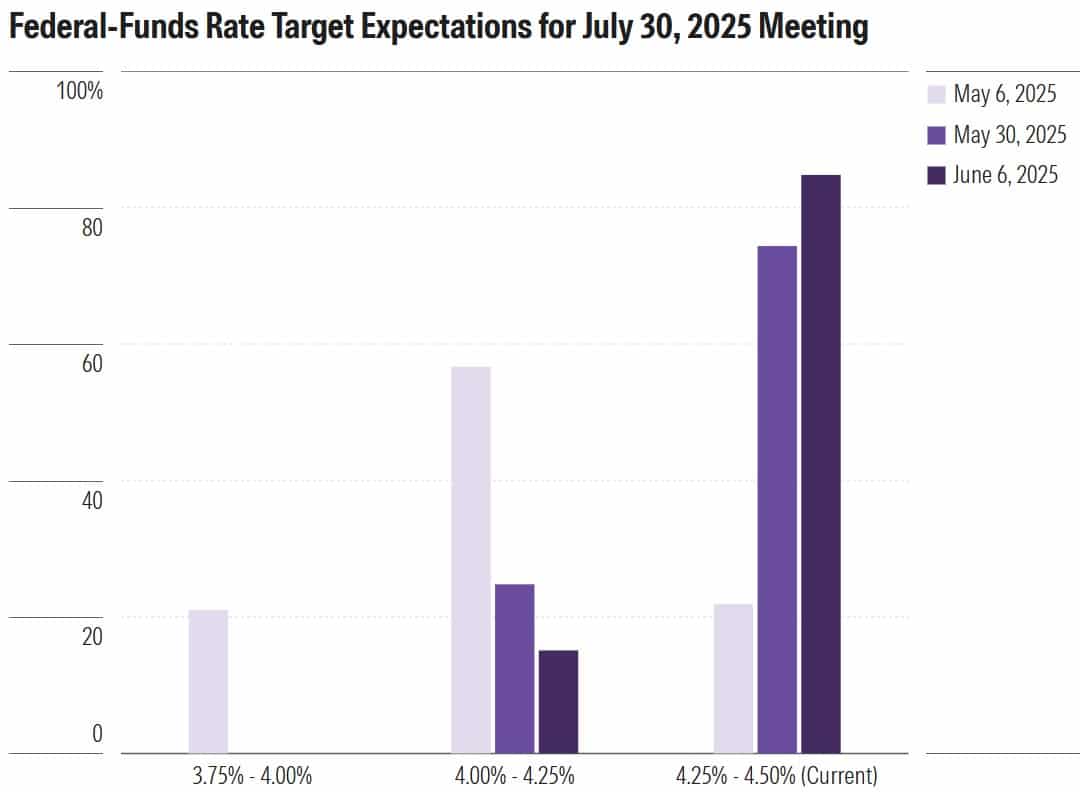

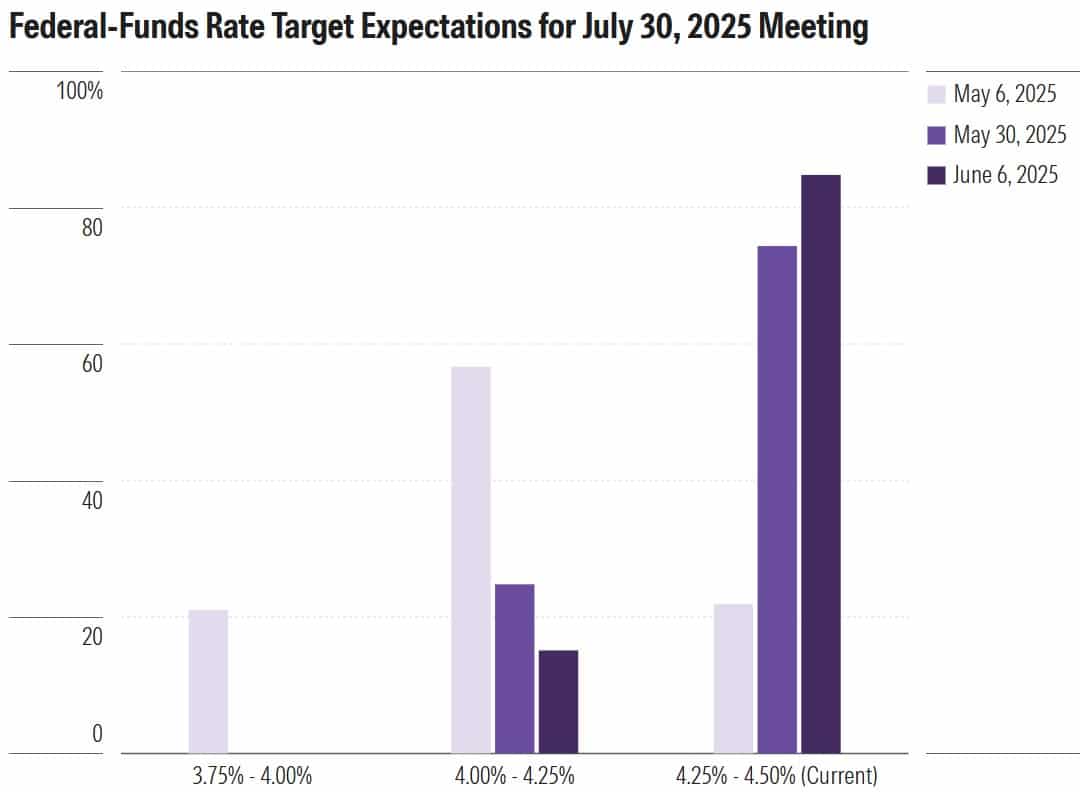

If the reading comes in stronger than expected, it might cool investor sentiment and lower the chances of a near-term Federal Reserve rate cut.

Source: CME FedWatch

If the CPI data comes in higher than expected, the Federal Reserve may keep interest rates elevated for a longer period—a move that’s typically bearish for Bitcoin.

Higher rates tend to reduce market liquidity, strengthen the U.S. dollar, and raise yields—all of which can put downward pressure on BTC. In this scenario, Bitcoin could potentially pull back to around $107,000.

On the other hand, if the CPI reading is favorable, Bitcoin’s uptrend could continue, increasing the likelihood of a retest of its all-time high (ATH).