- CryptoQuant CEO Ki Young Ju believes Bitcoin’s bull cycle has ended, predicting 6–12 months of bearish movement

- Historical trends suggest Bitcoin could surpass its all-time high by mid-2025

Bitcoin [BTC]‘s latest downturn has sparked a significant shift in market sentiment, with experts re-evaluating its trajectory on the charts. According to CoinMarketCap data, BTC was trading at $81,896.71 at press time, after a 0.46% decline in the last 24 hours.

Ki Young Ju’s Bitcoin warning

In response, CryptoQuant CEO Ki Young Ju, who previously dismissed bearish concerns, is now warning that Bitcoin’s bull cycle may have ended.

Taking to X, Ju said,

“#Bitcoin bull cycle is over, expecting 6–12 months of bearish or sideways price action.”

Source: Ki Young Ju/X

What is exec’s reasoning?

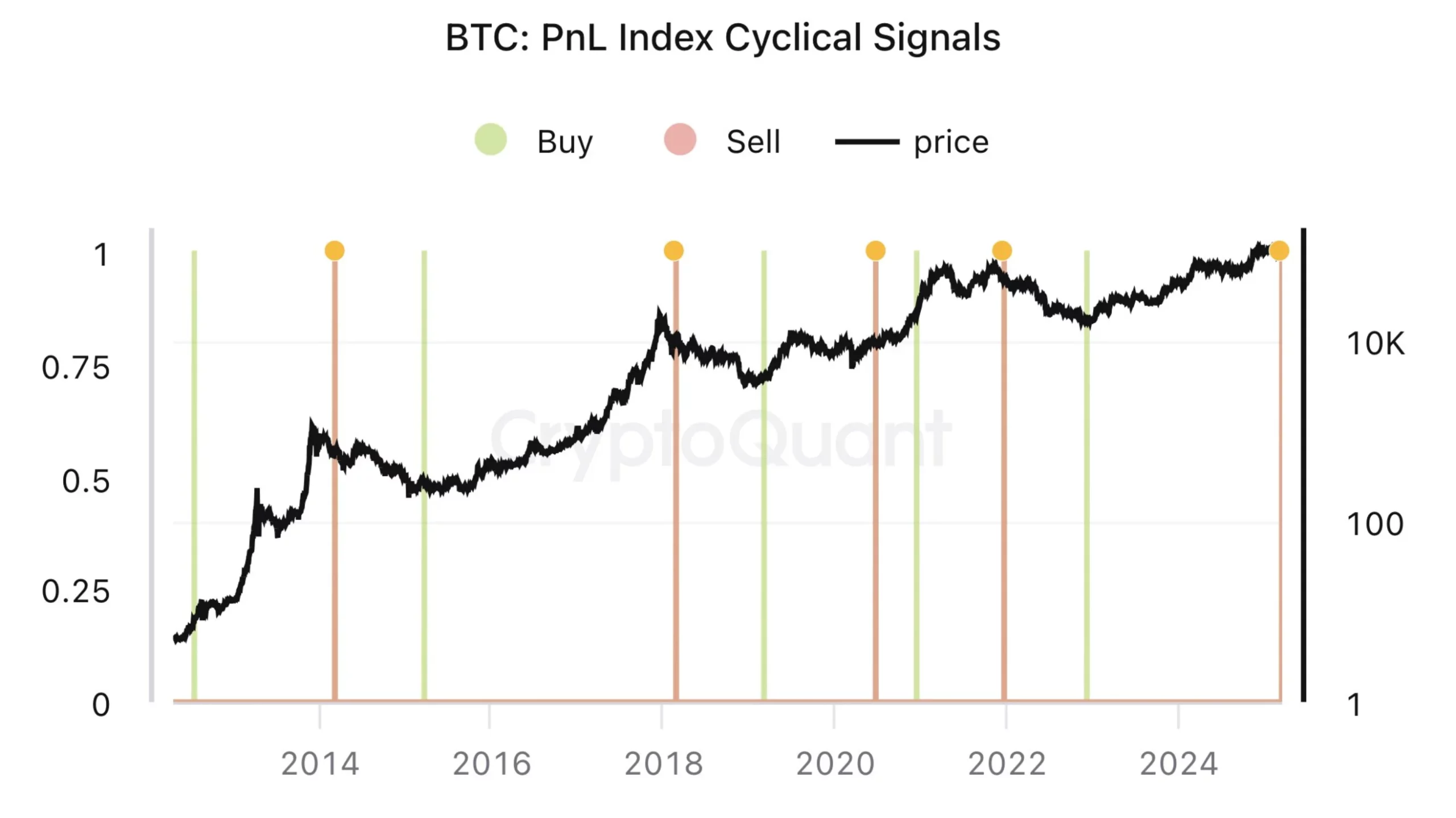

Ju’s latest analysis hinted at a concerning shift in Bitcoin’s market cycle, with key on-chain metrics signaling a bearish or sideways trend for the next six to twelve months. Sharing a chart on BTC’s Profit and Loss (PnL) Index, he suggested that bullish expectations for a strong rebound may be misplaced.

According to Ju, liquidity inflows are weakening, while newly emerged whales are offloading their holdings at lower prices.

