- Bitcoin’s short-term holder supply is rising. Does this signal a potential market shift or continued uncertainty?

- Key resistance near $87,000 could determine BTC’s next breakout as short-term holders adjust their positions.

Bitcoin’s [BTC] price action has triggered notable shifts in market participation, particularly among short-term holders [STH].

Recent data reveals that STH supply has increased significantly over the past month, reflecting renewed speculative interest as BTC attempts to reclaim key resistance levels.

Does this indicate a bullish continuation, or are short-term holders setting up a distribution phase?

Short-term holders’ influence on Bitcoin’s price trend

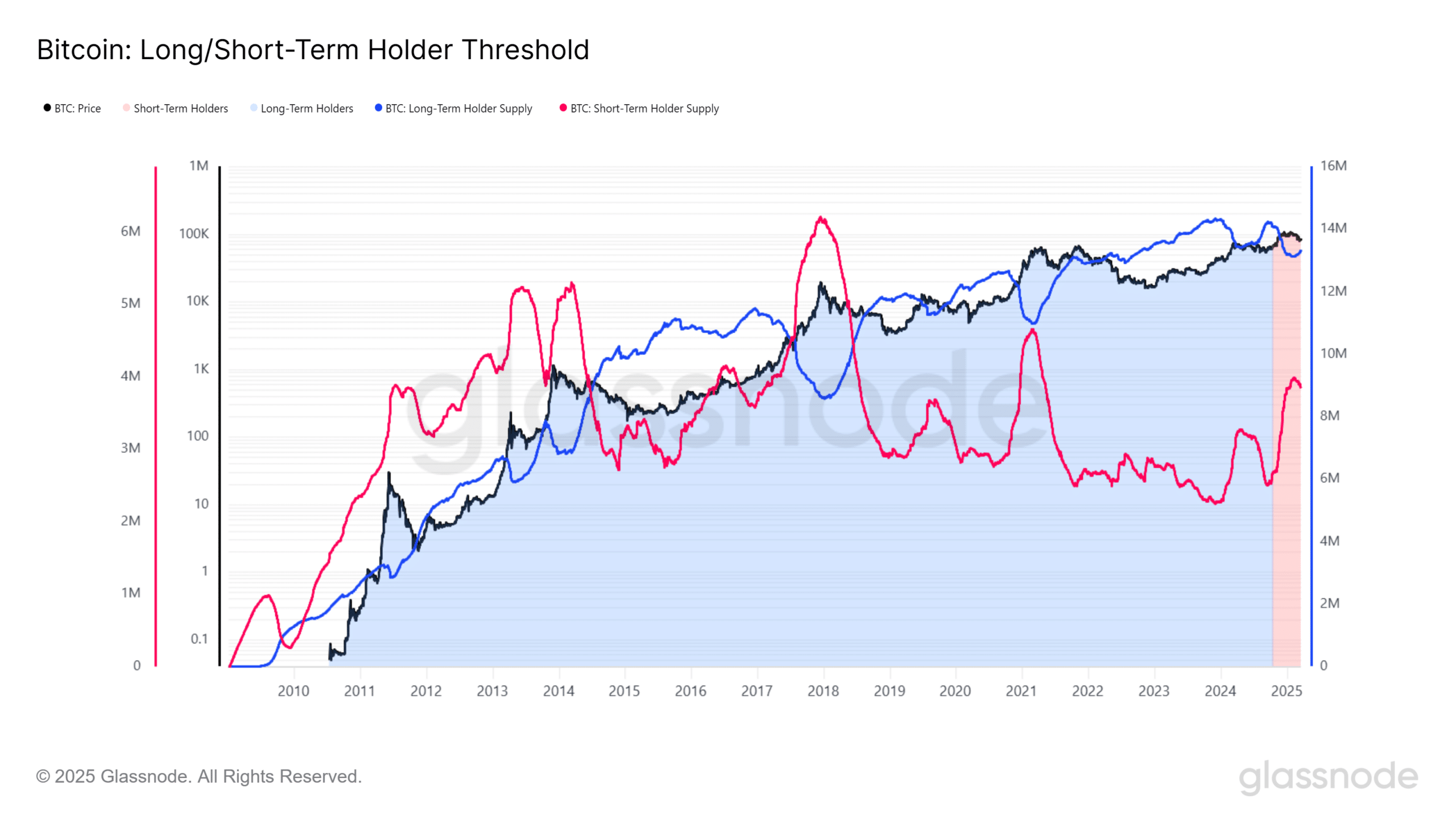

Glassnode’s Long/Short-Term Holder [LTH/STH] threshold data suggests that STH supply has seen a sharp rise in correlation with Bitcoin’s recent price recovery to $85,856.

Historically, an increase in STH holdings during an uptrend often signals heightened trading activity, leading to either sustained bullish momentum or profit-taking that stalls price growth.

Source: Glassnode

The latest chart shows that while long-term holders [LTH] maintain a dominant position, the recent uptick in STH supply suggests a shift in market sentiment.

STH supply tends to rise when new market participants enter during a rally, but if profit-taking accelerates, it could add selling pressure that limits BTC’s upside potential.

Key BTC price levels and market implications

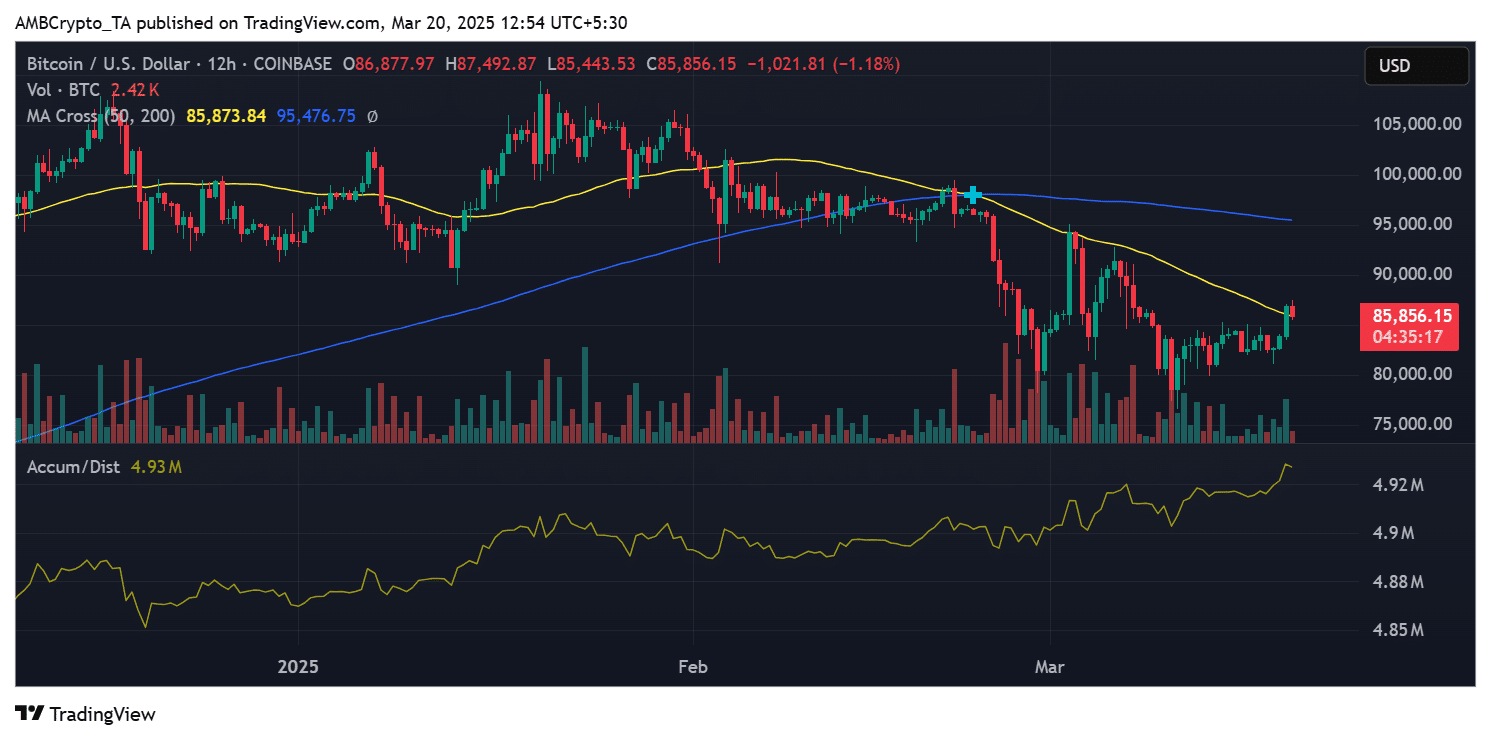

Bitcoin’s price was $85,856 at press time, testing resistance near its 50-day moving average at $85,873.

If short-term holders continue accumulating and holding onto their positions, BTC could attempt a breakout toward the 200-day moving average at $95,476.

However, if STHs begin offloading their holdings at resistance levels, BTC could face a correction toward the $82,500-$83,000 support range.

Source: TradingView

Another critical factor is accumulation trends. As of this writing, the accumulation/distribution indicator showed a rising trend at 4.93 million BTC, indicating ongoing demand.

If this continues, it could provide a foundation for BTC to stabilize and push higher.

Further upside or volatility for BTC?

The recent increase in STH supply highlights growing trader activity, which could either support further upside or lead to near-term volatility.

The market’s reaction to key resistance levels will determine BTC’s next major move.

If demand remains strong, Bitcoin could regain its bullish momentum, but if selling pressure increases, a deeper pullback may be on the horizon.