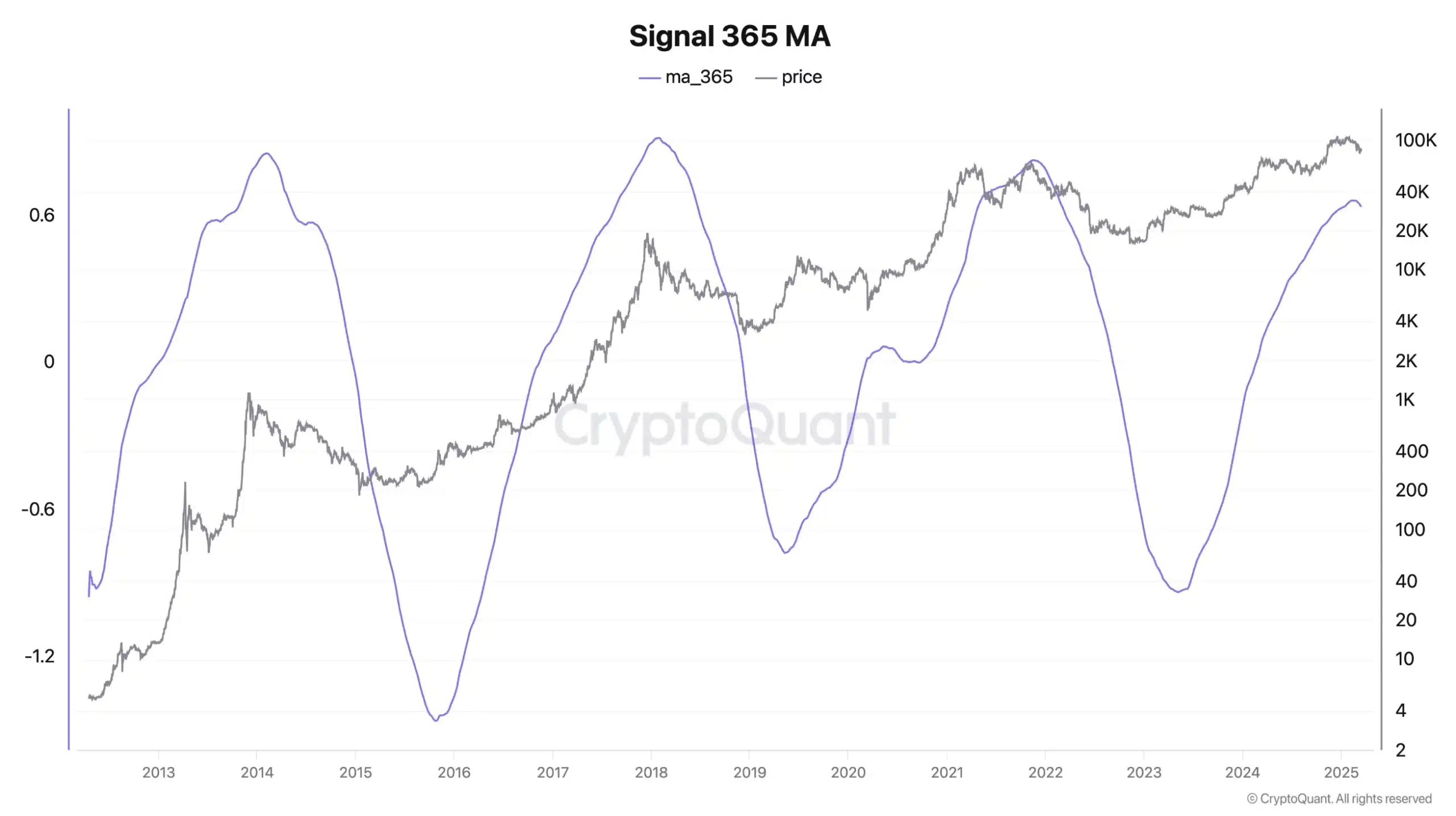

He also applied Principal Component Analysis (PCA) to indicators like the MVRV, SOPR, and NUPL, using a 365-day moving averag,e to identify trend reversals.

Source: Ki Young Ju/X

However, some traders remain skeptical, noting that Ju’s sell signal in 2020 did not play out as expected.

What’s more?

Ju further highlighted a major warning sign for Bitcoin’s trajectory – The decline in fresh liquidity, a key driver of price stability and growth. He noted that newly emerged whale investors are offloading their holdings at lower price levels, a pattern that has historically signaled the onset of bearish trends.

Adding to the concern, institutional demand appears to be waning. Espcially as ETF inflows have remained negative for three consecutive weeks. Episodes of sustained outflows can often be seen as a sign of weakening buying pressure, raising doubts about Bitcoin’s ability to regain bullish momentum in the near term.

Providing further insights, Ju added,

“Sorry to change my view, but it now looks pretty clear that we’re entering a bear market.”

He concluded it best when he said,

“I can’t keep sharing just my hopes when the data keeps signaling bearish. I’m not going to short BTC and still hold my spot.”

Is there any hope?

Despite current bearish signals, historical trends suggest Bitcoin could be on the verge of another major rally. In fact, an analysis of BTC’s price movements since 2015 highlighted a seasonal growth pattern, with the strongest gains occurring between April and October.

If this trend holds, Bitcoin may stabilize in the coming months before resuming its upward trajectory. Some projections even indicate that BTC could surpass its previous all-time high by mid-2025.

While short-term uncertainty remains, long-term indicators may hint at significant upside potential for the flagship cryptocurrency.

Hence, it remains to be seen whether Ju’s prediction holds or if Bitcoin can reignite another bull run.